All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 785 times.

Post: Does long term rentals still work to build wealth?

Post: Does long term rentals still work to build wealth?

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Charles Bishop,

Long-term rentals is the easiest and safest path to financial independence, provided you buy in a good investment city and your property is occupied by reliable tenants. The requirements.

- Investment city - The city matters most. Choose a city where rents and prices have consistently outpaced inflation. Every time you shop it costs more and more to buy the same goods and services. The only way you will have the income you will need to pay future inflated prices is if your rents increase faster than inflation. And, if prices of existing homes rise faster than inflation, you can acquire additional properties with minimal additional cash from savings using cash-out refinancing.

- Income reliability - Tenants pay rent, not properties. You need your property occupied by tenants who stay for many years and pay on time, which I call reliable tenants. Through property manager interviews, you can identify the segment(s) with a high concentration of reliable people. Then, buy properties similar to what and where they are currently renting.

Does this city and tenant segment driven process work? Below are our 17+ year results.

- We have delivered over 580 investment properties to over 170 clients worldwide. Less than 10 clients were local. All the rest lived in other states or countries. Also, we've never met 60% of our clients and a significant percentage have never been to Las Vegas.

- Our clients, on average, buy three or more properties because their properties continue to perform.

- Our average tenant stays over five years. This is due to the demographic we target which is families with young children.

- We've had seven evictions in the last 17+ years (over 1,000 tenants). This is due to the demographic we target, the skill of the property manager we work with, and the pro-landlord environment in Las Vegas.

- 2008 crash - Zero decline in rent and zero vacancies. The demographic we targeted have direct revenue producing, mission critical, or government jobs. They didn't lose their jobs so there was no decrease in rent or vacancies.

- Since 2015, the average annual appreciation and rent growth rates were 9% and 7%, respectively.

- Less than 2% vacancy rate

Where did I come up with this method? National retail chains. National retail chains have used these methods for almost 100 years and they are very good at what they do. I learned how companies like Whole Foods, Trader Joe's, Costco, Barnes & Noble, McDonald's and others select store locations and how to attract their target demographic based on offerings. I just did what they did.

Remote Investing

The odds that you live in a city that meets the requirements for financial independence are small. You need to invest where you can achieve long term financial independence. And, even if you were investing in your hometown, you need to work with an experienced investment team.

Everything you learn from books, podcast, seminars, websites, is general information. You're going to buy a specific property, in a specific location, subject to specific local conditions, and you will need local resources. An experienced local investment team has everything you need. And, you cannot duplicate the years of experience and resources a team of experts already possesses. And the best part is working with an investment team costs no more than working with any other realtor. Additionally, you get a master class on real world investing.

Summary

Long-term rentals are the easiest and safest method for achieving long-term financial independence. Millions have already done it and you can too. However, not just any rental in any city will do. You have to pick the city based on long-term performance and the tenant segment based on income reliability. Then purchase properties similar to what they're renting today.

Post: Advice on building equity or cash flow

Post: Advice on building equity or cash flow

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Jessica Yuan,

You need both. Cash flow pays bills, and appreciation grows wealth.

If your goal is long-term financial independence, then you need a rental income that increases faster than inflation and will last throughout your lifetime. Also, you'll likely need more than one property to replace your current income so you need to acquire multiple properties with the least additional capital.

Rents follow property prices, with a 2 to 5 year lag. When prices are high, fewer people can't afford to purchase so they are forced to rent. The increased demand for rental properties increase rents. When prices are low, more people can afford to purchase and fewer people rent leading to static or declining rents.

The city requirement for rising prices and rents can be summarized as follows:

-

Significant and sustained population growth. Population growth is the demand side of the supply and demand equation.

-

Low crime. People move to a city for a job. They don't just randomly move. Companies hesitate to set up new operation in cities known for high crime.

