Gold vs. the World

Over the last few years, much hay has been made about the rising values of gold and silver. (Not surprising that gold/silver brokers are the ones generating a large portion of the hype) As the price of gold has continued to rise, some have heralded it as the only safe haven for investors while others have begun to wonder whether it has become another bubble. In order to understand the holistic picture of gold and silver and their place in the worldwide economy, it makes sense to analyze the worldwide stock of these precious metals and compare them to other things of value over time. This will help to reveal the extent to which gold and silver is in the midst of a value bubble or show why it is the last and best harbor for investors seeking to protect themselves against inflation.

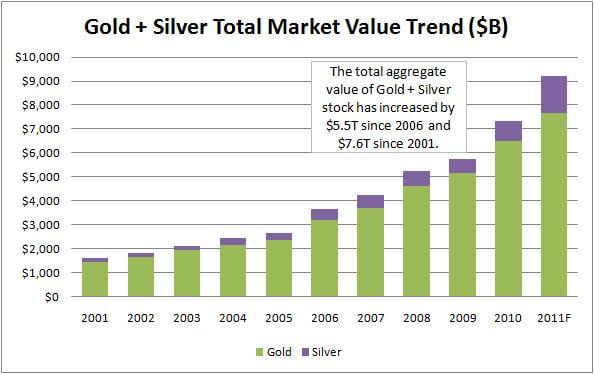

One of the first things for us to understand is the total value of all gold and silver outstanding, and the trend that this value has followed over time. At the current time, approximately 5.3 billion ounces of gold and 40.4 billion ounces of silver have been mined and are available throughout the world. As a way of understanding the total magnitude of these precious metals that are available, imagine that all of the gold in the entire world was stacked into a single pile. If that pile was two (American) football fields wide and two football fields long (Including the end zones), the pile would be 40 feet high. If the world’s silver supply were added to this pile, it would grow to a height of 599 feet. At current market values, these quantities result in a total “market value” of $7.6T for the world supply of gold and $1.5T for the world supply of silver. These two metals combine for a total market value of $9.2 Trillion dollars.

This amount is significantly larger than the total market value from even a few years ago. When compared against 2006, the market value of worldwide gold and silver has increased by 250% or $5.5T. Since 2001, the total value increase for gold and silver is a staggering $7.6T. The velocity with which gold and silver has increased in value leaves one to wonder whether it has become over-valued relative to all of the other things that can be purchased with its $9.2T of aggregate value. Gold and silver have always represented a bit of an investing enigma, due to the fact that its principal value is a general acceptance of gold and silver as a commodity alternative to paper currencies. (aka ‘money’) The part about these metals that make them difficult to understand is the fact that neither is widely used for industrial applications, so their only real value comes from people’s perception of their value. With no cash flows, dividends, or consumption value, gold and silver derive their value from the fact that people believe they have value.

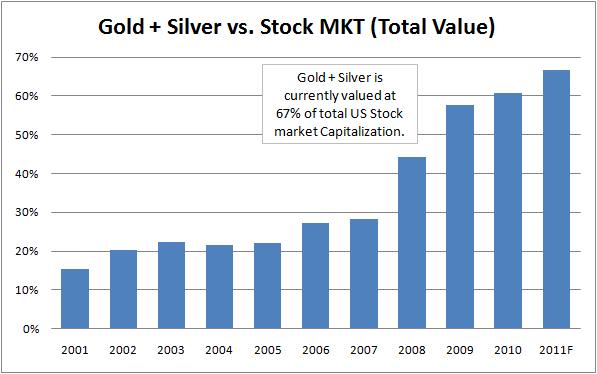

One point of comparison for gold and silver is to contrast their aggregate value against the total capitalization of the US stock market. At the current time, stock market capitalization is approximately $13.8T. This represents the aggregate market value of every publicly traded corporation in the United States of America. The entire energy sector, the entire pharmaceutical sector, the entire technology sector, all corporate farms, every major media outlet, all manufacturing, and many other forms of productive business. At current prices, the total value of gold and silver are 67% of the entire US stock market capitalization. By contrast, this ratio stood at 15% in 2001. Either gold and silver have become drastically over-valued, or US corporations were drastically over-valued in 2001.

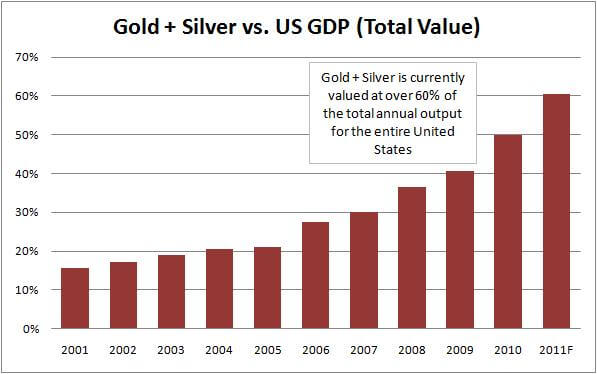

Another point of comparison for gold and silver is US Gross Domestic Product. This figure represents the aggregate value of all products and services that are sold to end customers. At current prices, the aggregate value of gold and silver is equal to 61% of the entire US economic output for one year. In 2001, this ratio stood at 16%, and has climbed at a meteoric pace over the last five years.

