Article: A thought experiment - Real Estate vs S&P500

AND imagine the real estate is NOT cash flow positive. Consider the ‘negative cash flow’ as simply additional reinvestment…just like the S&P.

I am all about building cash flow over time through real estate. However, I’m early early early on in my journey.

I am wrapping up construction on my ‘house-hack’ 3 bed / 3 bath single family home in Minnesota. Once it’s done, I’ll bring on two roommates, and effectively cut my living expenses by $1,500–2,000.

I’m just beginning in the journey and contemplating the two main paths I see before me (on this and the next deal).

I can go after a ‘pure’ tried-and-true-investment-20%down-property. One that cash flows right out of the box with minimal capital expenditure or reinvestment. Or, I can go for another rehab, to capitalize on forced appreciation and net worth impact.

As I consider the options before me, I create thought experiments. I’d like to include you in one today.

The problem with Forced Appreciation (Net Worth Impact) Properties:

Debt costs become too high for excellent cash flow.

Unless you find a gem that really doesn’t need much but looks like it does. If you undertake a total renovation, or “flip”, you’ll have pretty significant reconstruction costs. If you can get a cosmetic fixer-upper, the options open up on the cash flow side.

Construction costs on my current (and first) property have run over $130k. I bought it at $250k in a neighborhood that can support $600k+ property values. Houses that are just blocks from me go for 3/4 of a million dollars. My equity impact will be fine. But the cashflow return may not be.

Cashflow Assumptions

If I tried to rent the house as an entire unit, I could probably get $2,500–2,750. Let’s assume all utilities/trash/etc. are paid by the tenant. This means I don’t have additional cash expense outside of fixed debt payments. We’ll use $2,500 as a conservative estimate for the purposes of this thought experiment.

All-in (mortgage + construction loan payment), my fixed debt costs per month will be ~$2,400. That leaves only $100 of cash flow, BEFORE non-cash and deferred-cash expenses.

Non-cash expense includes an implied 5% vacancy, for example. This is not something that will actually hit the bank account but will impact cashflow at some point. Deferred-cash expenses are depreciation, reinvestment, capital expenditures, and maintenance. When estimating ~15% of rents for expenses like these, monthly noncash and deferred-cash expenses add $375/mo. They represent expenses that will be realized at some point (you just don’t know when).

Therefore, my net cashflow on the high-equity-impact house is negative ($275) per month. That means I’ll have to contribute/invest an extra $275 of my own personal cash per month to maintain the property.

Opportunity Costs

I’ll highlight why this isn’t such a huge deal to me, by using an economics concept called Opportunity Cost.

For those unfamiliar, Opportunity Cost is the implied cost of doing something because it also means you’re NOT doing something else. Essentially what you do is valued against what else you could have done instead.

By having to ‘invest’ an extra $275/month in the ‘non-cashflowing-equity-impact’ house, I can’t allocate that ‘investment’ elsewhere…like the S&P500.

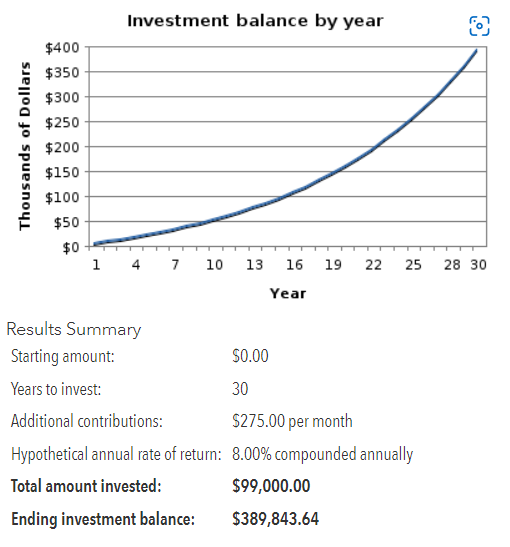

This is what my $275/month investment would look like in the S&P500 over 30 years (the length of my mortgage) at a long-term annual Rate of Return of 8%.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

My $99k investment over 30 years turns into $389,843. Not bad! 394% total return over that timeframe.

Now, let’s discount that number back to today’s dollars to get a Present Value (PV). PV represents a lump sum today of what future cash flows are worth. Because the $275 is invested over 30 years, the $389k cumulative asset is actually worth $38,741 if I had it as a lump sum today. I do this, because the cash flows of real estate and S&P500 transactions aren’t the same. By bringing it back down to an PV level, I can compare apples to apples today, so to speak.

PV of S&P500 investment over 30 years = $38,741.

Real Estate Additional $275 ‘Investment’

Similar to the S&P500 investment, over 30 years, I’ll accumulate $99k of additional investment dollars in the house project. However, this doesn’t have the same future value as the S&P500 because the house underpins the future value.

