Are You Choosing to be Poor?

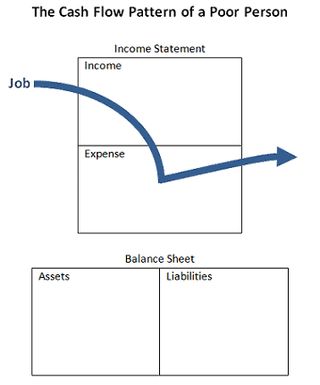

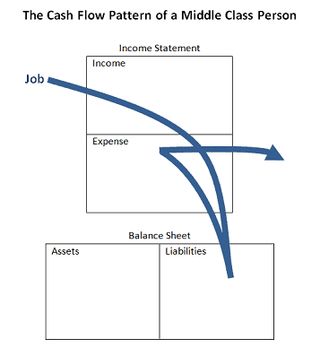

Several months ago, I was watching my six-year-old grandson for the weekend, and we were playing “Cash Flow for Kids" by Robert Kiyosaki. That’s when I noticed a small book had come with the game called, "Raising Your Child's Financial IQ," featuring Sharon L. Lechter (CPA) and Ann Nevin (PhD in Educational Psychology). It's just a small paperback, and although I've read many of that were published in the series, this, harder to find, book really struck a chord. Although I've been poor, middle class, and wealthy throughout my life, I never really knew why. To some extent we choose to be poor, middle class, or rich depending on the choices we make when each dollar comes through our hands. This simple explanation was literally an "Ah Ha" moment for a guy who likes to think he's a pretty sophisticated and savvy investor. It really all begins with our personal financial statement, which is really identical to a P&L (Profit and Loss Statement) and a Balance Sheet. The P&L displays one's income and expenses. The balance sheet, on the other hand, displays one's assets and liabilities. Now, the decisions made when a dollar of income comes in and is used for an expense, a liability, or an asset, determines whether we are choosing to be poor, middle class, or rich, respectively. See graphs:

Assets and Liabilities

I, like many people, believed that my house was my biggest asset. But, it is really the bank’s asset. The confusion is a direct result of not understanding the difference between an asset and a liability. Liability : an entity that requires money spent each month. Asset : an entity that produces money each month. Question to Ponder : "If you pay off your primary residence, is it really considered an asset now? No. It still costs you money (taxes, insurance, and repairs), and it doesn't make you any money (Cash Flow wise). When I went from being poor to rich, I shifted my focus on the type of income I was bringing in and how it was being taxed. When I was a painting contractor, my $100,000 income, for that year, would be taxed approximately $30,000. The $100,000 income I made from rentals in the same year would only be taxed approximately $15,000. Up until this point, I really didn’t understand the three types of income:

- Earned Income : You work for Money (taxed the highest, Example: Job)

- Portfolio Income: Money works for You (can depreciate assets, Example: Real Estate)

- Passive Income : Money works for You (no FICA, Example: Interest, dividends)

My priorities also shifted as I moved from poor, to middle class, to wealthy. Poor and Middle Class Rich #1. Employment #1. Investment Portfolio #2 . Consumption for Life's Comfort #2. Professional Satisfaction #3. Savings #3. Savings #4. Investing #4. Consumption Some might say we really need to start teaching our kids, and grandkids, the priorities of the rich. If you don't have a plan for your money, someone else will. We really need two plans for our money. Many of us (myself included) were taught: do your homework and get good grades, so you can get a good job and earn more money. Now that's plan number one for your money, but where's plan number two? _ Related : _

Are You Planning to Be Rich?

The reason I feel these types of games, whether for kids or adults, are so important is so one will have a plan (#2) for their money after they make it. Have you ever heard people say, "I know I should save, but I don't have any money left”? Or, "I know I should invest, but investing is too risky." These are really just symptoms of people (like myself at one time) who have a plan #1 to make money but have no plan #2 of what to do with that money. Plan #1 would be - how to earn income, then Plan #2 - how to convert income into passive or portfolio income. The common philosophy is that our wealth accumulation is determined by how much money we make, but it is what you do with the money and what you get the money to do for you that really matters. Income is not the real factor in becoming wealthy. The concept of Financial Intelligence is about how much money (and assets) you keep. It’s not just the understanding of an income statement or a balance sheet, nor is it just theoretical book learning. It requires the real world application of accounting principles. I never understood it; my six year old grandson got me to understand it. When a dollar hits your hand, you determine your financial destiny. So, what are you choosing to be? Photo: svet