I Track My Net Worth Every Month & So Should YOU!!!

It seems like many of the people who I talk to about finances or their future have this goal of “being a Millionaire.” I hear it all the time, “Someday, I want to be a Millionaire” or “I plan to retire as a Millionaire.” If you have goals like these, or BIGGER, do you know where you are today? Do you know how close you are to achieving those goals? What are you doing on a regular basis to get closer to those goals?

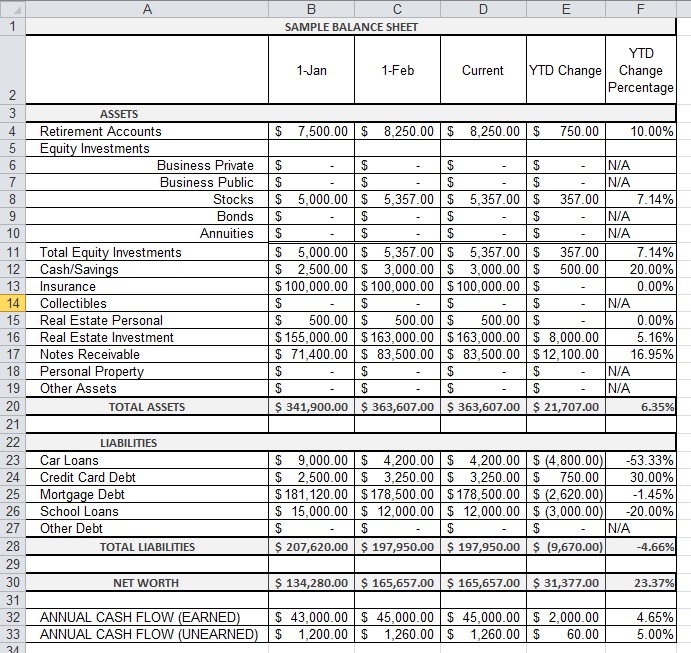

Earlier this year, I read Gary Keller’s book “The Millionaire Real Estate Investor.” There is a section in the book titled “The Net Worth Model.” The section talks about what Net Worth actually means and how to know & understand what your net worth is. He suggests that you should track your net worth every month so that you know where your finances are & where they are going. This section of the book really intrigued me & I decided that it was time for me to track my net worth. So I did it in February, March, April, May & June. I now have a system in place where I set an appointment on my calendar to work on my net worth calculations on the 25th of every month. I don’t miss that appointment and it has proven to be a huge advantage for me. Now I know, every month, what my financial situation looks like. I compare it to the previous month & (most important) I can decide what I need to do to improve on it. And now, I’m going to tell you how your can do the same thing in the hopes that it will help you improve your financial situation too. (*Sample Balance Sheet Below is adapted from sample listed in The Millionaire Real Estate Investor).

What is Net Worth?

The short answer to the question “What is net worth?” is that your net worth is equal to all of your assets minus all of your liabilities. On paper, it’s what you are worth financially. Your net worth can be a positive or a negative number. If your debts outweigh your assets, unfortunately, your net worth is negative.

Knowing Your Assets?

First thing is first, let’s try to figure out what all of your assets are, write them down on a piece of paper (or an excel spreadsheet).

- Retirement Accounts – Do you have any 401k accounts, IRA’s, SEP’s, 403b’s, Pension etc? If so, what are they worth? For these accounts you probably receive a quarterly statement, but you want an up-to-date statement effective today. Most retirement plans have some sort of online portal where you can see your account balance effective at the close of the previous business day. So, do what it takes & get an online account to find out what your balance is. Do this for all of your accounts. Don’t forget about those accounts from jobs where you haven’t been for years. So many people have retirement money that they don’t even remember they have. These are YOUR assets, make sure you know what they are.

- Equity Investments – Do you own equity in a public or private business? How about Stocks, Bonds or Annuities? This is the place to give yourself credit for the value in those equities

- Cash/Savings – This is an easy one, how much Cash do you have? How much money is in your checking & savings accounts?

- Insurance – Do you have a life insurance policy that has a Cash Value? If so, write down the cash value.

- Collectibles – What is the value of that baseball card collection that you have sitting in the attic? Or do you collect something else of value, write it down here? If you don’t know what the value is, this is a good time to have someone give you an estimate.

- Real Estate Personal – This is where you want to make a note of the value of your home. What is your house worth & how do you find out? One way to find out is to reach out to a Realtor & ask them to give you an opinion of what your house would sell for. If you really want something official, you can get a BPO (Broker’s Price Opinion) which may cost a little bit of money, but knowing the value could go a long way. Zillow has the “Zestimate”, which is a rough and dirty idea of what your home “may” be worth.

