Going Beyond Cash Flow

Fundamental Principle

Though the most touted, cash flow is just one of five ways to build wealth in real estate.

Passive monthly cash flow. Whenever we chat with new investors, we commonly find this to be the dream they’re chasing - and not without good reason. “Passive” is a (mythical) term for another time. While cash flow is an admirable goal, and a key piece of our real estate investing strategy, we find it to be a limiting criteria when it’s the sole focus in evaluating deals.

In fact - the increase we’ve seen to our net worth over the past few years has not been tied to monthly cash flow. While this income stream helps our investments self-sustain, it’s certainly not the biggest driver of our wealth. And it shouldn’t be the only thing you use when determining if a deal is worth pursuing.

A Deal We Might Have Missed

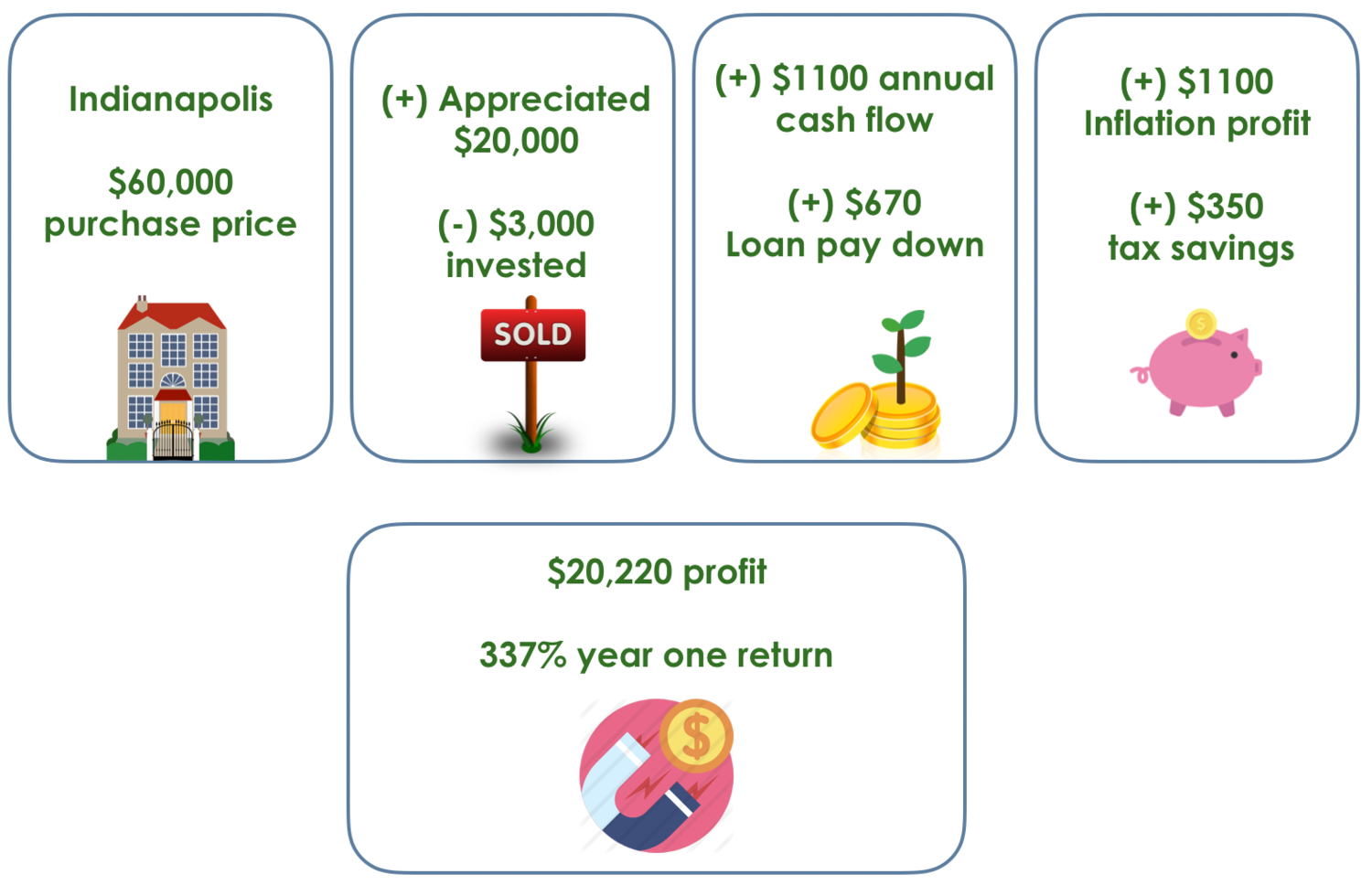

In 2019, we acquired a property in Indianapolis for $60,000 - putting just 10% into the deal with the remainder seller-financed at 6%. We chose to purchase this property, despite relatively low monthly cash flow, because we saw the chance to force appreciation with limited investment.

