Investing in Las Vegas NV area

Hi everyone,

I have been successful with my first two house hacks and have built 3 ADUs in California. I am looking to take the leap and invest in the Las Vegas area due to the insane home prices in California. Competition is crazy out here! Buyers are paying over 50k for properties in my area and the numbers don't work for me when considering as an investment property (20% down). In the long-term, I would still like to purchase properties in my hometown in California and build ADU's. ADUs are cash flowing machines, but there are not many financing options for them. Right now I am interested in fix and flips for Las Vegas and slowly build capital to finance ADUs. I am also interested in rentals in Las Vegas, but I am not informed on the market. Are there any local meetups in Las Vegas from Feb 18-21? I will be in Las Vegas visiting a friend and I would like network with others.

Hey David!!

Congratulations on your accomplishments! I come from the Central Coast myself. I graduated from Nipomo High. I don’t know of any meetups in that time frame but I’d be happy to sit down with you and discuss the market here in Vegas. Feel free to reach out

Originally posted by @Eric Ferreira:Hey David!!

Congratulations on your accomplishments! I come from the Central Coast myself. I graduated from Nipomo High. I don’t know of any meetups in that time frame but I’d be happy to sit down with you and discuss the market here in Vegas. Feel free to reach out

Thank you and That would be awesome! I'll definitely reach out to you before I fly over to set something up.

Hi David and Eric!

I don't know very many meetups here in Las Vegas but I am new to real estate investing and also come from California...Orange County for me! I would love to meet up with the two of you and discuss the market both here and in California if possible :)

The prices and competition in Vegas are crazy too. My wife and I have been looking at investment properties after moving here last year and very little is available for more than a few days. A lot of cash buyers willing to pay above asking and/or sight unseen.

I've also learned very quickly that there is pretty much no negotiating. We looked at a property on market for 45 days (which is a lifetime here), felt like it was overpriced but our agent told us the listing included a note saying the price wasn't negotiable.

There are a lot of people asking above market value, the problem is they are getting it. Makes it tougher for the average investor. There are opportunities out there, just have to keep looking.

I'm not aware of any meet ups in the area around that time, or any other time honestly, but would love to know of any.

Hi David/Everyone!

I am a commercial agent here in Las Vegas (focused on multi-family), I grew up in Lompoc, California (which is why I live in Vegas now). I have been watching the smaller multi-family properties for the last 3-4 weeks and have done the numbers on several of them. The numbers I ran for the multi-units four and under, meet and exceed what most investors want to make on a deal. There are still deals to be had on these properties, but they are moving. The residential agents I know do inform me that it is definitely a seller's market. My partner and I are more than willing to meet up to show what we've discovered when you're in town, if you'd like to share how your house hacks in Cali went. Our oldest lives out there and were encouraging her to get involved with small multi-family units.

Hello @David Maldonado and all,

Las Vegas real estate does pose an unprecedented opportunity.

During inflation and uncertainty, money flows to safe-havens. One such haven is real estate. However, not just any real estate will do. The real estate has to perform well even during troubling times. Why are so many investors and corporations pouring money into Las Vegas real estate?

Appreciation Rate

Below is a chart showing appreciation of properties that conform to our property profile. As you can see, since 2013, the average appreciation was 15.25%. In 2021, conforming properties appreciated an unbelievable 35%.

Looking at 2021 appreciation, it is an astounding 35% or 2.74%/Mo!

Rent Growth

The chart below shows the average rent growth based on the year put into production.

Inventory

Over the preceding 12 months, inventory in the segment we target fell.

Institutional Investor Interest

Multiple institutional investors have stepped up efforts dramatically to enter the Las Vegas market. For example, Progress Residential, a large private REIT, aggressively makes offers to acquire single-family homes to add to their rental property pool. In Las Vegas, a Progress property typically charges 10%-20% higher than non Progress properties for rent. Due to their need to deliver as much profit as possible for their investors. This will push up the rents for these newly acquired properties, driving up the overall market rent. The fact that these large institutional ventures are paying top dollars to acquire Las Vegas homes shows that they believe there is still significant growth ahead for Las Vegas home prices and rents.

Because of this significant increase in institutional investor participation, we expect the prices and rents to rise even faster than expected at the beginning of the year.

