- Residential Real Estate Investor

- Kansas City, MO

- 4,406

- Votes |

- 9,274

- Posts

Why There Will Be No "Eviction Tsunami"

As you may have heard, the CDC's federal eviction moratorium is set to end July 31st. So I began researching this piece by Googling "eviction moratorium end" and wasn't particularly surprised by what I found. Here were the first results:

- "With moratorium ending, more than 8 million households face foreclosure or eviction"

- "Is California still facing an eviction tsunami when the moratorium ends?"

- "Millions in the US 'race against the clock' to pay the rent and stave off eviction"

You get the idea.

But I'm here to tell you that, fortunately, it is highly unlikely there will be any "eviction tsunami."

"At risk of facing eviction"

These warnings started at the beginning of the pandemic and have been going on pretty much ever since. Set your Google search results for between March and September of 2020 and you can see examples like the following:

- "Mass evictions are a looming threat to 19-23 million American renters."

- "As many as 6.7 million rent-burdened households could face eviction once enhanced federal unemployment insurance expires at the end of July."

- “According to one study, as many as 40 million people in 17 million households risk eviction by the end of the year."

Fortunately, this eviction crisis has yet to come.

The problem with all of these estimates is that "facing eviction" or "risks eviction" are very nebulous terms. Unfortunately, many Americans live paycheck to paycheck and thus, are always going to be "close" to being evicted with such vague phrasings. Indeed, none of these studies or articles compare the number of people facing eviction to a baseline year. For example, how many households risked eviction in 2019?

Even if a tenant is short on cash for the month, there are lots of ways to avoid eviction: make a deal to leave with the landlord, borrow money from a friend or family member, apply for charitable assistance or government assistance, etc.

And offer assistance the government certainly did, most notably with the $2 trillion CARES Act, the $3 trillion HEROES ACT including the extra $600 a week in unemployment benefits. Indeed, it would seem that these 2020 analyses didn't fully appreciate how many people were able to get by with unemployment insurance or their own savings.

A partial moratorium

It should also be noted that as of this writing, 16 states still have eviction moratoriums of their own in addition to the CDC's moratorium. The reason some states still have moratoriums of their own is that there are limitations to the CDC's order. For example, to qualify a tenant must:

- Have used their best efforts to obtain government assistance for housing

- Are unable to pay their full rent due to a substantial loss of income

- Are making their best efforts to make timely partial payments of rent, and

- Would become homeless or have to move into a shared living setting if they were to be evicted."

In addition, the tenant must meet some basic financial requirements (i.e. not make over $99,000 a year or $198,000 jointly) and fill out an Eviction Protection Declaration. If they don't meet the requirements or fill out the declaration, they can still be evicted even with the CDC moratorium in place. Evictions for other reasons, such as criminal activity, are also permitted.

In other words, not all evictions have been banned by the federal government. As multiple articles have noted, "Renters are still being evicted despite the federal ban."

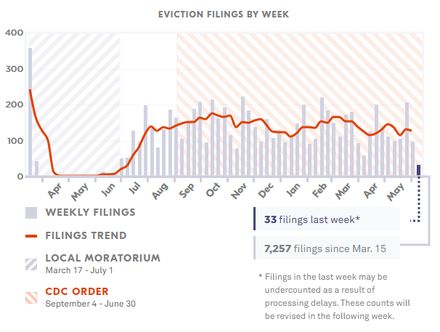

Many evictions are still being filed even if the moratorium prevents most from being executed. But it does not appear that the rate of filing has not gone up.

No uptick in filings

Despite much searching, I have not been able to find any good information on how many evictions there have been total in 2020 or so far in 2021 throughout the country. The best source of information seems to be the Eviction Lab at Princeton University. Unfortunately, their national data ends in 2016.

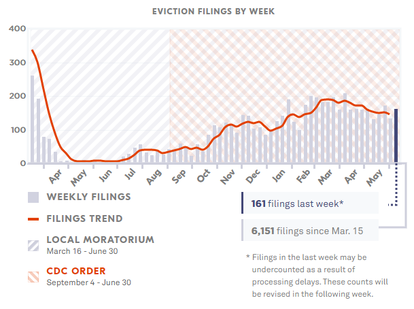

The Eviction Lab has still been tracking evictions in five states, however; Connecticut, Delaware, Indiana,

Minnesota, and Missouri. Those states tell an interesting story.