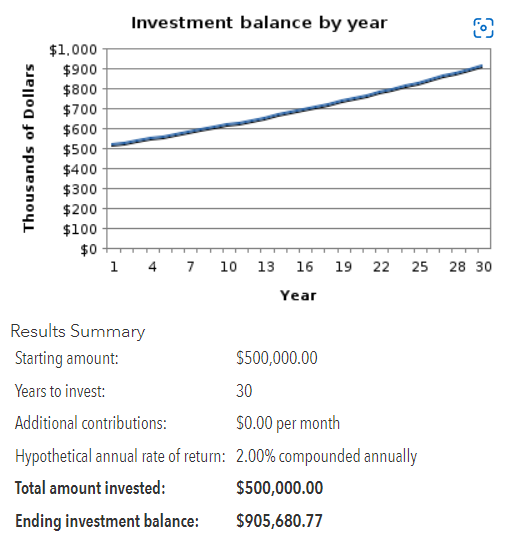

Here is what the property value will look like over 30 years.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

The property appreciates to $906k, assuming 2% annual return, starting from current value of $500k. Zero additional contribution is appropriate for the house calculation, since there are no positive realized cash flows from the property.

The key, though, is that over the 30-year period, the mortage and construction costs have been paid down by the monthly rents. Even though the monthly rents didn’t cover ALL of the expenses, the debts still got paid down over time, and I have a free-and-clear asset worth $906k in 30 years.

To find the PV of the real estate transaction, I need to maintain the 8% Rate of Return (since that’s my opportunity cost to invest in the S&P500).

The Present Value (value today) of the $906k house in 30 years = $90,089. That’s 2.3x the return of the S&P500 when measured in dollars today.

The Comparison

Would you rather have $38k today or $90k today?

Seems like an obvious answer, right?

I’ll take the $90k.

The house only appreciates at 2%. The S&P is at 8%. The house still wins.

What’s the difference? For one, the house is starting with a value higher than the S&P500 investment. However, if you remove the starting value of the house from the future value, the house still yields $406k ($906k-500k). That’s still higher than the $389k S&P500 future value, although not by as much.

How is it possible to have such a large difference!? It’s mainly in how the investments change in value.

The S&P investment derives most of its value through appreciation alone. Yes, there will be dividends…but over the long-term, the lion’s share of value comes from appreciation of equities.

The house, on the other hand gains value through BOTH appreciation AND debt paydown (aka equity improvement). By leveraging debt, I wrangled myself into an asset worth $500k as a starting point, versus starting at $0, as is the case in the S&P investment. The value improves so much more because while the house is appreciating, I am simultaneously gaining equity in the asset as it gets paid down.

To highlight the importance of this even further, we can segment the value of the house into two camps: appreciation and debt paydown (equity improvement). After 2 years, the house only appreciates to ~$520k. However, over that same time, I’ll accrue ~$10k in equity from debt paydowns (using other peoples’ money, IE: rents). Combined, that’s $30k of value, compared to the S&P investment of only $7,100(24 monthly payments of $275 = $6,600 + $510 interest). The equity paydown alone eclipses the value of the alternative investment within 2 years.

This is the power of leveraged appreciation and equity improvement through real estate.

Summary / Consolidation / Conclusion

I am definitely over-simplifying what it means to hold a real estate investment property for 30 years. There’s a lot that goes into it, that just doesn’t matter if you throw the same $275/month into an S&P index. There is management, deferred maintenance, updates, and tenants to deal with.

Perhaps that’s exactly why the returns are so different.

There is an implied opportunity cost of time, that I haven’t mentioned to this point. The simplicity and plug-and-play value in the S&P really works if you’re not into managing rental property. However, the difference in value could indicate the implied worth of property management work over time.

The other thing I didn’t mention in the calculation is that after the 30-year mortgage is up, the house cash flows the full rent, less non-cash and deferred-cash expenses. After all the debt is paid off, that’s effectively $2,225 per month of straight cash flow. Let that hit your bottom line & see what happens.

Stay frosty, friends.

Technical Finance Note: Some of you might have noticed that I used PV of the future cashflow, instead of NPV, which would have included discounts on each of the $275/mo (or $3,300/yr) investment installments. Some others might notice that I didn’t include the cost to purchase and rehab the property in either calculation. I essentially used ‘finished house, renters in place’ as Time-0 in both calcs. This was all done intentionally to keep the calculations relatively simple. If I were to add those to a true NPV calculation, it would yield a similar result, albeit with lower NPV values than PV values. The PV is still an effective method to compare apples to apples of the relative asset values after 30 years. The $99k ‘investment’ over time is the same, regardless of the NPV/PV calculation convention.

All I had to read was the first section, with all the "don't includes" and choices no smart REI would ever make, and knowing then that the rest of this post is based on fictional facts and bad (really bad) assumptions and rationalizations, I knew the rest wasn't worth reading.

@Joe Villeneuve, thanks for your response. I'm just starting out and appreciate you checking my thinking! Would you tell me more about what you saw that you don't think is prudent? Or what bad assumptions do I make? Would love to understand more of your thoughts.

I was trying to approach it to show the power of REI versus alternative investments. Where did I miss, in your opinion?

Quote from @Joshua Aycock:Starting with your first line, "...and the RE isn't CF positive". Negative CF isn't a "reinvestment", it's an unnecessary added cost...and nothing like investing in the Stock Market (S & P).

