Analyze a Property with our

Rental Property Calculator

Determine the profitability of a potential rental property.

Start A Report

Cash Flow

Investment Over Time

Lenders or Partners

Expenses

At BiggerPockets, we understand investing in a rental property is a big, important decision. There are a lot of factors that go into deciding if a rental property is the right real estate deal for you. With the BiggerPockets Rental Property Calculator, our users can determine how the property would cash flow—the optimal way to help users assess if the property is the right addition to a real estate portfolio.

If you are new to real estate investing and aren’t sure what to consider when choosing a rental property, we encourage you to read the information below.

How To Use the Rental Property Calculator

Using the BiggerPockets Rental Property Calculator is a straightforward process that allows you to analyze any rental property deal with precision. To make the most of this tool, you'll need specific information about the property and your financial situation.

Here's what you need and how to use the calculator effectively:

- Property Information: Enter the property's address, purchase price, and estimated closing costs. You can find this information on listing sites, through your investor-friendly real estate agent, or directly from the seller.

- Loan Details: Specify your down payment percentage, interest rate, loan term (e.g., 30 years), and whether you're paying points on the loan. These details determine your financing terms. An investor-friendly lender can help you get the best funding for your strategy.

- Income: Enter the estimated monthly rental income. You can gather this information from rental listing sites, local market knowledge, or BiggerPockets Insights (if you have access).

- Expenses: Include all relevant expenses, such as property taxes, insurance, utilities (if you're responsible), repairs and maintenance, capital expenditures, property management fees (if applicable), HOA fees (if applicable), garbage, sewer, and vacancy rate.

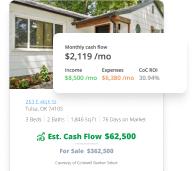

- Analysis: Once you've input all the necessary data, the calculator generates a comprehensive report. You'll find details about your annualized return, cash flow, cash-on-cash return, cap rate, and more. These metrics help you assess the profitability of the deal.

- Fine-Tuning: Feel free to adjust your assumptions and see how they impact the results. For instance, you can experiment with different rent values, vacancy rates, or financing options to evaluate various scenarios.

- Sharing: You can enable report sharing and even download your analysis as a PDF, making it easy to share with potential partners, lenders, or advisors.

Remember, what constitutes a "good deal" can vary depending on your unique circumstances and investment strategy. The BiggerPockets calculator empowers you to make informed decisions tailored to your goals, whether maximizing cash flow, seeking appreciation, or a balanced approach.

Utilize this tool to analyze properties effectively, and remember that ongoing market research and due diligence are key to successful real estate investing. With the BiggerPockets Rental Property Calculator, you can confidently evaluate potential investments and make decisions that align with your real estate investment objectives.

What You'll Learn From the Calculator

Unlocking the full potential of your real estate investment starts with a deep understanding of its financial dynamics. The BiggerPockets Rental Property Calculator offers more than just basic number crunching; it provides a holistic view of your prospective property's profitability, cash flow, and return on investment (ROI).

Whether you're investing solo or have a comprehensive real estate investing team, this tool will empower you to make data-driven decisions, ensuring your investments align seamlessly with your financial goals.

Profitability Analysis

Profitability is at the core of any real estate investment. The calculator provides a detailed profitability analysis by factoring in expenses like property taxes, insurance, and maintenance costs. It helps determine the property's ability to generate consistent profits over time. By assessing profitability, you can decide whether an investment aligns with your financial objectives.

Cash Flow (Rental Income)

One of the most critical elements in real estate investing is understanding your property's cash flow. The calculator breaks down rental income, allowing you to see how much money you can expect to receive each month after deducting expenses. This insight is crucial for ensuring that your investment generates positive cash flow, which can be used for ongoing property management, mortgage payments, or reinvestment in additional properties.

Return on Investment (ROI)

ROI is a key performance indicator for real estate investors. The calculator computes your ROI by considering annual rental income and property appreciation. This metric helps you evaluate the overall return you can expect from your investment over time. A high ROI indicates that the property has the potential to deliver substantial returns, making it an attractive investment option.

Rental Property as a Form of Income

A rental property investment is a property that is typically bought, held, and leased out to tenants with the intention of generating cash flow. The property type can range from a single-family home to a duplex or apartment building. When considering a rental property, you will want to make sure that it is a property that will generate positive cash flow based on the financial analysis that is conducted before purchase. The rental property calculator can help determine if a specific property is a smart investment.