-

Low operating costs. Every dollar you lose to overhead is a dollar less for you to live on. Some states, like Texas and Florida, have very high operating costs. Nevada has relatively low operating cost. Here’s a comparison of average homeowners insurance costs and property tax rates in 2025 for Florida, Nevada, and Texas:

State Avg. Homeowners Insurance (Annual) Avg. Property Tax Rate Typical Annual Property Taxes Florida $2,625 [per year]nerdwallet 0.80% ~$2,338 makefloridayourhome Nevada $1,305 [per year]nerdwallet+1 0.50% ~$1,335 (on $267K median) worldpopulationreview+1 Texas $4,585 [per year]nerdwallet 1.60–2.50% ~$5,200–$7,500+ (on $325K) hometaxsolutions

Key points:

- Florida and Texas rates can be much higher in coastal or urban areas, and local tax rates vary. Nevada also offers some of the lowest property taxes nationwide.

Sources:

- Homeowners insurance: National/state averages for $300K dwelling coverage with typical deductible.nerdwallet+1

- Property tax: State/local government averages and example calculations.makefloridayourhome+3

- https://www.nerdwallet.com/article/insurance/average-homeowners-insurance-cost

- https://www.makefloridayourhome.com/florida/blog/property-tax-in-florida

- https://www.nerdwallet.com/insurance/homeowners/nevada-home-insurance

- https://worldpopulationreview.com/states/nevada/property-tax

- https://smartasset.com/taxes/nevada-property-tax-calculator

- https://www.hometaxsolutions.com/2025/06/how-property-taxes-are-determined/

- https://www.nerdwallet.com/insurance/homeowners/florida-home-insurance

- https://www.bankrate.com/insurance/homeowners-insurance/states/

- https://www.axios.com/2025/08/26/home-insurance-premiums-cost-map

- https://matic.com/cost-of-homeowners-insurance-guide/

- https://www.moneygeek.com/insurance/homeowners/average-home-insurance-cost-calculator-texas/

- https://www.greatflorida.com/blog/2025/how-much-is-home-insurance-in-florida/

- https://www.kiplinger.com/taxes/floridians-vote-to-increase-property-tax-break

- https://www.moneygeek.com/insurance/homeowners/average-cost-home-insurance-nevada/

- https://states.aarp.org/texas/texas-homeowners-insurance-rates-rise

- https://www.texastribune.org/2025/06/04/texas-legislature-property-tax-cuts-2025/

- https://www.marketwatch.com/insurance-services/homeowners-insurance/average-home-insurance-cost/

- https://www.rocketmortgage.com/learn/property-taxes-by-state

- https://www.insurance.com/home-and-renters-insurance/home-insurance-basics/average-homeowners-insurance-rates-by-state

- https://belonghome.com/blog/property-taxes-by-state-2025

I hope this helps.

Post: Buying a property with tenants that don’t pay

Post: Buying a property with tenants that don’t pay

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Johnathan Cummings,

It really comes down to the cost and the time it takes to evict someone. Ideally, you’d want them to agree to a cash-for-keys arrangement, but that may not interest them. Right now they’re living rent-free, so there’s little motivation for them to move somewhere else and start paying rent, even if you hand them cash.

Eviction timelines vary a lot depending on the state and even the county. For example, here in Las Vegas, if a tenant doesn’t pay rent but hires an attorney and drags the process out in court, it usually takes somewhere between 17 and 35 days before they’re out. On the other end of the spectrum, I had a client in another state who went through an eviction that lasted 18 months.

You also have to factor in potential damage. If someone is essentially squatting and you force them out, the risk of them trashing the property is very real. Back in 2008 and 2009, during the foreclosure wave, I saw cases where people poured concrete down drains, stripped copper wiring from the walls, left water running to flood properties, and caused extreme mold damage. The cleanup costs were huge. Because of that, I always plan for the worst, even while hoping for the best.