@Joe Villeneuve, thanks for your response. I'm just starting out and appreciate you checking my thinking! Would you tell me more about what you saw that you don't think is prudent? Or what bad assumptions do I make? Would love to understand more of your thoughts.

I was trying to approach it to show the power of REI versus alternative investments. Where did I miss, in your opinion?

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.

Your next section on Force Appreciation tells you that the house described is a flip...not a hold...so there is no delayed CF.

Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.

- Rental Property Investor

- East Wenatchee, WA

- 15,893

- Votes |

- 10,159

- Posts

REI and indexes each have their place.

A househack is a no brainer. Reducing costs like living expenses, buying below market value and adding value at huge multiples are the main advantages of RE.

I would not net positive living in my house without RE or househacking. But my passivity is determined sometimes by things outside of my control like weather and tenants.

But RE takes work and someitmes indigestion.

There should be balance sheet investments as well as cash-flow. Both RE and S&P take buy and homework vs blind buy and hold or buy and hope.

Pivot into opportunities as they present themselves. I moved a lot from RE into the S&P mid June. RE has high transaction costs and long lead times. Buy and homework.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.

That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

Quote from @Steve Vaughan:

REI and indexes each have their place.

A househack is a no brainer. Reducing costs like living expenses, buying below market value and adding value at huge multiples are the main advantages of RE.

I would not net positive living in my house without RE or househacking. But my passivity is determined sometimes by things outside of my control like weather and tenants.

But RE takes work and someitmes indigestion.

There should be balance sheet investments as well as cash-flow. Both RE and S&P take buy and homework vs blind buy and hold or buy and hope.Pivot into opportunities as they present themselves. I moved a lot from RE into the S&P mid June. RE has high transaction costs and long lead times. Buy and homework.

@Steve Vaughan I like how you say that "RE takes work and sometimes indigestion"...it's been true up to this point. I like the passivity of S&P, but at this point in my career, I think I want to scale using RE equity jumps, then move into more passive, "plug and play" options like S&P down the line. Thanks for commenting!

and thank you, @JD Martin, appreciate the encouragement

Quote from @Joshua Aycock:You're thinking in the right direction, just missing the most important parts of REI that reinforce what you're trying to communicate. As a result, you're actually thinking small. Keep looking at this, in the ways a few of us have mentioned here, which is really just going beyond the direction you're going, and that lightbulb that you turned on will become a search light.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

Maybe I'm missing something in how you are breaking down your calcs or what you are trying to convey with this comparison, but if you were actually doing an apples to apples comparison of how the S&P investment and the home as an investment would perform, wouldn't you need to include whatever you paid out of pocket for the property as the initial value of the S&P investment and then do your TVM and NPV calcs? For example if you paid 20% of 250K = 50K and you paid that 130K for construction, then your starting investment in the S&P should be that 180K and then you add the 275/month you're evaluating.

I don't know what you put down on your property so I can't run the calcs for you, but I think that would be a more accurate approach.

That's not what I'm saying. What I'm saying is that comparing the Stock Market Investing to REI isn't an Apples to Apples comparison.

Along those lines, if you start with $100k (pick a number), a continuous 15% return in the SM can (and usually is) less profitable than a continuous 5% return plus CF in REI.

Quote from @Joshua Aycock:Keep in mind that the S&P is liquid, and real estate is not. Real estate can burn to the ground, be flooded or be broken into and has cap ex. You don't have to fix toilets with the S&P. You can live in another country with the S&P and not worry about a property. That all plays into how you decide cash flow and what is best for your personality.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

@Joshua Aycock the most important thing to recognize about a free market is the efficiency. Returns are proportional to risk, effort and other quantifiable and unquantifiable factors that all the other investors in your market have already defined for you.

Unless you have established a true competitive advantage, you only realize higher returns as you trade off something else. Only you can determine if the higher yield is worth the trade off.

Quote from @Mike Hern:RE is liquid, or is CF not "cash". S & P value adjust by the day, and can have massive swings in either direction. If the value of a stock ends up less than what you paid for it, you are losing money. If the PV in RE goes down to less than what you paid for it, you're still cash flowing the same since your CF isn't tied to the new PV...it's tied to mortgage pmt you're making based on what you originally paid for it.

Quote from @Joshua Aycock:Keep in mind that the S&P is liquid, and real estate is not. Real estate can burn to the ground, be flooded or be broken into and has cap ex. You don't have to fix toilets with the S&P. You can live in another country with the S&P and not worry about a property. That all plays into how you decide cash flow and what is best for your personality.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

When RE burns to the ground, insurance steps in. If the company you're invested in, goes bankrupt, you lose. There's no insurance to cover your a$$.

With RE, the toilets are covered from the positive CF. If a stock goes down in value, you can't fix it. You depend on the company to do it.

Why can't you live in a different country to own RE? It happens all the time. Sometimes partners play a role here. How many partners can you have when you buy stock?

