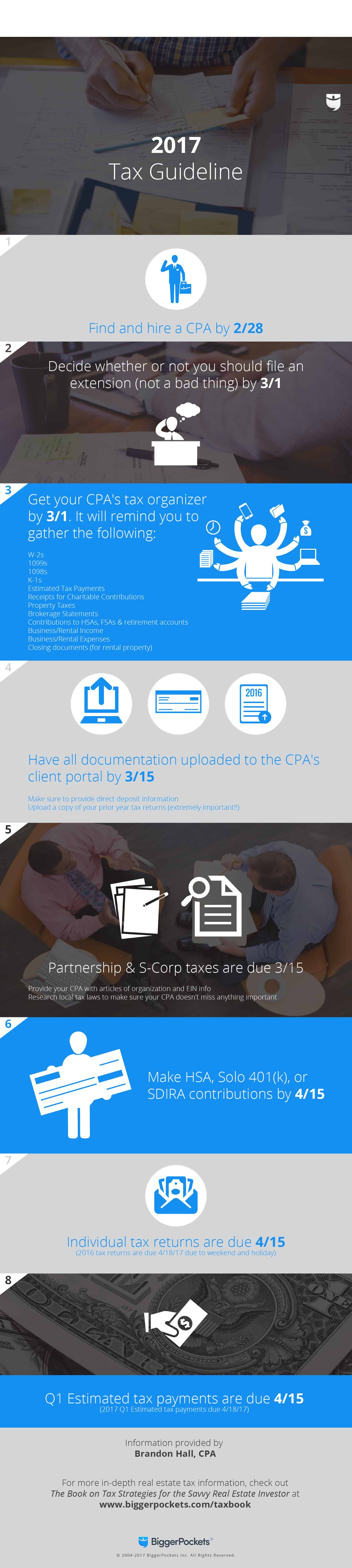

Infographic: 2017 Tax Deadlines Investors Can't Miss From Now Until April 15th

Have you hired a CPA yet? Decided whether you want to file for an extension? For investors in particular, all of these looming deadlines might seem daunting. If you're wondering where you should focus your attention as April approaches, use this visual representation to organize your thoughts.

2017 Tax Deadlines Investors Can't Miss From Now Until April 15th

-

Find and hire a CPA by 2/28

-

Decide whether or not you should file an extension (not a bad thing) by 3/1

-

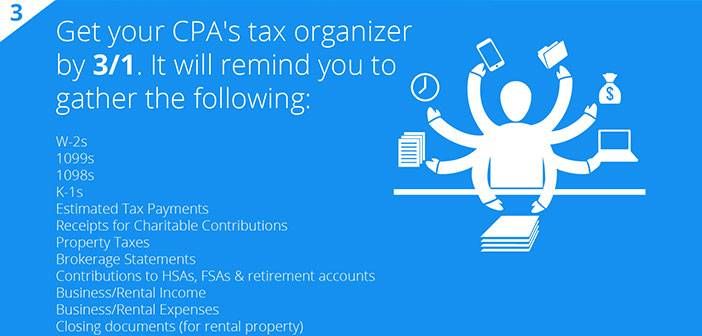

Get your CPA's tax organizer by 3/1. It will remind you to gather the following:

- W-2s

- 1099s

- 1098s

- K-1s

- Estimated Tax Payments

- Receipts for Charitable Contributions

- Property Taxes

- Brokerage Statements

- Contributions to HSAs, FSAs & retirement accounts

- Business/Rental Income

- Business/Rental Expenses

- Closing documents (for rental property)

-

Have all documentation uploaded to the CPA's client portal by 3/15

- Make sure to provide direct deposit information

- Upload a copy of your prior year tax returns (extremely important!)

-

Partnership & S-Corp taxes are due 3/15

- Provide your CPA with articles of organization and EIN info

- Research local tax laws to make sure your CPA doesn't miss anything important

-

Make HSA, Solo 401(k), or SDIRA contributions by 4/15

-

Individual tax returns are due 4/15 (2016 tax returns are due 4/18/17 due to weekend and holiday)

-

Q1 Estimated tax payments are due 4/15 (2017 Q1 Estimated tax payments due 4/18/17)

_ Related: The Ultimate Guide to Real Estate Investment Tax Benefits_  _Disclaimer: This article does not constitute legal advice. As always, consult your CPA or accountant before implementing any tax strategies to ensure that these methods fit with your particular situation._Which of these deadlines are you tackling now? Any questions about the above information? Please be sure to leave a comment below—and SHARE this post to help out your fellow tax season-fearing investors!

_Disclaimer: This article does not constitute legal advice. As always, consult your CPA or accountant before implementing any tax strategies to ensure that these methods fit with your particular situation._Which of these deadlines are you tackling now? Any questions about the above information? Please be sure to leave a comment below—and SHARE this post to help out your fellow tax season-fearing investors!