My recommendation is to first get a clear understanding of how long it will realistically take to remove this person if they fight the eviction process every step of the way. If the cost and timeline are manageable, I would still try to negotiate a cash-for-keys agreement to get them out without damage. Keep in mind, if they have poor or no credit, there’s very little leverage beyond the eviction process itself.

Even though you might feel like you’re getting a bargain—the seller probably factored in the hassle of removing the tenant. So, no matter how attractive the price or financing looks, if you can’t get the tenant out, the property turns into a money pit. So it’s crucial to plan carefully before moving forward.

Post: im just getting into real estate. need advice

Post: im just getting into real estate. need advice

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Some additional thoughts that I wanted to include.

Real estate investing is the common man’s path to financial independence. And, if you follow proven processes by companies like the ones below, your odds of success are high.

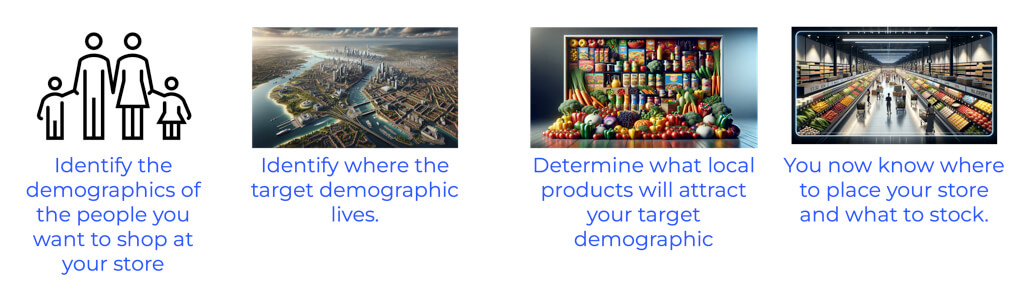

National retail chains follow a straightforward process when selecting store locations and localizing their inventory (click to enlarge):

The same process works in real estate.

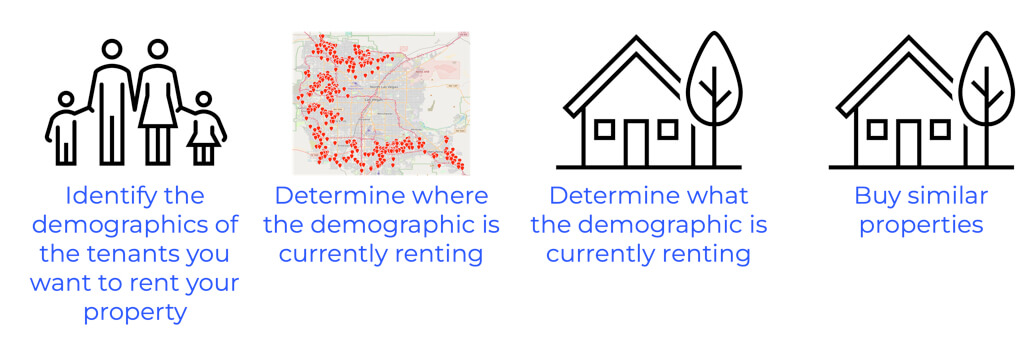

No property ever paid rent; the tenant pays the rent. So the process is:

- Identify a tenant segment that stays many years, pays the rent on schedule, and does not cause damage to the property.

- Determine what and where they rent today

- Buy similar properties

Do not listen to others’ opinions because every city is different; what works in Cleveland will not necessarily work in Houston. And, always remember, real estate investing is about making money, not conforming to property type dogma.

To identify a tenant segment that stays many years and pays rent on schedule, ask multiple property managers this question: "If you wanted to buy rental properties where tenants stay long-term and pay reliably, what and where would you buy?" When starting my business, I first used research to identify tenant segments with the right behaviors. I then verified my findings by asking about 15 property managers a similar question. Remarkably, 13 of the 15 property managers identified the same properties.

Has our tenant segment focused method worked? Here are 17+ years results:

- We have delivered over 580 investment properties to over 170 clients worldwide.

