Groupon vs. Income Property

The recent filing of an S-1 Document by Groupon for the purpose of an Initial Public Offering has led to many people speculating about the value of the company, especially in the wake of Google's $6 billion dollar acquisition offer that Groupon refused. When their stock lands on the exchanges, many expect it to be an extremely hot item since many people are anxious to own a share of the rapidly growing company. This filing has come on the heels of IPO’s and IPO rumors from companies such as Facebook, Twitter, and Linked-In that has led many to believe that a second wave of the technology bubble may be emerging.

The key characteristic of the technology bubble in the late 1990’s was excitement over proliferation of the Internet, and its potential to change business models. The predominant paradigm at play during this market frenzy was a belief in growth at all costs. Companies were formed and investments were made based on the belief that whoever was first to create a viable Internet marketplace would reap the lion’s share of the financial rewards. Since this growth paradigm generated tremendous losses for companies participating in the frenzy, many new measurements were concocted to cover-up the fact that loads of investor capital was being burned by these new companies.

To wit, Groupon has made sure to place emphasis on metrics such as Free Cash Flow, and something they call Adjusted Consolidated Segment Operating Income, or Adjusted CSOI. Neither of these metrics are part of Generally Accepted Accounting Principles or GAAP. Their “Free Cash Flow” measurement looks at operating cash flow with purchases and acquisitions removed. Many of these purchases are necessary parts of operating a business. The “CSOI” metric examines profitability from existing subscribers/customers, but ignores the cost of acquiring customers, equity compensation, and taxes.

As we can see, the measurements Groupon uses to evaluate itself leave out many significant costs that the management wishes to gloss over when selling a growth story to investors. Groupon’s value proposition comes from being a large-scale player … however, that large scale comes with large losses. In contrast to this are the small-scale profits that come from otherwise boring investments such as income properties.

Large Scale Losses

• High growth and high spending that produces large losses to purchase large revenues.

• Requires regular infusions of investor capital to keep the spending binge going.

• Lots of media attention will attract wide-eyed investors who expect that the stock will remain “hot” forever.

• Eventually, investors will tire of continuing to fund a money furnace.

• The early movers and insiders will cash-out long before the bubble bursts.

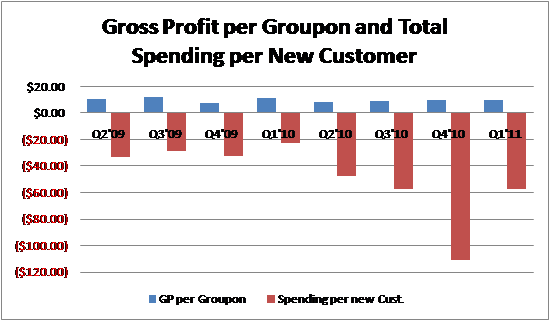

Charting out some data from the Groupon SEC filings shows a very interesting trend. Their gross profit per Groupon sold is very important. This represents the amount of money they actually see after paying the vendor their share. This amount has been very flat over time. However, the total spending of Groupon divided by the total number of new customers shows a startling trend. Groupon must spend an ever increasing amount of money for each new customer that it acquires. This does not bode particularly well for their long-term profitability. Astute investors should be wary of what this trend means for the future of their equity stake.

In contrast to the large-scale losses from a ‘sexy’ enterprise like Groupon, you have the small-scale profits of an ‘un-sexy’ investment such as income property. These two classes of investment differ in almost every fundamentally important way.

Small Scale Profits

• Very little media attention – the fragmented market means that there is no money for people like Goldman Sachs to securitize things like income properties and market them to the general public.

• Day one profitability combined with stable cash flow and low to modest growth makes things like income property less appealing to the general public who prefer “dynamic” investments.

• The power of time works in your favor, instead of against you. Instead of timing the market just right to avoid a bursting bubble, you can ride out market cycles on the back of strong cash flows and sell when values are optimal.

The contrast is clear … Groupon and all of the other associated “hot technology” stocks showcase lots of media attention, a sexy story, and large losses that grow with each passing year. Income properties offer small-scale, fragmented profits that keep them away from investment banks such as Goldman Sachs. For investors who are disciplined and astute, they offer a unique opportunity to grow your personal wealth in an optimal manner.

Action Item: Resist the temptation to chase after “hot” stocks with high rates of growth that burden investors with large losses. Discipline your mind and stick to fundamentals when other people are chasing bubbles. This will place you in a position to take advantage of opportunities that emerge when the bubble inevitably pop. Focus on consistent, sustainable profits that will allow you to build long-term wealth. (Top image: Flickr | diloz)

The JasonHartman.com Team

"The Complete Solution for Real Estate Investors"

Comments