Due your flood zone dilligence

If you haven't been paying attention, there are new flood zone maps currently in the public discussion phase that are going to be instituted next year. The Tampa Bay area is going to see a significant amount of property added to flood zones, as well as increased rates for properties already in the flood zone.

If you're an investor, you should check to see not only what the current flood zone requirements are, but also what they will be next year. If not, you could find yourself with significant addtional expense in the near future.

Many new properties are being built at a higher grade above ground, and these will better mitigate flood risks in the years to come. Properties in which the slabs are built on or near ground level are going to be at an increased risk for flood damage, and are likely to see much slower appreciation over the coming years. Some of these properties in lower elevations may already be considered obsolete because of this.

Setting the politics of climate change aside, it is a fact that water levels are rising in coastal regions, and some parts of PInellas county already have to deal with tidal flooding regularly. Smart investors will take this into consideration when making aquisitions to ensure their long-term success.

While I agree that flood insurance is something Florida investors obviously need to be cognizant of, the recent media hype over the acceleration of sea-level rise is an bit sensationalized.

Here in Tampa Bay, the difference between a regular low tide and high tide from just normal tidal cycles can be as much as three feet (see NOAA Tide charts for Tampa Bay).

By comparison, the latest estimates for sea level rise are 3.4 millimeters per year. The equates to about 1.3 inches per decade.

Politics aside:

Is that a concern? Sure.

Is it worth studying and monitoring? Of course.

But will a high tide 5 inches higher than it is now (50 years from now) cause catastrophic destruction or major population shifts in our lifetime? Almost certainly not.

Case in point: We already see fluctuations as high as 12 inches above normal (i.e. a 4 ft high tide) during a "King Tide", which happens a couple of times per year. You don't see that on the news, because it's not a big deal. Some low lying areas may see street flooding (similar to a heavy rain), but people aren't evacuating or moving because of it.

Could this be problematic for our great, great, great, great, great grandchildren in 120 years? Possibly. I'm not saying we shouldn't try to correct this problem for future generations. Only that it's a bit early to sound the alarm from a real estate investing standpoint. My advice is generally to avoid flood zones altogether.

@Jeff Copeland I'm having trouble reconciling your statements. You seem to not be concerned at all about sea level rise, but then you also say to avoid flood zones altogether.

If I followed your advice, I would have to write off large portions of Pinellas county, and most of the east bay, Westshore, and South Tampa areas based on the new maps.

I say the answer lies in between- you should monitor environmental changes as they occur and are forecast to occur, and as an investor, hedge against those changes (however big or small those may be). With the proposed flood zone map changes, it would be difficult to invest in the Tampa region without buying in a flood zone. I say there is no reason not to continue to invest, even in flood zone areas, if you've accounted for future changes and mitigated the risks.

Getting back to my original point, you can buy a property today that isn't in a flood zone, only to find out next year that it now is. The new maps are already available, and that's the key dilligence I recommend investors do.

@Chris Pflum

“Many new properties are being built at a higher grade above ground, and these will better mitigate flood risks in the years to come.”

I’m not an experienced investor but living on the Louisana coast my whole life, I know flooding is so important to consider. As you said, new properties are being built at higher grades. The water still has to go somewhere. Since the new levy systems after Katrina we’re seeing places flood that have never flooded before. There’s a multiplex in a college town that’s flooded twice since 2016 and had never flooded before. It’s for sale now. I’m just hoping some inexperienced investor doesn’t blow their savings thinking they found a steal on this.

@Chris Pflum - I'm wasn't disagreeing with you. I was agreeing that flood insurance is an issue, while also pointing out that the media hype about sea level rise is over-sensationalized. It is not expected to be an issue in our lifetime, or our children's lifetime - so should people avoid investing in Florida because of it? I suppose that depends on their own personal risk tolerance, but the actual level of risk ( at least in terms of sea level rise) isn't going to change significantly over the next 100 years.