- On average, our clients buy three or more properties because of consistent results.

- Our average tenant stays over five years.

- We've had seven evictions in the last 17+ years (over 1,000 tenants).

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID eviction moratorium - almost no impact

- Since 2015, the average annual appreciation and rent growth rates were 9% and 7%, respectively.

- Less than 2% vacancy

Summary

Tenants pay the rent, not the property. What you need to be successful is to always have your property occupied by people who stay for many years and pay the rent on schedule. And, do not make any assumptions or guesses. Follow the method used by national retail store chains.

Post: Evaluating established rental properties

Post: Evaluating established rental properties

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Kevin Mertus,

Stocks, bonds, and CDs play a different role than real estate.

Stocks

Stocks are for capital accumulation. Once you have accumulated enough capital you draw down a monthly amount. How much you need to accumulate depends on how much you need each month and how long you expect to live after retirement. For example, if you need $10,000 a month for 30 years, that’s about $3.6 million assuming no inflation and no market crashes. If there is a 5 percent average inflation with no market crashes, then you need to accumulate about $8 million before you retire. Hitting either number is tough for most people.

Advantages

- Near-instant liquidity

- Easy to start with small amounts

- Values are simple to track

Disadvantages

- You must consistently beat inflation and ride out crashes for your drawdown period, which even the best money managers are unable to do.

- Allocate time to monitor the markets and react

- Limited tax advantages, little or no leverage

- Monthly withdrawals reduce principal and make diversification more difficult.

Rentals

With rentals, my goal is to own enough properties so net rent replaces my paycheck. In the right market, I can add doors with modest new capital after the first purchase through cash-out refinancing. Rents in strong cities tend to outpace inflation while major costs stay fixed with long-term, fixed-rate loans. Tax tools like depreciation and 1031 exchanges improve after-tax results. The right tenant segment keeps income steady, and with an experienced local team, my time commitment stays low.

Advantages (when I invest in the right city)

- Inflation-adjusted rent growth can exceed inflation, lifting my standard of living over time

- I need a fraction of the capital required by pure accumulation strategies

- Income can last for life and continue for heirs

- Performance is driven by supply and demand, not daily sentiment

Disadvantages

- Real estate is not liquid

- Market and tenant selection are critical, though the process is straightforward

- Entry costs are higher, often about $140,000 cash plus a mortgage in Las Vegas

Bottom line: stocks are for building a pile, real estate is for building an income stream. They are not the same.

Should you sell?

The key test is simple, have your rent and property value outpaced inflation over time?

The old adage: “Live where you like but invest where you can make money” remains true. And, if you work with a local experienced investment team, it does not matter whether you invest in your city or across the country,

I hope this helps.

Post: Accessing Equity and Scaling the Portfolio

Post: Accessing Equity and Scaling the Portfolio

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Chris Berezansky,

You asked a simple question, but there’s no simple answer. Here are a few things I’d consider:

- If you refinance your rental, your rate will likely jump to around 6.5% or higher. That would probably wipe out your cash flow, and for me, it would be tough to give up such a low interest rate.

- If you go the HELOC route, you're right that it's a floating rate loan. Some lenders do offer fixed terms for five to seven years, which could buy you enough time to refinance if and when rates come down.

- House hacking is probably the lowest risk option, though it may take time for you to build up down payment if you can't use another 0% down VA loan. This would be a trade off between time and money.

The bigger question is whether continuing to hold the property or buying more properties in the same area makes sense. That depends on your long-term goals. If financial independence is the objective, then the income from your rentals has to meet certain requirements:

- Rents and prices need to rise faster than inflation.

- Operating costs must stay low. The two biggest costs investors face are property taxes and insurance. For example, I own two homes of similar value, one in Las Vegas and one in Austin. In Las Vegas, I pay about $2,200 a year in property taxes. In Austin, the taxes are over $10,000 a year, and the rent per square foot in Vegas is actually higher than in Austin.