Here's the big one. When you buy a stock, you're paying full price. When you buy RE, you're getting a PV of 5 times what you're paying for it...and, there's no "call" like there is when you buy a stock on margin. Plus, you have 30 years to pay off the other 80%...which you don't pay anyway...your tenant does.

You can buy more money based on the value of a property (refi), and still own both properties, with their respective CF and appreciating PV.

Quote from @Joe Villeneuve:

Quote from @Mike Hern:RE is liquid, or is CF not "cash". S & P value adjust by the day, and can have massive swings in either direction. If the value of a stock ends up less than what you paid for it, you are losing money. If the PV in RE goes down to less than what you paid for it, you're still cash flowing the same since your CF isn't tied to the new PV...it's tied to mortgage pmt you're making based on what you originally paid for it.

Quote from @Joshua Aycock:Keep in mind that the S&P is liquid, and real estate is not. Real estate can burn to the ground, be flooded or be broken into and has cap ex. You don't have to fix toilets with the S&P. You can live in another country with the S&P and not worry about a property. That all plays into how you decide cash flow and what is best for your personality.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

When RE burns to the ground, insurance steps in. If the company you're invested in, goes bankrupt, you lose. There's no insurance to cover your a$$.

With RE, the toilets are covered from the positive CF. If a stock goes down in value, you can't fix it. You depend on the company to do it.

Why can't you live in a different country to own RE? It happens all the time. Sometimes partners play a role here. How many partners can you have when you buy stock?

Here's the big one. When you buy a stock, you're paying full price. When you buy RE, you're getting a PV of 5 times what you're paying for it...and, there's no "call" like there is when you buy a stock on margin. Plus, you have 30 years to pay off the other 80%...which you don't pay anyway...your tenant does.

You can buy more money based on the value of a property (refi), and still own both properties, with their respective CF and appreciating PV.

Your comment: "RE is liquid, or is CF not "cash"." No, real estate isn't liquid (as you already know. You're just playin') There is a big difference between getting cash flow of $200 a month off of an asset versus the entire asset being available on very short notice.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

I've never bought the S&P and wouldn't touch it with a 10 foot pole. ;-) Although the S&P has some advantages, there aren't enough advantages nor is it predictable enough.

Quote from @Joshua Aycock:

AND imagine the real estate is NOT cash flow positive. Consider the ‘negative cash flow’ as simply additional reinvestment…just like the S&P.

I am all about building cash flow over time through real estate. However, I’m early early early on in my journey.

I am wrapping up construction on my ‘house-hack’ 3 bed / 3 bath single family home in Minnesota. Once it’s done, I’ll bring on two roommates, and effectively cut my living expenses by $1,500–2,000.

I’m just beginning in the journey and contemplating the two main paths I see before me (on this and the next deal).

I can go after a ‘pure’ tried-and-true-investment-20%down-property. One that cash flows right out of the box with minimal capital expenditure or reinvestment. Or, I can go for another rehab, to capitalize on forced appreciation and net worth impact.

As I consider the options before me, I create thought experiments. I’d like to include you in one today.

The problem with Forced Appreciation (Net Worth Impact) Properties:

Debt costs become too high for excellent cash flow.

Unless you find a gem that really doesn’t need much but looks like it does. If you undertake a total renovation, or “flip”, you’ll have pretty significant reconstruction costs. If you can get a cosmetic fixer-upper, the options open up on the cash flow side.

Construction costs on my current (and first) property have run over $130k. I bought it at $250k in a neighborhood that can support $600k+ property values. Houses that are just blocks from me go for 3/4 of a million dollars. My equity impact will be fine. But the cashflow return may not be.

Cashflow Assumptions

If I tried to rent the house as an entire unit, I could probably get $2,500–2,750. Let’s assume all utilities/trash/etc. are paid by the tenant. This means I don’t have additional cash expense outside of fixed debt payments. We’ll use $2,500 as a conservative estimate for the purposes of this thought experiment.

All-in (mortgage + construction loan payment), my fixed debt costs per month will be ~$2,400. That leaves only $100 of cash flow, BEFORE non-cash and deferred-cash expenses.

Non-cash expense includes an implied 5% vacancy, for example. This is not something that will actually hit the bank account but will impact cashflow at some point. Deferred-cash expenses are depreciation, reinvestment, capital expenditures, and maintenance. When estimating ~15% of rents for expenses like these, monthly noncash and deferred-cash expenses add $375/mo. They represent expenses that will be realized at some point (you just don’t know when).

Therefore, my net cashflow on the high-equity-impact house is negative ($275) per month. That means I’ll have to contribute/invest an extra $275 of my own personal cash per month to maintain the property.

Opportunity Costs

I’ll highlight why this isn’t such a huge deal to me, by using an economics concept called Opportunity Cost.

For those unfamiliar, Opportunity Cost is the implied cost of doing something because it also means you’re NOT doing something else. Essentially what you do is valued against what else you could have done instead.

By having to ‘invest’ an extra $275/month in the ‘non-cashflowing-equity-impact’ house, I can’t allocate that ‘investment’ elsewhere…like the S&P500.