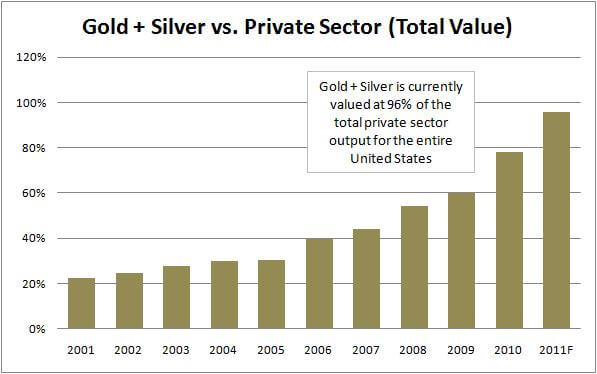

In addition to total GDP, it makes sense to compare gold against adjusted national output that does not include government spending. For the purpose of this analysis, we have chosen to use subtract total government spending (including transfer payments) instead of simply the GDP directly run through the government. This figure shows the total output of private sector production that is not directly or indirectly subsidized by the government. On this point of comparison, worldwide gold value has grown to 96% of total US private sector output for an entire year. Fundamentally, the market is currently saying that the total US annual private sector output and the worldwide stock of gold and silver are approximately equal in value. As before, this ratio has grown significantly over the last few years.

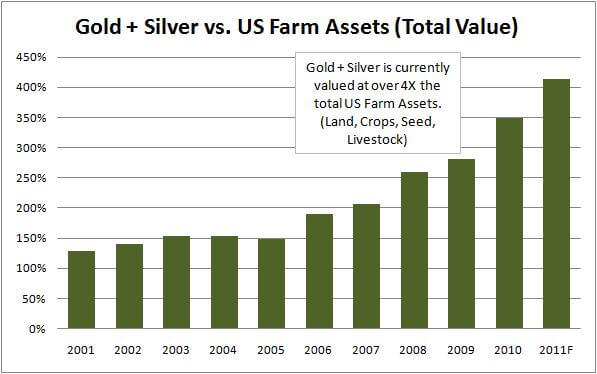

One more thing to look at in regard to gold and silver is a sub-segment of the US economy … namely total US farm assets. The reason why this comparison bears such importance is that both metals and farm assets represent real things. Many people would make the argument that gold price increases relative to assets like GDP or stock market capitalization simply reflect a decrease in the dollar’s value. Since most gold and silver investors seek metals as a hedge against inflation, it is not surprising that this sentiment is prevalent.

When comparing the worldwide gold and silver stock against total US farm assets (land, livestock, crops, seed, everything), a similar trend of rapid escalation can be readily seen. In this case, gold and silver have gone from being valued at 129% of total US farm assets in 2001 to 414% of farm assets today. It is hard to reasonably fathom how the value of all US farm assets has lost near three quarters of its real value if gold and silver prices simply represent an erosion in the dollar’s purchasing power.

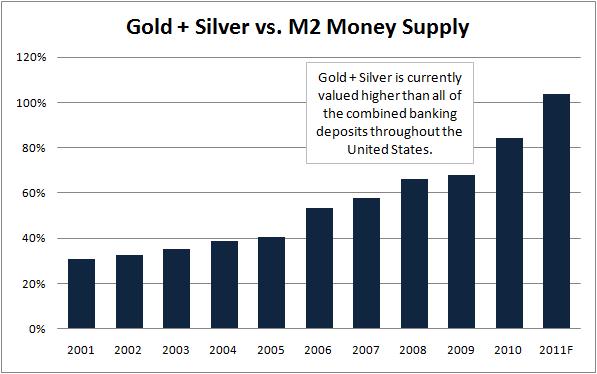

As a final vector of comparison, at current values gold and silver are worth more than the entire US M2 money supply. This means that the aggregate value of all banking deposits throughout the United States has a lower value than the worldwide stock of gold and silver. Again, this ratio has grown prodigiously in recent years. In 2001, it stood at 31% and has grown by a factor of 3.4X since then. If the 2001 ratio between gold and M2 banking deposits were true today, there would need to be $30 trillion dollars of deposits in the banking system. Even for hard-line inflationists, this is a stretch.

Also consider the prediction that has been made by some metals prognosticators of $5,000 per ounce gold. If this were to happen (and silver grew at a similar rate), the aggregate value of gold and silver would rise to $31.8 Trillion dollars. At this rate, it would be more than the total US stock market capitalization and total US gross domestic product combined.

What we have seen from all of these analytical vectors is that gold and silver are valued significantly higher than many other categories of assets, products, and services that each possess a much more tangible intrinsic value with greater general utility. These facts lead to one of two mutually exclusive conclusions. The first is that gold and silver are fairly valued, meaning that US stock market capitalization, private sector output, farm assets, and money supply are all significantly over-valued. The second conclusion is that US economic output, stock market capitalization, farm assets and banking deposits are valued (more or less) fairly, meaning that gold and silver are over-valued. Ultimately it is the responsibility of each investor to draw their own conclusions. However, our analysis points rather squarely at an asset bubble for gold and silver that has resulted in abnormally high and unsustainable market prices.

Action Item: Avoid the allure of “easy money” promises of metals dealers. The astronomical prices they forecast do not bear out when compared against the larger marketplace for products, services, and capital. Wealth is created by productive assets that generate cash by providing real products and services to real people.

The JasonHartman.com Team

"The Complete Solution for Income Property Investors"

Comments