The 10 US Markets With the Biggest Rent Increases & Decreases in 2015

In on rent affordability, RealtyTrac found that, assuming a 3 percent down payment, buying a home is more affordable than renting in 58 percent of US housing markets. Still, home price appreciation continued to outpace rent growth in 55 percent of the markets, and rent growth continued to outpace weekly wage growth in 57 percent of markets. “Renters in 2016 will be caught between a bit of a rock and a hard place, with rents becoming less affordable as they rise faster than wages, but home prices rising even faster than rents,” commented RealtyTrac VP Daren Blomquist. “In markets where home prices are still relatively affordable, 2016 may be a good time for some renters to take the plunge into homeownership before rising prices and possibly rising interest rates make it increasingly tougher to afford to buy a home.” _ Related: BiggerPockets Real Estate Investment Market Index: The Best (and Worst) Major Markets for Real Estate Investors, 2015_

Markets With the Biggest Increases & Decreases in Rents

In the 504 counties studied, the following was discovered:

- Three-bedroom property rents are likely to increase an average of 3.5 percent in 2016 compared to 2015 across all markets, according to HUD data

- Weekly wages in Q2 of 2015 were up an average of 2.6 percent from a year ago

- Median home prices were up an average of 5.0 percent in Q3 of 2015 compared to a year ago

Markets with the biggest increases in rents include:

- Sumter, South Carolina

- Burlington, North Carolina

- Goldsboro, North Carolina

- Houma-Thibodaux, Louisiana

- Missoula, Montana

The biggest increases among counties with populations of one million or more include:

- Santa Clara County, California in the San Jose metro area (up 9.3 percent)

- Travis County, Texas in the Austin metro area (up 8.0 percent)

- San Diego County, California (up 7.5 percent)

- Cook County, Illinois in the Chicago metro area (up 7.3 percent)

- Bexar County, Texas in the San Antonio metro area (up 7.2 percent)

The markets that saw the biggest decrease in rents include:

- Johnson City, Tennessee

- Abilene, Texas

- California-Lexington Park, Maryland

- Ithaca, New York

- Roseburg, Oregon

Counties with a population of one million or more with the biggest decreases are:

- Suffolk and Nassau counties in Long Island, New York (both down 6.8 percent)

- Clark County, Nevada in the Las Vegas metro area (down 1.4 percent)

- Sacramento County, California (down 0.4 percent)

- Contra Costa County, California in the San Francisco metro area (down 0.3 percent)

The Most & Least Affordable Markets for Renters

Across the US markets examined, the study found that wage earners on average will likely need to shell out 37 percent of their income on rents for a three-bedroom home in 2016. The price to buy a home -- again, assuming a 3 percent down payment and including mortgage, taxes, insurance and mortgage insurance -- for a median priced property would require just more than that, at 38 percent of income. Overall, 213 of the 504 counties studied (42 percent) saw higher affordability of renting over buying, while in 291 counties (58 percent), it was more affordable to buy. _ Related: _ The markets that are likely to require the highest percentage of income to be spent on rent (more than 60 percent of average wages) in 2016 include:

- Honolulu

- Washington, DC

- New York City

- Northern California metros of Salinas, Santa Cruz and San Francisco

Conversely, those markets that are projected to require the smallest percentage of income (less than 25 percent of average wages) are:

- Huntsville, Alabama

- Peoria, Illinois

- Davenport, Iowa

- Atlanta, Georgia

- Pittsburgh, Pennsylvania

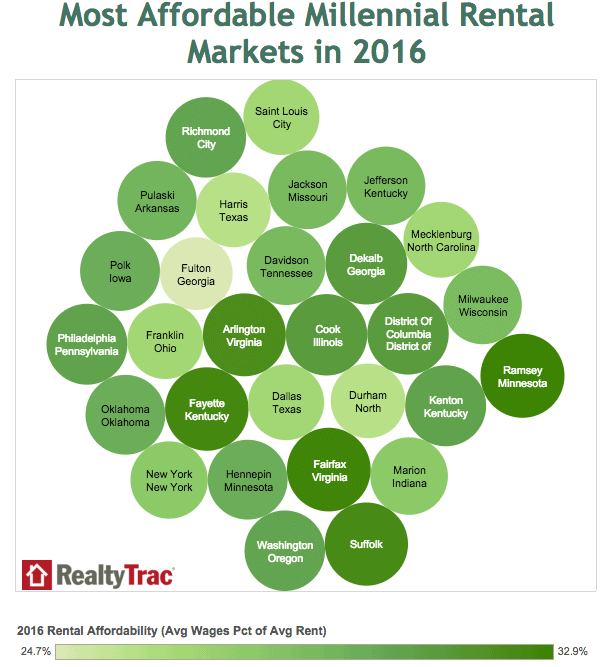

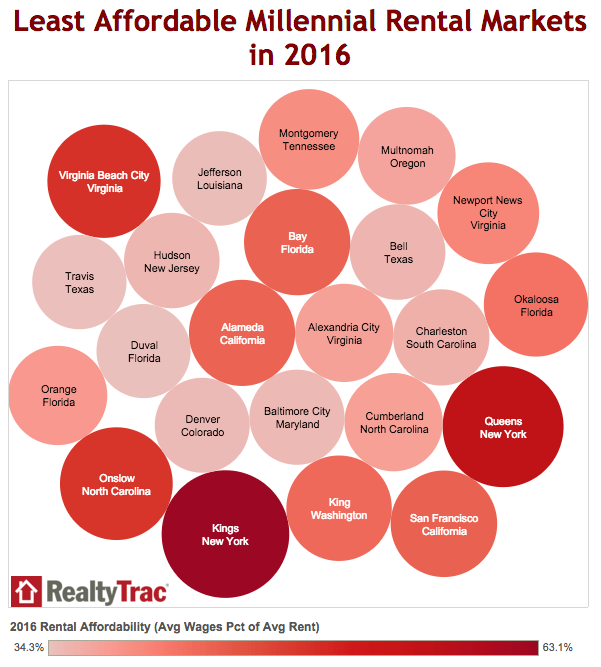

Most & Least Affordable Millennial Rental Markets for 2016

RealtyTrac's study also took a look at "millennial magnet" markets, those where the millennial share of the population increased at least 10 percent from 2008 to 2013. The findings were as follows: [caption id="attachment_76202" align="alignnone" width="614"] Via: RealtyTrac[/caption] [caption id="attachment_76203" align="alignnone" width="601"]

Via: RealtyTrac[/caption] [caption id="attachment_76203" align="alignnone" width="601"] Via: RealtyTrac[/caption]

Via: RealtyTrac[/caption]

What Does This Mean for Investors?

As rents continue to rise, landlords should be able to find good returns in many markets; however, they'll have to contend with unaffordable property prices that may continue to escalate in 2016. Whether the millennial population, which has been notoriously slow to jump on the homeownership band wagon, will take the plunge and begin to buy property this coming year or continue to rent is yet to be seen. Wondering what the projected stats look like for your specific market? Be sure to check out this interactive map to see what 2016 has in store for the rental and buying markets in your area. What have you seen as far as rent and home prices in 2015 in YOUR market? What do you think will happen in 2016? Leave a comment!