This is what my $275/month investment would look like in the S&P500 over 30 years (the length of my mortgage) at a long-term annual Rate of Return of 8%.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

My $99k investment over 30 years turns into $389,843. Not bad! 394% total return over that timeframe.

Now, let’s discount that number back to today’s dollars to get a Present Value (PV). PV represents a lump sum today of what future cash flows are worth. Because the $275 is invested over 30 years, the $389k cumulative asset is actually worth $38,741 if I had it as a lump sum today. I do this, because the cash flows of real estate and S&P500 transactions aren’t the same. By bringing it back down to an PV level, I can compare apples to apples today, so to speak.

PV of S&P500 investment over 30 years = $38,741.

Real Estate Additional $275 ‘Investment’

Similar to the S&P500 investment, over 30 years, I’ll accumulate $99k of additional investment dollars in the house project. However, this doesn’t have the same future value as the S&P500 because the house underpins the future value.

Here is what the property value will look like over 30 years.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

The property appreciates to $906k, assuming 2% annual return, starting from current value of $500k. Zero additional contribution is appropriate for the house calculation, since there are no positive realized cash flows from the property.

The key, though, is that over the 30-year period, the mortage and construction costs have been paid down by the monthly rents. Even though the monthly rents didn’t cover ALL of the expenses, the debts still got paid down over time, and I have a free-and-clear asset worth $906k in 30 years.

To find the PV of the real estate transaction, I need to maintain the 8% Rate of Return (since that’s my opportunity cost to invest in the S&P500).

The Present Value (value today) of the $906k house in 30 years = $90,089. That’s 2.3x the return of the S&P500 when measured in dollars today.

The Comparison

Would you rather have $38k today or $90k today?

Seems like an obvious answer, right?

I’ll take the $90k.

The house only appreciates at 2%. The S&P is at 8%. The house still wins.

What’s the difference? For one, the house is starting with a value higher than the S&P500 investment. However, if you remove the starting value of the house from the future value, the house still yields $406k ($906k-500k). That’s still higher than the $389k S&P500 future value, although not by as much.

How is it possible to have such a large difference!? It’s mainly in how the investments change in value.

The S&P investment derives most of its value through appreciation alone. Yes, there will be dividends…but over the long-term, the lion’s share of value comes from appreciation of equities.

The house, on the other hand gains value through BOTH appreciation AND debt paydown (aka equity improvement). By leveraging debt, I wrangled myself into an asset worth $500k as a starting point, versus starting at $0, as is the case in the S&P investment. The value improves so much more because while the house is appreciating, I am simultaneously gaining equity in the asset as it gets paid down.

To highlight the importance of this even further, we can segment the value of the house into two camps: appreciation and debt paydown (equity improvement). After 2 years, the house only appreciates to ~$520k. However, over that same time, I’ll accrue ~$10k in equity from debt paydowns (using other peoples’ money, IE: rents). Combined, that’s $30k of value, compared to the S&P investment of only $7,100(24 monthly payments of $275 = $6,600 + $510 interest). The equity paydown alone eclipses the value of the alternative investment within 2 years.

This is the power of leveraged appreciation and equity improvement through real estate.

Summary / Consolidation / Conclusion

I am definitely over-simplifying what it means to hold a real estate investment property for 30 years. There’s a lot that goes into it, that just doesn’t matter if you throw the same $275/month into an S&P index. There is management, deferred maintenance, updates, and tenants to deal with.

Perhaps that’s exactly why the returns are so different.

There is an implied opportunity cost of time, that I haven’t mentioned to this point. The simplicity and plug-and-play value in the S&P really works if you’re not into managing rental property. However, the difference in value could indicate the implied worth of property management work over time.

The other thing I didn’t mention in the calculation is that after the 30-year mortgage is up, the house cash flows the full rent, less non-cash and deferred-cash expenses. After all the debt is paid off, that’s effectively $2,225 per month of straight cash flow. Let that hit your bottom line & see what happens.

Stay frosty, friends.

Technical Finance Note: Some of you might have noticed that I used PV of the future cashflow, instead of NPV, which would have included discounts on each of the $275/mo (or $3,300/yr) investment installments. Some others might notice that I didn’t include the cost to purchase and rehab the property in either calculation. I essentially used ‘finished house, renters in place’ as Time-0 in both calcs. This was all done intentionally to keep the calculations relatively simple. If I were to add those to a true NPV calculation, it would yield a similar result, albeit with lower NPV values than PV values. The PV is still an effective method to compare apples to apples of the relative asset values after 30 years. The $99k ‘investment’ over time is the same, regardless of the NPV/PV calculation convention.

How much are you putting down to acquire the 500K property? 100K? How are you accounting for the future value difference between a monthly 275 payment vs putting down a lump sum 100K payment? That's a pretty huge Opportunity Cost delta between those two scenarios. If you put 100K into the S&P for 30 years with an annual return of 8%, you would end up with 1,006,265.69 all without lifting a single finger.

Of course, at this point you'd be subject to 900K in LTCG which is a substantial tax liability. That's where RE and its like-kind exchange option helps to even out the gap.

