All Forum Posts by: Desiree Rejeili

Desiree Rejeili has started 132 posts and replied 170 times.

Post: History Shows the Housing Market Always Recovers

Post: History Shows the Housing Market Always Recovers

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Now that the market is slowing down, homeowners who haven’t sold at the price they were hoping for are increasingly pulling their homes off the market. According to the latest data from Realtor.com, the number of homeowners taking their homes off the market is up 38% since the start of this year and 48% since the same time last June. For every 100 new listings in June, about 21 homes were taken off the market.

And if you’ve made that same choice, you’re probably frustrated things didn’t go the way you wanted. It’s hard when you feel like the market isn’t working with you. But while slowdowns can be painful in the moment, history tells us they don’t last forever.

History Repeats Itself: Proof from the PastThis isn’t the first time the housing market has experienced a slowdown. Here are some other notable times when home sales dropped significantly:

- 1980s: When mortgage rates climbed past 18%, buyers stopped cold. Sales crawled for years. But as soon as rates came down, sales surged back, and the market found its footing again.

- 2008: The Great Financial Crisis was one of the toughest housing downturns in history. Sales and prices both dropped hard. Still, sales rebounded once the economy recovered.

- 2020: During COVID, sales disappeared overnight, and many people had to put their plans on hold. Yet the recovery was faster than anyone expected, with a surge of buyers re-entering the market as soon as restrictions eased.

The lesson is clear: no matter the cause, the market always rebounds.

Today’s Situation: Where We Stand NowOver the past few years, home sales have been sluggish. And one big reason why is affordability. Mortgage rates rose at a record-breaking pace in 2022, and home prices were climbing at the same time. That combination put buying out of reach for many people. And when demand slows, home sales do too.

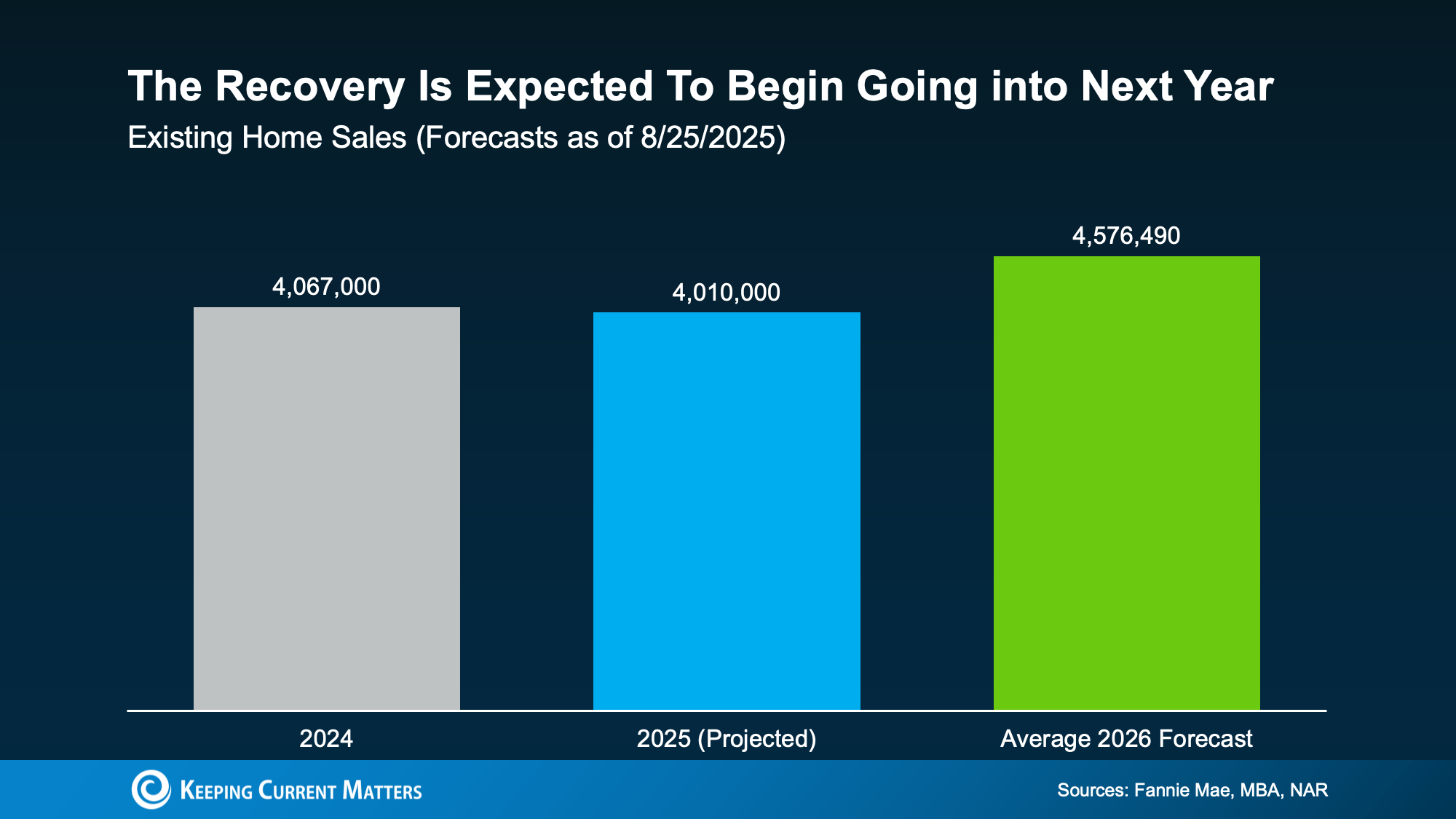

The Outlook: Why Things Will ImproveBut here’s the encouraging part. Forecasts show sales are expected to pick up again moving into 2026.

Last year, just about 4 million homes sold (shown in gray in the graph below). And this year is looking very similar (shown in blue). But the average of the latest forecasts from , the (MBA), and the (NAR) show the experts believe there will be around 4.6 million home sales in 2026 (shown in green).

And a big reason behind that projection is the expectation that mortgage rates will come down a bit, making it easier for more buyers to jump back in.

That means what’s happening now is part of a cycle we’ve seen before. Every slowdown in the past has eventually given way to more activity, and this one will too.

That means what’s happening now is part of a cycle we’ve seen before. Every slowdown in the past has eventually given way to more activity, and this one will too.Just like the 1980s, 2008, and 2020, today’s dip in home sales is temporary.

What That Means for YouIf you’ve paused your moving plans, you did what you thought was right. Your frustration is valid. But it’s also important to remember the bigger picture. Housing slowdowns don’t last forever.

That’s where your local real estate agent comes in. Their job is to keep a close eye on the market for you. When the first signs of a rebound appear, they’ll help you spot the shift early so you can relist with confidence.

Bottom Line

If today’s housing market feels stuck, remember it’s never stayed down for good. Slowdowns end, activity returns, and people get moving again. So, connect with a local real estate agent, because when the next wave of buyers shows up, you won’t want to miss it.

As activity picks up again, will you be ready to put your house back on the market, or do you need to move sooner?

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Hi Devin, Exactly! 🙌 It’s so important to zoom out and see the bigger picture. What feels like a slowdown is really just the market finding balance again, and that opens up opportunities for buyers and sellers alike. Thanks for sharing your perspective!

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Hi Ky, Of course! Glad you found it helpful 😊

Post: Don’t Let Student Loans Hold You Back from Homeownership

Post: Don’t Let Student Loans Hold You Back from Homeownership

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you’re wondering:

- Do you have to wait until you’ve paid off those loans before you can buy your first home?

- Or is it possible you could still qualify for a home loan even with that debt?

Having questions like these is normal, especially when you’re thinking about making such a big purchase. But you should know, you may be putting your homeownership goals on the backburner unnecessarily.