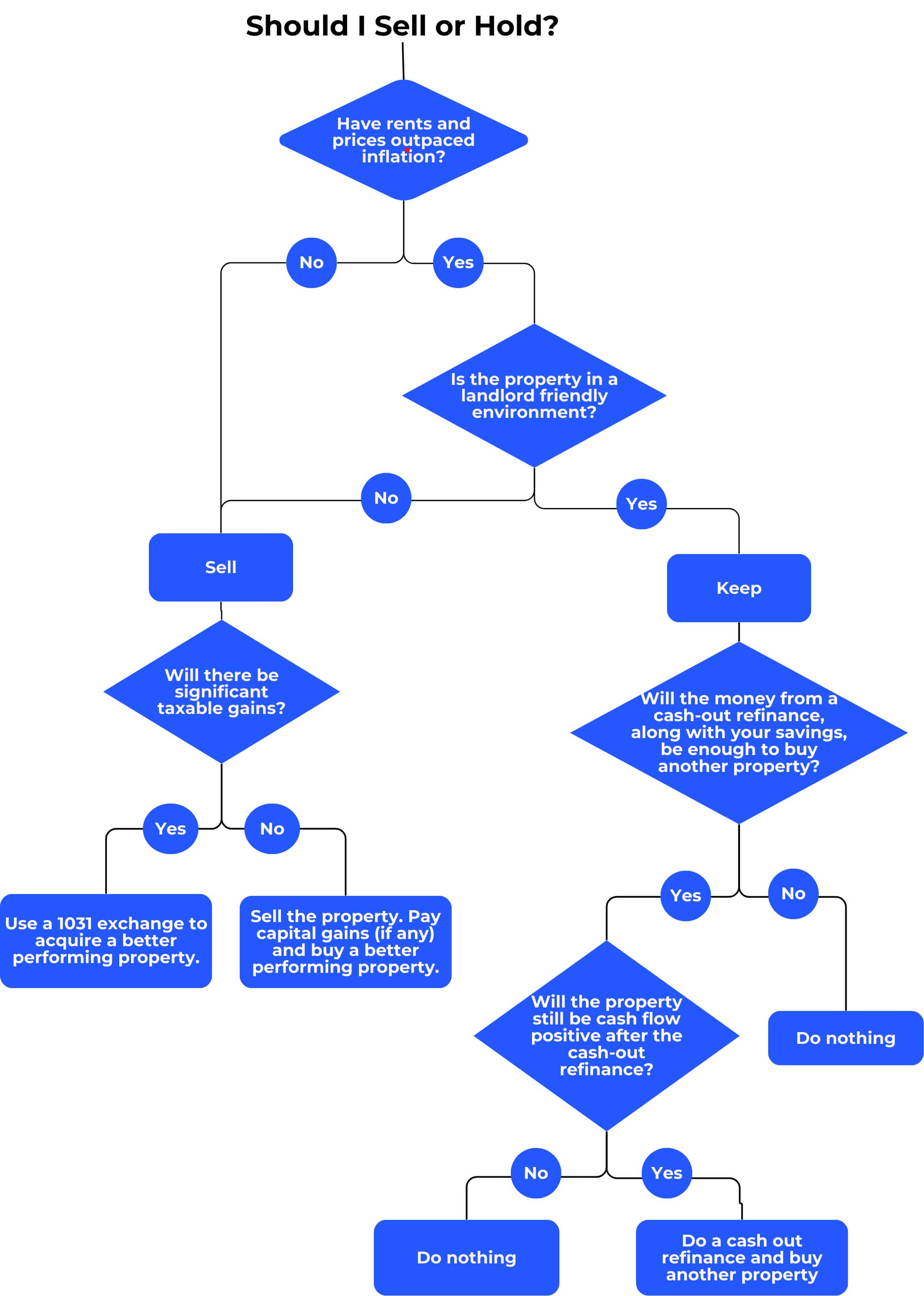

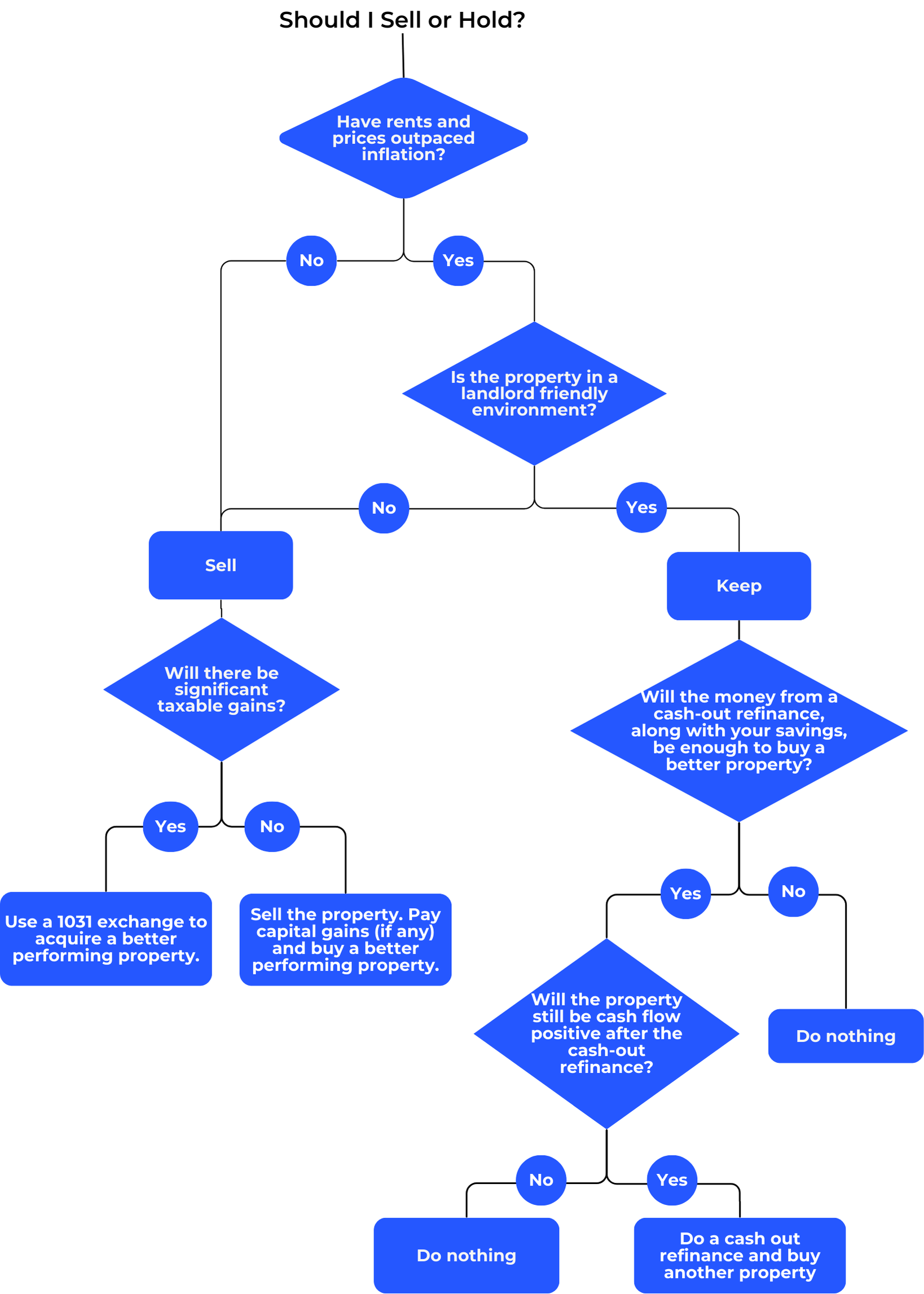

I created this decision tree to help investors think through whether to refinance, hold, or sell:

In my view, there’s more to consider than just interest rates. To live on rental income in the future, you need rents that consistently grow faster than inflation. If they don’t, then no matter how many properties you own, it won’t add up to sustainable financial independence.

