Updated 4 months ago on . Most recent reply

Case Study On 12 Unit Multifamily Property Just Outside Kansas City MO

Wanted to share the details on this deal we represented a buyer on since the numbers are pretty sweet on it. This was a very sophisticated buyer that had his own GC company and raised the funds through a mastermind he partly runs.

This property is located in Independence MO. It had just come back to market after the previous buyer was unable to close. We were able to scoop up the property for $50k below asking price, purchasing for $400k, and of course getting our buyers agent commission covered by the seller (who was also the listing agent). After inspections on an as-is sale, we still managed to get the flooring demo'd out of the property which was the final bit of demo needed as the property was practically a shell.

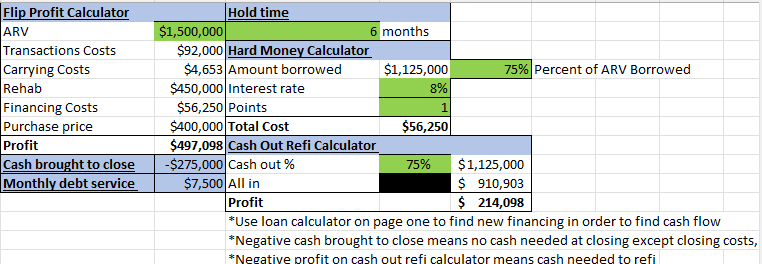

This property already had stamped plans set up for 10 2-bed units and 2 1-bed units, to create a server/storage room on site. It also included a gazebo and entertainment area. The buyer is modifying the plans to have 12 2-bed units and 10 garage/storage units put up where the gazebo was supposed to go. After walking the property with contractors the budget was deemed to be around $450,000, and they state they will be able to finish the project within 2 months. Buyers property manager will immediately begin leasing the property for proof of concept to hit rental rates needed to justify a $1,500,000 sale prices at an 8.6 cap, which is still high for the area as Independence is closer to a 7-7.5 Cap rate. The underwriting can be seen above on the stabilized sales price. Seller is targeting $1,300 for rent on a 2 bed 1 bath 600sqft room with 2 parking spots and in unit washer and dryer, with EVERYTHING brand new. Property is walking distance to Independence square.

Now this investor could even refinance into long term debt and hold onto this asset and still manage to pull out $214k+ tax free. However, he plans on selling the property. The breakdown can be seen below. Should he pay 6% (which we will negotiate down on buyers representation) in commissions and hold the property for 6 months that brings his profit to nearly $500k when everything is said and done!

About Independence and the Independence Square:

Independence borders Kansas City MO on the eastern side of Jackson county. Geographically it is a very large city, and of the older cities within Kansas City with a significant historical impact in Kansas City. It is a mostly solid C class market, with some areas reaching B class!

Independence Summary Table

Metric Value

2024 Estimated Population ~121,600

Median Age ~38.4 years

Median Household Income ~$59K–$61K

Median Home Value (2023) ~$166,400

Homeownership Rate ~61%

Current investment in Independence square infrastructure/redevelopment:

$2 million in public streetscape planning

$25 million in infrastructure improvements

$10 million in public investment within the Truman Historic district

$15 million in private residential redevelopment

$30 million in private commercial redevelopment

Over $1 million committed to commercial façade improvements

→ Grand total: Approximately $83 million in combined public and private investment

- Johnathan Trimble