Developing your Rehab Project Proposal

A key element of the rehab process is developing your project proposal. The project proposal will serve as the cornerstone of your financial analysis and will drive the success of your flip from start to finish. This document also serves as a crucial piece in your effort to find funding for your deals. Your private lenders will expect that you have performed your due diligence to ensure that the project makes sound financial and business sense.

Presenting your project proposal is an opportunity for you to impress your lenders. A professional, organized and comprehensive analysis will help to establish your credibility and lead your lenders to feel comfortable with their ensuing investment.

Below are the four essential elements to include in your project proposal

Element #1 – Project Summary

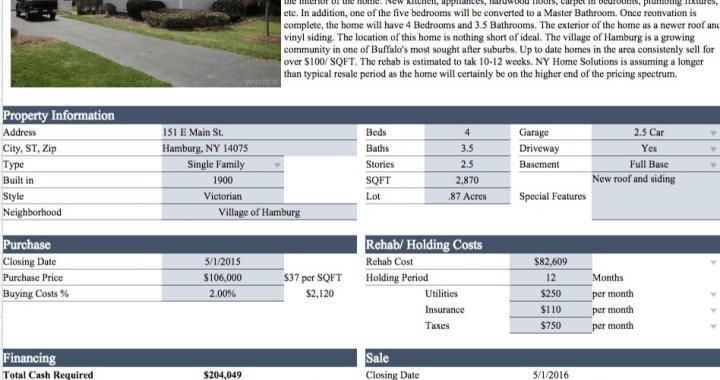

The project summary is a single page that contains all key financial and property information. The summary is a high level snapshot of the overall project. You will not include detailed analysis at this point. The purpose of this page is to provide a quick view of all the pertinent project information. During discussion with your private lenders, it is very likely that you will not get past this initial page. This is all the more reason to ensure that your summary is organized and professional.

Key Elements of your One Page Project Summary

- Investment Summary

- The investment summary is a verbal description of the overall project. You should include some high level numbers, a high level view of the major rehab elements, estimated project duration and your proposed exit strategy.

- Property Information

- Address

- Home Type

- Year Built

- Home Style

- Neighborhood

- # of Bedrooms

- # of Bathrooms

- # of Stories

- Square Footage

- Lot Size

- Garage

- Driveway

- Basement

- Other special features or noteworthy information

- Purchase Information

- Purchase Price

- Contract Closing Date

- Estimated Selling Costs (sum of attorney fees, title insurance,

- Rehab/ Holding Costs

- High level rehab cost (derived from detailed scope of work)

- Estimated Property Tax

- Estimated Hazard Insurance

- Estimated Utility costs

- Financing

- Total amount of cash required to fund the entire deal

- Loan Amount and terms

- Equity and Profit Split

- Estimated Sale Price (ARV)

- Profit Summary

Element #2 – Comparable Sales & ARV

Without fail, missing on the After Repair Value is the biggest potential pitfall of every rehab project. If you don’t hit your ARV, your entire profit framework falls to pieces. The ARV is also the aspect of the rehab over which you have the least control. The market is going to dictate one, and only one, price for your home. While you can make adjustments to your rehab budget and even your holding costs, you will not be able to dictate the price paid for the home by the eventual home owner.

This Comperable Sales section illustrates your rationale for your estimated ARV. It is essential that you take the time to take a deep look into comparable sales in the area surrounding the subject home. List out the addresses and pertinent information for similar houses that sold within the last 3-6 months. The key figure you are looking for is the price per square foot. If you have a decent sample size of comps, you will notice that the price per square foot of houses with similar features should be relatively close.

A key mistake is to trust the numbers of your comps without digging deep into the unique characteristics of each house. Only include comps that have very similar features to the subject property. Also be sure to include a heavy does of your qualitative analysis and judgement based on your experience. There are several variables that play into the final price of a home. Price per Square foot is only one feature. Analyze the pros and cons of the comps and compare them to your eventual end product. Adjust your price per square foot to account for any shortcomings and/or positive features of your house. Also account for the time of year during which your comps sold. Houses that sold for $100/SQFT in the prime Spring Buying season may sell for $95/SQFT in the dead of winter.

Key Attributes to Keep in Mind when Analyzing Comps:

- Square Footage – Filter your comps based on a range that is ~200 sqft lower and ~200 higher than the subject property

- # of Bedrooms – Try to find an exact match here

- # of Bathrooms – Again, try to find an exact match. You might be 0.5 baths off in either direction. This is okay…as long as you account for it in your estimated ARV

- Garage (Attached vs. Detached)

- Driveway

- Basement

- Yard/ Outdoor deck or patio

As always, its a good idea to be conservative with your ARV estimate. You never know what will happen with the market. Think of the ARV as a “Worst Case Scenario”. You don’t want to force the issue with a rehab project. If the numbers make sense using conservative numbers, your profit will only be higher if you hit your potential upside.

Element #3 – Project Scope & Budget

After the ARV, the next potential area for a slip up is hitting your rehab budget. No rehab goes exactly to plan. This is a fact. You will have budget overages and hopefully even some areas where you come in under budget. The goal is to continuously evolve your budgeting process so that your plan is as close to your actuals as possible. During the rehab project, your scope and project plan is bound to change. This will undoubtedly bring changes and adjustments to your budget.

Tips to Nailing your Rehab Budget

- Include a Contingency – Add 10% to your rehab costs. If you have some experience, you can lower this number to 5%

- Be Comprehensive – Ensure that your scoping tool covers all the potential areas of rehab. Its better to have a huge budget document with a lot of 0’s than a compressed budget that is missing budget allocation for key areas of the rehab.

- Be conservative – It should go without saying that all of your financial projections should be conservative. This means that you should not assume you will get a deal from your contractors or hit black Friday to purchase all the fixtures for the home. Pad your numbers. If they come in lower, more profit for you!

- Get Contractor Estimates up Front – To whatever degree its possible, try to get contractor estimates at the onset of your analysis. If you have access to the home, bring your key contractors through to get firm numbers on some of the major rehab areas. Some items don’t even require access to the home. For example, you should always get estimates for major exterior repairs prior to closing on your house. Know how much your new roof, siding and deck will cost before you get into the project.

Element #4 – Pictures

Include as many pictures as possible. These should be of the subject property as well as some of the comps you listed in your ARV page. You could even include pictures of your past work to demonstrate the degree of rehab you are planning for the house.

If you are printing your proposal, it probably doesn’t make sense to print all your pictures. However, you should have the proposal on a tablet or PC for your meeting with the private lender. If the conversation gets to the physical attributes of the home and the comps, you can quickly access all of your research.

Comments (5)

This helped me out immensely. Thank you

Maxwell Lewis, over 8 years ago

awesome info, I use an app for my calculations but your work sheet is awesome , any way we could down load a copy ???

Mitch Gale, over 8 years ago

Thanks Charles, speaks to the specifics thanks for putting this together.

Daria B., over 8 years ago

This is a great guide for a Rehab Proposal. Very useful. Summary up front, Current Comps & After Repair Value in Section 2, The Numbers in Section 3 and Element #4, as they say a picture is worth 1000 words. Thank you for this post.

Charles David

Charles David, over 8 years ago

Thanks Charles! Your comments are greatly appreciated!

Nick Baldo, over 8 years ago