Can You Qualify for a Home Loan if You Have Student Loans?In the simplest sense, what you want to know is can you still buy your first home if you have student debt. Here’s what Yahoo Finance says:

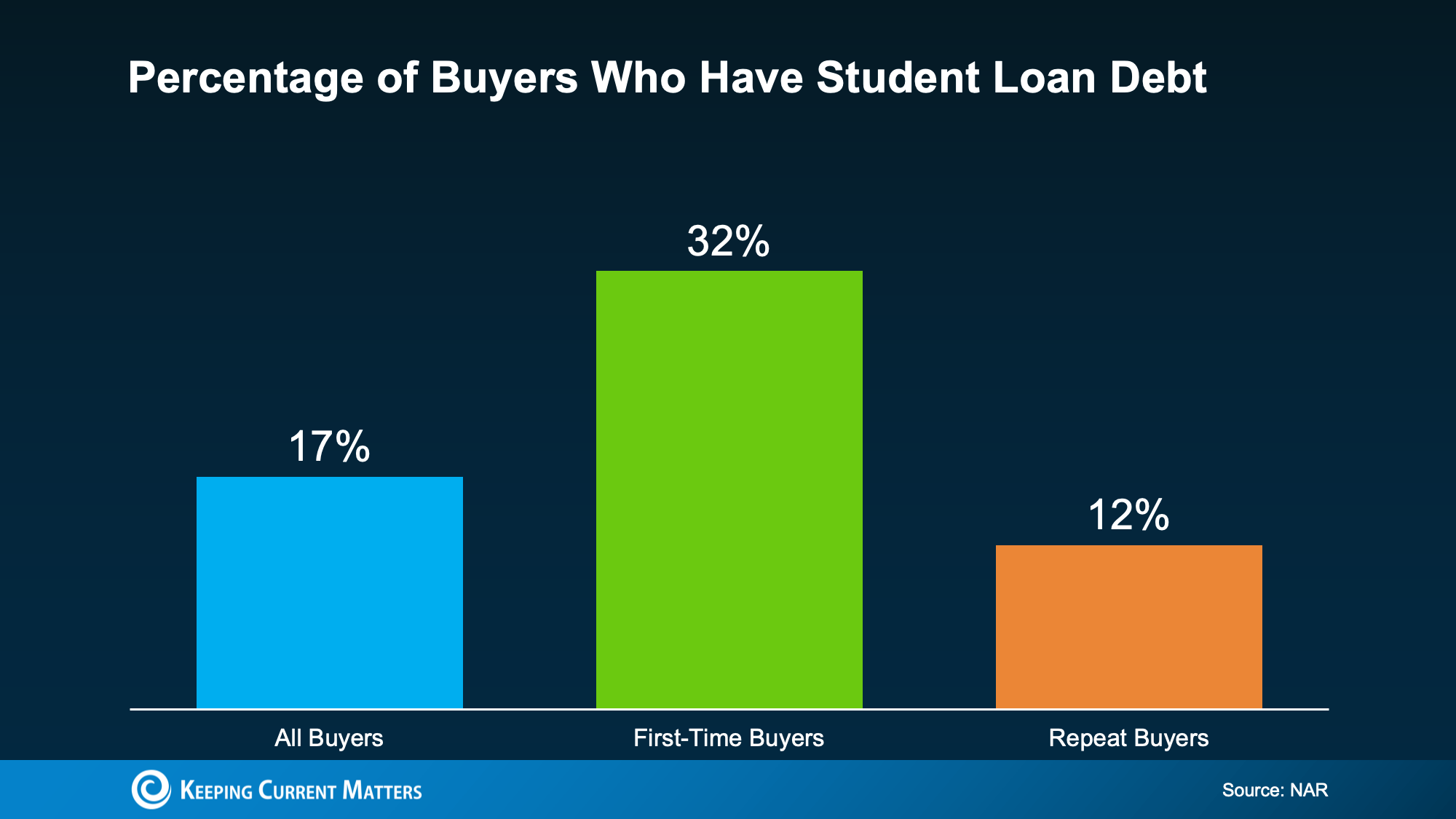

And the data backs this up. An annual report from the National Association of Realtors (NAR), shows that 32% of first-time buyers had student loan debt (see graph below):

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was . As an article from Chase says:

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was . As an article from Chase says:If your income is steady and your overall finances are solid, homeownership can still be within reach. So, having student loans doesn’t necessarily mean you have to wait to buy a home.

Bottom Line

Having student loans doesn’t mean buying a home is off the table. Before you count yourself out, talk to a lender to get a clearer picture of what you can afford and how close you are to taking the first step toward homeownership.

Post: Should You Still Expect a Bidding War?

Post: Should You Still Expect a Bidding War?

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

If you’re still worried about having to deal with a bidding war when you buy a home, you may be able to let some of that fear go.

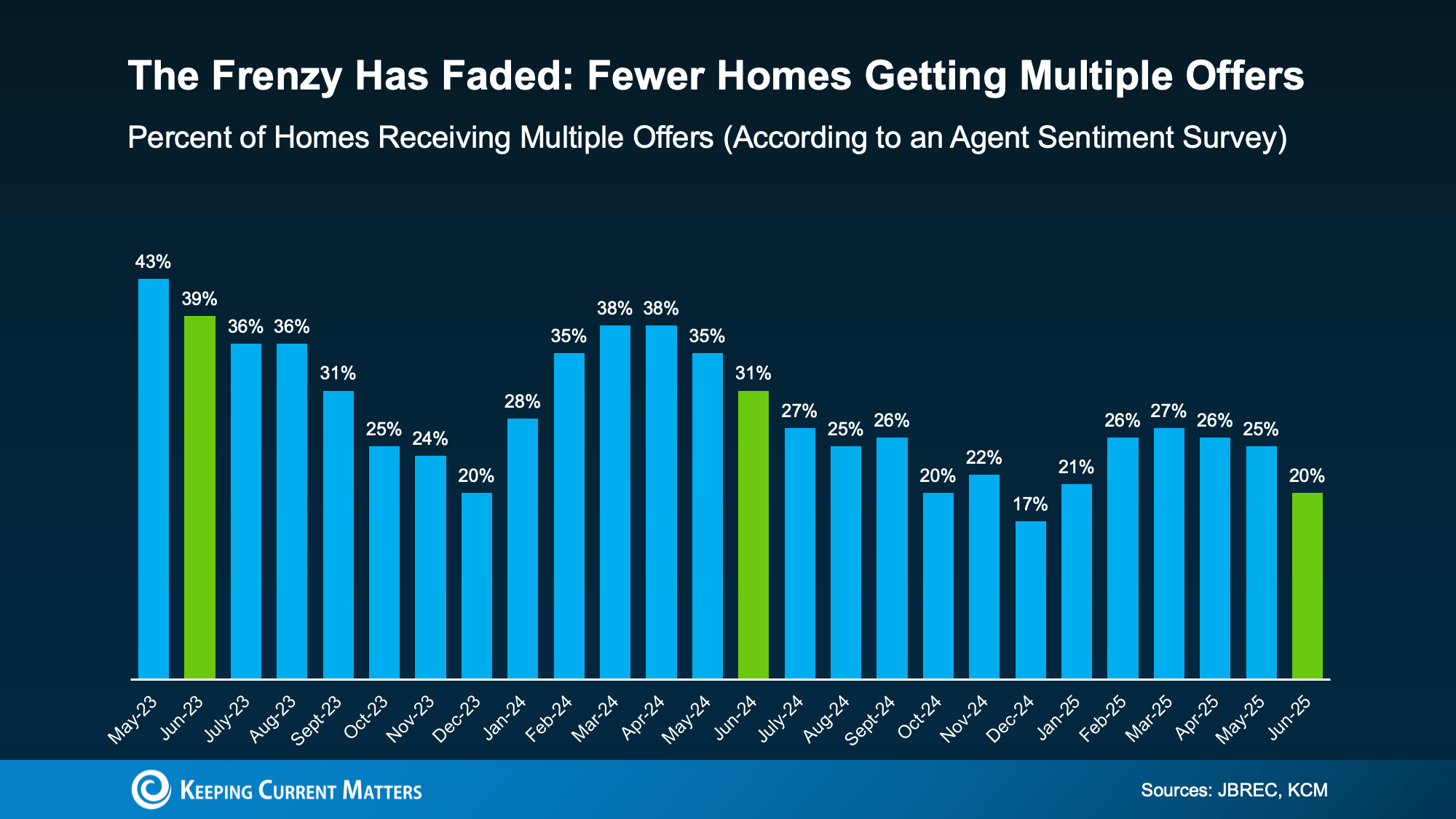

While multiple-offer situations haven’t disappeared entirely, they’re not nearly as common as they used to be. In fact, a shows agents reported only 1 in 5 homes (20%) nationally received multiple offers in June 2025.