If you ever wondered whether Las Vegas is a good investment location, you have your answer.

Where You Make Money

There are two ways real estate generates money. The first is cash flow, and the second is appreciation. I put together the simplistic example below showing two properties. Property A appreciates at 10% but has zero cash flow. Property B has zero appreciation but 10% cash flow. At the end of 3 years, with Property A, you have $99,300 to reinvest. With Property B, you have $21,000 to reinvest.

Below is the investable cash after 3 years at 15% and 20% appreciation.

What is Driving Appreciation and rent Growth?

- Jobs - There is a shortage of workers, and help wanted signs are everywhere. And, with over $20B in new construction underway, and another $5B to $7B announced, the demand for workers will increase, bringing more people to Las Vegas. The increasing demand will drive up prices and rents.

- Blue State Exodus - Almost every day, I read another article about companies and people fleeing blue states due to high taxes or high costs. As more people flee, more people will come to Las Vegas for jobs and the low cost of living. Demand for housing will continue to increase, driving appreciation and rent for the foreseeable future.

- Pro Business Environment - Nevada has no state income taxes, low property tax, low-cost property insurance, reasonable traffic, reasonable property prices, lower cost of just about everything. Las Vegas is investor-friendly. Evictions take less than 30 days and cost about $500. Another advantage Nevada offers businesses is low electricity cost. Las Vegas' commercial energy rate is less than 1/2 the cost of California.

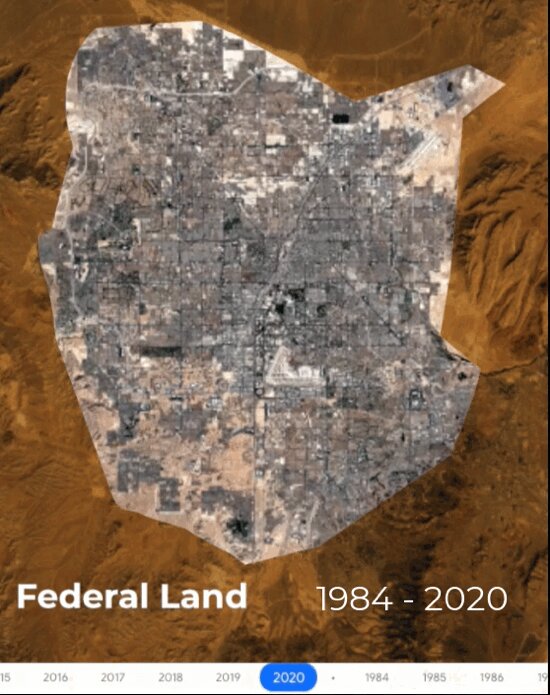

- Land Shortage - As you can see in the gif below, Las Vegas has reached its boundaries in many locations. And, little of what remains is suitable for residential housing. The high cost of land and the limited available land for expansion result in new homes' entry price in desirable areas being over $550,000. Properties that target our tenant pool today cost between $380,000 and $470,000. New homes will not dilute the supply of investment properties.

A question you may have is whether Las Vegas' economy will continue to do well. One of the reasons real estate is a safe heaven is that markets are like giant cargo ships; they change directions slowly. So, the conditions that make Las Vegas residential real estate a safe haven today are likely to remain so for the foreseeable future.

Quote from @Brian Walters:

The prices and competition in Vegas are crazy too. My wife and I have been looking at investment properties after moving here last year and very little is available for more than a few days. A lot of cash buyers willing to pay above asking and/or sight unseen.

I've also learned very quickly that there is pretty much no negotiating. We looked at a property on market for 45 days (which is a lifetime here), felt like it was overpriced but our agent told us the listing included a note saying the price wasn't negotiable.

There are a lot of people asking above market value, the problem is they are getting it. Makes it tougher for the average investor. There are opportunities out there, just have to keep looking.

I'm not aware of any meet ups in the area around that time, or any other time honestly, but would love to know of any.

AGREE %100

I'm wrestling with selling my 4 bedroom SFR (N Las Vegas) or keeping as a rental. I've had a great run but long term tenant cannot afford market rate and really needs to move into something smaller. Either way, my property manager will be leading rehab this late spring to get it ready for sale/rent. Bought the house brand new in 1994 for $116K and financed with a $1 down VA loan!

