RETURN ON EQUITY: WHY I SOLD MY HIGH APPRECIATION SEATTLE RENTALS

“We are almost paid off our property and cashflowing like crazy!” – an Unsofisticated investor

Don’t take it from me take it from a Forbes article – Three Financial Metrics Investors Must Monitor To Evaluate A Property’s Success

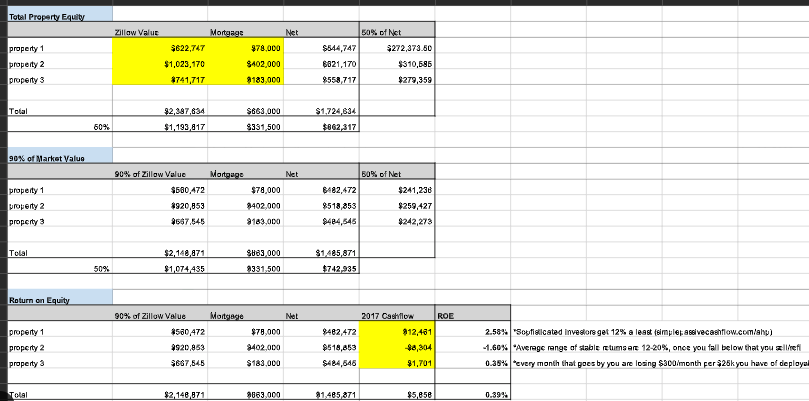

Download the worksheet to calculate the return on your deployable equity.

Wait I thought Seattle/San Francisco was a hot market with double-digit appreciation and an up and coming tech market?!? Return on Equity = Profit (Cashflow) / Total Deployable Equity if your sold (Don’t forget to include selling commissions)

“every month that goes by you are losing $300/month per $25k you have of deployable equity”

As a real estate investor or any investors consider your Return on Equity (ROE) as a means to evaluate the highest and best use for your capital and to be able to make adjustments to your portfolio over time.

The saying “buy and never sell” will work but “buy and evaluate your ROE prudently” will yield high returns and safer capital preservation.

There are many metrics that Investors use to quantify the quality of their investments. COC, ROI, ROE, are to name a few.

