Location Location Location

You've heard this phrase uttered in the business world forever. And it's the #1 Mantra in Real Estate repeated 3 times for emphasis. The phrase started out as advice, stressing the importance of finding a location for your business that would be very active, attractive and appropriate for what you were selling. Throughout the years it has entered into the real estate investing world. You must know the right areas to invest in. What areas have shown the most increase in market value, the most growth, what are the "Up and Coming" neighborhoods? What type of demographic criteria should you be considering? In other words, where does everyone want to live?

In residential real estate sometimes you want to find the worst house on the best street, renovate it and resell for a profit in an area where values of surrounding homes are already strong. This is good advice here in Pittsburgh and most other markets. Finding a good resale property has also attracted Flippers interested in buying low, renovating and then reselling at a higher rate. The "BRRRR" strategy has become popular with the idea of buying, rehabbing, renting, refinancing and then repeating. All of those strategies aside, more important is analyzing different neighborhoods carefully to ensure you will find the best opportunities for growth. Points to consider include:

1. Hot Market Locations

2. Investment vs. Resale Values in different sections of a city

3. Rental Rates compared in various neighborhoods

4. Rental Turnover

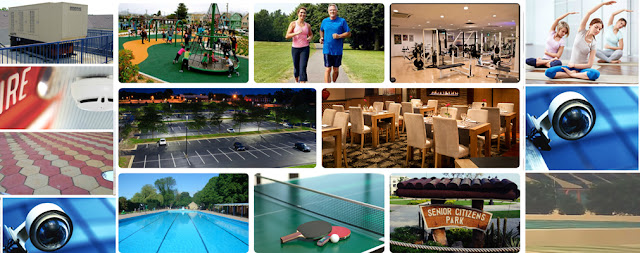

5. Proximity to Shopping, Restaurants, Work, School, Places of Worship, Healthcare and well, "Life"

6. Availability of Transportation and parking access.

A city often has "hot markets" where those sections have been revitalized to encourage housing growth. The trick is to find an area that is predicted to become a hot market and buy into it ahead of time before the market explodes. Look at factors such as cost of investment, resale values and rental rates, analyzing how they change in various areas of the city. What is contributing to this growth? Is it civic investment, an industry change or what? What is drawing people to a certain area and how does this affect rents and its desirability. You want people to stay in an area and help it grow.

Speaking of staying, what is the rental turnover on a property you are considering? Turnover can be good or bad, depending on the situation. If your property is in a college town, then turnover is to be expected, but that's consistent, ongoing and predictable turnover. College towns can be desirable as you are almost guaranteed income from renters. Just do your due diligence and background checks carefully as you still want responsible tenants. If you find that a property has high turnover and shouldn't, research the vacancy rate. You don't want tenants coming and going quickly. Check out crime statistics in the area. Also determine if the area you are considering is in an economically stable area. You should be researching all statistics including what rents are going for in various neighborhoods and what they could go for with some renovation. Also consider how much are you investing and figure out if property values have increased and at what rate. What has been the resale history of the property and how does that compare to others in that neighborhood as well as other neighborhoods? It is also good as an Investor to think of yourself as a tenant, just to find out what attracts dwellers to a certain area.

Think of your potential tenants and what will attract them to your property. How close will they be to work, shopping, school, healthcare, place of worship, restaurants and such? Is the neighborhood you are considering attractive to the dweller that wants all of these things? Also do YOU want your property to be in an area like this? Is it close to public transportation and/or have ample parking? Good to consider especially in city areas where parking is a premium. Yes, I have asked a lot of questions and so should you when considering a location to invest in.

Not sure what locations are hot and what are not? Get with people who know the area and ask questions. Research, compare, analyze, even spreadsheet it if you have to, but most importantly you don't have to do this alone. There are always people to help you and offer advice. It really boils down to what do you want to invest in and what area do you want your property to be in.

If your goal is to make money with real estate investing, then it's all about

Location! Location! Location!

Comments