Updated over 2 years ago on . Most recent reply

Las Vegas/Henderson Market Shift

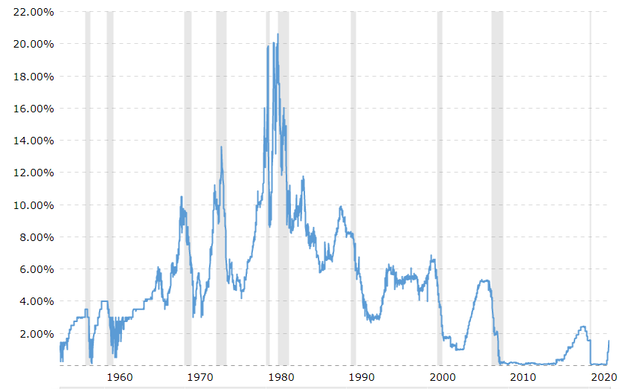

The buzz around the country right now is the shifting economy and that is no different in the real estate sector. With the Fed raising the overnight interest rates and implementing Quantitative Tightening (QT) to combat the hyper inflation we are seeing across industries as it hits inflation rates we have not seen since the 80's, the ripple effects are reaching everyone. Due to the pandemic the Fed pumped money into the system that drove the demand of goods and services through the roof. This has put the reputation and value of the dollar as the world currency at risk. Below is a chart of the inflation rates since we started tracking them in the 60's.

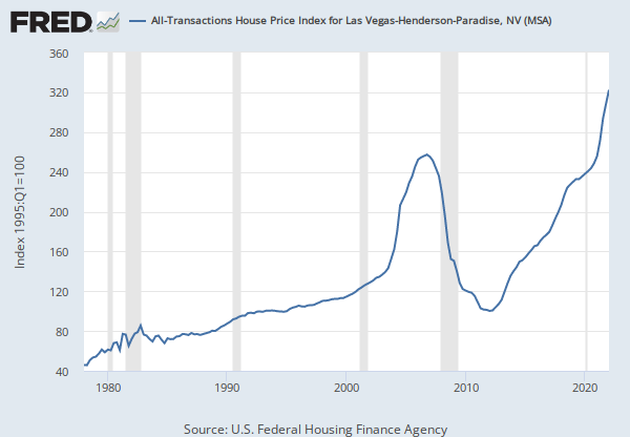

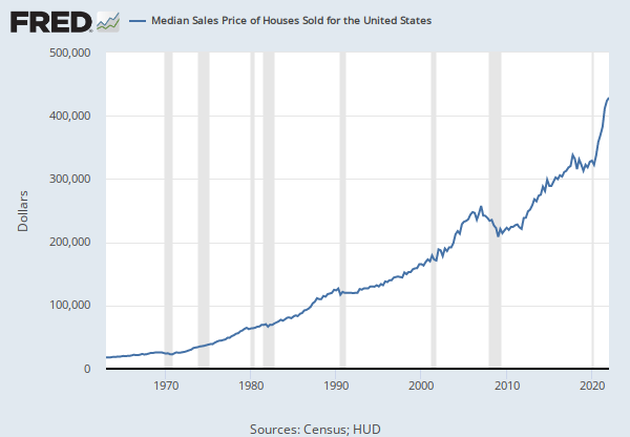

With this being said, many are asking themselves if a housing crash like 2008 is headed our way. This is a very logical question given the fact that inflation is still very high despite rate hikes, stocks are plummeting, crypto currency is down, supply issues are still affecting the world as a whole, fuel prices are at all time highs, and the political climate across the globe is tense with the Russia / Ukraine conflict. Below is chart of historic housing prices.

To get this in check the Fed has raised rates multiple times and are expected to raise rates several more times throughout 2022 and into 2023. With that being said rates are still historically low and at this time are still lower than the inflation rate. These are not mortgage rates but rather the overnight Fed rate at which banks lend amongst themselves. Think of it as wholesale rates between banks in the back end. Mortgage rates are more like retail rates to consumers. While the Fed rates do play a part in mortgage rates they are not directly tied to one another. The Fed rate also plays a role in other types of loans like credit cards, HELOC's, auto loans, business loans, etc. See the chart below for the historic Fed rate.

