Multifamily Analysis: Example Deal - When You Should Walk!

Here is a deal that came across my desk a few weeks back. I am posting this deal to illustrate the level of BS brokers feed you to try and sell a deal. The Net Operating Income is so important; getting that right will determine how much you should pay for a property.

Example: LIVE DEAL

I am going to walk you through a live deal that came across my desk a few weeks back:

The information from the seller’s broker:

“NOI in place today is around $515,000, providing a value of $7,350,000 at a 7% cap rate.

Existing rent roll is well below market rents of $830 and $725 for the 108-2 x1’s and 12 - 1x1’s Currently 100% occupied. ”

Ok great: First, nothing is ever “100% occupied”

STEP 1: Jump on rentometer and check what they are saying about the “market” rents. I found out average rents in the area for 2bed apartments are $747/month (say $750), and $625 for 1 bed apartments. Straight off the bat my research shows me that the broker is already telling me lies.

For this example lets use ($750 for 2 bed, $625 for 1 bed) – Remember that this is an existing building; maybe new buildings with amenities would fetch higher rents, but not in this case. Building was built in 1965.

STEP 2: Take the rent-roll provide and determine how many people moved in within:

- The past 0-3months

- Past 3-6 months

- Past 6-12 months

Show as a percentage of the entire building (ie: X/120 units), this will show you if the property manager is ‘filling’ apartments to show a lower vacancy. The higher the % is within the past 6 months, the more concerning it is (RED FLAG).

STEP 3: Lets go through the PnL: I am going to highlight things that jumped out at me (NOTE: I could write an entire blog on just analyzing the PnL for the trail 12 months). Looking back at the performance of the property; this is the most accurate way to analyze the deal:

1.GROSS Income: $926, 614 (see pic).

- In this deal they presented the “past due rents” and the “prepaid rents”; that is great, but look at how much the “past due rent” is (approx. $22k)… It is something to note.

- Vacancy: $53,920 which represents 5.5% - So it is not 100% occupied

2.Other Income: They have good additional income from laundry and security deposits. Ask the seller for proof of these incomes (you want to see documented evidence)

3.Administrative Expenses: Nothing crazy to report here, they have included the property management fee in this line item. Total Admin expenses 5.73% seems reasonable (PM 4% of gross which is fine)

4.Maintenance and Repairs: This is where I like to ‘get into the weeds’…..

- First thing I notice is that for some reason some expenses are not charged for 4-5 months of the year: Cleaning, Contracted Maintenance… This isn’t uncommon to see this but ask the seller why for 4 months they didn’t have cleaning… what are they cleaning? Apartments?

- Contracted Maintenance: This line item needs to be carefully considered… You need to ask yourself why in some months is the seller spending on average $2500/month? Is it because they are gearing up to sell it.. Ask the question… Also, you want to make sure your full time employees aren’t just calling a contractor every time something is wrong. You want to employee a good handyman/trick-of-all-trades that can fix HVAC, Plumbing electrical.. Granted there will be times that you will need 3rd party work done, but keep this in mind.

- The big line items that stand out are: pest control, plumbing, painting and paint supplies.. What happened that they need to spend $30,000 on pest control?… Giant mutant rats? It seems very high.. and in combination with the paint and plumbing in June 2015.. Clearly something happened. Ask the seller what happened. If they don’t have a good answer they are hiding something (RED FLAG).

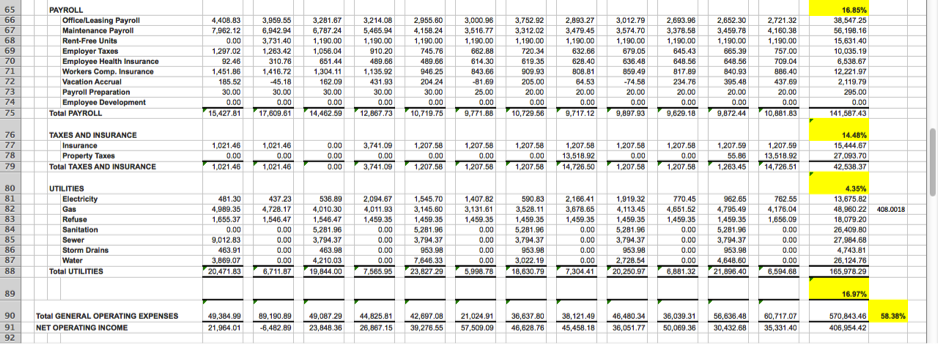

- Overall, the maintenance and repairs are 16.85% of the gross rental income.. That is high!