Vegas has been ON FIRE in recent years just like so many other places around the country. I believe both rents and values have gone up around 25% in the last year. We invest there and have been very pleased. Steady tenants with very little turnover.

Quote from @Tom Rietkerk:

I'm wrestling with selling my 4 bedroom SFR (N Las Vegas) or keeping as a rental. I've had a great run but long term tenant cannot afford market rate and really needs to move into something smaller. Either way, my property manager will be leading rehab this late spring to get it ready for sale/rent. Bought the house brand new in 1994 for $116K and financed with a $1 down VA loan!

What are you looking to get for the property? Any interest in seller financing?

I would be happy to oversee the rehab as well if that helps.

Las Vegas is crazy too. I'm a cash buyer, either all up front or 50-60% down - and it's nuts out there. I currently have 10 free and clear.

I'm trying to get an eleventh. I put in offers and others start bidding over list and push me out, sometimes over list by 15K - and usually investors from Cali.

I was lucky to start buying in cash in 2018. For example, townhouses I bought for 240 and now going for 380, condos I bought for 170 are going for 265. Another townhouse I dropped 270 on is now nearing 430.

It's become near impossible for me to buy straight-up in those higher-end areas, because prices are nuts. And I say nuts because 20% down on most properties are nothing, because you lose money even with top market Vegas rent. Right now I'm looking to drop as much as 140K down on my next one and pay it off in full by next year, but I keep getting outbid. I went 6K over list on the last property I place an offer on and I was still outbid. However, I only target the hotter areas in town, because I only want certain types of tenants and very high rent revenue - plus guaranteed equity increases from year to year - all of which I've obtained on my first 10.

Quote from @Mark S.:

Las Vegas is crazy too. I'm a cash buyer, either all up front or 50-60% down - and it's nuts out there. I currently have 10 free and clear.

I'm trying to get an eleventh. I put in offers and others start bidding over list and push me out, sometimes over list by 15K - and usually investors from Cali.

I was lucky to start buying in cash in 2018. For example, townhouses I bought for 240 and now going for 380, condos I bought for 170 are going for 265. Another townhouse I dropped 270 on is now nearing 430.

It's become near impossible for me to buy straight-up in those higher-end areas, because prices are nuts. And I say nuts because 20% down on most properties are nothing, because you lose money even with top market Vegas rent. Right now I'm looking to drop as much as 140K down on my next one and pay it off in full by next year, but I keep getting outbid. I went 6K over list on the last property I place an offer on and I was still outbid. However, I only target the hotter areas in town, because I only want certain types of tenants and very high rent revenue - plus guaranteed equity increases from year to year - all of which I've obtained on my first 10.

Sounds like you are in an amazing spot Mark. How did you start off?

Quote from @Chris A.:sold a company I created for a few million, had a good amount saved in the bank. decided to risk the bulk of it on buying real estate

Quote from @Mark S.:

Las Vegas is crazy too. I'm a cash buyer, either all up front or 50-60% down - and it's nuts out there. I currently have 10 free and clear.

I'm trying to get an eleventh. I put in offers and others start bidding over list and push me out, sometimes over list by 15K - and usually investors from Cali.

I was lucky to start buying in cash in 2018. For example, townhouses I bought for 240 and now going for 380, condos I bought for 170 are going for 265. Another townhouse I dropped 270 on is now nearing 430.

It's become near impossible for me to buy straight-up in those higher-end areas, because prices are nuts. And I say nuts because 20% down on most properties are nothing, because you lose money even with top market Vegas rent. Right now I'm looking to drop as much as 140K down on my next one and pay it off in full by next year, but I keep getting outbid. I went 6K over list on the last property I place an offer on and I was still outbid. However, I only target the hotter areas in town, because I only want certain types of tenants and very high rent revenue - plus guaranteed equity increases from year to year - all of which I've obtained on my first 10.

Sounds like you are in an amazing spot Mark. How did you start off?

Quote from @Brian Walters:Thanks for the offer! I’m working with my property manager for the rehab and we haven’t begun the rehab yet. Tenant should be out at end of this month. Looks like comps are around $330 to 350K.

