Location Matters: The Dallas, Texas Real Estate Market

When it comes to real estate market investing, location matters. In the current real estate market, you cannot merely look at state statistics to determine if you are making a good investment decision. Instead, you have to also look at the local real estate market. Just because the state’s real estate market appears one way, does not necessarily mean that the area in which you are considering investing replicates these numbers.

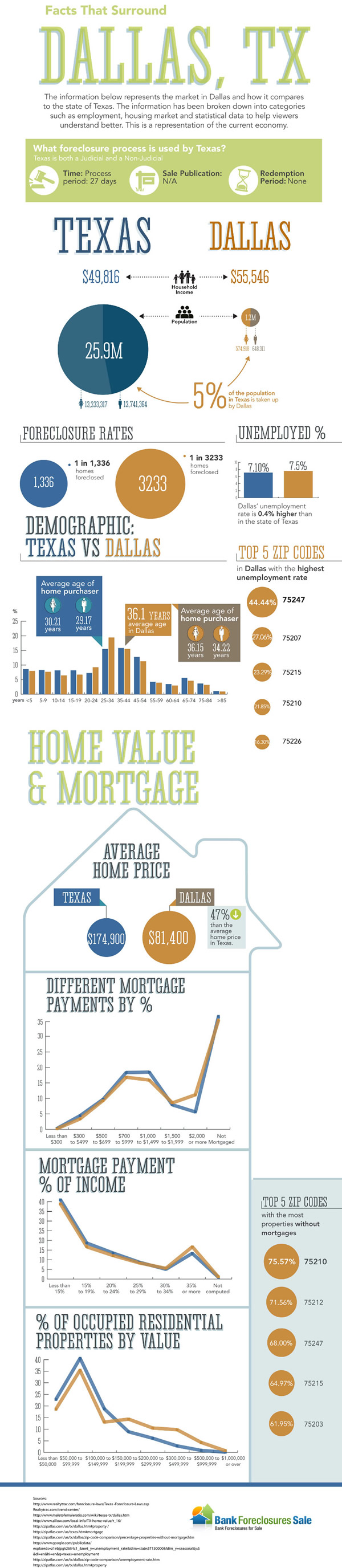

The following infographic takes a look at the Dallas, Texas real estate market in comparison the entire state of Texas—taking into consideration everything from unemployment rate and demographics to home prices and foreclosures.

A quick glance at the infographic reveals that Dallas, Texas has a higher average household income than the average household income for the entire state—$55,546 and $49,816, respectively. However, Dallas has an unemployment rate of 7.5%, while the unemployment rate for the entire state of Texas is 7.10%. Specifically, the following five zip codes in Dallas have the highest unemployment rates: 75247, 75207, 75215, 75210, and 75226—this information can help when looking deeper into investment opportunities in the Dallas area.

When it comes to the real estate market, the average home value for the state of Texas is $174,900 in comparison to $81,400 for the city of Dallas—a 47% difference. However, only 1 in 3,233 homes are in foreclosure in Dallas in comparison to 1 in 1,336 for the entire state.

When you put all of this information together, low home values coupled with the higher average household income and low foreclosure rates could be positive signs that investors may be able to find some great investment opportunities in the Dallas area. In a broader sense, this information reveals the importance of location—when you are looking to invest in real estate,make sure you understand not only the state’s real estate situation but also the local real estate statistics.

Comments