My 3 biggest issues with land investing

In a previous post, I outlined the 3 potential exit strategies you should have when buying land as an investment. Since land doesn’t typically appreciate as quickly as a home does, you need to stay flexible and ensure you have a way to turn a profit. One of the strategies I highlighted was Development, which I believe has the highest return possible of the three strategies and is the strategy I would guess most of you plan to pursue.

If you’re a buy & hold real estate investor, a flipper, or a first-time investor, Development is definitely a challenge that has very little overlap with the real estate investing strategies you are most familiar with.

In this post, I’ll go over my first-hand experience with developing a land investment that I purchased and the three issues I faced when attempting to develop.

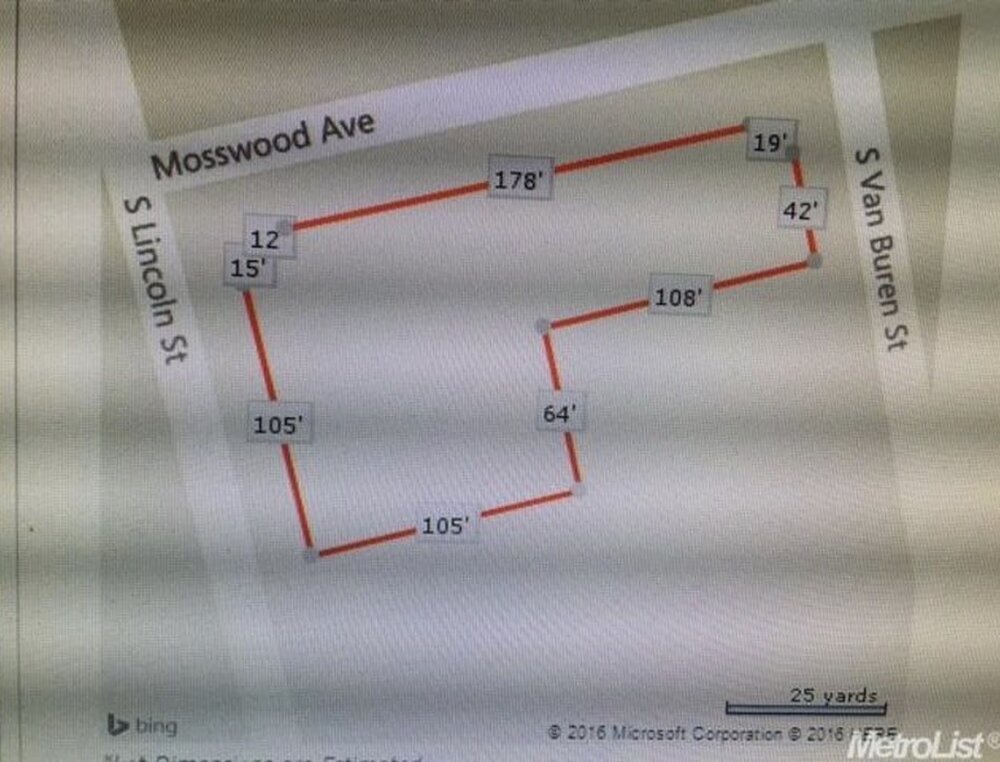

In May 2015, I bought an empty lot in Stockton, CA, a 12,000 square foot empty land parcel. Given that Development forecasted to generate the most profit, I pursued that strategy soon after closing on the land. Getting into new home construction seemed like the next challenge for me to grow in real estate.

While I had never done home construction before, my uncle was a home development contract who initially agreed to help me. He estimated the cost for development of a 3 bedroom 2 bathroom to be $175K and homes this size were averaging $200K, implying a $50K profit per lot or $75K in profit for the three lots.

Little did I know, I was biting off far more than I could chew.

Issue #1: Soon after the purchase went through, I reached out to my uncle who I had consulted prior to the purchase. After several calls and voicemails, I could never reach him. This was a gut punch since my development strategy heavily depended on him.

Lesson #1: Build a team you can trust. Rather than relying on family member that I had never worked with, I should have based my decision to purchase after consulting a contractor that had been referred by a reliable source or a contractor I had worked with previously.

Issue #2: Still eager to develop the land, I asked my realtor and searched through Yelp, Google, and Angie’s list for contractors who specialize in developing new homes. Unfortunately, after several calls, I could not find a resource.

Lesson #2: Network more and have a back-up plan. Years later, I learned of several contractors in my area that specialize in new home construction. Had I built my network more (by going to Meet-Ups or contributing to the Bigger Pockets forums), I could have found a back-up partner in place when my uncle could not be reached.

Issue #3: Still optimistic and hopeful to develop the land, I researched constructing a Modular Home on the lot. After reaching out to two modular home companies that I found on Google, they advised that costs to construct would be about $175K. At the time, new homes were averaging about $200K in 2016. Factoring in funds needed for unexpected expenses didn’t leave me much profit in the project. And with no experience doing new home construction, I wanted to be overly cautious.

Lesson #3: Budget funds in case anything goes wrong. In my case, after spending $45K on the land purchase, I didn’t have much cash left over to fund the Modular Home project. I didn’t do more research on if financing was available with the Home Builder and I didn’t do research into finding financing elsewhere.

Having hit a wall with Development, I held onto the property for 11 more months without doing anything to it, but still paying the property taxes and sewer fees. I decided to sell the home in April 2016. I admitted that I was out of my league in what to do with the land and that I could use the funds from the land to acquire rental properties, of which I knew more about. I felt secure going forward with selling because I remember reading articles that highlighted that if you sold an investment property, the profits made are not taxed.

To recap:

Lesson #1: Build a team you can trust.

Lesson #2: Network more and have a back-up plan.

Lesson #3: Budget funds in case anything goes wrong.

Lesson #4: Be realistic in your experience and take baby steps. Identify what you know, and gradually advance to master what you don’t. Pick your niche and become an expert in it.

Lesson #5: Know when to call it quits. Knowing when you are out of your league is as valuable as doing everything in your power to make something work. While perseverance is valuable, persevering while running a financial loss can be costly.

As in life, anything that can go wrong will go wrong. It is up to us as investors to calculate the risks and rewards and execute even when we hit unexpected challenges. For me, I walked into purchasing this property thinking I had done all the preparation to ensure I could hit the ground running.