- Real Estate Investment – This is the place where you will list the value of any investment properties that you own. I like to list mine out individually as their own line item so that I can follow them closer. You can use the same methods above to find out their value.

- Notes Receivable – Have you loaned money as a Note? Make sure that you account for the amount that is remaining on that note.

- Personal Property – Do you own any personal property that has a value? This is a good place to list your car(s) if you own them, or even if you have them financed. The car has a value, even if the value is less than the amount owed to the finance company. It's also important to note that if you have a vehicle that is being leased that is not considered to be an asset since you will not be the owner.

- Other – Did we miss anything? I’m not sure what else there is, but if you have something that doesn’t fall into one of these buckets, make sure you are accounting for it.

Total Assets

Ok, now add them all up. This is the total value of all of your assets. What does it look like? Is it higher than you thought? I hope so.

Knowing your Liabilities

Now that we did the fun part & looked at all of your assets, it’s time to look at your liabilities. These are all of payments or debts that you currently owe.

- Car Loans – Every month when you receive your car loan statement it will show you the outstanding balance, this is what you still owe on your car. Make sure that you include any leased vehicles on here. A lease payment is one of your debts, so you want to make sure to track it.

- Credit Card Debt – List out the amount owed for each credit card that you have here. Give each card its own line so that you can see which ones are increasing & which are decreasing.

- Mortgage Debt – Every month your statement will show your Outstanding Principal Balance; this is the amount of principal that you owe on your house. Just like the asset section, create a separate line for each mortgage that you have (personal & investment)

- School Loans – Find out what the payoff for your student loan debt is. Make sure that you include all loans.

- Other Debts – Do you have any other outstanding debts? Include them here. Things like HELOC’s may be included here or other debts that didn’t fit into one of the categories mentioned.

Total Liabilities

Now it’s time to add up the Liabilities. That’s everything that you owe. Is that number higher than you thought? I hope not, but if it is, now you know what you have to do.

What is your number?

So now, just do the last bit of math. Total Assets (minus) Total Liabilities = Net Worth. Now you know, financially, what you are worth as of today.

Cash Flow

The bottom of the sheet has a section where you can track your cash flow. Did you have a goal in 2016 to make more money at your regular job? Did you have a goal to increase your unearned income (rental income, investment income, etc...)? The year is half way over, how are you doing? This is a good place to keep tract of this and help you to achieve those financial goals.

Just Do It

As I mentioned earlier, I do this every month. The first month took me a little more than an hour to get everything set up, but now it probably takes me less than 30 minutes to do it. Some great things that I’ve learned from doing this exercise:

- Every time I make mortgage payment the Outstanding Principal Balance will decrease, which makes my net worth increase. That’s fun to see every month, especially on the properties where that mortgage is paid by my tenants.

- Every time I pay down one on those nasty credit cards, my net worth goes up. It’s great to watch them go down & also a good motivation to make sure they don’t go up.

- I now keep a closer eye on my retirement accounts than I ever have in the past. I'm actually in the process of making some changes that I'll blog about in the future. I probably would not have been so motivated to make these changes before I started doing this exercise.

I hope you try this exercise & I hope that it helps you to have a better understanding of your own financial situation. Let me know how it worked out for you. Are you closer to reaching that goal of being a Millionaire than you thought? Have you found new ways to decrease your debts & increase your net worth? Please leave a comment.

Good Luck!!!

Comments (16)

Bob Mastroianni, over 7 years ago

Thanks for the great feedback @Josh Caldwell I agree about your personal residence. I'm basically following the pattern that Gary Keller set, I didn't want to divert from it too much. The other thing that I stopped tracking is my Insurance Policy. I felt like it gave me a bit of a false number.

Bob Mastroianni, over 7 years ago

@Bob Mastroianni I like what you're doing. I just read the book as well, great read. As far as all the people saying they use different programs like Mint, I'd just like to say that making your own spreadsheet and manually entering all the figures give you a more intimate relationship with your finances. I'm sure people are different but I'm much more in touch with all my different accounts since I started consistently getting my hands dirty with my spreadsheets. Just my two cents!

Kenneth R. Reimer

Kenneth Reimer, almost 8 years ago

I love the article but I caution you not to include your personal house in the asset section. You personal house is a living expense, even if you sell your house and make a pile of money, you will still have to pay to live somewhere else. At best your personal house is a net zero if it doesnt cost you anything to live there.