That’s down from nearly 1 in 3 (31%) just a year ago – and dramatically lower than in June 2023 (39%) (see graph below):

This trend means you should face less competition when you buy. That gives you more time to make decisions and the ability to negotiate price or terms. It Still Depends on Where You’re Buying

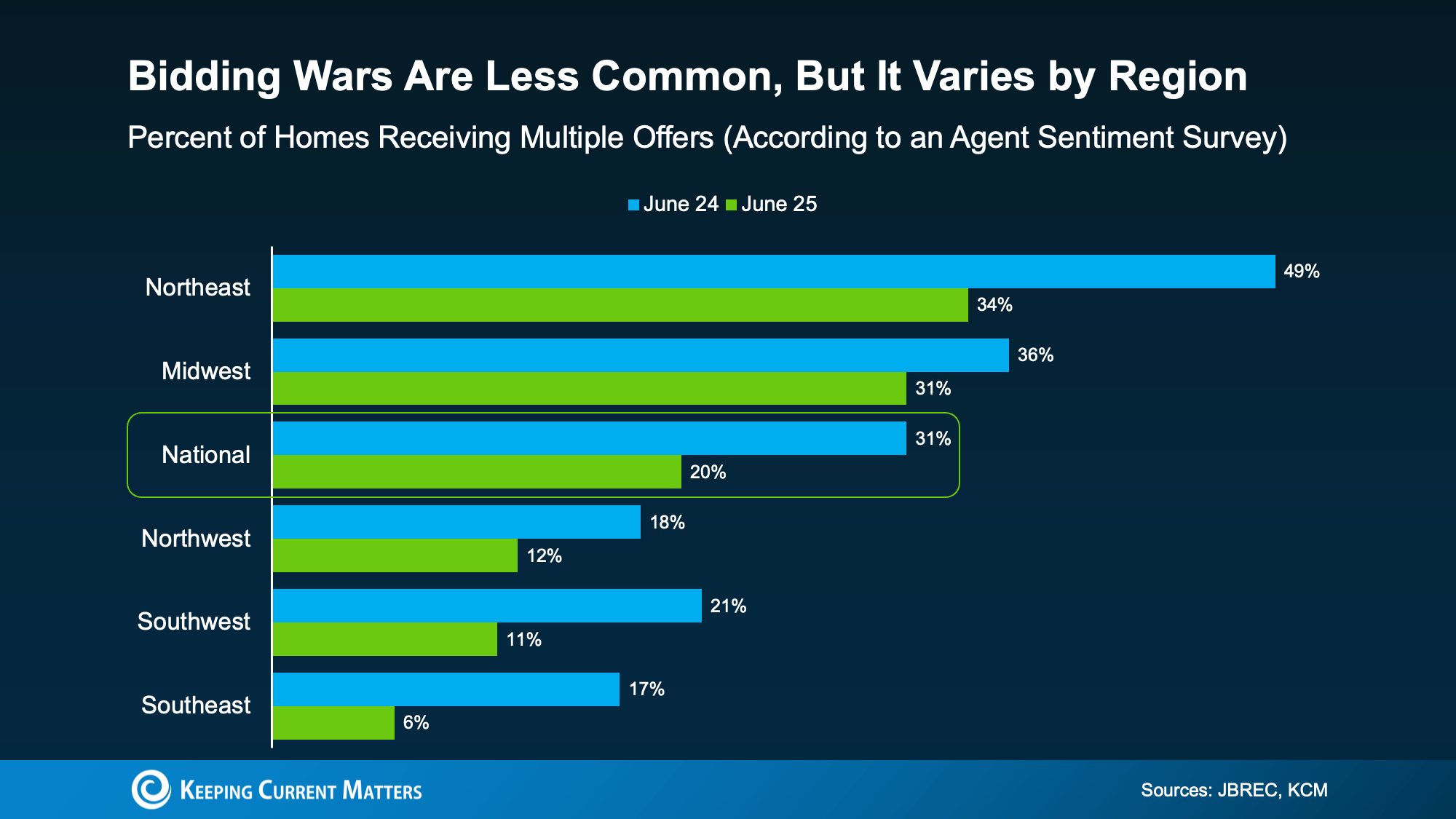

This trend means you should face less competition when you buy. That gives you more time to make decisions and the ability to negotiate price or terms. It Still Depends on Where You’re Buying Of course, national trends don’t tell the full story. Local dynamics matter, a lot. This second graph uses survey data from John Burns Research & Consulting (JBREC) and Keeping Current Matters (KCM) to break things down by region to prove just how true that is. It shows, while the share of homes getting multiple offers has dropped pretty much everywhere, some areas are still seeing more offers than others:

In the Northeast, 34% of homes (roughly 1 in 3) are still receiving multiple offers. That’s more than the national average. But in Southeast, that number drops to just 6%.

In the Northeast, 34% of homes (roughly 1 in 3) are still receiving multiple offers. That’s more than the national average. But in Southeast, that number drops to just 6%. What’s behind the difference? In general, the areas still seeing bidding wars tend to have lower-than-normal inventory. That imbalance between buyers and available homes keeps pressure on prices and competition. But markets with more listings are seeing conditions cool – and that means fewer bidding wars.

Sellers Are More Flexible Than You Might ThinkHere’s another shift to show you just how much things have changed. According to a Redfin report, almost half of sellers are offering concessions, like covering their buyer’s closing costs or dropping their asking price to get their house sold.

That’s a clear sign this isn’t the same ultra-competitive market we saw a few years ago. Back then, sellers rarely compromised. And buyers often waived their inspection or appraisal to try to make their offer stand out. Now, things are different.

But again, how often this is happening is going to vary based on where you’re looking to buy. And that’s why you need a local agent’s expertise.

Bottom Line

If concerns about bidding wars have been holding you back, it may be time to take another look. Nationally, competition is down. In some markets, it’s down significantly. And with more sellers offering concessions, buyers today have more power and flexibility than they’ve had in a long time.

Want to find out what the market looks like where you’re buying? Connect with a local agent.

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

Post: From Frenzy to Breathing Room: Buyers Finally Have Time Again

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only took hours. You had to drop everything to go and see the house, and if you hesitated even slightly, someone else swooped in and bought it – sometimes even sight unseen.

That kind of intensity pushed a lot of buyers to the sidelines. It was stressful, chaotic, and for many, really discouraging.

But here’s what you need to know: those days are behind us.

Today’s market is moving slower, in the best possible way. And that’s creating more opportunity for buyers who felt shut out in recent years.

