3 ways that Cap Rates affect your commercial mortgage

Cap rate, short for capitalization rate, is a key metric in commercial real estate. As the ratio between a property investment’s net operating income and its open-market value, cap rate is a measure of how much a property’s prospective cash flows are worth in combination with the level of risk. Two buildings can have the exact same amount of income, but the one that is considered less risky will be worth more. We’ll see that “priced in” as a lower cap rate.

For a lender, the key goal of a loan is to manage risks while collecting their returns as interest and fees, so measuring potential risks is key.

Cap rates let the lender determine their LTV (Loan to Value ratio) on a loan. This is important for three reasons:

Skin in the game

The difference between the loan’s balance and the property’s value is the sponsor’s equity, or their “skin in the game”. In many scenarios, a lender will want to make sure that this amount is not too little, or else the sponsor may have little incentive to avoid default or bankruptcy. Psychologically, having little of your own capital at stake based on the performance of the property can be a risk for a lender. This is especially important for new acquisitions. The sponsor may have too little skin in the game if they buy a property at the wrong cap rate, if the property’s financials dip, or if cap rates in their market rise significantly.

Downside protection during unforeseen event

This is a consideration for lenders even if a property’s cash flow is enabling on-time payments. In the off chance that the property needs to be sold prematurely (and unfortunately there are reasons), if cap rates dictate that the property can’t be sold for more than the loan’s remaining principal, that could lead to loan default.

Believability in value creation

Often on value-add projects, and almost always on construction projects, a lender will provide funding that is greater than the current value of the property. In those cases, the lender does so because they believe that the borrower is able to create more value than the lender’s money which they are spending. The borrower’s business plan will outline how much the property will be worth after spending the money from the loan — and to determine the “worth” of the property at that point, the lender will seek cap rate comps on similar properties, and apply them to the underwritten NOI.

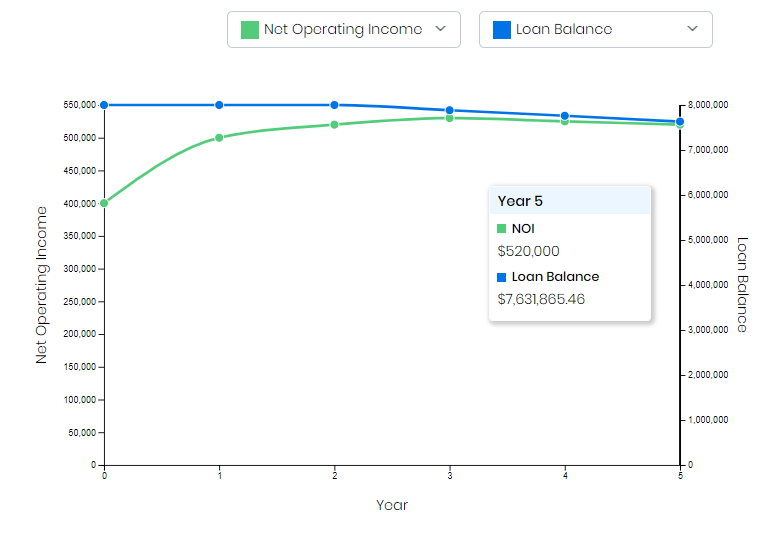

Consider this scenario: an investor buys an cash-flowing multifamily property, current NOI $400,000, for $10,000,000, which is a 4% cap rate. 4% cap is pretty expensive, but the asset is in a city where some other assets have sold between 4 and 5 caps, and he thinks he’ll be able to boost NOI significantly, so the actual yield will be higher. The investor does succeed in increasing the NOI for the first couple of years, with help from a 5-year, $8 Million loan starting with a two year I/O period:

However, the economy takes a turn for the worse during the 5 year loan term, this city doesn’t weather it well, and, even though the investor was able to make his loan payments (if just barely), now he’s left with a maturing loan and must pay off the remaining balance of about ~$7.6 Million. The city’s economy is in the gutter, so the best sales price the investor can get to sell the building is $7.2 Million, which is not enough to pay off the loan in full, especially after selling costs. The problem here was not just the tight DSCR (NOI never dipped below debt service), but that the investor bought at too low a cap rate based on a rosy view of increased NOI and price appreciation.

Know the market

So cap rates are important to lenders to determine potential financing terms. As a property investor, understanding a market’s cap rates ahead of time will save time, maybe save a project, and certainly help in making good investing decisions. Don’t grab an arbitrary cap rate number out of thin air — research and apply cap rate comps, and think about relative risks between markets in different scenarios. If for no other reason (though the reasons are plenty), know the market’s cap rates in order to set out in the financing process with the right request.

Comments