Commercial Real Estate Investors Beware: Skinny Dippers Will be Exposed!

Historically, the celebrated returns and safety of commercial real estate investing were reserved for wealthy insiders. The Forbes 400 is a list of the wealthiest on the planet. These are the movers and shakers who pull the strings behind world governments and economies. The poorest on the list have assets in the range of well over $4,000 million. (Yeah, I know that’s $4 billion. Just having a little fun with the numbers.) Though it would take a detailed study to prove this, it is widely known that the majority of this group made their fortune through commercial real estate or they now invest in commercial real estate to grow their portfolio and accelerate it for the next generation. These people know how to grow true wealth. And their friends inside the beltway (ahem, Washington D.C.) have greased the skids through tax-savings opportunities that would cause a revolt if they were widely publicized._ Related _: Why the Wealthy Put Their Money Into Multifamily & Commercial Real Estate

Low Taxes? Sign Me Up

A friend of mine—who had been in commercial real estate investing for decades—once told me that if the American people knew how little real estate investors pay in taxes that we’d have another tax revolt on our hands. He went on to show me his strategy to take $20 million and invest it for 20 years. After reinvesting distributions for the first decade, his leveraged portfolio would throw off $131 million in years 11-20 and be valued at $210 million at the end. That was great. But he amazed me even more when he showed me how this investor might pay only a few hundred thousand in taxes. Or even zero. Where else can you get predictable, tax-advantaged, recession-resistant investments like this? I signed up! The barriers to entry for most of us have made this lucrative opportunity out of reach. But thanks to the JOBS Act of 2012 and a number of other developments, these opportunities are available to the masses. Most anyone with say $10,000 or more can get in. And the opportunities available for accredited investors are truly plentiful. _ Related _:

The Pros of Passive Investing

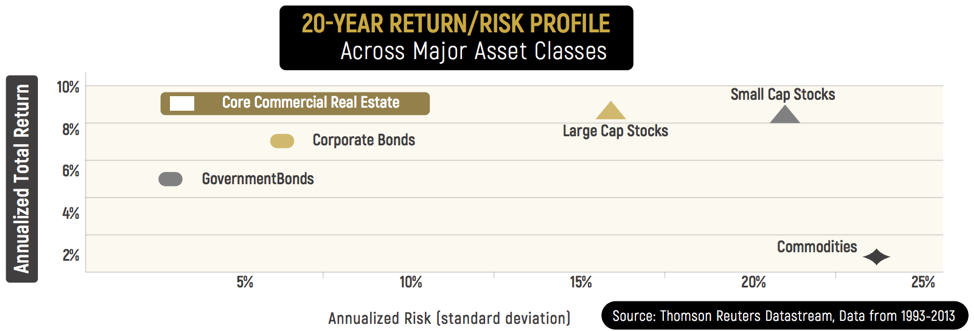

I’m a big fan of investing passively like this. As I said in my previous post, I do it myself. And my team has built a platform to give other accredited investors access to this coveted investing sector. This graph alone should convince most anyone that commercial real estate is the most powerful, risk-adjusted investment opportunity on the planet. (Note that your goal should be to land as far to the left on the x-axis (lowest risk) and as far north as possible on the y-axis (high return)).  Within the commercial real estate realm, I love self-storage and mobile home parks the best. They have the lowest default rate of all, and their fragmented ownership makes them prime for recession-resistant investments. I’ve written about this often. Check out the net income growth of these two asset classes since the turn of the century:

Within the commercial real estate realm, I love self-storage and mobile home parks the best. They have the lowest default rate of all, and their fragmented ownership makes them prime for recession-resistant investments. I’ve written about this often. Check out the net income growth of these two asset classes since the turn of the century:  But there’s a significant problem here.

But there’s a significant problem here.

Newbie Takeover

The popularity of commercial real estate investing has caused many newbies—who are better marketers than operators—to jump in. And the rising tide since 2010 has risen all boats. Everyone’s an expert while things are going well. But the tide will go out one day soon, and like Warren Buffett said, “Then we’ll see who’s swimming without a bathing suit.” We’ve seen this coming for some time, and we’ve done a lot of due diligence on operators and assets to be sure that our investors don’t get burned. And to assure that we have the peace of mind gained by those who are on track toward true wealth and financial independence. True Wealth = Assets that Produce Income What used to be impossible to access is easily accessible now. Honestly, investors have a lot of options. But investor beware! Don’t invest your hard-earned capital without carefully vetting the sponsor. Find out about...