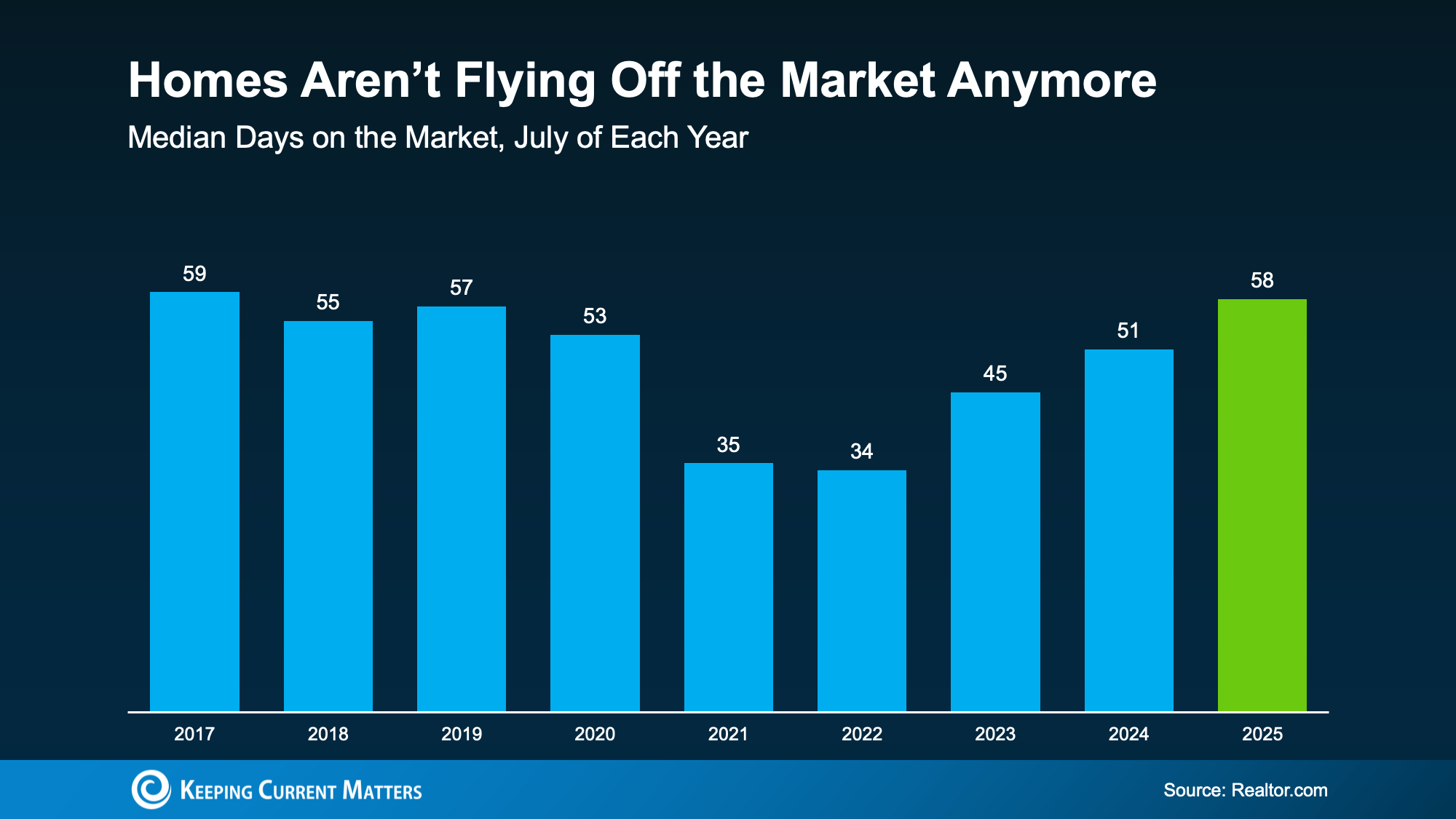

The Stat That Changes EverythingAccording to the latest data, homes are spending an average of 58 days on the market. That’s much more normal. And it’s a big improvement compared to the height of the pandemic, when homes were flying off the shelves in a matter of days (see graph below):

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:Time to think.

Time to negotiate.

Time to make a smart move without all the pressure.

More Time Means Less Stress (and More Leverage)Based on the data in the graph above, you have an extra week to decide compared to last year. And nearly double the time you would have had at the market’s peak.

Back then, fear of missing out drove buyers to act fast, sometimes too fast. Today, the pace is slower, which means you’re in control. As Bankrate puts it:

With more homes on the market and fewer buyers racing to grab them, the balance has shifted. Bidding wars aren’t as common, and that means you may have room to negotiate. And you can actually take a breath before you make your decision.

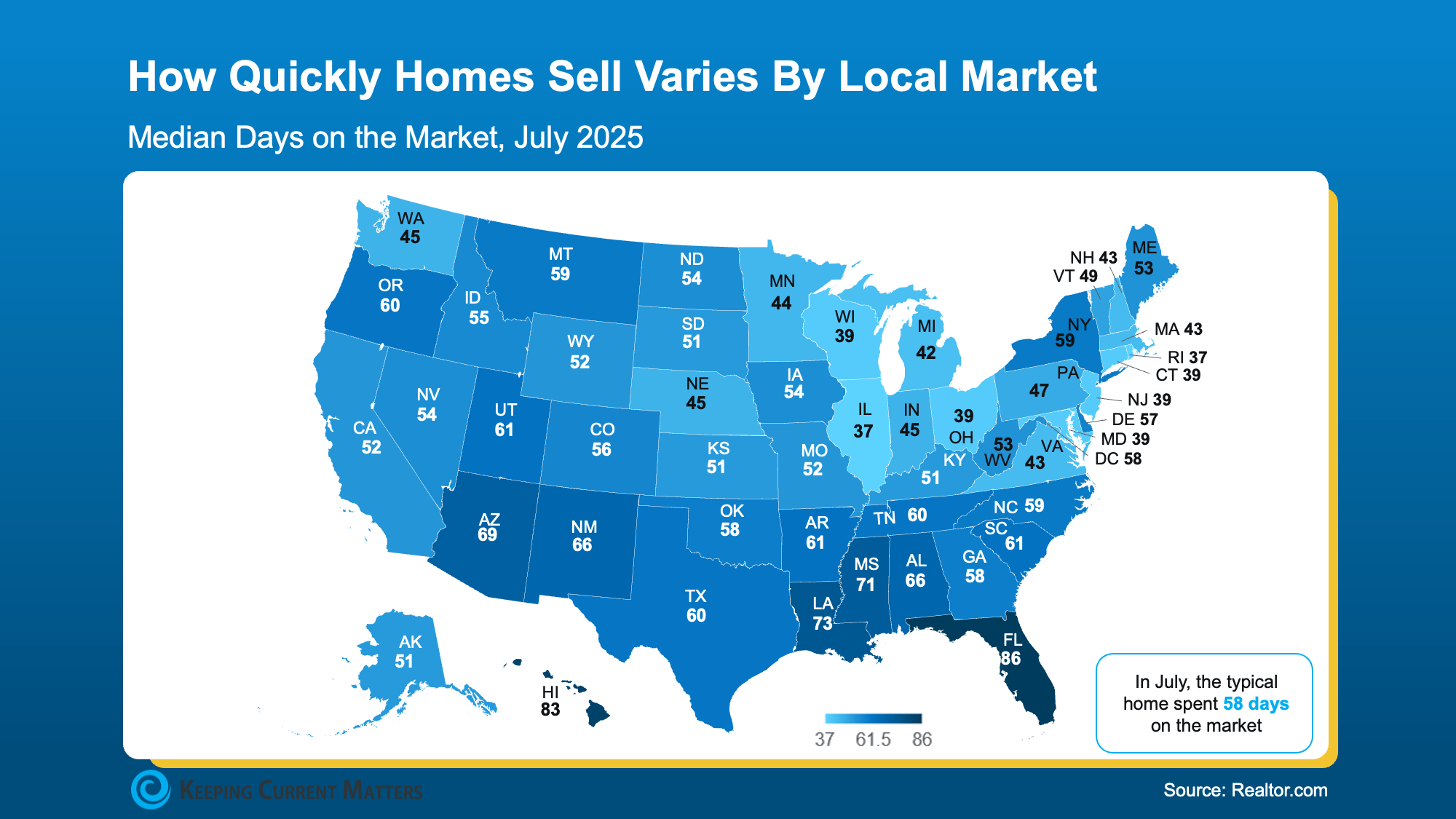

More listings + a slower pace = less stress and more opportunityBut, and this is important, it still depends on where you’re buying. Nationally, homes are moving slower. But your local market sets your real pace. Some states are moving faster than others. It may even vary down to the specific zip code or neighborhood you’re looking at. And that’s why working with an agent to know what’s happening in your area is more important than ever.

