buying property in 2023

Is it good idea to buy now in Vegas or waited out ?... and if yes: SFR or condo/townhouse -- and I am talking from perspective either an investor or " regular " buyer - (first time home buyer)

- Investor

- Austin, TX

- 5,506

- Votes |

- 9,861

- Posts

There will always be a reason to buy, and there will always be a reason not to buy. You should be looking at all times. Take advantage of the market, no matter the state of it.

Always a good time to buy if the price is right.

I think it's a fine time to buy, although I'd be very cautious and tread lightly. A few things to keep in mind in this market:

1. There are a lot of stubborn sellers out there still. Meaning they have their homes listed for sale, but they are asking 2021/2022 prices. Don't buy these homes, or if you do be prepared to lowball them.

2. Location and price is more important than ever. The market is already down a lot from the peak in Vegas but it's possible the market continues to drop as we enter a recession. If you buy in the right location and at a deep enough discount, you will be somewhat insulated from a further downturn.

3. SFR's always outperform condo/townhouses on appreciation. So for that reason alone I would buy a SFR over a condo/townhouse, every time.

Quote from @Rafal Soltysek:

Is it good idea to buy now in Vegas or waited out ?... and if yes: SFR or condo/townhouse -- and I am talking from perspective either an investor or " regular " buyer - (first time home buyer)

I think there are always deals to be had. I mean they were still making deals work when interest rates were at 17%.

Hello @Rafal Soltysek,

In this post I'll talk about waiting and how our clients are dealing with the high interest rates.

Should You Buy or Wait?

Waiting to acquire a property only makes sense if interest rates and/or property prices decrease significantly, leading to a significant decrease in your acquisition cost and debt service.

Interest Rates

The Fed recently increased the interest rate by another 0.25%. With inflation still around 5% and unemployment near historic lows, I do not anticipate interest rates decreasing significantly in the foreseeable future, instead, they may increase. Keep in mind that if the interest rate falls, the prices will increase as more buyers go after an already tight supply. Higher prices increase your acquisition cost and debt service. So, waiting for interest rates to fall significantly is not a viable option.

Property Prices

Rents and prices are driven by local supply and demand. In Las Vegas, the supply and demand situation depends on the property segment.

The housing market is not homogeneous; it is comprised of multiple segments. The demand for one segment could be high while the demand for another is low. For example, demand for $1M homes might be practically non-existent, while at the same time, there is high demand for homes ranging from $300,000 to $400,000.

Which segment do we target? For over 15 years, we have focused on a narrow tenant segment. The properties that meet this segment's housing requirements are primarily single-family homes currently priced between $320,000 and $475,000. What is the current demand situation with this segment of properties? In a word, high.

Why? It's due to a combination of limited supply and ever-increasing demand. I will address supply first.

Almost Fixed Supply of Properties

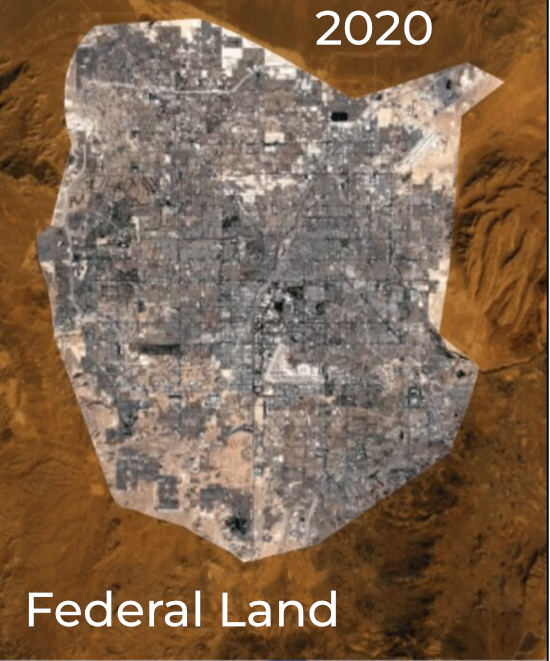

The limited supply of properties within our target price range is due to the high cost of land. See the 2020 aerial view of Las Vegas below. Las Vegas is a small island of private land in an ocean of federal land. And, there is little undeveloped non-federal land remaining.

In the areas we target, land costs more than $1 million per acre. As a result, the prices of most new homes in these areas start at $550,000. No matter how many +$550,000 they build, they do not increase the number of properties in the $320,000 to $475,000 price range. So, the number of properties in the $320,000 to $475,000 range is almost fixed.

Below are the 13-month trailing stats showing the supply of our target segment. We are at 1 month of supply and I do not see any factors that will reverse the trend abruptly.

Demand

Demand is driven by population growth. Las Vegas’ average annual population growth has been between 2% and 3%. And, is likely to increase. Penske Truck Rental’s annual report on where people are moving lists Las Vegas as the #2 destination, following Houston as #1.

What is bringing so many people to Las Vegas? Jobs. In January, the Monster and Glass Door job sites showed there were between 26,000 and 31,000 open jobs. And, depending on which article you read, today there is between $18B and $26B under construction. As these projects come online, they will create thousands of additional jobs. Jobs will continue to bring more people to Las Vegas.

And every person will need a place to live. The two options are to buy or rent.