To further cool the supply of money for lenders in the housing sector they lowered the amount of mortgage backed securities (MBS) the government is buying to further lower liquidity in the market. As we all know basic economics with less supply of money the cost of the money/loans will increase. During the pandemic the government drastically increased the volume of MBS to add liquidity to the market to help keep rates low to stabilize the economy as we battled covid's impact on our economy. As the MBS's volume is decreased it will further affect affordability and the costs of financing for homes. See the historic chart for Mortgage Backed Securities (MBS) below.

So you ask, WHAT DOES THIS MEAN FOR THE REAL ESTATE MARKET??? This means lenders will have less liquidity meaning they will have less money to lend (lowering the supply side of money to lend will cause the cost to borrow money to increase). You combine that with the higher Fed rates and lenders are forced to increase their mortgage rates to consumers. These higher mortgage rates combined with higher home prices that we have seen in recent years due to the hyper appreciation caused by the low housing inventory over the past several years and inflation costs, this will create affordability issues for many first time home buyers and financed buyers in general.

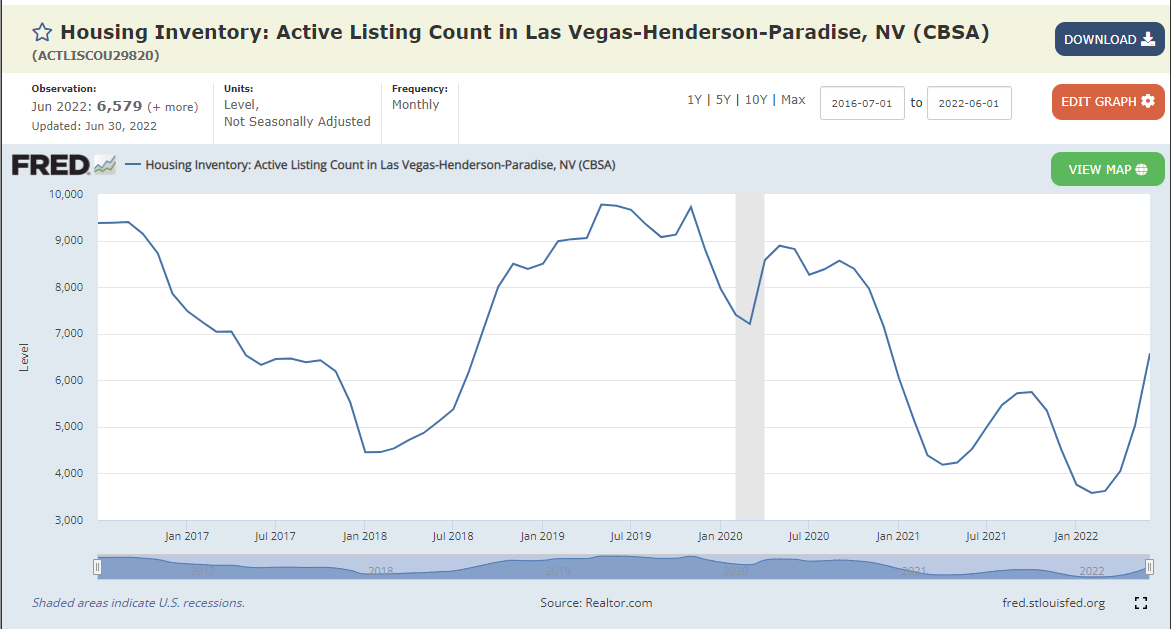

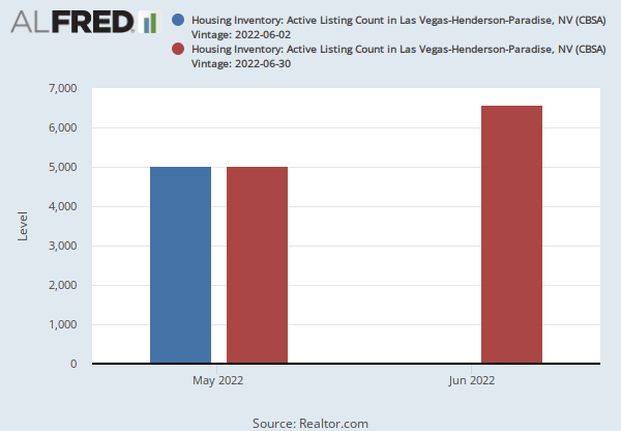

So far the real estate market has had a knee jerk reaction to the monetary changes and demand has slowed dramatically. You combine this with many sellers panicking and putting their properties on the market to sell in fear of a crash and you see the significant increase in housing inventory. At the lowest point here in the Las Vegas / Henderson market we only had 2 weeks supply with less than 2,000 listings. Over the past few months we have seen month after month increases in inventory and locally we now are sitting just shy of 2.5 months supply with almost 7,000 listings. While relative to the inventory we did have this is a major increase, to put it into perspective we would need 4 month to 6 month supply to reach a balanced market (not a buyer or sellers market). If we rise to above 6 months supply you can expect prices to start decreasing. To put things into perspective, after the 2008 crash we had over 15,000 homes for sale here in Vegas with 5,000 foreclosures every month. We are no where near those numbers right now and foreclosures make up less than 1% of the available homes for sale. See the local Las Vegas/Henderson inventory charts below.

Despite all of these factors we have not seen home values decrease yet other than the latest median home price report that says here locally our median home price dropped from $482k to $480k last month (June 2022) for the first time since April 2020 when the media home price was only $310k. This $2k median value decrease is such a minor change it barely qualifies as a value decrease. We are feeling the shift as active agents and investors with boots on the ground that submit offers every single day. Rather than there being 30+ offers on a property and the property selling for $50k+ over appraisal value we are seeing most properties sell at value. If the home is distressed or a dime a dozen type of property we are seeing those sell slightly below value, or perhaps at value with some seller concessions included. If the property is remodeled, unique in some way, or a niche product we are still seeing those sell for slight over value. Believe it or not this is actually how homes sell in a healthy market. The 20%-30% appreciation that we saw last year is not healthy nor sustainable. The housing market needed to cool and that is what we are seeing. See historic housing prices for the country below.