I generally don't generally advise buying investment property in flood zones because the cost of flood insurance is an unnecessary expense in many cases (all else being equal, and assuming you can buy a comparable property in a non flood zone).

That being said, our highest-priced real estate is along the coast, and I have some investors who do very well with Class-A properties on our barrier islands, such as St Pete Beach.

And I have others who have done well purchasing apartment buildings in flood zones - every deal has to be underwritten based on the numbers, including the potential income, all expenses (including flood insurance) and risk - both of being flooded, and of flood insurance premiums increasing.

Two other observations:

1. The idea that most of Pinellas and Hillsborough counties are in flood zones is a misconception. It's probably more like 30-40% of Pinellas and 10% of Hillsborough, in terms of land area. Trulia used to have a great interactive flood zone map product. Unfortunately they no longer support it as far as I can tell, but I have a video where I discuss this using the old Trulia maps and show an overview of both counties' flood zones.

2. FEMA described the project as a "multi-year project to re-examine Pinellas County coastal flood zones and develop detailed, digital flood hazard maps (Flood Insurance Rate Maps)".

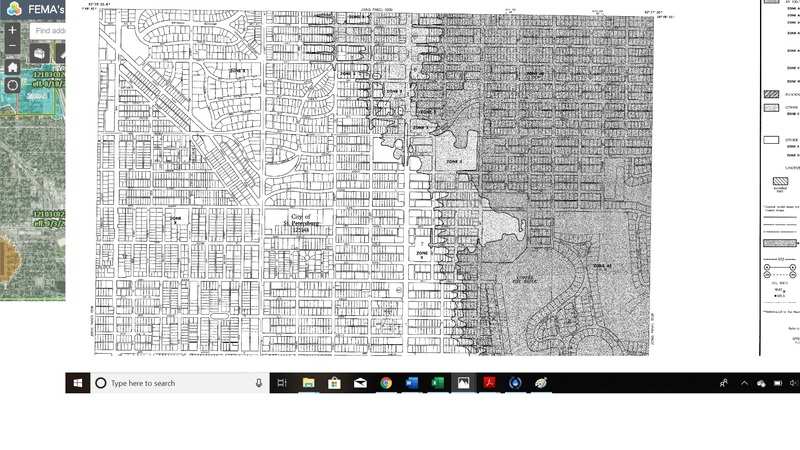

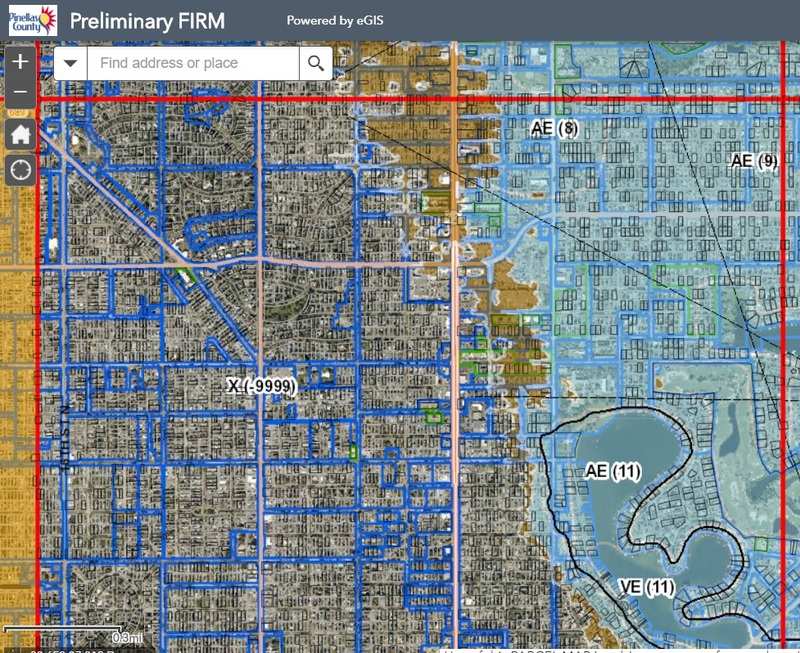

So one of the biggest changes coming with the new FEMA flood zone maps is the fact that they are being digitized. We had solid LIDAR elevation data when the previous maps were issued in 2003, so it's unlikely there will be sweeping changes to the actual flood zones. But FEMA is finally moving from black and white PDF flood panels like the one shown below, to an interactive digital product:

OLD MAP:

NEW MAP:

@Jesse Aaron You always hope that investors do their research and don't get themselves stuck with something like that. But you're right, someone could come along and buy that without having any idea what they're getting.

@Chris Pflum I want to thank you for your post. As a flood insurance nerd, I often run across new properties that are built after 1973 (when the flood insurance program started with our government). The main issue is that the home that is built after this date should be built with flood mitigation in mind. This usually means building the base foundation above the BFE (how high the water will go in a catastrophic event). The issue I seem to be asked how to solve is when a developer has built without doing their "diligence" and wants me to help them with their flood insurance rates. There, unfortunately, is little I can do short of seeing if the Private flood insurance policy will pick up the risk. Do a google search for "Private flood insurance" or "Lloyds of London Flood insurance" if you haven't heard of this flood insurance option before. Note skip over the ads they don't have any information.

The requirement to get flood insurance is mandated by the government but is forced through your lender(s) if they are getting government funds for your loan. The properties that were previously in an X-flood zone and are now moved into a AE-flood zone do have an option to purchase flood insurance within a year of the map change and will get a heavily subsidized policy that can be beneficial for many years and if you are working with a knowledgable flood nerd you can get that policy transferred to a new owner taking the "issue of flood insurance" off the table for those hoping to sell in the next few years, unfortunately, few realtors advise their communities they are farming about this beneficial program. If you have questions send me a note.

@Jesse Aaron you bring up a good point about the floodwaters have to go somewhere and how flood mitigation to save one area is now causing flooding in another. I see this all the time across the nation, I think one main issue is that if someone is in a X flood zone they think their property is safe since they are not required to have flood insurance. Over 90% of the flooding with Harvey in Houston was in areas that were considered low risk (X flood zone) and many properties didn't have flood coverage. FEMA's flood maps are political oftentimes and redrawn to make them more "popular," I think any wise investor would protect their investment, you buy hazard insurance even though there is a .01% chance of your property ever having a fire and even less chance of that fire wiping it out. We need to change as a culture our belief about flooding and if you are in a state or area that has a bunch of water, X flood zone does not mean safe. X flood zone means the lender won't require it and it also means that you can get a better rate on flood insurance with the government policy.

@ Jeff Copeland thanks for the flood maps. One thing to know is that it can take fema up to 5 years to make a flood map effective once they have created it, and again I want to state that just because a property is not in the high-risk flood zone (AE flood zone) it doesn't mean it is safe from flooding. Those moving from a X to AE should by a flood policy within a year of the map change and they can benefit from the government-subsidized policies. Those that are in an AE and are seeing your premium jump should see if you can get a "private flood insurance" policy to save you money. Google the Term "Private flood insurance".

I do believe that there is an opportunity for savvy investors to take areas that are by the coast and to rebuild the area with flood mitigation (building higher) in mind. Let me know if you have any questions about flood insurance. The Flood Nerd

@Robert Murphy thank you for the information, this is a great explanation

The National Flood Experts, a local company, can help battle any issues. We were working with a lady who lived in a home that had a new flood zone and it was ludicrous. A simple elevation cert and letting them handle the file they were able to get her out saving her about $400+/mo and she was able to stay in her forever home. They do great work, it can also be beneficial when doing due diligence on new properties to acquire, if you can change/get out of flood zone it may increase NOI quite a bit depending on the type of property.