Flip or Flop or Scam?

Flip or Flop or Scam?

Tarek and Christina El Moussa stars of HGTV's hit show Flip or Flop are now operating in the real estate education space.

Recently The Holton-Wise team went to one of their seminars ran by a company called Success Path.

Armando is notorious for having a dicey reputation. Tarek and Christina's reputation has not faced as much public scrutiny as Armando's has so we wanted see what type of seminar they were putting their names on. Upon further investigation of Tarek and Christina we found out that their Success Path seminar's reputation was also under heavy scrutiny online.

A quick google search shows up countless reviews and accusations that the seminar is nothing but a scam.

Some rough online press but we went in with an open mind to see if they were teaching their students anything of value or if they were going to go the route that Armando took.

The seminar

The seminar had roughly 65-75 people in attendance. The presenter's name was Mike. Pretty charismatic speaker. We kept our real estate experience level to ourselves during the seminar. It was clear that the rest of the audience had little to no real estate experience and Mike played off of that quite well.

Mike led off with REO's. Mike portrayed flipping REO's as the best thing since sliced bread. He threw a lot of statistics at the audience without any meat behind them. Just high numbers to get them excited.

One such example was that the average flip in the U.S. nets the investor $75,000 in profit. A direct contradiction of another stat that Mike threw out to the crowd to get excitement. The other stat being that the average REO in Cleveland sells for $31,000 from the bank and is flipped for an average retail sales price $87,000. Clearly impossible for one to make a profit of $75,000 on such a deal, However when Mike explained the $31,000 acquisition cost with the exit price being $87,000 nobody cared about making $75,000 because they were so excited to hear him say that is a return of OVER 100%

Mike made it a point to tell us that this would be an interactive seminar. He encouraged participation however, any question that was brought up by the audience that may derail his rosy perception of investing was quickly sidestepped.

I asked several questions to try and pry some type of honesty out of Mike but he quickly deflected. I questioned Mike about the return of OVER 100% on the $31,000 REO that is resold for $87,000. "How could it be over 100% return, we need to fix it of course" That was received with a blank stare then a quick redirection.

Enjoying the article? Show your support by Tweeting it.

Another grossly misrepresented fact was the cost and availability of hard money lenders. Mike threw out lots of low interest numbers on the money such as 1%-9%. That fact that the money was 1%-9% MONTHLY and not annually ANNUALLY was of course glossed over. The room was told that they could buy any property they wanted without cash, credit, experience or a job. All they had to do to gain access to these lenders was become a student of Success Path. He then went into the pitch about the three day seminar. Which of course regularly goes for $5,997 but today it is being offered at a special price of $1,997.

I attempted in vein to get Mike to give some truth to the room in regards to up front costs in receiving this hard money such as appraisal costs. At this point Mike explained things of that nature are covered in the three day seminar and then the crowd was told he would not be able to take questions and if anyone had any questions they should write them down and later we could ask the other crew members in private. So much for an interactive seminar.

It's very unfortunate that the audience members are ONLY going to find out about all the up front fees such as application and appraisal costs after they have shelled out their $1,997.