In summary, we do not have a crystal ball to tell you exactly how this will all play out but I can tell you that the changes in housing and lending that were implemented after the 2008 housing crash have protected homeownership and made housing a much safer investment than back then. 30% of homes locally have been being bought with cash in recent years. Predatory and subprime lending like "no doc" loans are no longer available. Most loans have been taken out with down payments, very low fixed 30 year principal and interest payments, and have had to prove how the loan will be repaid. Adjustable rate mortgages (ARM's) while recently being reintroduced to the market are a very small percentage of loans that have been taken out.

Another huge factor that is new to our current market that was not around prior to the 2008 crash is the institutional buyers. Hedge funds with billions of dollars that have bought around 280,000 homes across the country. Most of which are not being resold. They are being held as long term rentals for cash flow for the hedge fund shareholders profits. As affordability becomes an issue for financed buyer, these hedge funds will likely continue to buy just with less competition from the financed buyers.

We now also have iBuyers such as Opendoor, Offerpad etc that have billions of dollars to buy homes cash like a trade-in and then resell them to a retail end-buyer.

After considering ALL of these factors we are expecting the market to continue to soften in the short term. We are hoping we see a flat market but there may be a 5% to 10% decrease in values until buyers gain confidence in the market again, higher interest rates normalize in the minds of consumers, and inventory flattens. Once this happens we are projecting the market will stabilize and we will see healthier 3% to 5% annual appreciation for the next few years. I am also expecting interest rates to continue to go up to the 8% to 10% range before inflation will get under control. At which time we will likely still be in a recession and then the Fed will most likely have to lower rates back down to help pull us out of the recession.

I personally am continuing to buy and invest in the local real estate market but I have adjusted my formula to match the current and projected market conditions. You can no longer bank on aggressive appreciation when calculating your After Repair Value (ARV). Be conservative and calculated with your formula, don't be emotional, and if the numbers work then buy smart. It is also wise to have a Plan B should your exit strategy not work out. I recommend making sure the property is also a good "buy and hold" property for cash flow as a worse case scenario so you can wait out the storm should it get unexpectedly worse.

- Robert Adams

- 702-349-9175

Most Popular Reply

Thank you for sharing Rob. Great insight for those not only here in Las Vegas but for all!