To see how your state compares to the national average (58 days), check out the map below:

As Realtor.com explains:

As Realtor.com explains:A smart local agent can tell you exactly when to move fast and when you can take your time, so you never miss the right home for you.

Bottom Line

If the chaos of the past few years drove you to hit pause, this is your green light. The market’s pace has shifted. You have more time. More options. More power.

And with the right agent guiding you, you’re in the best position you’ve been in for years.

Connect with a local agent to talk about what the pace looks like in your area, and if now could be the right time for you to re-enter the market.

Post: Condos Could Be a Win for Today’s Buyers

Post: Condos Could Be a Win for Today’s Buyers

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Not every homebuyer wants the biggest house on the block. Some want something simpler, more affordable, and easier to maintain, especially in a market where every dollar counts. That’s where condos come in.

For first-time buyers, they can be a smart way to get into homeownership without stretching your budget. For downsizers, they offer less space to maintain with the flexibility to stay in a great location.

And right now, condos are one of the most buyer-friendly parts of the market.

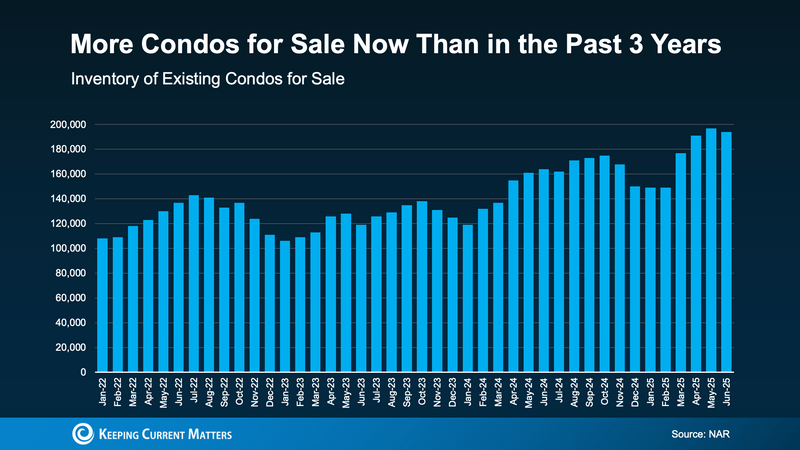

Condo Inventory Is Up, And That Means More ChoiceAccording to the National Association of Realtors (NAR), there are condos for sale right now. That’s the second highest amount we’ve seen in the last three years (see graph below):

Just remember, this is the national figure. The exact number is going to vary based on where you’re looking to buy. But, generally speaking, you have more options and less competition.

You’re not stuck waiting for something to pop up or rushing into an offer just to beat someone else to it. You’ve got plenty to choose from. And if you’re particular about layout, location, or amenities, this is your chance to be selective.

That’s a big shift from the market frenzy of just a few years ago. Compared to early 2022, we’ve got nearly double the condos available now. That gives you more breathing room to find the right fit.

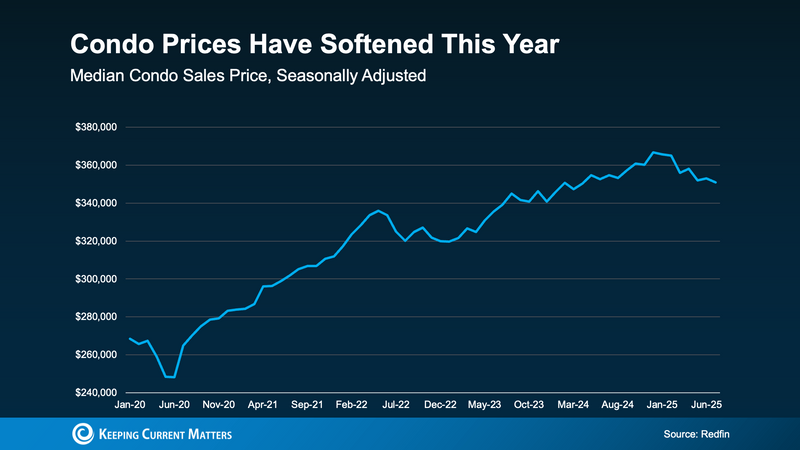

Prices Are Cooling, and Buyers Hold More Negotiating PowerAnd since there are more for sale, many sellers are more open to negotiating right now. So, you may be able to get a better price. As Redfin explains:

Condo prices are starting to ease in many markets. According to Intercontinental Exchange (ICE), condo prices dipped in June compared to last year. And over half of the top 100 U.S. metros saw condo prices drop slightly year-over-year.

Data from Redfin shows what the recent dip in prices looks like (see graph below):

That doesn’t just help with affordability, it also shifts the power dynamic. Condo buyers in many markets are now in a position to negotiate on price and ask for concessions, like help with closing costs.

Bottom Line

Condos aren’t just a fallback option. In today’s market, they’re one of the most strategic ways to buy. With more options, softening prices, and more room to negotiate, now could be the right time to make your move.

Could a condo check more boxes than you expected? Talk through your options with a local real estate agent and find out.

Post: The Rooms That Matter Most When You Sell

Post: The Rooms That Matter Most When You Sell

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

Now that buyers have more options for their move, you need to be a bit more intentional about making sure your house looks its best when you sell. And proper staging can be a great way to do just that.

What Is Home Staging?It’s not about making your house look super trendy or like it belongs in a magazine. It’s about helping it feel welcoming and move-in ready, so it’s easy for buyers to picture themselves living there.

It’s important to understand there’s a range when it comes to staging. It can include everything from simple tweaks to more extensive setups, depending on your needs and budget. But a little bit of time, effort, and money invested in this process can really make a difference when you sell – especially in today’s market.