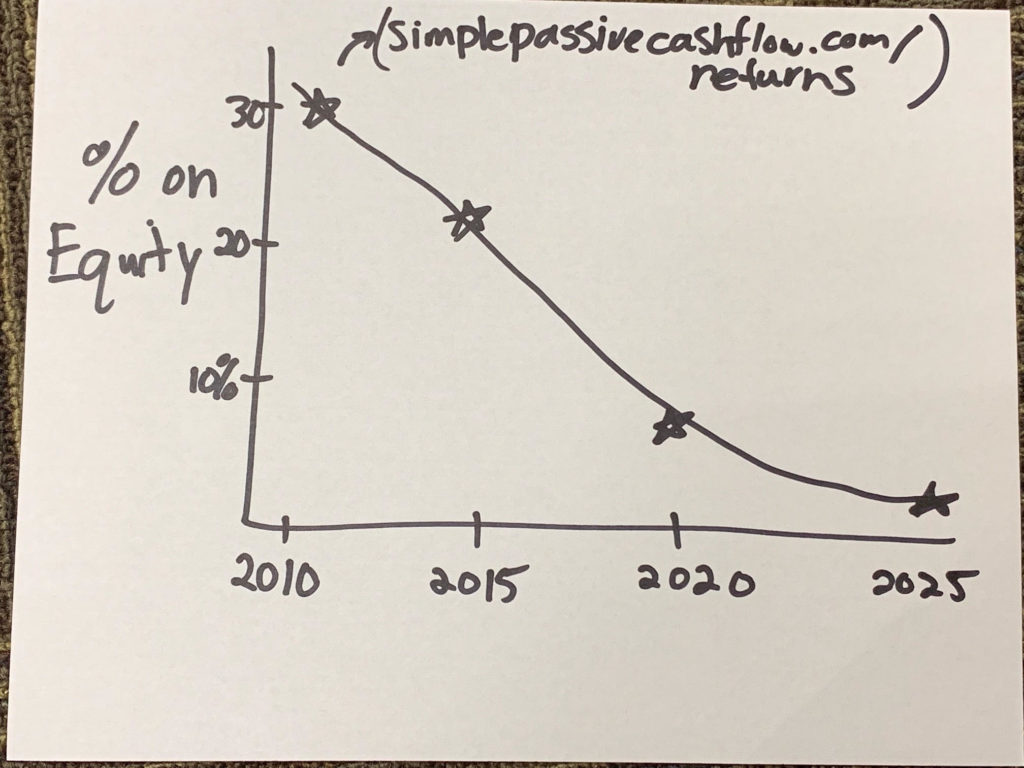

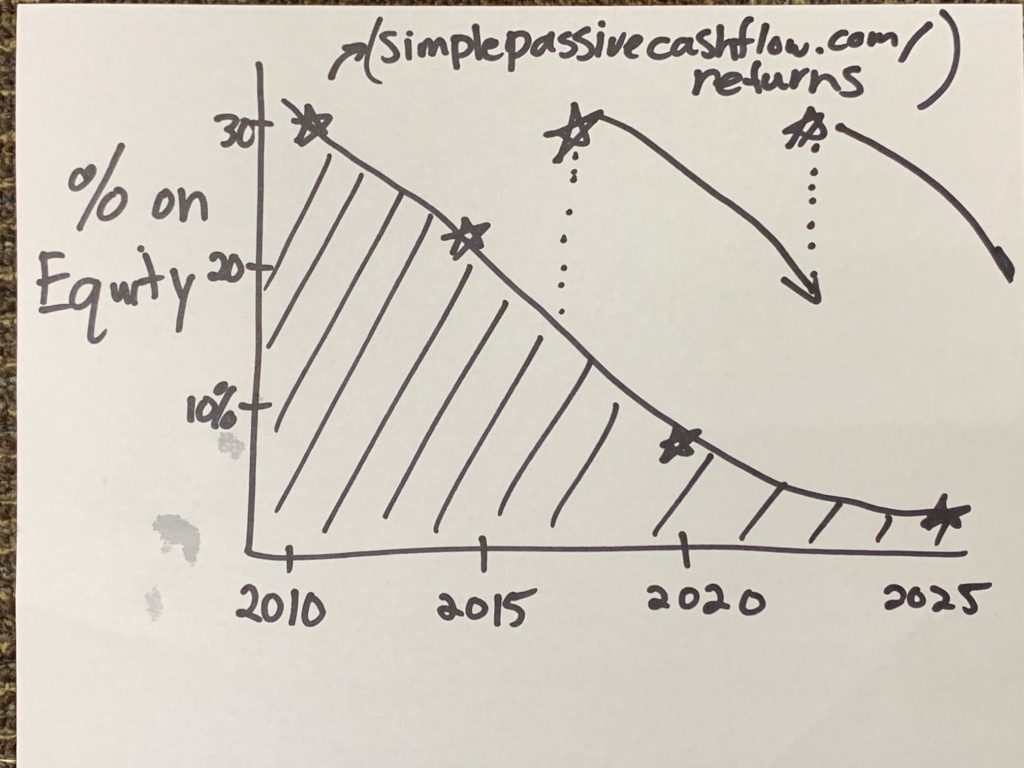

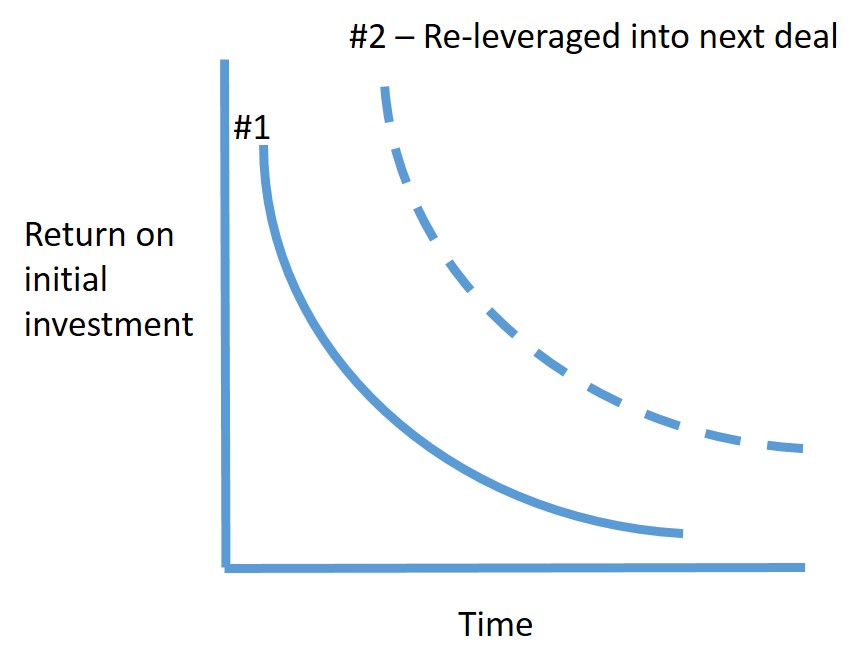

Sophisticated investors re-leverage after their return on equity goes down

Cash on Cash Return on Investment (COC Return)

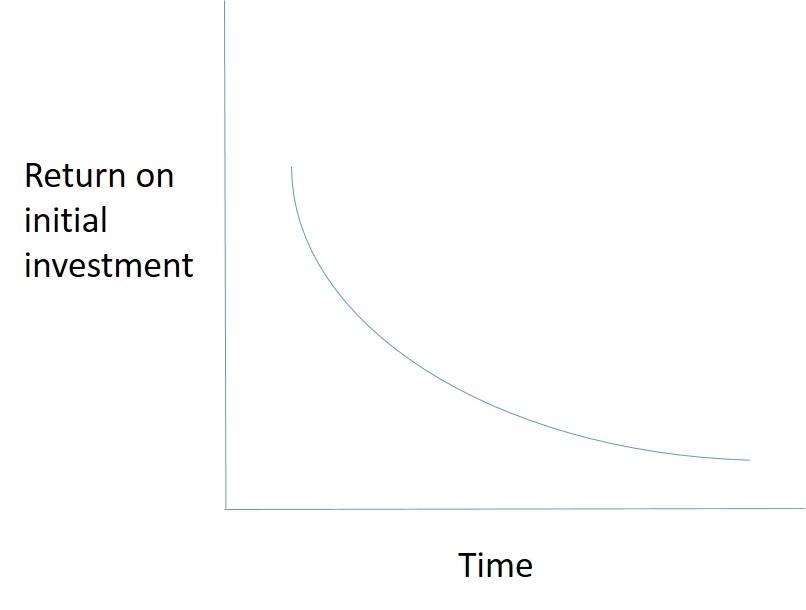

The pre-tax year-end cash flow divided by the actual amount of original investment you have invested.

COC is used to compare your investment with other options excluding factions such as the use of leverage (mortgage), taxes, appreciation over time, and mortgage paydown over time. As time goes along and your investment goes well due to your tenants paying their rent as they should and the home going up in value due to inflation and market appreciation, COC becomes less relevant.

For example, if you purchased a property with $22,500 down payment, $5,000 in closing expenses, and $2,500 for some touch-up paint and new carpet, you are all-in for an original investment of $30,000. If at the end of the first year with your rental property in operation that you are able to profit $10,000 from cash flow after all operational expenses and debt service were paid, your COC return would be $10,000/$30,000 or 33%.