Josh Caldwell, almost 8 years ago

I love the concept, I need to start doing this myself

Josh Caldwell, almost 8 years ago

Hi @Derek Vaughn Thanks for the response. Those were 2 very good questions, I apprecaite it,

1) I based this sample off of the sample in The Millionaire Real Estate Investor, it looks like I made a mistake when typing the numbers in. The $500 amount should be in Personal Property; the $155,000 (and then $163,000) amount should be Real Estate Personal & the $71,400 (and then $83,500) should be in the Real Estate Investment. I hope this helps a little bit. These are not my personal numbers, just a sample.

2) For Insurance, I have a policy that has a cash value. Part of the money that I pay towards my premiums goes into that & if I ever had to take a loan or hardship that money is available as cash to me. I use that in my Insurance number. When I first started doing it, I put the amount of the policy in there, but for me that just didn't make sense. I just feel like if I have $500,000 worth of life insurance, it doesn't make me "worth" a 1/2 million dollars. That's just the way I do it though, some may advise to use the total value of the insurance policy, it just didn't make sense to me do it that way.

I hope my error didn't cause too much confusion. Thanks again!

Bob Mastroianni, almost 8 years ago

@Bob Mastroianni Thanks for this, great article! Only question I have is for the real estate personal and real estate investment lines. Why is there the large total for investments, which I'm assuming is the equity that you have in those... And then only $500 for the personal line? And lastly, what about the insurance line? Where do you get that number? Thanks again for a detailed article

Derek Vaughn, almost 8 years ago

Thanks for the great feedback guys.

@David Cahill & @Chad Olsen That's a really good idea about having quarterly meetings with your wife. What a great way to make sure you are both on the same page with the family finances & moving forward. Good job!

@Chuck Brooking I like your thoughts behind creating a separate net work (your ANW). I actually separate my insurance out so I can see what my net worth is without insurance. It's just an item that I feel like it can easily pad your numbers a bit.

@Eric Schultz I will look into Personal Capital, sounds like a cool tool. Thanks for recommending it

@Kyle Doney I anticipate that at some point, as my business continues to grow, this may become a bit of a chore to do every month. Doing it quarterly may be the way that I have to go. For now, because I'm so new to it, I really want to stay on top of it & also form the habit of doing it regularly.

Thanks again for all of the great feedback everyone.

Bob Mastroianni, almost 8 years ago

I have been using Yodlee Labs (formerly Yodlee MoneyCenter) for over 10 years. I have all my financial accounts linked there. I log in as part of my morning routine and just hit the update button to freshen the information.

Last November I realized with most of my assets in a retirement account in the stock market, I couldn't determine whether I was making ground toward my financial goals for the year. If the market is up it looks great, if it is down it looks bad. I started using what I termed my Adjusted Net Worth (ANW). This is simply my total assets minus my stock accounts, minus my total liabilities. I track my ANW monthly to see my gains regardless of the current stock market.

I use two different spreadsheets to track spending and for my budget. I adjust the budget spreadsheet quarterly using the 12 month averages from the spending spreadsheet. I know where my money goes and can adjust my spending to accomplish my goals.

Chuck Brooking, almost 8 years ago

My wife and I also do this. We track net worth about quarterly and see if change based on decisions we've made. But what is really dramatic to watch is our weekly numbers. Every week on Sunday i log into ask or bank accounts and log the existing balance for all the cash and credit we have. Then I have a slew of metrics and graphs that I can see how things are changing over time.

I've been doing it for almost 2.5 years now and seeing our cash go up and debt stay flat on a weekly basis is very powerful. I love tracking these things!

Chad Olsen, almost 8 years ago

I do this on a quarterly basis on a spreadsheet I made similar to yours. I think quarterly is a more profound change in net worth and its super motivating through the quarter to think ahead at how big of a change I can make.

Kyle Doney, almost 8 years ago

I would recommend PersonalCapital.com. It is more powerful than Mint.com when it comes to investment accounts. Cashflow, spending, income tracking and graphs are all part of the platform.

Eric Schultz, almost 8 years ago

Great article! My wife and I have quarterly finance meetings where we do the same thing. I use Quickbooks. We tried Mint.com a few year back, but at that point, it was tough to combine accounts for married people and it was tough to track cash flow for our investment property. Not sure if they fixed those bugs or not.

David Cahill, almost 8 years ago

Thanks @Joshua Locke & @Curtis Mears for the feedback, I really appreciate it. I will definitely check out mint.com

Bob Mastroianni, almost 8 years ago

Yes, I also use Mint and love it.

Curtis Mears, almost 8 years ago

I use Mint.com for budgeting and saving goals and if you add in all your assets it will calculate your net worth for you and you can track it on a graph over time.

Joshua Locke, almost 8 years ago