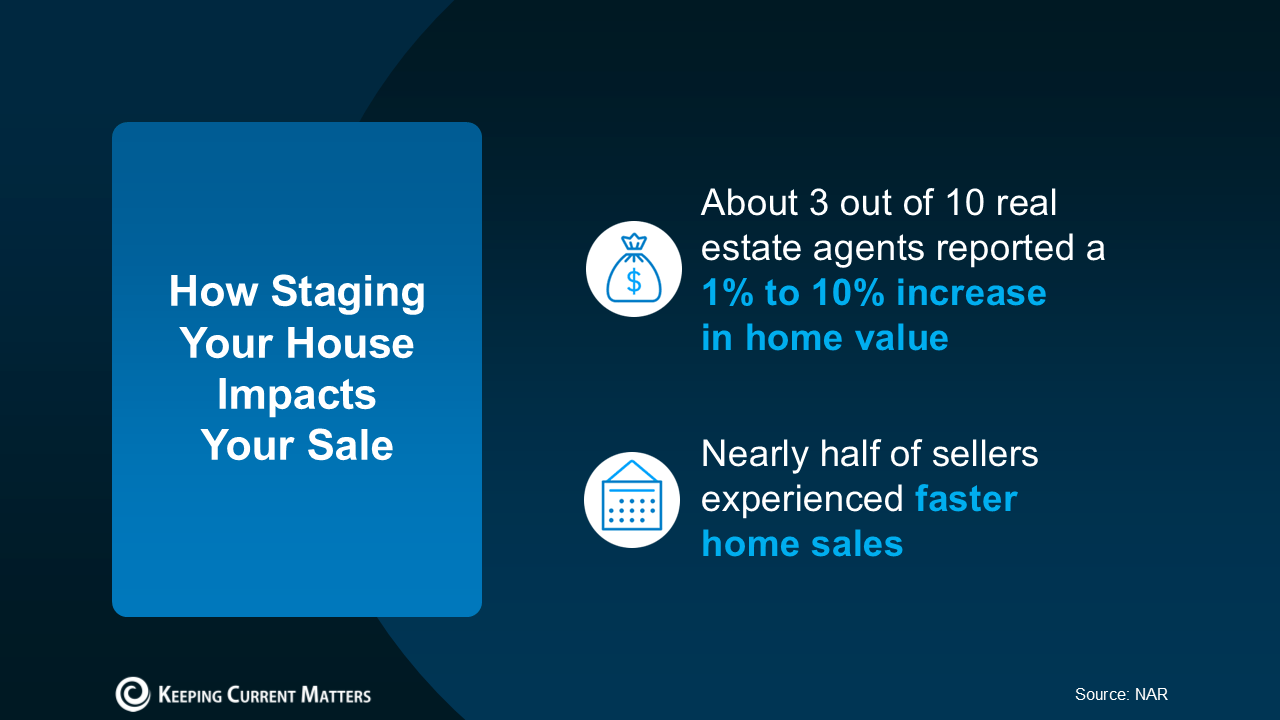

A from the National Association of Realtors (NAR) shows staged homes sell faster and for more money than homes that aren’t staged at all (see below):

Which Rooms Matter Most?

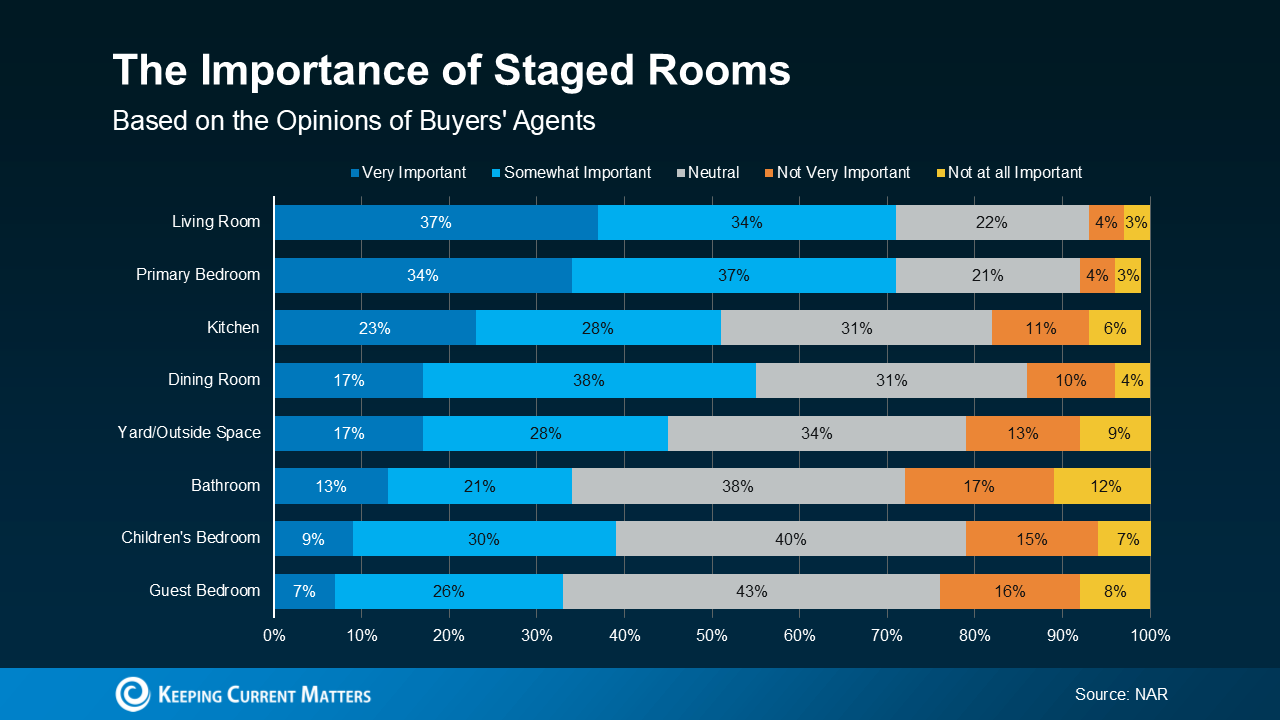

Which Rooms Matter Most? The best part is, odds are you don’t have to stage your whole house to make an impact. According to NAR, here's where buyers' agents say staging can make the biggest difference (see graph below):

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.While this can give you a good general idea of what may be worth it and what’s probably not, it can’t match a local agent’s expertise.

How an Agent Helps You Decide What You Need To DoAgents are experts on what buyers are looking for where you live, because they hear that feedback all the time in showings, home tours, walkthroughs, and from other agents. And they’ll use those insights to give their opinion on your specific house and what areas may need a little bit of staging help, like if you need to:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room’s flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

A lot of buyers can use the agent's know-how as the only staging advice they need. But, if your home needs more of a transformation, or it's empty and could benefit from rented furniture, a great agent will be able to determine if bringing in a professional stager might be a good idea, too. Just know that level of help comes with a higher price tag. NAR reports:

A local agent will help you weigh the costs and benefits based on your budget, your timeline, and the overall condition of your house. They’ll also consider how quickly similar homes are selling nearby and what buyers are expecting at your price point.

Bottom Line

Staging doesn’t have to be over-the-top or expensive. It just needs to help buyers feel at home. And a great agent will help you figure out the level of staging that makes the most sense for your goals.

Which room in your house do you think would make the biggest impression on a buyer?

Get an agent to walk through your home with you and go over what will make your house stand out.

Post: More Contracts Are Falling Through. Here’s How To Get Ahead.

Post: More Contracts Are Falling Through. Here’s How To Get Ahead.

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

When you sell a house, the last thing you want is for the deal to fall apart right before closing. But according to the latest data from Redfin, that’s happening a bit more often lately. The good news is, it’s completely avoidable if you lean on an agent for insight into why that is and how to avoid it happening to you.