The popularity of commercial real estate investing has caused many newbies—who are better marketers than operators—to jump in. And the rising tide since 2010 has risen all boats. Everyone’s an expert while things are going well. But the tide will go out one day soon, and like Warren Buffett said, “Then we’ll see who’s swimming without a bathing suit.” We’ve seen this coming for some time, and we’ve done a lot of due diligence on operators and assets to be sure that our investors don’t get burned. And to assure that we have the peace of mind gained by those who are on track toward true wealth and financial independence. True Wealth = Assets that Produce Income What used to be impossible to access is easily accessible now. Honestly, investors have a lot of options. But investor beware! Don’t invest your hard-earned capital without carefully vetting the sponsor. Find out about...

- Their track record (verify their history with facts)

- Their experience through the Great Recession (Were they even in this asset class then?)

- Their team (Are they a unified team of W-2 staff—or a loose coalition of 1099s?)

- Their character and ethics (How do they treat the server, speak about their spouse, and take care of investors and staff?)

- Their references (Check those they give you. And if possible, those they don’t.)

- Their recession-resistance (This is a matter of assets, debt, and more.)

- Their debt, deal structure, assumptions, and a few dozen other items

And if you don’t have the time or skills to do this on your own, partner up with someone who does. There are a lot of folks on BiggerPockets who can help. We’re looking for operators who lived through the last recession in the same asset class and who are poised to more than survive, but thrive, in the next one. They are out there. But it may take patience on your part to find them.

Sitting on the Sidelines

I was in Miami, Fla. at an investor event several months back. Though he was not on the agenda, one of America’s most famous multifamily syndicators took the stage. As a multifamily author, I was delighted to see him and was eager to hear his thoughts on the market. I’ll never forget what he said: “You need to get into multifamily! People talk about overpaying. That doesn’t matter. Just get in!” I was waiting for the punchline. It never came. I have to admit that this started a few days of self-doubt for me. I’ve been warning people about not overpaying for multifamily again and again on BiggerPockets and on podcasts for the past few years. And I sat on the sidelines while lots of my friends bought and sold a number of multifamily assets for huge profits. Maybe I was the one who was wrong. Then I thought about Warren Buffett. And Charlie Munger. And Ray Dalio. And Howard Marks. And their veritable investment father, Benjamin Graham.

I was in Miami, Fla. at an investor event several months back. Though he was not on the agenda, one of America’s most famous multifamily syndicators took the stage. As a multifamily author, I was delighted to see him and was eager to hear his thoughts on the market. I’ll never forget what he said: “You need to get into multifamily! People talk about overpaying. That doesn’t matter. Just get in!” I was waiting for the punchline. It never came. I have to admit that this started a few days of self-doubt for me. I’ve been warning people about not overpaying for multifamily again and again on BiggerPockets and on podcasts for the past few years. And I sat on the sidelines while lots of my friends bought and sold a number of multifamily assets for huge profits. Maybe I was the one who was wrong. Then I thought about Warren Buffett. And Charlie Munger. And Ray Dalio. And Howard Marks. And their veritable investment father, Benjamin Graham.

Playing It Safe

All these powerful investors and many more would heartily disagree with this statement. They would be running the other way while guys like this lead investors off a cliff. I’d rather sit on the sidelines and be wrong... than jump into a pool of alligators and be right. Warren Buffett has been criticized at the last two Berkshire Hathaway annual meetings for his position on this. He’s sitting on the sideline with a large chunk of cash preparing for a potential downturn and holding out for only the best deals. But he’s been criticized before (like when he refused to join the crowd pre-tech bubble burst). And my money is on him. I don’t want to see the inevitable results of syndicators and investors who are skinny dipping at high tide. But I’d rather see one than be one.  What's your take on everyone jumping into commercial real state? Will you be sitting on the sidelines or jumping in the pool? Please share with a comment below!

What's your take on everyone jumping into commercial real state? Will you be sitting on the sidelines or jumping in the pool? Please share with a comment below!