5.Payroll: $141K (approx.): for 120 units you will probably have 2-3 full time employees (one in the office $38k, two maintenance $56K): this seems reasonable for the average wage.

6. Utilities: $165,978; approx. 17%.. this is high. I would want to start billing back the tenants to reduce expenses. Research the market to see if a bill-back program is acceptable in the area. I would want to reduce this line item to approx. 10%.

7.Taxes and Insurance: 4.35% seems reasonable, check with your local insurance broker.

8.TOTAL Expenses Ratio: 58.38%, which is very high! It screams that there is a lot of deferred maintenance going with this property, this I not a bad thing, as there are areas to reduce expenses.

9.The total NOI based on the T12 is $406,954! This is over $100k less than what the broker told me..

Based on a 7% CAP the building is only worth $5.813 mill not $7.35 mill

STEP 4: Do your own analysis: I would want to get the expenses down to around 45%... that is a 13.4% reduction… Is this achievable? Well probably not give the age of the building. You have to be realistic with yourself.

STEP 5: Make an offer for $5.7mill.. And then I would walk the property.

Ultimately I would walk away from this deal given:

- The high expense ratio.

- Cash on Cash return is 2.74% at $7.25 mill, this is really low..

- I don’t know the area but I know it is not worth $7.25 mill

- This property would require A LOT of hands on management to reposition it. If I lived in this town, yes, I would consider it, but as I am 1,500 miles away it is high risk to leave such a large reposition in the hands of other people.

- I have only just started to scratch the surface… I haven’t even seen the HVAC systems or roofing. Again, in DD you can inspect the property.

At the end of the day you need to ask yourself can I increase the cash on cash to 12% (which is my investing criteria)? This would require a reduction in expenses to 41% and I need to pick up the property for $5.8 mill.

What would you do? Leave a comment….

Comments (5)

Great job breaking thinks down.

Damien Dupee, over 6 years ago

Thanks for posting a simple write up on a multi-family analysis! I'm currently looking to sponsor a larger multi-family deal, and I see a lot of fictitious income and expense numbers from Brokers' OMs as well. It's great to see how you quickly assessed what expenses were reasonable and which ones raised red flags. Thanks!

Sarah May, over 7 years ago

Thanks @Sarah May for your comments. It is the world we live in, brokers love blowing 'smoke' trying to distract you from the real issues.

Are you looking for a sponsor right now? PM me.

Thanks

Reed Goossens, over 7 years ago

@Mark Viscusi All very good points, and definitely something I look at as well. Bad debt and past due rents are huge red flags... to me it indicates poor management; The only way this would work is getting the property for around $5.5mill.

I appreciate your feedback! Keep it up.

Cheers

Reed

Reed Goossens, over 7 years ago

In my eyes the whole "net rental income" section is a red flag. Maybe it's my formal accounting background as a CPA who audits quite a few large multi-families annual statements, but when I look at net rental income I expect to see GPR less vacancies and concessions (credits). The end. Maybe it makes sense to include your bad debt recovery there. Prepaid rents and "past-due rents" (aka accounts receivable) are both balance sheet items - if you're starting with gross potential, the other items should be adjustments to cash received that do not change your NOI. And while we're up there, why does the recorded amount for GPR vary from month to month?

I would also be concerned with the income line for Net Security Deposits. Is this the total of all SD collected during the year? If so, they are a cash item and a liability to be potentially repaid at move-out - it's not your cash yet. If not, what kind of tenants are typically moving into this property that you're holding back this amount of cash when tenants move out?

Now I'm wondering why I see an amount for collection recovery but not a bad debt expense.

And those are just the issues that feed the PM calculation... maybe it's just a layout thing and the underlying numbers are right enough, but there's already enough doubt (especially with the other things you've pointed out) to take a hard pass on this one!

Mark Viscusi, over 7 years ago