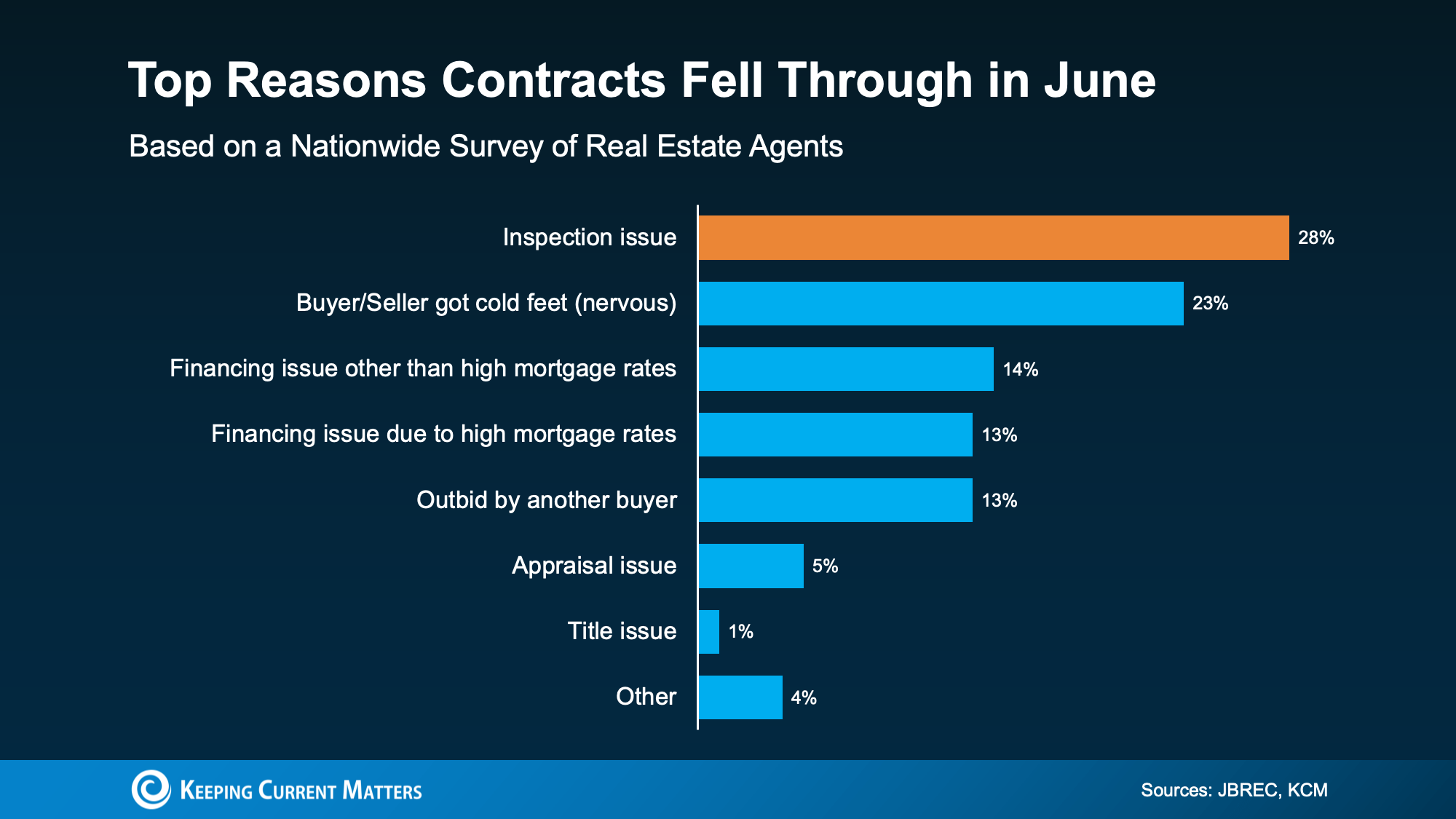

This June, 15% of pending home sales fell through. That means those buyers backed out of their contracts. That’s not too much higher than the norm of roughly 12% from 2017-2019, but it’s still an increase. And it’s one you don’t want to have to deal with.

The key to avoiding this headache is knowing what’s causing the issues that lead to a buyer walking away. A recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) finds that agents reported the #1 reason deals are falling apart today is stemming from the home inspection (see graph below):

Here’s why. With high prices and mortgage rates stretching buyers’ budgets, they don’t have a lot of room (or appetite) for unexpected repairs.

Here’s why. With high prices and mortgage rates stretching buyers’ budgets, they don’t have a lot of room (or appetite) for unexpected repairs.Not to mention, buyers have more options to choose from now that there are more homes on the market. So, if the inspection turns up a major issue, they may opt to walk away. Afterall, there are plenty of other homes they could buy instead.

Or, if the seller isn’t willing to tackle repairs, a buyer may back out because they don’t want the expense (and the hassle) of dealing with those issues themselves.

The good news is, there’s a way you can get ahead of any unpleasant surprises as a seller, and that’s getting a pre-listing inspection. It’s not required, but the National Association of Realtors (NAR) explains why it’s helpful right now:

What’s a Pre-Listing Inspection?It’s exactly what it sounds like: a professional home inspection you schedule before your home hits the market. Here’s what it can do for you:

- Give you time to fix what matters. You’ll know what issues could come up in the buyer’s inspection. So, you’ll have time to take care of them before anyone even walks through the door.

- Avoid last-minute renegotiations. When buyers uncover unexpected issues after you’re under contract, it opens the door for concessions you may have to make like price drops or repairs, or worse, a canceled deal. A pre-listing inspection helps you stay ahead of those things before they become deal breakers.

- Show buyers you’re serious. When your home is clean, well-maintained, and already vetted, buyers see that. It builds trust and can help you sell faster with fewer back-and-forth negotiations.

The bottom line? A few hundred dollars upfront can save you thousands later.

Should Every Seller Do This?Not necessarily. Your real estate agent can help you decide what makes the most sense for your situation, your house, and your market. If you decide to move forward with a pre-listing inspection, your agent will guide you every step of the way. They’ll:

- Advise on whether to fix or disclose each issue

- Help you prioritize repairs based on what buyers in your area care about

- Make sure you understand your local disclosure laws

Bottom Line

If you want to avoid potential snags in your deal, a pre-listing inspection could be the way to go. Connect with an agent to go over whether a pre-listing inspection is the right move for your house and market.

Would you rather find out about a major repair now, when you can handle it on your terms – or after you’re under contract, when the clock is ticking?

Post: Are These Myths About Buying a Newly Built Home Holding You Back?

Post: Are These Myths About Buying a Newly Built Home Holding You Back?

- Real Estate Agent

- Virginia, Maryland and North Carolina

- Posts 179

- Votes 33

If you’ve been skipping over newly built homes in your search, you might be doing so based on outdated assumptions. Let’s clear up a few of the most common myths, so you don’t miss out on a solid opportunity.