Quote from @Tom Rietkerk:

I'm wrestling with selling my 4 bedroom SFR (N Las Vegas) or keeping as a rental. I've had a great run but long term tenant cannot afford market rate and really needs to move into something smaller. Either way, my property manager will be leading rehab this late spring to get it ready for sale/rent. Bought the house brand new in 1994 for $116K and financed with a $1 down VA loan!

What are you looking to get for the property? Any interest in seller financing?

I would be happy to oversee the rehab as well if that helps.

Quote from @David Maldonado:

Hi everyone,

I have been successful with my first two house hacks and have built 3 ADUs in California. I am looking to take the leap and invest in the Las Vegas area due to the insane home prices in California. Competition is crazy out here! Buyers are paying over 50k for properties in my area and the numbers don't work for me when considering as an investment property (20% down). In the long-term, I would still like to purchase properties in my hometown in California and build ADU's. ADUs are cash flowing machines, but there are not many financing options for them. Right now I am interested in fix and flips for Las Vegas and slowly build capital to finance ADUs. I am also interested in rentals in Las Vegas, but I am not informed on the market. Are there any local meetups in Las Vegas from Feb 18-21? I will be in Las Vegas visiting a friend and I would like network with others.

David if you're still interested in RE in LV, here is one local REI group that has meetups monthly: https://www.facebook.com/group...

I will also say that flipping in Vegas is extremely popular and thus extremely competitive. You have several mega-flippers doing 100+ props regularly. You can find many of them on FB or Youtube even, several run TV commercials. Not saying it can't be done as a new flipper, but finding off-market / wholesale deals could be tough without a lot of connections. You would definitely need to get out here and get boots on the ground and build relationships.

Quote from @Tom Rietkerk:Tom, If you are still looking to rent that property. PadSplit might be a great option. Vegas is opperating at 100% occupancy with really good rental rates. (Rent by the room model) more than happy to talk about it. I own two and wish I would have bought in Vegas now

I'm wrestling with selling my 4 bedroom SFR (N Las Vegas) or keeping as a rental. I've had a great run but long term tenant cannot afford market rate and really needs to move into something smaller. Either way, my property manager will be leading rehab this late spring to get it ready for sale/rent. Bought the house brand new in 1994 for $116K and financed with a $1 down VA loan!

Quote from @Mark S.:

Las Vegas is crazy too. I'm a cash buyer, either all up front or 50-60% down - and it's nuts out there. I currently have 10 free and clear.

I'm trying to get an eleventh. I put in offers and others start bidding over list and push me out, sometimes over list by 15K - and usually investors from Cali.

I was lucky to start buying in cash in 2018. For example, townhouses I bought for 240 and now going for 380, condos I bought for 170 are going for 265. Another townhouse I dropped 270 on is now nearing 430.

It's become near impossible for me to buy straight-up in those higher-end areas, because prices are nuts. And I say nuts because 20% down on most properties are nothing, because you lose money even with top market Vegas rent. Right now I'm looking to drop as much as 140K down on my next one and pay it off in full by next year, but I keep getting outbid. I went 6K over list on the last property I place an offer on and I was still outbid. However, I only target the hotter areas in town, because I only want certain types of tenants and very high rent revenue - plus guaranteed equity increases from year to year - all of which I've obtained on my first 10.

Hello Mark,

I applaud your focus on a specific tenant pool in Las Vegas; we’ve done the same for the last 15+ years. While the location defines long-term income characteristics, the tenant pool determines income reliability. Too many people focus on what properties or deals they can get but ignore the types of tenants these properties attract. Different tenant pools have drastically different characteristics. For example, there are three major tenant pools in Las Vegas.

- Transient - Occupies C and B- properties. Average tenant stays < 1 year. Skips, evictions, and property damage are frequent. The average annual vacancy cost is >$4,000/Yr.

- Permanent - This is the tenant pool we target. They occupy A and A- properties. Out of a population of over 470 properties, we’ve had five evictions in the last 15+ years. The average tenant stay is over five years, and our clients had no rent interruptions or decreases during the 2008 crash and COVID. The average annual vacancy cost is about $400/Yr.

