Is Las Vegas Still A Good Place to Invest?

Before I talk specifically about Las Vegas, I want to establish a common understanding. I believe that every investment property and investment location must meet three criteria:

- Sustained profitability - The property must generate a positive cashflow today and into the foreseeable future.

- Likely to appreciate over time - Appreciation should never be the primary goal of investment but is advantageous in that it offers you future flexibility. Appreciation is dependent upon ongoing demand, which is a function of population growth and sustained job quantity and quality.

- Located in an area with investor friendly taxes and legislation - Taxes include both state income tax and property tax. Regulations include property related laws like the time and cost of evictions.

Select Las Vegas investments meet all three of the above criteria. I will cover each of the above criteria below as they apply to Las Vegas.

The Problem with ROI

ROI and similar measurements only show how a property is likely to perform today but real estate investing is a long term proposition. Typical hold times are 10+ years so how the property performs over the foreseeable future is just as important as how the property performs today. I will talk first about short term factors and then long term factors.

Short Term Profitability

We are able to consistently find properties which generate between 4% and 8% (assuming 20% down conventional financing) using the formula below. This formula closely reflects what our clients actually experience. There are many variants of the ROI calculation and most show much higher return because they do not include all the recurring costs or include such things as unrealized gain.

Note that good investments in Las Vegas, like everywhere else, are not common. We are able to consistently find the 0.1% of the available 10,000 to 14,000 properties that are good investments using software we developed over several years. Without our software, it would be very difficult to find any good investment properties.

Other major factors affecting short term profitability compared to other locations include property taxes, state income taxes and insurance. Below is a comparison between Las Vegas and two other locations. Costs such as state income tax, property taxes and insurance are direct hits to bottom line profitability.

Longer Term Profitability

Longer term profitability factors can slowly change a high performing asset into a financial nightmare. Below are some of the more common factors but each location might have others.

Incentives to Pay All the Rent on Schedule

In order for a tenant to consistently pay rent they have to have both the ability to pay and the willingness to pay. The ability to pay is dependent upon the target tenant pool for the property remaining employed at similar wages. The willingness to pay is driven by incentives to pay or not pay. For example, in California it can take up to one year to evict a non-paying tenant. Tenants know that they can skip paying the rent for months with little risk of being evicted; the incentive to pay the rent in California (and places with similar anti-landlord legislation) is very weak. In Las Vegas, a typical eviction takes less than 30 days and costs less than $500. Tenants know this so they prioritize paying the rent because they know that they will be quickly evicted if they don't. Thus, the incentive to pay all of the rent on schedule in Las Vegas is very strong.

Population Trends

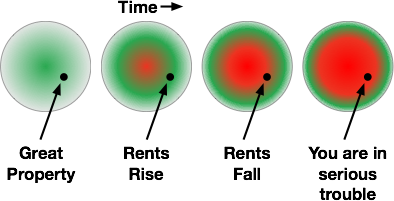

If people are moving out of an area, housing prices and rental rates are likely to fall due to decreasing demand. If people are moving into an area, then there is likely to be appreciation and rising rents due to increased demand. However, even if the general area population is stable, specific sub-areas could be losing or gaining population. One major cause of this is urban sprawl. People want newer floor plans and newer homes and, if they have the money and freedom to do so, they will move to areas where they can buy such properties. As people with money move out of an area those left behind will, on average, have lower incomes. Property prices will then start to fall due to decreased demand. As property prices fall, property tax revenues will fall. City services are largely dependent on property tax and local sales tax revenues so as these fall, cities have no choice but to cut services. This starts a downward trend from which few locations have recovered. Below is an illustration showing the effects of urban sprawl on investment properties.

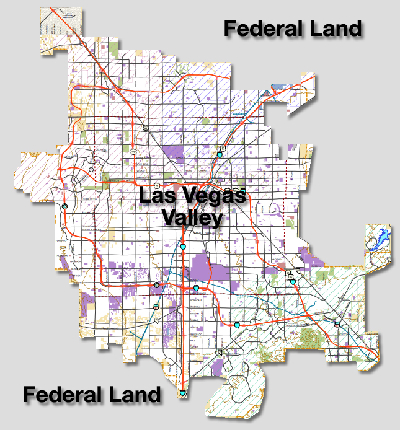

Las Vegas is one of the few major cities not subject to urban sprawl because it is virtually an island; it is surrounded by federal land. The map below shows the Las Vegas metro area. The gray area is federal land. Las Vegas has extremely limited undeveloped land in desirable areas.