Also, in real life, a good property would also be providing you with a good amount of income for those 30 years.

One good thing about options and derivatives is: that you can make a position in such a way that "even if you're wrong, you could still make a profit". You could reduce the 'surprise' effect of investment via active hedging.

In real estate, it's the other way around, even if you do anything correctly, you could still lose money as there's too many surprises.

If you're good at options and math, investing in options/etf is actually more profitable in short term, but most people are not good at doing both.

Quote from @Mike Hern:Isn't the CF from RE part of the RE investment? Since the answer is yes, then there IS some liquidity to RE.

Quote from @Joe Villeneuve:

Quote from @Mike Hern:RE is liquid, or is CF not "cash". S & P value adjust by the day, and can have massive swings in either direction. If the value of a stock ends up less than what you paid for it, you are losing money. If the PV in RE goes down to less than what you paid for it, you're still cash flowing the same since your CF isn't tied to the new PV...it's tied to mortgage pmt you're making based on what you originally paid for it.

Quote from @Joshua Aycock:Keep in mind that the S&P is liquid, and real estate is not. Real estate can burn to the ground, be flooded or be broken into and has cap ex. You don't have to fix toilets with the S&P. You can live in another country with the S&P and not worry about a property. That all plays into how you decide cash flow and what is best for your personality.

Thanks for the further feedback, Joe. I've addressed some of your comments below. I'll think more on how I can describe what I'm trying to do in the future.

Quote from @Joe Villeneuve:

House hacking is only an investment if, after you are no longer living in the house, will it cash flow.Your next section describes a property that is negative CF just waiting to happen ($100/m CF). If it has a NCF of $275/month ($3300/yr), that means after 5 years you will have paid an additional $16,500 for that property...and will have made no money.

What I'm trying to argue is that even without perfectly CFing the property, I'd still end up ahead from an EQUITY perspective. The asset appreciation and principal paydown (using someone else's money) provide a Net Worth Impact regardless of whether I had to contribute additional money over that timeframe.

Your definition of "opportunity cost" is incorrectly applied here. The alternative investment in the SM. at only 8%, is a linear return. REI gives you an exponential return. The "opportunity loss) over that same 30 year period, would include so many zeros, it wouldn't fit on the page. Comparing the SM to REI, is far from an "apples to apples" comparison.That's basically my point...that over 30 years, I'd still end up ahead, even if the property required consistent cash re-infusion. I'm just trying to bring that future value back to a number today.

Thanks again for making me think harder on what I'm trying to communicate!

all the best

When RE burns to the ground, insurance steps in. If the company you're invested in, goes bankrupt, you lose. There's no insurance to cover your a$$.

With RE, the toilets are covered from the positive CF. If a stock goes down in value, you can't fix it. You depend on the company to do it.

Why can't you live in a different country to own RE? It happens all the time. Sometimes partners play a role here. How many partners can you have when you buy stock?

Here's the big one. When you buy a stock, you're paying full price. When you buy RE, you're getting a PV of 5 times what you're paying for it...and, there's no "call" like there is when you buy a stock on margin. Plus, you have 30 years to pay off the other 80%...which you don't pay anyway...your tenant does.

You can buy more money based on the value of a property (refi), and still own both properties, with their respective CF and appreciating PV.Your comment: "RE is liquid, or is CF not "cash"." No, real estate isn't liquid (as you already know. You're just playin') There is a big difference between getting cash flow of $200 a month off of an asset versus the entire asset being available on very short notice.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

I've never bought the S&P and wouldn't touch it with a 10 foot pole. ;-) Although the S&P has some advantages, there aren't enough advantages nor is it predictable enough.

Quote from @Carlos Ptriawan:

One good thing about options and derivatives is: that you can make a position in such a way that "even if you're wrong, you could still make a profit". You could reduce the 'surprise' effect of investment via active hedging.

In real estate, it's the other way around, even if you do anything correctly, you could still lose money as there's too many surprises.

If you're good at options and math, investing in options/etf is actually more profitable in short term, but most people are not good at doing both.

No. If you believe what you wrote about REI, then you're doing it wrong.

meant to say, for example, we can't avoid the risk of tenants destroying sewer lines. So the risk in real estate, thru direct ownership, is real and can only be minimalized.

Quote from @Tony Kim:

Quote from @Joshua Aycock:

AND imagine the real estate is NOT cash flow positive. Consider the ‘negative cash flow’ as simply additional reinvestment…just like the S&P.

I am all about building cash flow over time through real estate. However, I’m early early early on in my journey.

I am wrapping up construction on my ‘house-hack’ 3 bed / 3 bath single family home in Minnesota. Once it’s done, I’ll bring on two roommates, and effectively cut my living expenses by $1,500–2,000.

I’m just beginning in the journey and contemplating the two main paths I see before me (on this and the next deal).

I can go after a ‘pure’ tried-and-true-investment-20%down-property. One that cash flows right out of the box with minimal capital expenditure or reinvestment. Or, I can go for another rehab, to capitalize on forced appreciation and net worth impact.

