Updated about 3 hours ago on . Most recent reply

Dover NH Duplex Analysis

Duplex sold in Dover in 2026 for mid $300’s

(2) 2 bed/1 bath unit and approx 2500 sqft

In need of cosmetic updates and remodeling

175k/unit and approx $130/sqft

These numbers show this is quite the deal in the Dover market!

From a pure investment standpoint, if an investor put 25% down and spent 75k for renovations to upgrade the units, a nice 2 bedroom in Dover would go for $2100/mo——although I’ve heard recently that it’s been harder to find people for the rented units this winter.

But, say they both get rented for a total of $4200/mo. PITI payments as well as estimated Capex and maintenance ballpark about 3k/mo, which nets $1200. Say $1000/mo to be safe. That’s a 13.7% CoC return in the Dover market, which seems like a rarity.

What do you guys think about this property? Do the numbers look right?

Most Popular Reply

Hello @Jakob Mikhitarian,

On paper, it may look like an excellent investment. However, you are only looking at the property. Properties don’t pay rent — tenants do. A rental property is just a container. Its performance depends on the tenant occupying the property. So before analyzing the property, analyze the tenant it is likely to attract.

A mistake many investors make is assuming all tenants behave the same. They don’t.

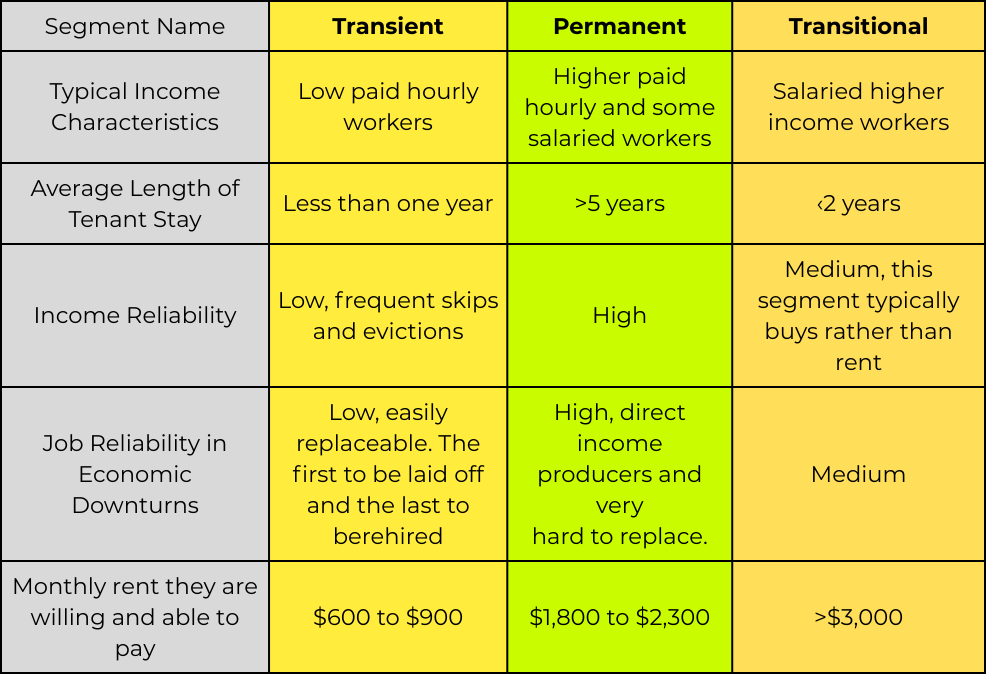

In 2005, I did extensive research on the various tenant segments in Las Vegas. I discovered there are three major segments, as shown below, and each has multiple subsegments.

This table shows the problem. If you purchased a property that only attracted the Transient segment, there's almost no way to make money.

For this duplex, I’d want to know:

- What income bracket can comfortably afford the rent? Not “who might rent it,” but who can qualify to rent it. Usually, people spend about 30% of their gross monthly household income on rent. If the gross income is $55,000, the maximum rent they can qualify for is about $1,375/Mo. ($55,000/Yr / 12 Mo/Yr x 30%)

- What jobs dominate that income bracket locally? You can search job boards for positions that pay that amount (in this case, $55,000). From the nature of the job at that income range, you can determine whether the job is business-critical or a government job. This tells you what is likely to happen with rental income during a recession.

- Is this a 1–2 year renter or a 5+ year renter? Every day your property sits vacant, your expenses continue without rent to cover them. This is why choosing the right tenant segment is critical. Find a segment with people who stay many years, pay rent on time, and take good care of the property. Then buy what they're willing and able to rent.

If the tenant segment is stable and the days to rent for comparable units are reasonable — the duplex likely works long term.

If the tenant base is transient, stretched financially, or oversupplied — the math may look fine today but degrade quickly.

Before debating cap rate, I’d want clarity on who exactly lives here — and why they stay.

Curious what the dominant tenant profile looks like in this submarket.

- Eric Fernwood

- [email protected]

- 702-358-8884