Sophisticated investors compare COC with other investments to determine the highest and best use for their liquidity going into an investment whereas ROE is used once the investment is owned. COC for mutual fund and stock investments have been known to have been in the 8-10% COC range.

Join our club to get full access to this “Return on Equity” Spreadsheet and more!

Join our club to get full access to this “Return on Equity” Spreadsheet and more!

Annualized Return on Investment (Annualized Return)

Annualized return is used to evaluate an investment’s performance over time. Real estate is not a get rich scheme and many times if rehab is done to the property it will require a few years to complete the construction and stabilize the rents for the next buyer to feel comfortable and pay a higher price for the investment.

Annualized return takes into account the cash flow returns received during the hold of the property and the sale or refinances of a property that takes place at the exit. The annualized return is often used to compare syndications (private placements) with different business plans but similar lengths of ownership.

For example, if you received a 8% COC return for 5 years ($8,000 per year on a $100,000 investment for each of 5 years = $40,000). And then you exited the property via a sale at end of year 5 for a gain of $60,000. Your annualized return would be a total of $100,000/5-years or 20% a year. This is calculated with $40,000 in cash flow plus the $60,000 due to the general appreciation of the property.

“If you have an employee that does nothing or very little would you keep them around?”

Return on Equity (ROE)

One of the few downsides of real estate investing is that your investment is illiquid unless you sell or refinance the asset.

As you hold on to investments you are increasing you equity position over time via the following:

- Mortgage paydown

- General appreciation from the market

- Forced appreciation from any property improvements

Say you had a great investment kicking off 20% COC a year. Your return on equity shortly after purchase on a $100,000 home that you used $20,000 to acquire is making you $4,000 profit a year. In this case, your ROE would be 20% ($4,000 divided by $20,000).

Great!

But say a couple years go by and with a hot market the property is now worth $160,000. You return of equity on the $160,000 home that you used $20,000 to acquire is now making $5,000 profit a year. In this case, your ROE would be only 6.25% ($5,000 divided by $80,000). Note: This does not include mortgage paydown.

For the minor headaches rental property ownership brings 6.25% would not be worth it. I personally believe that when you ROE dips lower than 10-15% you need to look to make a change in your portfolio via 1) Cash out refinance, 2) 1031 exchange or, 3) simply selling the asset.

There is one intangle metric that we did not talk about here which is your Return on Time (ROT). I don’t believe this is an official term but something that is near and dear to Simple Passive Cashflow Followers. At some point, you need to transition from higher returns and higher headache investments to more scaleable investments where you investing passively.

After purchasing a couple rentals in the Seattle market and being the beneficiary of some nice appreciation, I evaluated the property’s performance with a ROE or Return of Equity metric. On of my rentals had appreciated all the way to $450k and my mortgage that I owned was $200k. Therefore, I had about 250K of “lazy” equity. If you kids are at home with you calculators that 250k goes in the denominator of the calculation. The numerator is the annual cash flow which was about $4K a year. Therefore my return on equity was less than 2%=4k/250k. Frankly, 2% is very poor compared to stocks (~8-10%) or properly leveraged Real Estate (~20-40%).

Calculate how lazy your current rental investments are with this spreadsheet: Link

Video: If your interested in seeing a A-Grade rental in Seattle that does not cashflow (poor cashflow investment)

I am sure someone somewhere is trying to invest in something similar and fooling themselves that they are making money on the project. But you are smart and you subscribe via RSS feed to this blog and podcast

Long story short, I decided to sell these rentals to unleash this “lazy money” and get it working again with prudent leverage. This is what separates sophisticated investors who look at the numbers and your mom & pop investors who go by warm & fuzzy feelings of “hey I’m making cashflow, life is good”. Yes, Mom you are cashflowing but that is because you are halfway to 100% cash in the deal and you are taking on all that hassle and risk for a microscopic return.

Comments