eCommerce Is Killing Retail, But Where Does That Leave Landlords? We Asked a Shopping App CEO

Times have been tough for retail landlords in recent years, as retailers are filing bankruptcies at a blistering pace. And it's not just mom-and-pop stores that are folding — this trend is led by iconic brands like Toys "R" Us. On the property-owner side, real estate moguls and market experts have , though in less PG-13 terms. Even prime strips in New York City are finding it hard to lease out their spaces. Meanwhile, online shopping has skyrocketed, turned one web guy into a centi-billionaire, all the while putting big brands (like Toys "R" Us) out of business. And experts expect the so-called "retail apocalypse" to continue. Why? According to Forbes, mainly because big retailers have failed to embrace "digital transformation." (Here's a more thorough report from Cushman & Wakefield that looks at .) [caption id="attachment_97571" align="alignnone" width="702"]  Retail of the future: 150+ startups transforming brick-and-mortar retail.[/caption] According to this infographic, more than 150 startups (as of 2017!) have raised funding—all in an effort to either transform, disrupt, or outright replace brick-and-mortar as we know it. Apps like Wish — one I didn't even know existed and which, for the record, thinks it will be ) — is now worth more than J. C. Penney, Sears, and Macy's combined. And others are hitting the market, with one after another raising millions, and some even selling for billions. To get some insight on the trend, I sat down with New Jersey–based investor and entrepreneur Ali Mahvan, who recently launched Sharebert, a Tinder-style app that pays users to swipe and share purchases on their smartphones. Despite its young age and a modest $3 million valuation (pre-money), Mahvan's startup has racked up deals with 15,000 retailers to date. "We want to take out brick-and-mortar as we know it," he says. [caption id="attachment_97605" align="alignnone" width="702"]

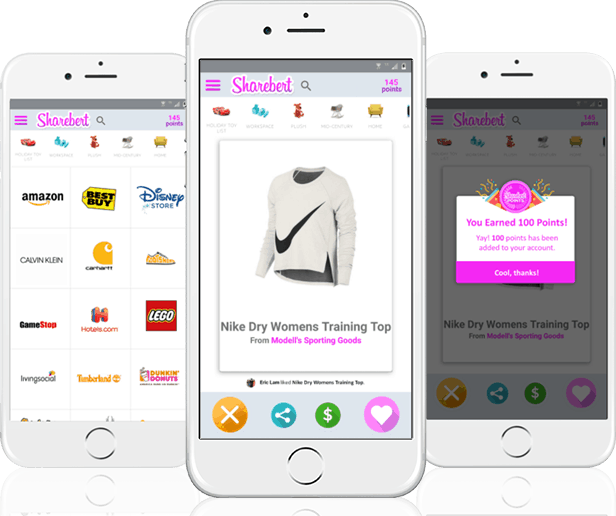

Retail of the future: 150+ startups transforming brick-and-mortar retail.[/caption] According to this infographic, more than 150 startups (as of 2017!) have raised funding—all in an effort to either transform, disrupt, or outright replace brick-and-mortar as we know it. Apps like Wish — one I didn't even know existed and which, for the record, thinks it will be ) — is now worth more than J. C. Penney, Sears, and Macy's combined. And others are hitting the market, with one after another raising millions, and some even selling for billions. To get some insight on the trend, I sat down with New Jersey–based investor and entrepreneur Ali Mahvan, who recently launched Sharebert, a Tinder-style app that pays users to swipe and share purchases on their smartphones. Despite its young age and a modest $3 million valuation (pre-money), Mahvan's startup has racked up deals with 15,000 retailers to date. "We want to take out brick-and-mortar as we know it," he says. [caption id="attachment_97605" align="alignnone" width="702"]  Philip Michael and Sharebert founder Ali Mahvan at Microsoft's Times Square office. Photo Credit: Mugabe Woodside/Instagram @baswoods[/caption] But where does that leave landlords? Can both survive? Or will one have to bite the dust? I asked him this (and more). Read on.

Philip Michael and Sharebert founder Ali Mahvan at Microsoft's Times Square office. Photo Credit: Mugabe Woodside/Instagram @baswoods[/caption] But where does that leave landlords? Can both survive? Or will one have to bite the dust? I asked him this (and more). Read on.

The Future is Digital

BiggerPockets: You've set a bold goal with Sharebert. Why are you so bullish about online shopping?** Ali Mahvan: **Convenience. People only do things that are totally convenient. It’s the reason you’ve spent literally hundreds of dollars over the past few years at that filthy gas station or convenience store near your home or office. We’ve all done it. It’s the reason Sears, Macy’s, and J. C. Penney are sinking in a mountain of debt and fewer people are out shopping in malls. Everything you could buy at the mall and more can be bought online and delivered directly to your home.