Post: September Las Vegas Rental Market Update

Post: September Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Young Yim,

There are overall trends, and then there are individual properties. Even if the general trend is strong, a specific property may not perform as well, and vice versa. Starting in August, we hit a slower time of year for rentals, which you can see in the stats we posted. Part of the challenge is that we focus on families with children, and once school starts in mid-August, demand slows down. The impact is more pronounced for larger homes such as yours (you have a beautiful property in a highly desirable location). As a result, it’s taking longer to lease, and we’re not getting the higher rents we had expected.

I will reach out to the property manager and get back to you via email.

Post: Remove or leave a wheelchair/ senior accessible bathtub?

Post: Remove or leave a wheelchair/ senior accessible bathtub?

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Carlos Licon,

It really depends on the demographic you are targeting. If your main audience is senior citizens, a walk-in tub can be a selling point. In our case, we focus on families with elementary school children, which is why we’ve been removing them.

Another issue is that of the eight or ten walk-in tubs we’ve replaced, most had leaks. That often meant repairing flooring in addition to replacing the tub.

So, if a walk-in tub makes your property more attractive to your target market, keep it. If not, it’s better to remove it.

Post: New Real Estate Investor

Post: New Real Estate Investor

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

Hello @Brian Cronin,

Do not select a property (type) and hope the tenants it attracts will provide a reliable rental income. No property ever paid rent—the tenants do. A property is just a container, and what matters is the behaviors of the tenant segment it attracts.

How I Did It

I started by identifying a tenant segment that stays for many years, pays on time, and takes care of the property. Once I identified this segment, we selected properties similar to what they currently rented.

The results of our tenant focused property selection process for the +580 investment properties we’ve delivered over the last 17 years: our average tenant stays over five years, we’ve had only seven evictions out of more than 1,000 tenants, and even during the 2008 crash we had zero rent declines and zero vacancies. Since 2015, the homes we’ve delivered averaged 9% annual appreciation and 7% annual rent growth, with less than 2% vacancy. This is critical: Rent growth must outpace inflation—otherwise your buying power erodes, no matter how many properties you own.

Location

The other crucial factor is the investment city. The city you invest in determines long-term performance. To sustain financial independence, you need a city with a metro population over one million (to attract businesses that create lasting jobs), significant and sustained population growth, low crime, and low operating costs. I can expand on these criteria and provide the resource links, if you like.

Investment Team

Once you’ve selected a city that meets all the financial independence requirements, the next step is to find an experienced local investment team. Books, seminars, podcasts, and websites give you general knowledge. However, you will not buy a “general” property. You will buy a specific property in a specific location subject to local rules and regulations. The only source for the local knowledge, processes, resources and experience is an experienced local investment team. This is true even if you invest in your hometown. The best part is working with a professional investment team doesn’t cost more than any other realtor, plus you get a master class on real world investing.