In the first year of owning this property, we put $3,000 into rehab to bring it up to the neighborhood standard. In return, we benefitted from the following:

If you only consider cash flow, we’re bringing in $1100 annually with a return of 18% (a solid return, but inflated by our very low capital investment).

When we invest, we absolutely look for cash flow - but we also dig deeper into the five key ways in which real estate helps us build wealth.

Going Past Cash Flow

Appreciation

Appreciation is a controversial topic in the investor community, and we should absolutely note, you cannot count on appreciation to drive your return. In most cases - if you’re counting on appreciation to make the deal - you’re setting yourself up to lose.

Market Appreciation

That said, historical real estate values indicate we can expect appreciation on a longer time horizon. What’s harder to predict are changes in market conditions (or even global pandemics) that may hit when you plan to sell - so it’s dangerous to make this a lynchpin of your strategy.

When looking for neighborhoods or markets likely to appreciate, consider factors like job growth, net migration, unemployment, and school districts. To gather this data, you can follow specific markets on BiggerPockets, or local census data trends.

Forced Appreciation

Forced appreciation refers to an increase in the property’s value due to owner actions, such as rehabilitating the property. This is a more reliable form of appreciation, assuming you know the market and neighborhood, and can invest wisely to bring a property up to a neighborhood’s standards.

There are times it makes sense to set cash flow aside, and invest for appreciation. Mostly, you’ll see this in higher end areas - where a home has fallen into disrepair and you can invest wisely to bring it up to par. Just ensure your ARV (after repair value) far exceeds your rehab costs + purchase price (and remember, build a significant margin into those rehab costs - they tend to creep!) Higher end neighborhoods are notoriously tough for cash flow deals, but they often bear appreciation opportunity and lower costs in turns and repairs.

You may also find properties with potential for ADU’s (additional dwelling units) which not only increase the property value, but also increase your cash flow. You don’t need the funds to develop on day one - but it’s still worth considering for the longer term potential.

--

Long-Term Debt and Inflation Hedging

Fixed-rate, long-term debt is an asset - not a liability. **Note, this may be an uncomfortable concept for many – still is for the Mrs. Giulioni!

The logic to this madness is that you’re borrowing with today’s dollars - and as inflation continues (government targets 2% annually) - those dollars become continually less expensive to pay back. Even without any loan pay down, if the government hits (or exceeds) that 2% target, the principle left on your mortgage is now 2% less than the year before.

Some economists believe current inflation is well above 2%, but we look to be conservative with our estimates. With 2% as our number, and a ~25% down payment (that number does change throughout the course of your mortgage as your leverage decreases), your actual return based on inflation is closer to 8%.

In general terms, your loan is diluted each year, as the net amount to pay back remains the same, but the value in today’s dollars goes down. It’s trickier to account for, but a key way in which you (and we) are building wealth.

--

Loan Pay Down

Each month, your tenants pay down the aforementioned fixed-rate debt on your behalf. As the mortgage term progresses, the principle pay down increases - and that’s literal cash in your piggybank. It’s an add to your net worth (arguably one of the most significant) and it can become liquid through a refinance, HELOC, or sale of the property.

--

Tax and Depreciation

We feel it’s worth mentioning once again, we are not tax, legal, or accounting professionals. This material is for informational purposes only, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

We work closely with our real estate accountants to ensure we benefit from the tax advantages surrounding depreciation. So far, we’ve not had to pay taxes on our rentals - depreciation expense has more than offset our income. We also have passive losses we can’t currently claim against W2 income, but plan to in the future.

A Note on Passive Losses

For those making less than $100,000 in annual W2 income, you can deduct up to $25,000 in passive losses against your W2 wages. This is phased out once your MAGI (Modified Adjusted Gross Income) exceeds $100,000 and eliminated entirely when it exceeds $150,000.

For those working as real estate professionals (for a minimum of 751 hours/year), you can use your passive losses against your or your spouse’s W2 wages. This is Nick’s long-term plan, as he’s looking to transition into real estate full-time down the road, while Diane wants to maintain her W2 role. We look forward to pursuing our true interests, and reducing our tax burden as a result.

All Together Now

While the most touted benefit of real estate investing, cash flow is not the only way in which to generate returns. Loan pay down, inflation hedging, passive losses (depreciation), and appreciation are key elements to consider in every deal. If you’re only considering cash flow, you’re likely missing out on golden opportunities to build your portfolio and your net worth.

Comments