As I consider the options before me, I create thought experiments. I’d like to include you in one today.

The problem with Forced Appreciation (Net Worth Impact) Properties:

Debt costs become too high for excellent cash flow.

Unless you find a gem that really doesn’t need much but looks like it does. If you undertake a total renovation, or “flip”, you’ll have pretty significant reconstruction costs. If you can get a cosmetic fixer-upper, the options open up on the cash flow side.

Construction costs on my current (and first) property have run over $130k. I bought it at $250k in a neighborhood that can support $600k+ property values. Houses that are just blocks from me go for 3/4 of a million dollars. My equity impact will be fine. But the cashflow return may not be.

Cashflow Assumptions

If I tried to rent the house as an entire unit, I could probably get $2,500–2,750. Let’s assume all utilities/trash/etc. are paid by the tenant. This means I don’t have additional cash expense outside of fixed debt payments. We’ll use $2,500 as a conservative estimate for the purposes of this thought experiment.

All-in (mortgage + construction loan payment), my fixed debt costs per month will be ~$2,400. That leaves only $100 of cash flow, BEFORE non-cash and deferred-cash expenses.

Non-cash expense includes an implied 5% vacancy, for example. This is not something that will actually hit the bank account but will impact cashflow at some point. Deferred-cash expenses are depreciation, reinvestment, capital expenditures, and maintenance. When estimating ~15% of rents for expenses like these, monthly noncash and deferred-cash expenses add $375/mo. They represent expenses that will be realized at some point (you just don’t know when).

Therefore, my net cashflow on the high-equity-impact house is negative ($275) per month. That means I’ll have to contribute/invest an extra $275 of my own personal cash per month to maintain the property.

Opportunity Costs

I’ll highlight why this isn’t such a huge deal to me, by using an economics concept called Opportunity Cost.

For those unfamiliar, Opportunity Cost is the implied cost of doing something because it also means you’re NOT doing something else. Essentially what you do is valued against what else you could have done instead.

By having to ‘invest’ an extra $275/month in the ‘non-cashflowing-equity-impact’ house, I can’t allocate that ‘investment’ elsewhere…like the S&P500.

This is what my $275/month investment would look like in the S&P500 over 30 years (the length of my mortgage) at a long-term annual Rate of Return of 8%.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

My $99k investment over 30 years turns into $389,843. Not bad! 394% total return over that timeframe.

Now, let’s discount that number back to today’s dollars to get a Present Value (PV). PV represents a lump sum today of what future cash flows are worth. Because the $275 is invested over 30 years, the $389k cumulative asset is actually worth $38,741 if I had it as a lump sum today. I do this, because the cash flows of real estate and S&P500 transactions aren’t the same. By bringing it back down to an PV level, I can compare apples to apples today, so to speak.

PV of S&P500 investment over 30 years = $38,741.

Real Estate Additional $275 ‘Investment’

Similar to the S&P500 investment, over 30 years, I’ll accumulate $99k of additional investment dollars in the house project. However, this doesn’t have the same future value as the S&P500 because the house underpins the future value.

Here is what the property value will look like over 30 years.

Calculator & visualization courtesy of KJE Computer Solutions via American Funds

The property appreciates to $906k, assuming 2% annual return, starting from current value of $500k. Zero additional contribution is appropriate for the house calculation, since there are no positive realized cash flows from the property.

The key, though, is that over the 30-year period, the mortage and construction costs have been paid down by the monthly rents. Even though the monthly rents didn’t cover ALL of the expenses, the debts still got paid down over time, and I have a free-and-clear asset worth $906k in 30 years.

To find the PV of the real estate transaction, I need to maintain the 8% Rate of Return (since that’s my opportunity cost to invest in the S&P500).

The Present Value (value today) of the $906k house in 30 years = $90,089. That’s 2.3x the return of the S&P500 when measured in dollars today.

The Comparison

Would you rather have $38k today or $90k today?

Seems like an obvious answer, right?

I’ll take the $90k.

The house only appreciates at 2%. The S&P is at 8%. The house still wins.

What’s the difference? For one, the house is starting with a value higher than the S&P500 investment. However, if you remove the starting value of the house from the future value, the house still yields $406k ($906k-500k). That’s still higher than the $389k S&P500 future value, although not by as much.

How is it possible to have such a large difference!? It’s mainly in how the investments change in value.

The S&P investment derives most of its value through appreciation alone. Yes, there will be dividends…but over the long-term, the lion’s share of value comes from appreciation of equities.

The house, on the other hand gains value through BOTH appreciation AND debt paydown (aka equity improvement). By leveraging debt, I wrangled myself into an asset worth $500k as a starting point, versus starting at $0, as is the case in the S&P investment. The value improves so much more because while the house is appreciating, I am simultaneously gaining equity in the asset as it gets paid down.

To highlight the importance of this even further, we can segment the value of the house into two camps: appreciation and debt paydown (equity improvement). After 2 years, the house only appreciates to ~$520k. However, over that same time, I’ll accrue ~$10k in equity from debt paydowns (using other peoples’ money, IE: rents). Combined, that’s $30k of value, compared to the S&P investment of only $7,100(24 monthly payments of $275 = $6,600 + $510 interest). The equity paydown alone eclipses the value of the alternative investment within 2 years.

