Updated 7 months ago on .

Thinking about an Adjustable-Rate Mortgage? Read This First.

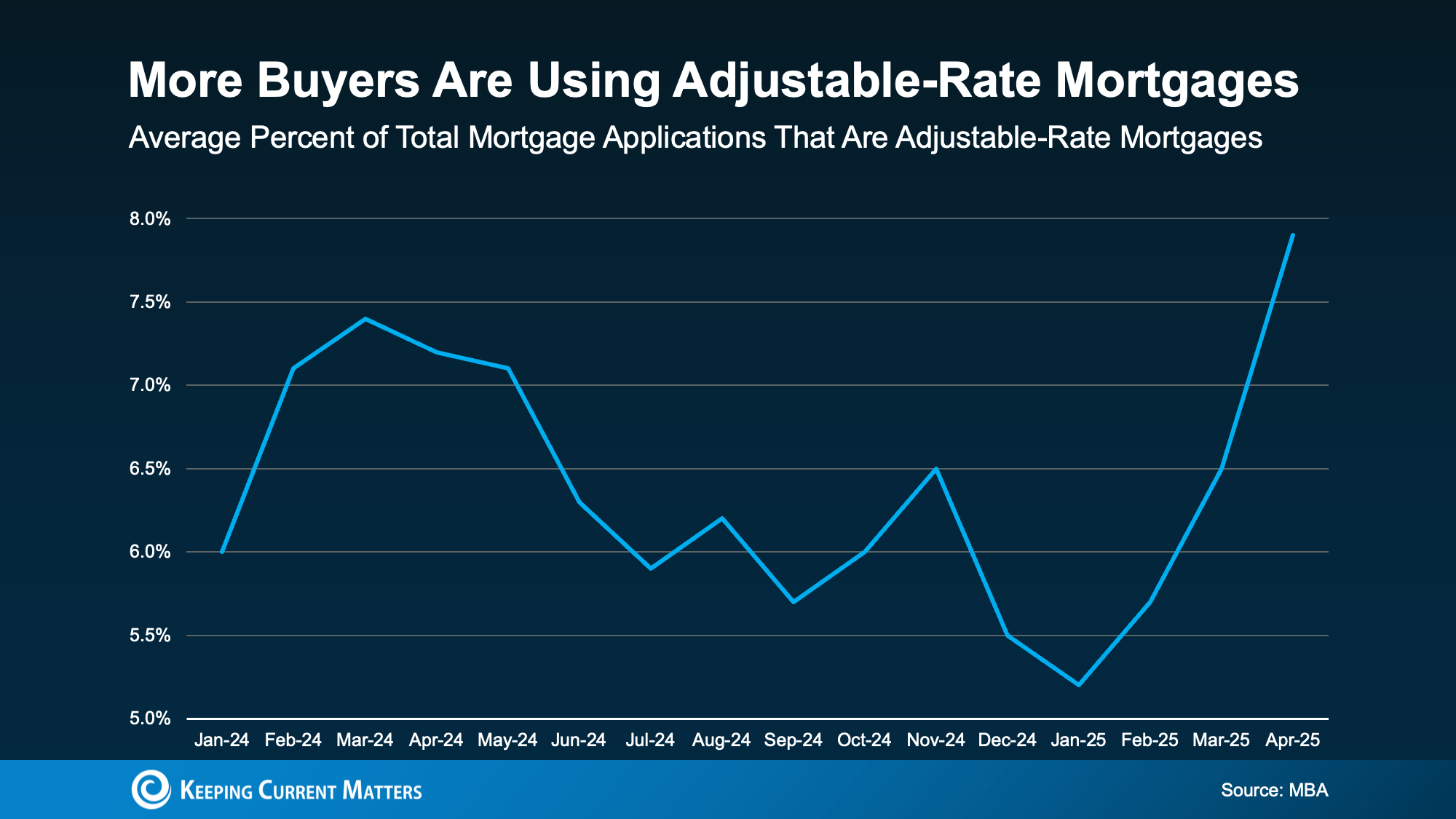

If you’ve been house hunting lately, you’ve probably felt the sting of today’s mortgage rates. And it’s because of those rates and rising home prices that many homebuyers are starting to explore other types of loans to make the numbers work. And one option that’s gaining popularity? Adjustable-rate mortgages (ARMs).

If you remember the crash in 2008, this may bring up some concerns. But don’t worry. Today’s ARMs aren’t the same. Here’s why.

Back then, some buyers were given loans they couldn’t afford after the rates adjusted. But now, lenders are more cautious, and they evaluate whether you could still afford the loan if your rate increases. So, don’t assume the return of ARMs means another crash. Right now, it just shows some buyers are looking for creative solutions when affordability is tough.

You can see the recent trend in this data from the Mortgage Bankers Association (MBA). More people are opting for ARMs right now (see graph below):

And while ARMs aren’t right for everyone, in certain situations they do have their benefits.

How an Adjustable-Rate Mortgage WorksHere’s how Business Insider explains the main difference between a fixed-rate mortgage and an adjustable-rate mortgage:

Of course, things like taxes or homeowner’s insurance can still have an impact on a fixed-rate loan, but the baseline of your mortgage payment doesn’t change much. Adjustable-rate mortgages don’t work the same way.

Pros and Cons of an ARMHere’s a little more information on why some buyers are giving ARMs another look. They offer some pretty appealing upsides, like a lower initial rate. As Business Insider explains:

On the flip side, just remember, if you have an ARM, your rate will change over time. As Barron’s explains there’s the potential for higher costs later:

So, while the upfront savings can be helpful now, you’ll want to think through what could happen if you’re still in that home when your initial rate ends. Because while projections show rates are expected to ease a bit over the next year or two, no forecast is guaranteed.

That's why it's essential to talk with your lender and financial advisor about all your options and whether an ARM aligns with your financial goals and your comfort with risk.

Bottom Line

For the right buyer, ARMs can offer some big advantages. But they’re not one-size-fits-all. The key is understanding how they work, weighing the pros and cons, and thinking through if they’d be something that would work for you financially. And that’s why you need to talk to a trusted lender and financial advisor before you make any decisions.