Related: HOW TO GROW YOUR BUSINESS USING BIGGER POCKETS

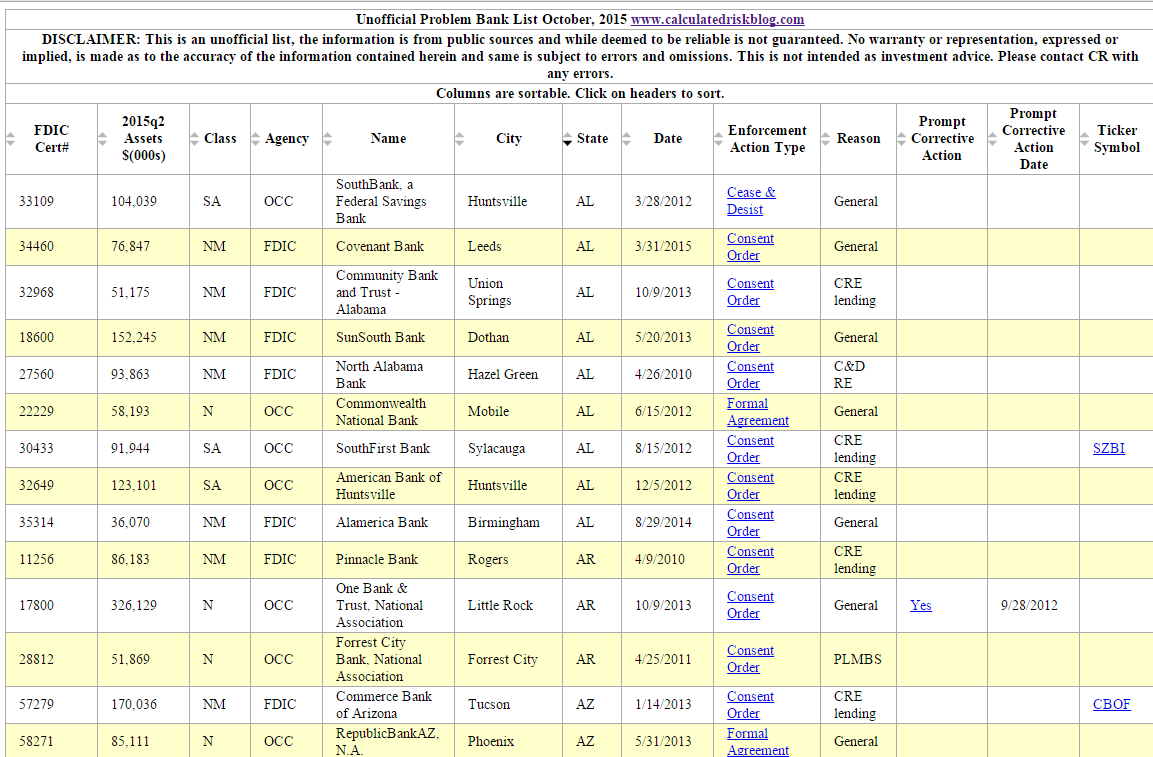

Mike then went one to explain to the audience about a secret list of banks that are in trouble with the FDIC. Success Path has this list and the value of this list is $10,000 Success Path students have access to it after signing up for training. I was able to pull up this secret list on google in about 2 min. Below is actually the image that was used by Mike in his presentation.

Mike then began to go into all the riches that would be made by all of the potential flippers in the audience by having access to this list of troubled banks. All of these banks have troubled inventory that they need to liquidate. We were told that there was an unlimited amount of inventory for us to get our hands on.

Mike began telling us about a bank in Ohio that was on the list. It was called The Bank of Maumee. As you can see there is actually only the one bank Mike spoke about and one other bank from Ohio on this list. The one Mike spoke about currently has a mere $39,402 worth of assets. Hardly enough for the 65 of us to begin doing deal after deal. This fact of course was not mentioned.

A few other quick points that were discussed during the seminar that were misrepresentations of reality.

- The audience was told we could be Buying HOA foreclosures valued at $250,000 for $4,000.

- The audience was told Hard Money Loans would be seen by the banks as cash offers.

- The audience was told we could be earning an average wholesaling fee of $10,000-$20,000 per deal. This would not require us to spend any money and we would only be working 5-7 hours per week. No mention of brokerage laws. ORC 4735.01 or this letter written by The Ohio Division of Real Estate.

In conclusion

Tarek and Christina El Moussa should be ashamed of themselves. They have attached their names to a program that uses high pressure sales tactics along with a gross misrepresentation of the facts to target the desperate, uniformed and easily manipulated. Their notoriety is being used cash in on the misfortune others will undoubtedly face when spending their hard earned money on horribly misleading education offered by Success Path.

Flip or Flop or Scam?

Enjoyed the article? Show your support by Sharing it on Facebook

About the author:

James Wise is the Broker and Owner of The Holton Wise Property Group, a real estate brokerage and property management company operating one of the largest scattered site rental property portfolios in the greater Cleveland, Ohio area. He has been a guest speaker on several real estate internet radio shows and podcasts. He regularly writes blogs and articles for multiple real estate related websites. He is an active member of the National Association of Realtors® and the Akron Cleveland Association of Realtors®.

Comments (25)

Armando Montelongo is now Facing Civil RICO lawsuit.

http://www.jeannorton.com/3137-2

Jean Norton, over 9 years ago

Here is some more information on the Armando Montelongo RICO lawsuit if anyone would like to read.

Real estate mogul accused of racketeering

San Antonio house-flipper Montelongo sued by 164 ex-students

Ex-students sue 'Flip This House' star Montelongo over seminars

James Wise, over 9 years ago

Interesting blog. I'm always amazed that they can get anyone to shell out money that way, which sometimes makes me feel bad that I'm not dishonest :D . Good review! And that's disappointing, because I like to think I'd like these people (well, I know I'd like Christina!)