For one, there was a huge drop off in evictions following statewide moratoriums in Connecticut, Delaware, Indiana, and Minnesota. In Minnesota and Connecticut, those moratoriums have stayed in effect, keeping eviction filings in Connecticut low, although Minnesota's have consistently risen.

Eviction LabsConnecticut has had 6,151 eviction filings between March 15, 2020, and June 13, 2021, while Minnesota had 1,960. In contrast, in 2016, Minnesota and Connecticut had 17,470 and 13,622 respectively. So if we were to return to "normal" levels, while there would be a notable increase, it would only look like a "tsunami" to those who forgot what things looked like pre-COVID-19.

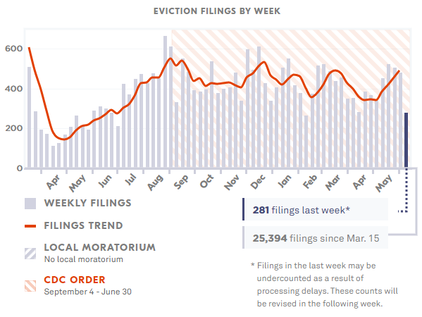

Missouri never had a state moratorium (although in Kansas City, a judge did order a freeze on evictions). Evictions fell right before the pandemic from about 500 weekly filings in March to about 100 in April and then rose to around 600 before stabilizing between 400 and 500 since the CDC moratorium was put in place.

Eviction LabsMissouri has had 25,394 eviction filings in the previous 15 months as compared to 35,106 in 2016. So even if it almost doubled, it would be at about its 2016 levels.

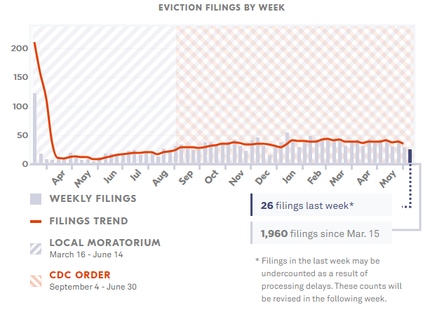

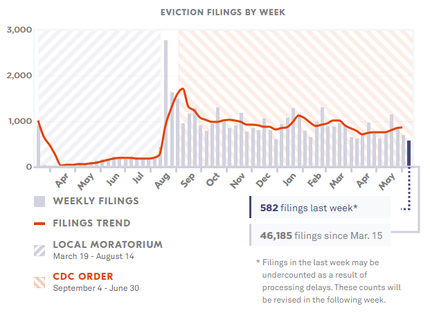

Indiana and Delaware are both interesting because they had state-wide moratoriums that ended before the CDC moratorium was put in place.

The Indiana state moratorium brought evictions close to zero. It ended only a few weeks before the CDC moratorium began and when it did end, there was a one-week spike before evictions came down to about the level they have been since the CDC moratorium was put in place.

Eviction LabsIndiana has had 46,185 filings since March 15th, 2020 as compared to 66,544 in all of 2016. Again, as unfortunate as evictions are, even a substantial increase would just be going back to 2016 levels, not some catastrophic anomaly.

Delaware had almost two months between the end of its state moratorium and the beginning of the CDC moratorium. Again, the state moratorium brought evictions close to zero. Once it ended, they rose to about 150 per week which is where they have been almost every week since the CDC moratorium was imposed.

Eviction LabsDelaware has had 7,257 fillings since March 15th, 2020 as compared to 17,370 in 2016.

Similar trends can be seen in the 29 cities the Eviction Lab follow as well.

It would seem the CDC moratorium has had a fairly limited effect, at least with regards to filings, especially in comparison to the state moratoriums. And most of the state moratoriums have already ended and did so without or with only a very brief spike in evictions outside of what had been the average before.

Thereby, we should not expect to see a surge in evictions much above pre-COVID-19 levels once the moratorium is lifted.

Most tenants are paying rent

The main reason there will not be an eviction crisis is simply because most tenants are paying rent. Anecdotally, our own delinquency is about the same as what it was in 2019 and I have heard the same from many other landlords.

It would seem to be the most common sentiment in the BiggerPockets forums as well.

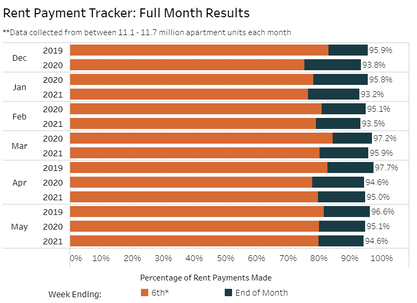

But I have more than my gut and anecdotes to back this assertion. The National Multifamily Housing Council does a monthly survey of the owners of between 11.1 million and 11.7 million apartment units and has found no major uptick in delinquency.