Many people will purchase homes in the $320,000 to $475,000 price range, while the majority of others will rent homes in that same price range. As the population increases, the demand for homes in the $320,000 to $475,000 price range will continue to rise, driving up both home prices and rents.

The combination of a nearly fixed supply and rising demand almost guarantees that prices and rents will continue to increase.

I Have a Question for You

If you had the opportunity to purchase a business that provided a reliable, passive income that you would not outlive and that kept pace with inflation, would you pass on the opportunity because the initial returns did not match what you could have earned two or three years ago?

Dealing with High-Interest Rates

Gone are the days of 2% and 3% interest rates. Today, investment loan rates range between 7% and 7.5%, and they're not expected to decrease anytime soon. We need to deal with this reality. The question is, how?

Interest Rate Buy Downs

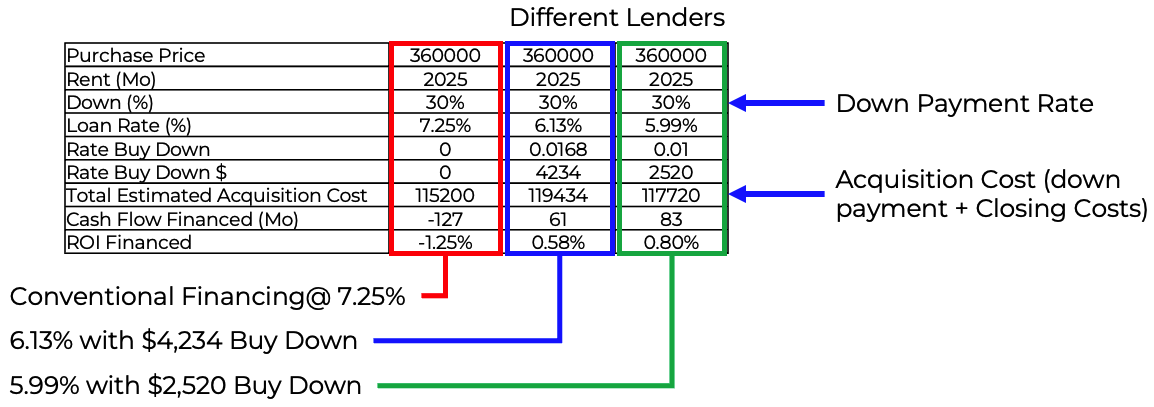

An interest-rate buydown is an option where you pay an amount upfront to reduce the interest rate on a loan. Below is a comparison between a conventional 7.25% rate compared to two interest-rate buy-down options.

- Column one is a conventional loan at 7.25% with no buy-down. The result is a -1.25% return. The acquisition cost (down payment plus closing cost) is $115,200.

- Column two uses an interest buy-down to reduce the interest rate to 6.13%. The upfront cost to decrease the interest rate is $4,234. The acquisition cost (down payment plus closing cost plus buy-down cost) is $119,434 resulting in a 0.58% return.

- Column three uses an interest rate buy-down to reduce the rate to 5.99%, for an upfront cost of $2,520. The acquisition price is $117,720 resulting in a 0.80% return.

Column two and column three are from different lenders. As you can see, there is a significant difference in buy-down costs and rates. Our clients always rate shop these days once they have a property under contract.

Conclusion

If you are hoping to wait for conditions to change back to what they were two or three years ago, that is not going to happen. And, delaying your purchase will result in paying more and missing out on a lot of appreciation and tax savings. The time to act is now.

The best time to buy was yesterday, and the second best time to buy is today.

Ask yourself.

Does the property cash flow?

How can I add value? What is the location?

Is it likely to appreciate in value?

No one can tell you if the market is right for you only you could decide. Some investors or after slow appreciation with high cash flow. Some want the exact opposite. I know it is confusing right now due to the crazy market shift due to the mass migration from California, causing all the prices to rise exponentially. If you know what you want and are able to act on it you'll ultimately make the right decision for you.

Quote from @Steven Foster Wilson:

Quote from @Rafal Soltysek:

Is it good idea to buy now in Vegas or waited out ?... and if yes: SFR or condo/townhouse -- and I am talking from perspective either an investor or " regular " buyer - (first time home buyer)

I think there are always deals to be had. I mean they were still making deals work when interest rates were at 17%.

I think this lacks context. When interest rates were that high, the cost of houses was significantly lower. Enough lower that even with those sky high interest rates, housing was a drastically lower percentage of income.

Are there deals to be had, yes? I'm trying to find a right move for me, but I think throwing around that 17% number without the context of how cheap houses were is a bit of a misrepresentation.

Thanks!

Really great explanation , easy to understand what’s goin on,- thanks again

It certainly depends on a lot of factors, and most importantly, your personal situation and finances. As well as your goals. Can you explain what your current situation is? How liquid are you? Are you already preapproved?

Buying, at the end of the day is most the time a better option than throwing money at rent for years on it. As many mention it above, vegas is only going to get more costly. We have the Oakland A’s moving into the city, we have Hollywood, potentially making big moves here, and never ending investments, are only growing to become more popular and more costly. Yet people moving in from California, and regardless what the rates do, especially, if they go down, prices are going to hold steady for a good while and if anything definitely increase.