JD Martin, over 9 years ago

Great article. It's always nice to hear the scoop from someone with your experience. Thanks for sharing, and spreading the real news about these investment seminars.

Julie Marquez, over 9 years ago

Good article James. I really like watching the Flip or Flop show. I find it entertaining and do think they are probably more honest about their flops than most. Of course, as real estate agents, their closing costs are always on the low side so it does inflate their numbers a bit. But they've actually admitted to losing money on some of their opportunities which you don't often see.

But knowing what I know about these seminars, I wouldn't go to them unless I really knew who was running it. And whenever I see these big free pitches with hundreds of people coming, I know there's bound to be the big sellup.

I will point out one error in your post. The bank with only $39,402 in assets actually has $39,402,000 in assets. The numbers are in the thousands.

Hey, keep up the great work!

Ronald Perich, over 9 years ago

Thanks for reading Ronald Perich. Glad you enjoyed it.

James Wise, over 9 years ago

John Thedford, over 9 years ago

Thanks James. Glad to see you keep the fight up for honesty, integrity, and getting an education. Anyone can make a great living in RE if they find the right information. Hopefully, we will see some enforcement actions against these scam companies.

John Thedford, over 9 years ago

Agreed. It appears The Ohio Division of Real Estate feels the same way.

ODRE Using social media in investigations powerpoint

James Wise, over 9 years ago

Great post James, very well documented. I only wish I had done a little bit of research before foolishly wasting $2000 and 3 days of my life. This is definitely a total scam. I learned more in a couple days in Bigger Pockets, reading some posts, listening to some podcast and reading a couple books.

The only good thing that Success Path did for me was to push me into learning more about REI.

Juan Gomez, over 9 years ago

Glad to see you found some quality education here on BP Juan. Good luck to you.

James Wise, over 9 years ago

Just look at how far learning about real estate has come. Use to be this was the only way to learn, at least for most folks.

Account Closed, over 9 years ago

Very true. Good thing there are many more avenues for new investors these days.

James Wise, over 9 years ago

Great post. So many of these seminars come through San Antonio. It's doesn't help that Armando M is based here. What people don't realize is that these so called "real estate experts" make money from seminars now instead of real estate deals.

James Daniel, over 9 years ago

Thanks for reading James. Armando is probably the worst of all of them.

James Wise, over 9 years ago

Thanks for the review James! Similar seminars come through the areas of where I live - it's always sad to see people unknowingly lose their money this way. It's a good reminder to share this with others who may not be in the know that this is what often happens at these seminars.

Sergey Tkachev, over 9 years ago

Thanks Sergey. I agree as many people as we can warn the better.

James Wise, over 9 years ago

James,

Great post. As you know from the article that I wrote for the Division of Real Estate (included in your post) this is a battle I had been fighting the past 3-4 years. I am hoping to that since I have left employment with State government I will be able to get the message out there about the predatory schemes involving the "Gurus". While they do have content in their presentations that speaks to purchasing, rehabbing and/or flipping, the majority of their content targets individuals that are looking for the "rags to riches" story. Unfortunately that is a fallacy. At each event the emphasis appears to be to teach wholesaling, as that is the easiest and least expansive entry into real estate investing. The unwitting attendees are taught the wrong way to wholesale and risk exposing themselves to regulatory and even possible criminal prosecution. I will be posting more about the legalities of wholesaling in the future.

Regards,

Nick Chucales

Account Closed, over 9 years ago

Thanks for reading Nick. Spreading awareness about this stuff is my number one priority as it will help people from being scammed and better our industry. I encourage you and others to share this article on your social media profiles.

James Wise, over 9 years ago

Great Review James! It makes me sick to hear people do that to other people...they r just taking their money and running vs building a relationship that helps each other out.

Bryan C., over 9 years ago

Thanks for reading @bryan c Glad you enjoyed it.

James Wise, over 9 years ago

Good review. I would feel sick to my stomach watching people buy this program.

Dawn Anastasi, over 9 years ago

Thanks Dawn. Be sure to spread awareness by sharing on Facebook & Twitter. The folks on BP already have an idea of what is going on. It is the folks on the other social media sites who are going to be manipulated and taken advantage of.

James Wise, over 9 years ago

Good post. Ive been asked by a lot of friends about these and other scam artists. Seems like a lot of them have been coming through my area in the last year. I almost wish I could go stand outside with a sign warning the people going to these things.

Russell Brazil, over 9 years ago

Yea, it's pretty sad to see 10 or 12 people run up to the table and spend $2,000 a piece. Just watched $24,000 go up in smoke in minutes.

James Wise, over 9 years ago