This is the power of leveraged appreciation and equity improvement through real estate.

Summary / Consolidation / Conclusion

I am definitely over-simplifying what it means to hold a real estate investment property for 30 years. There’s a lot that goes into it, that just doesn’t matter if you throw the same $275/month into an S&P index. There is management, deferred maintenance, updates, and tenants to deal with.

Perhaps that’s exactly why the returns are so different.

There is an implied opportunity cost of time, that I haven’t mentioned to this point. The simplicity and plug-and-play value in the S&P really works if you’re not into managing rental property. However, the difference in value could indicate the implied worth of property management work over time.

The other thing I didn’t mention in the calculation is that after the 30-year mortgage is up, the house cash flows the full rent, less non-cash and deferred-cash expenses. After all the debt is paid off, that’s effectively $2,225 per month of straight cash flow. Let that hit your bottom line & see what happens.

Stay frosty, friends.

Technical Finance Note: Some of you might have noticed that I used PV of the future cashflow, instead of NPV, which would have included discounts on each of the $275/mo (or $3,300/yr) investment installments. Some others might notice that I didn’t include the cost to purchase and rehab the property in either calculation. I essentially used ‘finished house, renters in place’ as Time-0 in both calcs. This was all done intentionally to keep the calculations relatively simple. If I were to add those to a true NPV calculation, it would yield a similar result, albeit with lower NPV values than PV values. The PV is still an effective method to compare apples to apples of the relative asset values after 30 years. The $99k ‘investment’ over time is the same, regardless of the NPV/PV calculation convention.

How much are you putting down to acquire the 500K property? 100K? How are you accounting for the future value difference between a monthly 275 payment vs putting down a lump sum 100K payment? That's a pretty huge Opportunity Cost delta between those two scenarios. If you put 100K into the S&P for 30 years with an annual return of 8%, you would end up with 1,006,265.69 all without lifting a single finger.

Of course, at this point you'd be subject to 900K in LTCG which is a substantial tax liability. That's where RE and its like-kind exchange option helps to even out the gap.

Also, in real life, a good property would also be providing you with a good amount of income for those 30 years.

Yeah, @Tony Kim, I BRRRR'd this deal. So I got into it for $12,500 down on $250k original purchase price. The $500k is on the after-rehab value.

But you bring up a good point in the size of a lump sum versus time in the market.

The point I was trying to illustrate is that IF I have to pay an extra $275/mo...IF that was going somewhere, it would still make sense for it to be into the property, despite not being CF positive.

Great point though! Throwing a big chunk into S&P would yield a lot more down-the-line...so could RE though, so neither are bad options IMO...just tradeoffs.

Quote from @Allan C.:

@Joshua Aycock the most important thing to recognize about a free market is the efficiency. Returns are proportional to risk, effort and other quantifiable and unquantifiable factors that all the other investors in your market have already defined for you.

Unless you have established a true competitive advantage, you only realize higher returns as you trade off something else. Only you can determine if the higher yield is worth the trade off.

Yep, love this thought @Allan C. The effort and management required of RE is definitely something to consider in the process, and absolutey a factor. I don't believe I have a distinct competitive advantage (yet) but agree that the risks/effort matrices are different between the two investment options. Thanks for reading & responding!

In order to "control" Risk, one must understand what Risk is.

Risk is made up of 3 things:

1 - What is at Risk,

2 - Who is at Risk, and...

3 - Who is "the" risk.

What, Who and Who:

1 - What is at risk is always the same thing...the cash. The Cash. In the case of a lender, the cash is the loan. In the case of the REI, the cash is the DP...in other words, the cash the REI put into the deal.

2 - Who is at risk is always the person that put in the cash. So, when you combine this with #1 above, the more cash you have in, the greater the risk you are taking, because the more you have "at risk".

3 - The "who" that is "the risk", is who/what is responsible for returning the cash to the person defined in #2 above. In the case of both the REI and the Lender, this would be the Property. I bet you thought I was going to say the REI. Nope. The responsibility for returning the cash to both the REI (DP) and the Lender (Loan) is in fact, the property.

So, when that age old cliche' of, "the greater the risk, the greater the reward", doesn't apply here...unless the REI, who is the custodian of the property, doesn't do their job. The job of the custodian is to:

1 - Buy a property that will return the cash to the two parties at risk,...and this can only be in the form of CF. Equity doesn't count towards the return of cash...in either case. Cash goes in, and cash must be returned since it's the "cash" that is at risk.

2 - Then make the payments in cash to the two who are at risk,...the Lender (mortgage pmt) and the REI (Cash Flow). This is one of the reasons why CF is so important...it's how you eliminate the risk. Once the cumulative CF equals the cash put in by the REI, the REI has nothing left that is "at risk". All of this is why Lenders want the REI to have some "cash" in the game. If they don't, the REI is putting nothing at risk.