Newbie Landlords: This May Be The Most Important Metric To Know

This goes without saying, when you own real estate, or any business, you gotta know your numbers. The cool thing about investment properties vs. other businesses is the simplicity of the business model; you don’t have to worry about too many product lines — just collect the rent. But as any entrepreneur knows, it’s not about what you make. So for that reason, whether you're an owner or a buyer, a property's operating expenses (OPEX) is a basic but extremely important metric to monitor.

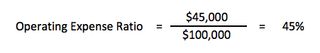

Here's the operating expenses formula, calculated as a ratio:

For young landlords (myself included!), one of the most common issues I’ve seen is keeping a property’s operating expenses (OPEX) under control. Sure, if you have great tenants, you could have a property where your OPEX is reduced to just property taxes. If that’s you, SWEET! You’ve got it made! For many others, the number is closer to 50 percent over time.It could be the metric that runs your property into the ground and forces you to sell. Or it could be the hack for you to unlock crazy profits. There are a couple of reasons for that. One, if your expenses go too high, you’re eating into your profits and your potential cash cow could turn into a lemon._ Related: How to Be a Landlord: Top 12 Tips for Success_Put simply, the metric is vital for no other reason than if you're mismanaging your expenses, you're eating into your profits and thus the value of your asset.Most importantly: Getting OPEX down means NOI goes up! And as NOI goes up, so does the value of your property. Take a look at this hypothetical but extremely common scenario.

For young landlords (myself included!), one of the most common issues I’ve seen is keeping a property’s operating expenses (OPEX) under control. Sure, if you have great tenants, you could have a property where your OPEX is reduced to just property taxes. If that’s you, SWEET! You’ve got it made! For many others, the number is closer to 50 percent over time.It could be the metric that runs your property into the ground and forces you to sell. Or it could be the hack for you to unlock crazy profits. There are a couple of reasons for that. One, if your expenses go too high, you’re eating into your profits and your potential cash cow could turn into a lemon._ Related: How to Be a Landlord: Top 12 Tips for Success_Put simply, the metric is vital for no other reason than if you're mismanaging your expenses, you're eating into your profits and thus the value of your asset.Most importantly: Getting OPEX down means NOI goes up! And as NOI goes up, so does the value of your property. Take a look at this hypothetical but extremely common scenario.

Uncle Bill is Tired of the Bull$hit

Let's assume your uncle Bill owns a 25-unit apartment building in the Midwest, and he's owned it for 20 years. It's generating $250,000 a year in rental, lowly leveraged (not a lot of debt), not a lot of repairs.In spite of the solid fundamentals, Uncle Bill's OPEX is a grim 55 percent ($112,500 NOI), mainly due to mismanagement and delinquent tenants. And unfavorable laws have left Uncle Bill with some squatters that he now has to go to court to evict.So Uncle Billy wants to cash out; he can't be bothered with this crap anymore. But where Uncle Bill sees agony, you see opportunity. If he just got the right tenants, this is a gold mine, you think.Granted, you don’t necessarily have a lot of money. HOWEVER, you’re super active on the BiggerPockets forums, have posted, participated, and built relationships with fellow investors.

Seizing the Deal

So you shoot a message to a group of fellow BPers. You obviously printed out your kickass three-page report so it’s quick to show the deal, get 10 partners to chip in $30k, and get it under contract.Because the OPEX was a disaster, you see the upside. You go to a lender—again with your kickass report—show that your numbers are on point, your DSCR is well above 1.2x, and all that good stuff.Let's assume fair market value is $1.25 million at a 9 percent cap rate. So you throw Uncle Bill a bone and buy it for $1.4 million at a generous 8 percent cap rate. Uncle Bill's a happy, stress free, millionaire and e's retired, sipping on margaritas in the Bahamas. He's probably buying his favorite nephew a Benz for Christmas._ Related: Dear New Landlords: 7 Things an Experienced Landlord Would Like You to Know_Meanwhile, here you come with your goon squad of cut-throat lawyers, tenacious brokers, and value-add property managers, ready to get this thing under control.

Fast Forward Six Months...

You've gotten rid of the bad apples, invested a bit in the property, sliced the OPEX to 35 percent while raising rents 15 percent ($287.5k) just for good measure.NOTE! And #neverforget — the value of income-producing real estate is derived directly from the net income it generates, using the cap rate to determine its value. This is so important that it warrants a second mention: the value of your asset correlates directly to the money it makes. Here's _that _formula:

NOI / divided by cap rate from recent sold comp = your property's value.

Sorry for the brief detour. Back to Uncle Bill. So even though you technically overpaid for it, by getting your OPEX (and NOI) under control, you're sitting pretty on a $2M+ building:

$287,500 minus 35% OPEX divided by 9% cap rate = $2,07,388.89 value

Granted, some of the upside was unlocked through raising rents, which also boosts NOI. But the main hack here was getting expenses under control. And because you did, you basically printed money. And that, my friend, is if you can’t do anything else, learn to master expenses.

OPEX Post-Scriptum

On a semi-unrelated, kinda related writer's note: This example of forced appreciation is why you often see outrageous transaction prices millions above just a year or two before, where it may appear a buyer is paying far above market. And you wonder, WTF; is there a bubble?!In reality, you actually cut a great deal because you added value — and unlocked that value. These NYC developers, for instance, specialize in "NOI hacking." They buy Manhattan properties WAY above value, at 1-2 percent cap rates and reposition the asset (hotels to apartments, long term to short term, for instance), and its strategy by adding short-term rentals a la _Airbnb or WeWork.)__Much like professional Airbnbers, this allows them aggressively bolster the NOI and _And for full disclosure, I actually went to a pitch at their HQs, saw the return projections for equity investors, which were impressive. Got a tour of their properties. Also impressive. I ultimately decided to pass, due to the aggressive NOI projections, basically underwritten on a foundation of an Airbnb-style business model. Due to the increased level of variables that come with that, plus occupancy rates, I didn't find that sustainable long-term. But I could be way off. And I've been wrong before.