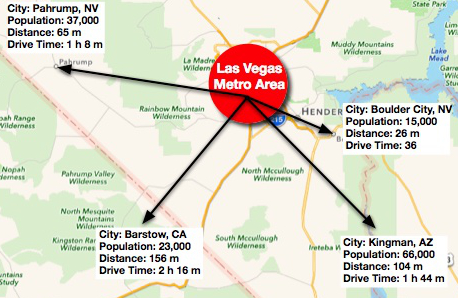

Unlike other cities, there are few alternative cities from which people could commute to jobs in Las Vegas. As you can see on the map below there is little development within commuting range outside of the Las Vegas metro area. Also, since most properties in Las Vegas are still selling below replacement cost, prices in the few surrounding cities are not significantly less than metro Las Vegas so commuting does not make sense.

As far as the Las Vegas population trends, depending on which study you choose to believe, Las Vegas' population is projected to increase by 1% to 2% per year for the foreseeable future. When you combine a growing population with no room for expansion we feel that appreciation and rent increases are almost inevitable.

Job Quantity and Quality

The value of a property is no better than the jobs around it. In many parts of the US, manufacturing and similar jobs are going away and what remains are service sector jobs. Service sector jobs tend to pay less than manufacturing jobs so the families of these workers have less disposable income. Less disposable income means that they cannot afford to pay the level of rent they did in the past. A key indicator is inflation adjusted per capita income over the past few years. If you see an inflation adjusted declining per capita income you need to carefully consider the long term value of the investment.

Inflation adjusted income in Las Vegas has been slowly increasing (except during the 2008 to 2011 crash) and projections are that the increases will continue according to a Federal Reserve Bank study.

Ongoing Maintenance Cost

Ongoing maintenance costs can have a significant impact on profitability. Below are some generalizations about ongoing maintenance costs:

• Composition roofs require more maintenance than tile roofs

• Properties in climates with hard freezes require more maintenance than properties in milder climates.

• Properties in locations with a lot of moisture require more maintenance than properties in dryer climates.

• Wood siding requires more maintenance than aluminum or stucco siding.

• Properties with lush vegetation require more maintenance than properties with little or no vegetation.

As you can see, there is not a lot to maintain.

Summary

Las Vegas is an excellent place to invest but finding good properties is challenging using traditional approaches because less than 0.1% of available properties are good investments. For the foreseeable future, population growth, inflation adjusted per capita income, job quality and quantity are predicted to be positive. Nevada's eviction laws incentivize paying all the rent on schedule.

I hope I was able to communicate why Las Vegas continues to be an excellent investment location.

Comments (4)

Thanks for this excellent analysis, Eric. Really well done. I always love reading about market analysis and seeing how investors evaluate a specific market they're in (or thinking of entering). You've done a great job here and other investors would do well to emulate your thorough approach.

Kent Clothier, about 8 years ago

Eric Fernwood, about 8 years ago

Eric,

I was stationed at Nellis from 94-97. Purchased a SFR (4 bedrm) near Camino El Norte and Craig Road and converted it to a rental in 97. I have had good tenants and tried not to panic after the big crash. It's nice to see home values coming back again. I enjoyed your analysis and I plan on hanging onto the property for a while. My rent has stayed flat for the last several years because I was concerned about turnover and the availability of rentals. Where do you see rates going in the next few years?

Tom Rietkerk, about 8 years ago

Hello @Tom Rietkerk,

We are seeing rents slowly rise on A and most B class properties. On a property renting for $1100/Mo. we are increasing rents by $50/Mo. to $100/Mo. We did an interview with the property manager we work with (for A and B class properties) and here is the article.

We also did a recent study of rental rates and property prices between 1/1/2010 and 12/31/2015. We did the study in response to client questions. They were asking for how the types of properties we recommend performed historically. It was a bit of challenge for us as the software and processes we developed are too selective for us to retroactively select conforming properties. So we decided to mine historical MLS data based on a broader range of criteria:

• A specific geographical area (shown below)

• A specific rental rate range: $1000/Mo. to $1400/Mo

• A specific configuration: single family home, 2+ car garage, 3+ bedrooms, no pool and 1000+ SqFt of living space.

• Sold or rented between 1/1/2010 and 12/31/2015

Below is a graph showing the average $/SqFt for conforming properties sold through the MLS during the 1/1/2010 and 12/31/2015 period.

As you can see, sales appreciation has been significant since 2012. Below is the graph showing the average $/SqFt for conforming properties rented through the MLS during the 1/1/2010 and 12/31/2015 period.

As you can see, the monthly rent has increased from approximately $.69/SqFt at the beginning of 2014 to approximately $.75/SqFt at the end of 2015, or 8.7% over the last two years.

We expect rents to continue to increase due to the shortage of properties that will rent in the $1000/Mo. to $1400/Mo. range, steadily increasing population, increasing job quantity and job quality and diminishing build-able land in desirable areas.

Here is an article we send to new investor clients on Las Vegas which explains the unique nature of Las Vegas for investors.

Eric Fernwood, about 8 years ago