In May of 2019, 96.6% of rental payments were collected. In May of 2020, it fell a bit to 95.1%. In May of 2021, it stayed about the same, only slipping half a percentage point to 94.6%.

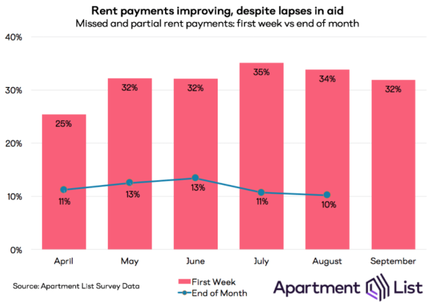

National Multifamily Housing CouncilIn addition, while a bit old, Apartment List's survey of tenants in September of last year found that while those paying their rent in the first week had declined from the beginning of the pandemic, those paying all their rent by the end of the month had slightly improved from 89% in April to 90% in September.

Apartment ListFinally, a Realty Income report found that rent collection had stabilized in March of 2021 for commercial tenants.

And much of those late rents are the accumulation of tenants that are behind and cannot be evicted because of various moratoriums. Thus, it's possible this slight downward trend is simply because delinquent tenants are not being turned over as fast as before and there is no uptick in delinquency at all. Regardless, a 94.6% collection rate is not going to lead to a surge in evictions.

After all, Americans are getting back to work. The unemployment rate peaked in April of 2020 at 14.7% but has fallen back to 5.5% in May of 2021. Of course, this was accomplished, in part, by printing enormous amounts of money which we're starting to see the effects of as inflation ticks up. And while inflation will hurt consumers and may push people on the edge into eviction, that will not be happening en masse any time soon.

Most tenants who lost their jobs during the pandemic have found new ones. And if they can't catch up on rent, many will at least move on to another place without forcing the landlord to evict to avoid having an eviction on their record.

This is a key point regarding evictions. For example, in Missouri in 2016, there were 35,106 eviction filings but only 20,651 evictions. The reason for this is many tenants either caught up after the eviction was filed or left willingly before the eviction was executed, often with a "cash for keys" arrangement.

I further suspect (although can not prove) that the ratio of eviction filings to executed evictions will increase substantially after June 30. I suspect that many tenants who fell behind on rent before getting a new job but still can't pay the back rent will avoid eviction by saving the landlord by moving out before the eviction filing is executed.

Indeed, the courts can't operate any faster than they did before the moratoriums so any backlog will be slow to unwind instead of a "tsunami." This will spread out the evictions and give even more time for cash for keys deals and other arrangements between tenants and landlords.

In our own experience this has worked quite well. We had a few tenants who were not paying at the beginning of this year and then made a concerted effort to get them to leave with cash for keys. All but two did so. I suspect there will be a lot of similar offers for people who have been holding on because they could and come June 30, they will finally decide to leave versus getting an eviction on their record.

Resources for tenants are not going away

Furthermore, there are still resources available for tenants who need help. For example, California has a program that "Landlords can choose to accept 80% of any unpaid rent owed from April 1, 2020, through March 31, 2021. If a landlord accepts this funding, the landlord agrees to forgive the remaining unpaid rent for that covered period."

Missouri, likewise, set aside $324 million for a similar program. Other states have programs like this as well.

Indeed, several states such as New York and New Jersey will maintain eviction moratoriums past June 30 as well.

There are also many non-profits such as that aid struggling tenants and will likely increase their efforts as evictions tick up.

Finally, if I am sorely mistaken and there really is a surge of evictions well beyond historical averages, the federal government will surely step in with additional funds to prevent an enormous crisis and the instability it would bring. They certainly haven't shown any reluctance over the past two years to spend massive amounts of money. Yes, this will cause even more inflation, but again, that won't be felt until further down the line.

Conclusion

Evictions will certainly tick up as the CDC's eviction moratorium ends. Delinquency rates are slightly higher than they have been in years past and there is a backlog of eviction filings that will need to be processed (although there's no reason to expect they will be processed quickly).

But I doubt there will be an episode of mass evictions. There will likely be a short spike before evictions return to historical averages and that's about it.