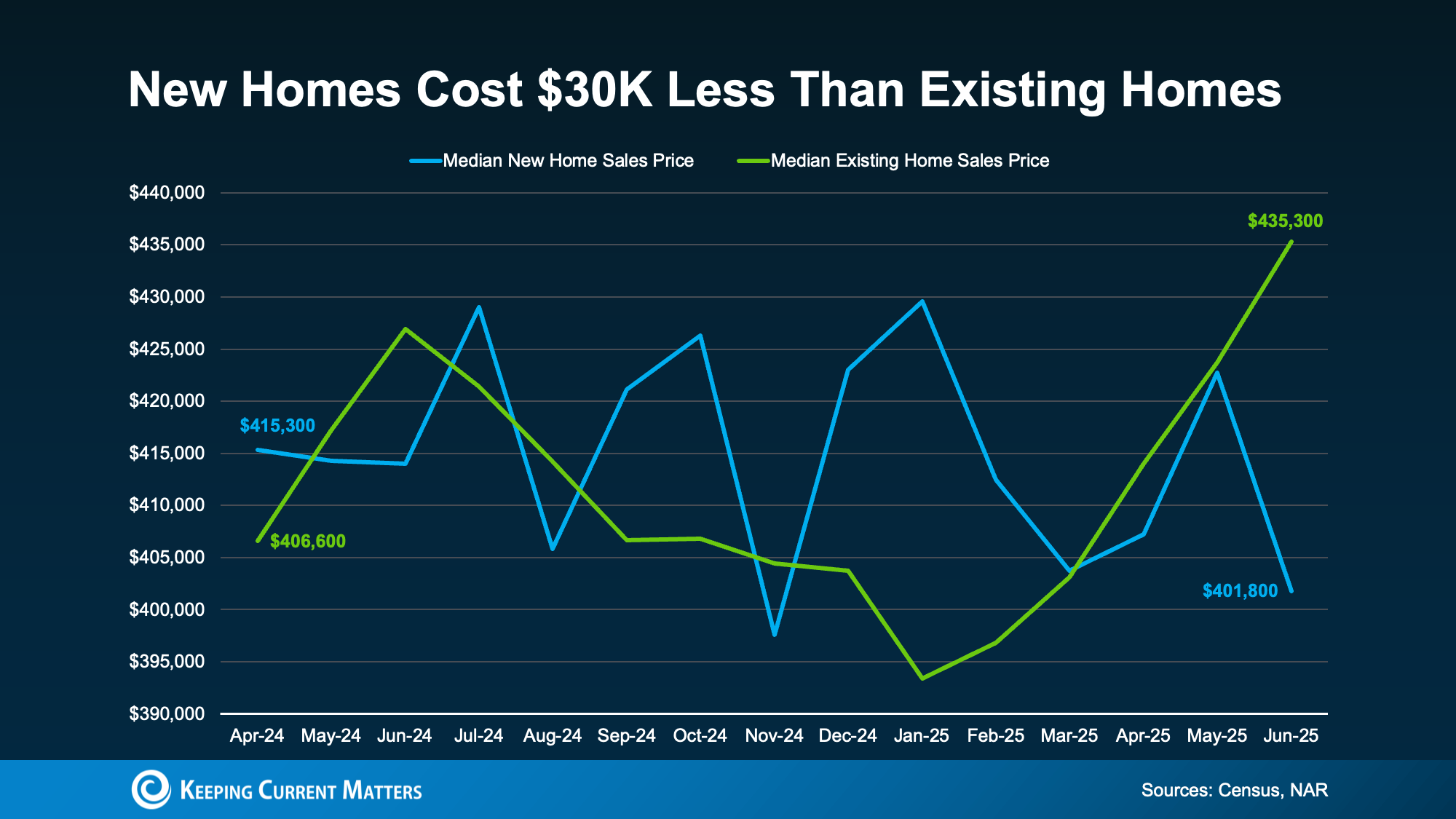

Myth 1: New Homes Are More ExpensiveIt’s easy to assume a new build will cost more than an existing home, but that’s not necessarily true, especially right now.

Data from and the (NAR) shows the median price of a newly built home today is actually lower than a home that's been lived in already (an existing home):

So, why’s this happening? As Heather Long, Chief Economist at Navy Federal Credit Union, explains:

So, why’s this happening? As Heather Long, Chief Economist at Navy Federal Credit Union, explains:If you’ve ruled out new construction based on price alone, it’s time to take another look. Talk to your local real estate agent to see what’s available (and at what price points).

Myth 2: Builders Don’t NegotiateMany buyers assume builders aren’t going to play ball when it comes time to negotiate. But that’s just not the case. A number of builders are sitting on finished inventory they want to sell quickly. And that makes them more open to compromising. Mark Fleming, Chief Economist at First American, explains a builder:

That means you may find builders more flexible than individual sellers, and more motivated to toss in incentives to get the deal done. According to Zonda, of new home communities offered incentives on new homes considered quick move-ins in June.

Myth 3: They Don’t Build Them Like They Used ToSome people think newer homes lack the craftsmanship of older ones. But here’s a reality check. Quality can vary in any era. And using a reputable builder matters more than the build date.

According to the National Association of Home Builders (NAHB), a good way to gauge quality is by talking to buyers who have purchased from that builder recently. In an article, NAHB explains:

The article suggests asking those buyers questions like:

- Did the builder meet their expectations?

- Would you use that same builder, if you were to do it again?

But you can also ask your agent about the builder’s reputation. Generally, agents know about the builders active in your area and may even have experience with past clients who have bought a home in one of that builder’s communities.

Myth 4: You Don’t Need Your Own Real Estate AgentThis might be the biggest myth of all. The truth is, when you buy a brand-new home, using your own agent is even more important. Builder contracts have different fine print, and you’ll want a pro on your side who can really explain what you’re signing and advocate for your best interests.

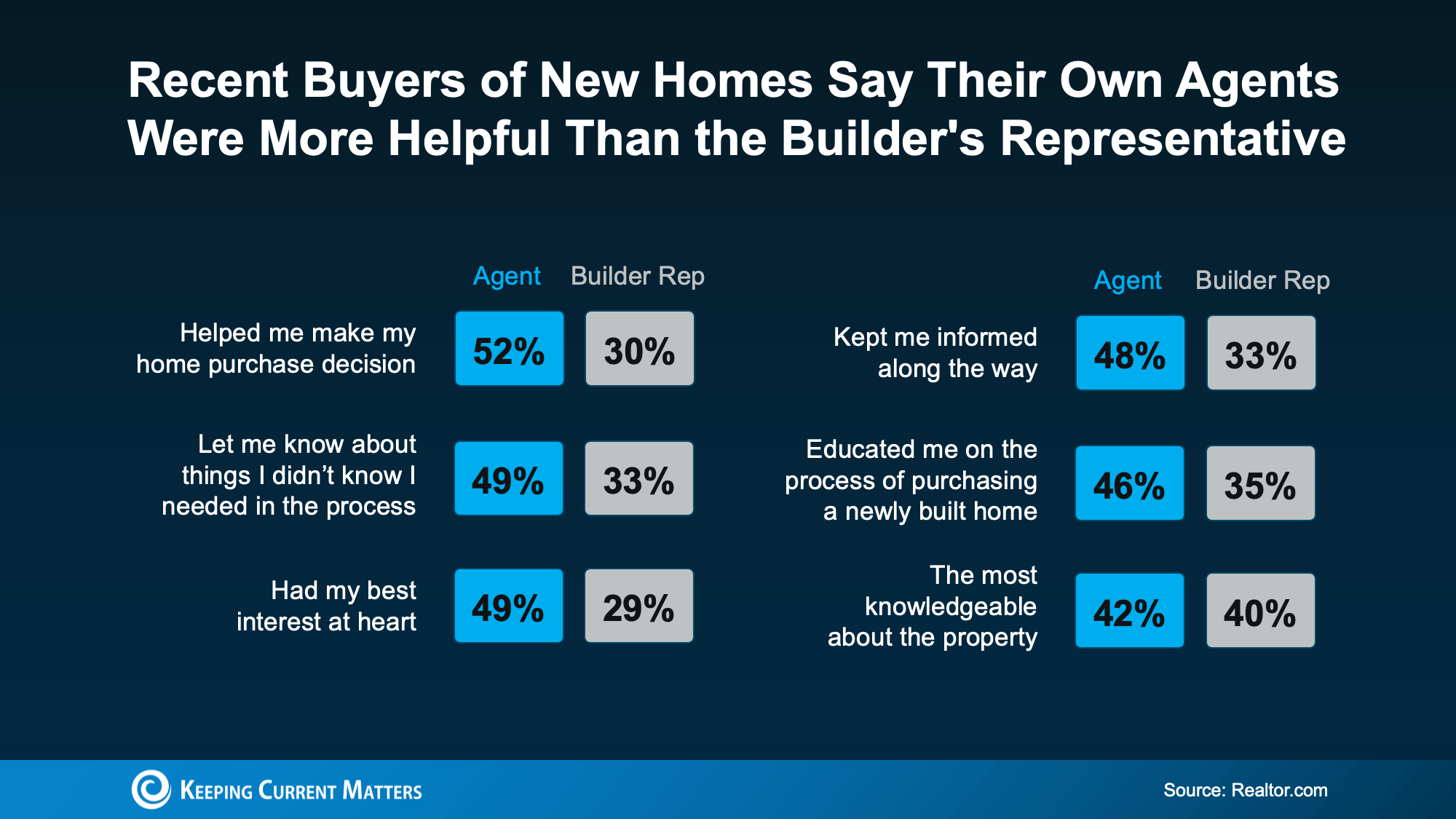

These stats seem to prove that’s the case. In a Realtor.com survey, buyers who purchased a newly built home rated their agents far more helpful than the builder (or the builder’s representative) during the process (see visual below):

Bottom Line

Don’t let misconceptions keep you from exploring one of the most promising options in today’s housing market.

Whether you’re curious about what’s being built nearby or wondering if a new home fits your budget, connect with a local agent. You might be surprised by what’s out there.