When the capital stack gets mezzy

What is “mezz”?

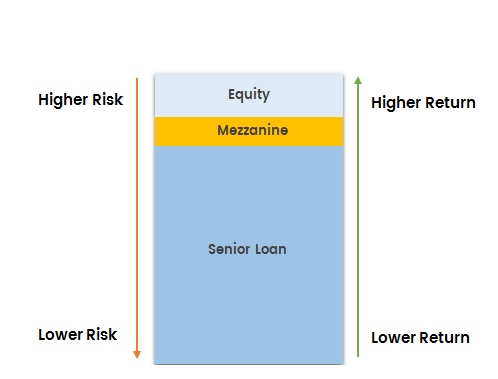

Mezz is an abbreviation for mezzanine, a level of financing between a senior loan (your typical commercial mortgage) and the owners’ equity. There can be a few different ways mezzanine financing can be structured to fill up the capital stack. Here we’ll focus on a mezzanine loan, also known as a second mortgage (as opposed to Preferred Equity which we may cover in a separate post later).

When is mezzanine financing right for me?

Mezzanine financing could be right for your deal when you have a gap in financing between your equity and the best available senior loan, but the financials still work out on the deal to bridge the gap with a smaller, higher-rate loan. Mezzanine is considered “higher up” the capital stack (see image above), which means it will cost a higher rate to compensate for higher risk. If a property goes bankrupt, first the equity will lose out, and then the mezzanine lender, before the senior lender loses out on their principal. A mezzanine lender will look at the deal as a balancing act between their risk (not getting paid back) and return (the interest and fees). Using a mezzanine lender means paying more each month in interest than using equity alone, but if your deal still yields a higher return, it can be worth the interest payments.

How much does it cost?

Coupon Rate

Mezzanine loans are often priced in the 10–15% interest range. While the rate on a mezzanine loan is quite a bit higher than a typical commercial mortgage, don’t be thrown off by the initial shock of the rate itself. You need to think of the total cost of capital for your project — the total interest paid each month across both loans.

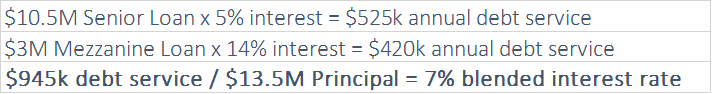

Calculating Blended Cost of Capital

Let’s say you are you are financing a $15M asset, and have enough capital ($1.5M) to put 10% equity in. You aren’t able to find a lender to provide 90% LTV financing, but you are able to find a senior loan for 70% LTV at 5% fixed interest. You have a shortfall of 20%, or $3M. If you can find a mezzanine lender to provide that $3M at even 14% interest, your blended cost of capital for the entire 90% stack of debt would be exactly 7%.

Comments