Online isn’t a new trend by any means. Internet entrepreneurs have been hitting home runs since the '90s. Everyone's heard of Jeff Bezos. Startup Zulily sold for [$2.4 billion] and is one of the 20-largest retailers in the world. Most people have never heard of Wish, but it's worth more than $10 billion — more than Macy’s, Sears, and JC Penny combined.

The future of all commerce is e-commerce, which is now quickly becoming M-commerce—mobile online shopping. Hence the existence of Sharebert. We wanted to fuse those two industries together.

What does your app do?

What does your app do?

The vast majority of people have their phones with them at all times, and more and more people are flocking to shopping online. That said, shopping on your phone is actually pretty annoying in most cases. Text and images are small, loading times are longer. The process is just annoying — especially if what you’re looking for isn’t readily available on the first site or app you open.

We try to solve all of these problems. For one, the more you use it, the app learns what you like and will recommend that to you. Secondly, all of the products from every major retailer on the internet are found in Sharebert’s app, companies like Amazon, Walmart, Best Buy, Disney, GameStop, Carhartt, Hotels.com, and tons more.

Lastly, we give users points, similar to credit cards — which can be traded in for products — just for using the app. In essence, we're paying users to window shop. But in a Tinder-style format with swiping.

A Lifeline for Brick-and-Mortar Retailers

Online shopping apps — including yours — have effectively declared war on brick-and-mortar retail. That's bad news for a lot of real estate investors. Is there room for retail in today's shopping climate?

Yes, definitely.

Really?! Absolutely. Being able to buy anything from home just means I don’t need to visit a brick-and-mortar retail location to make my purchases. So you need to get me there another way. _ Related: 4 Ways Technology is Shaking Up Commercial Real Estate (& Why Multifamily Will Pull Ahead)_ What's that way?

You need me as a consumer to be interacting with — and thinking about — your brand in a positive light. That can be done with experiences. Google has become a sort of sensation with its themed pop-up shops. I’m not wasting time and energy visiting a retail location to give my money to a brand unless there is a bigger benefit for me, such as Google’s recent Stranger Things pop-up. There are photo-ops, a real theme, and feeling that you’ve entered the world of stranger things.

Give me an example.

There’s no question in my mind that if Game of Thrones were to open a pop-up shop that I’d leave there with an overpriced, $8 turkey leg and a $1,500 suit of armor. I can buy all of these things online, but the experience is what would get me there and get me to use emotion to open my wallet and make purchases.

Tesla is another master at this. The first time I experienced it — and was sold on buying a Tesla — was in a mall. They rented a storefront, parked some cars, and placed one half-built Tesla in it, which allowed passersby to see the inner workings. It was a completely different experience than any other car dealership. It was memorable and it created brand loyalty before I even owned one of their products.

Do you think retail landlords can exist with this trend? What can they do to adapt where retail itself has failed to keep up?

Retail property investors can still exist, but like in every other faster-moving industry, they’re going to have to pivot. If you know the market is steering away from brick and mortar retail, steer potential renters towards in-store experiences. Offer shorter terms at higher premiums to attract pop-up shops, and offer additional services to help increase the bottom line. Focus on helping your customers be successful in their ventures.

_ Related: 5 Ways the Real Estate Industry Will Completely Transform Over the Next Decade_

Investors with multiple locations in different regions can offer recurring seasonal contracts, and location changes or “tours,” allowing pop-ups and experiences to shift locations often to keep a fresh flow of revenue coming in.

How can retail and mall owners work with online shopping giants like Amazon, Ebates—even yourself?

Obviously online retailers hold a massive advantage over [brick-and-mortar] stores in terms of accessibility, 24-hour access to customers, and so forth. But many times they are missing out on the physical and emotional connection you only get with in-person experiences — just like I mentioned with Tesla.

Amazon has already begun steps to try to resolve this issue with their experimental Amazon Go store, a grocery store with no cash registers. You simply enter the store and the [Amazon] app tracks where you are and what you’re taking off the shelves. It's automatically billed to your Amazon account and you’re free to go. It all goes back to the experience. And that's where landlords need to look.

For full disclosure I am a minority shareholder of Sharebert. I decided to tell this story to give investors an idea on where retail is going, whether it's feasible as a real estate investor, and, of course, to share a fellow entrepreneur's story with the BiggerPockets audience. This interview has been edited for brevity and clarity.