Real estate investors can earn income from rental properties in a couple of ways—the most common being collecting rent from tenants. Typically, rental properties will cash flow monthly based on the rent collected from tenants, which is a passive form of income for property owners. In addition, the property may build equity over time, from which the owner will profit upon selling it.

Analyzing Your Rental Property Investment

The BiggerPockets Rental Property Calculator offers a comprehensive overview of your prospective property, but diving into the specific metrics can provide invaluable insights into its viability. We'll walk you through the key metrics to consider, each offering a unique perspective on your investment's potential.

Cash-on-Cash Return (CoCR)

The CoCR is a fundamental metric to evaluate the immediate return on your investment. It represents the annual pre-tax cash flow as a percentage of your initial cash investment. By factoring in the initial down payment, closing costs, and any upfront expenses, the CoCR swiftly tells you how well your investment generates cash flow compared to the capital you've injected. It's a simple test to identify if a property has the potential for strong cash returns or might not be financially viable.

Internal Rate of Return (IRR)

The IRR is a more intricate but highly revealing metric within the rental property calculator. It calculates the annualized rate of return that considers the time value of money and paints a holistic picture of your investment's profitability. It factors your property's projected cash flows, equity buildup, and appreciation, offering a comprehensive view of your long-term returns. The IRR is a crucial metric for those investors focused on the long game, as it assists in gauging whether an investment can outperform other opportunities or even other investment types.

Capitalization Rate (Cap Rate)

The Cap Rate is another indispensable tool in your investment property calculator kit. It measures the expected annual return on your investment property based on its current market value. This metric helps you compare different properties in various markets by disregarding financing details and focusing solely on the property's income-generating potential. The Cap Rate assists in quickly assessing whether a property is priced competitively and if it aligns with your investment strategy.

1% Rule

The 1% Rule is a simplified guideline to gauge a property's potential for generating income. It suggests that a rental property should generate at least 1% of its purchase price in monthly rent. While not an exhaustive metric, it can be a quick filter to identify properties with strong rental income potential. Remember that the 1% Rule is a rough guideline, and market dynamics and property-specific details should always be considered.

50% Rule

The 50% Rule provides a ballpark estimate of the property's operating expenses as a percentage of its rental income. It suggests that, on average, about half of your rental income will go towards expenses like property taxes, insurance, maintenance, and property management. This rule aids in creating a preliminary budget and assessing whether the property has the potential to generate positive cash flow based on local market conditions.

What’s a Good ROI for a Rental Property?

When evaluating a potential rental property investment using a rental calculator, one key metric to consider is the Return on Investment (ROI). ROI is a critical indicator of how well your investment performs and whether it aligns with your financial goals. But what exactly constitutes a good ROI for a rental property?

The answer isn't one-size-fits-all. The ideal ROI can vary depending on factors like location, property type, risk tolerance, and overall investment objectives. Generally, a good ROI for a rental property should exceed your initial expectations and provide a competitive return compared to alternative investments. In real estate, a commonly accepted benchmark is an ROI of at least 8% to 12%, although many successful investors aim for higher figures to maximize their wealth-building potential.

Ultimately, the definition of a good ROI is unique to your individual investment strategy and objectives, making it crucial to consider your financial circumstances and risk tolerance when assessing a rental property's performance.

Responsibilities of Being a Landlord

While it is great to earn passive income from a rental property, it’s important to consider the responsibilities of such a venture before diving in. Here are some of the responsibilities you will have to undertake as a rental property owner/landlord:

- Property Management: The owner is typically responsible for repairs, general upkeep, renovations, and anything else that keeps the property desirable and rentable.

- Finding/Screening Tenants: The owner is also responsible for finding and screening tenants to fill the home/apartments. After the tenants are moved in, there is also collecting rent, managing repairs, etc.

- Administrative Work: This will include doing paperwork, collecting rent, paying bills, filing taxes, budgeting, and all other financial tasks associated with owning a long-term rental property.

Keep in mind that while a property owner is responsible for these tasks, it doesn’t mean that they have to be handled by the owner. Most rental property owners will hire a property management company to handle these things for them.

Other Helpful Calculators

If you are looking into other types of real estate investments and aren’t considering a buy and hold property,

then you might find the following calculators helpful in your real estate investing journey:

Featured Books

Books On Rental Properties

Interested in learning about making the biggest profit on your rental properties? Read more about the process from the rental property experts!