- Transitional - This segment normally buys homes; only a small percentage rents. They occupy A properties. They rent during stressful events and typically stay <2 years. The average annual vacancy cost is >$4,500/Yr.

On finding good properties, they are few and far between. We find 5 to 10 properties monthly using our proprietary data mining software. Also, the market recently changed. As inventories increase, we see more good opportunities. For example, the seller paying for point buy-down, etc. However, we do not know how long this will last. The fundamentals of Las Vegas market will drive prices and rents higher over time:

- Land shortage - The population increases by 2% to 3% per year, and the available land for new development is rapidly declining. Below is an aerial view of Las Vegas at the end of 2020. Not much land is available for expansion. Soon, the only option for expansion will be redevelopment. I have never heard of a situation where increasing buyers chased a declining supply where prices did not increase. The land shortage is the primary reason rents and prices will continue to rise.

- Jobs - A rental property is no better than the jobs around it. Various job boards show Las Vegas has between 26,000 and 31,000 open jobs. And, there is currently $22B in new construction, creating even more jobs.

- Jobs - A rental property is no better than the jobs around it. Various job boards show Las Vegas has between 26,000 and 31,000 open jobs. And, there is currently $22B in new construction, creating even more jobs.

- Continuous California exodus - California seems to be doing all it can to force people and companies out of California. As long as this continues, Las Vegas investments will do well.

- Cheap and reliable energy - California commercial energy is $0.237/KwH, and Nevada is $0.102/KwH. Also, Las Vegas is one of the few cities with dual electricity sources (California and Hoover Dam), which results in high reliability.

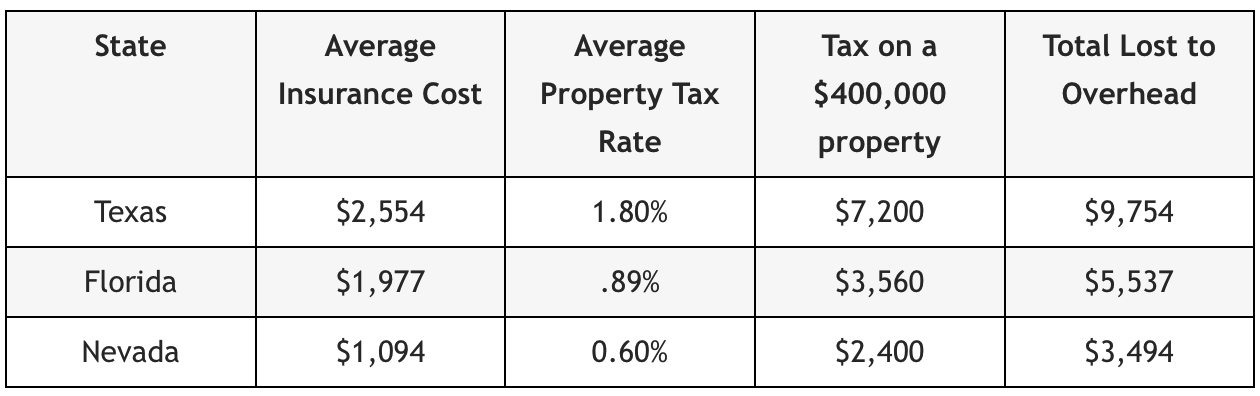

- Low overhead costs - Texas, Florida, and Nevada have no state income taxes and similar average rent/SF, so the cost of insurance and property taxes greatly impact net rental income.

Mark, reach out if we can help.

Quote from @Nicolas Bowers:

Quote from @Tom Rietkerk:Tom, If you are still looking to rent that property. PadSplit might be a great option. Vegas is opperating at 100% occupancy with really good rental rates. (Rent by the room model) more than happy to talk about it. I own two and wish I would have bought in Vegas now

I'm wrestling with selling my 4 bedroom SFR (N Las Vegas) or keeping as a rental. I've had a great run but long term tenant cannot afford market rate and really needs to move into something smaller. Either way, my property manager will be leading rehab this late spring to get it ready for sale/rent. Bought the house brand new in 1994 for $116K and financed with a $1 down VA loan!

Would love to hear what this is and the revenue model etc. Can you PM me your contact info? I'm local as well.