Post: September Las Vegas Rental Market Update

Post: September Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 816

- Votes 1,565

It's September, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

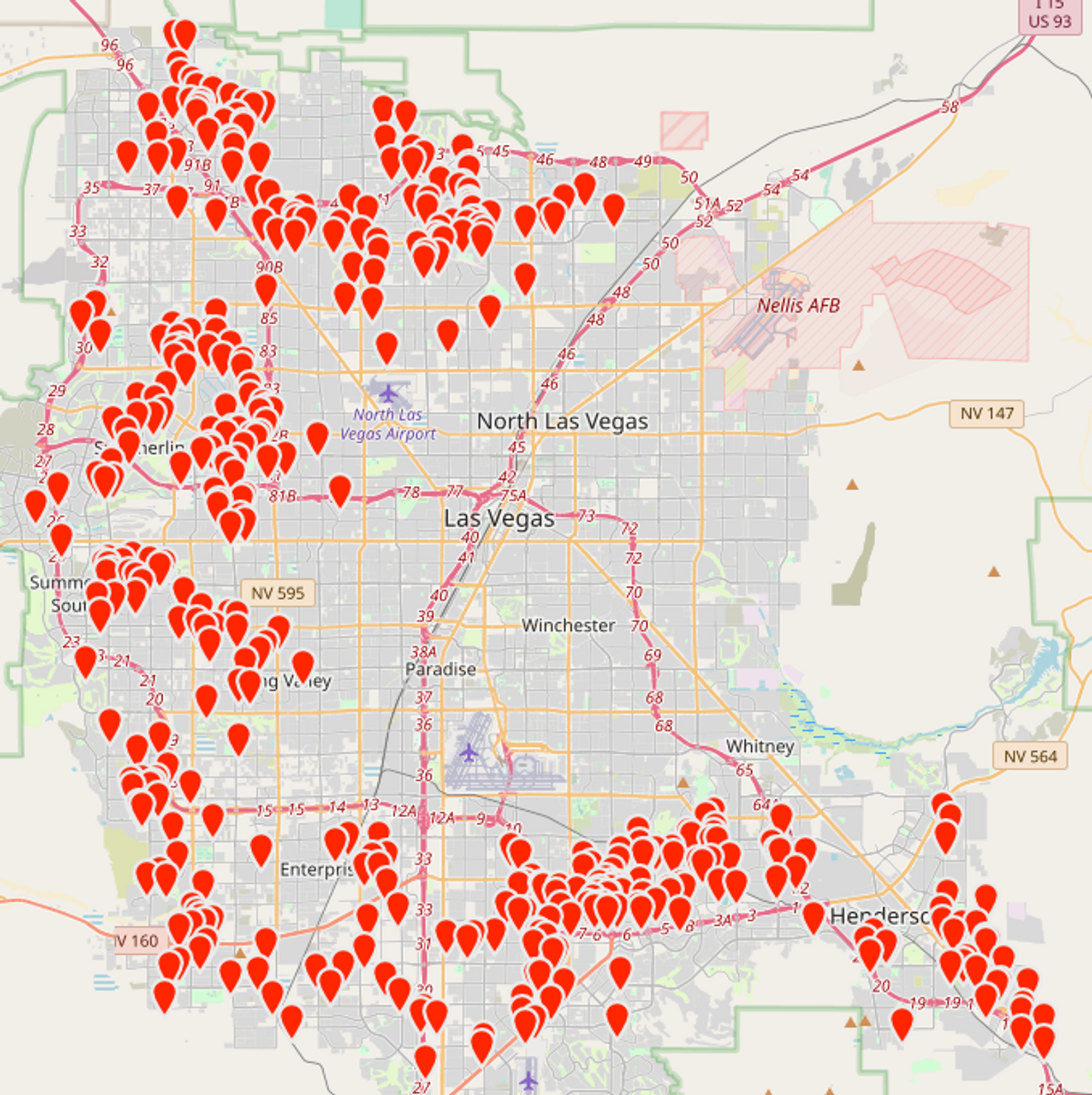

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

- Location: See the map below

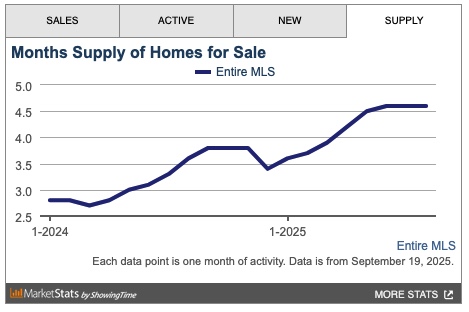

Overall Market Inventory

The chart below, from the MLS, includes ALL property types and price ranges. The overall inventory has stabilized.

Rental Market Trends

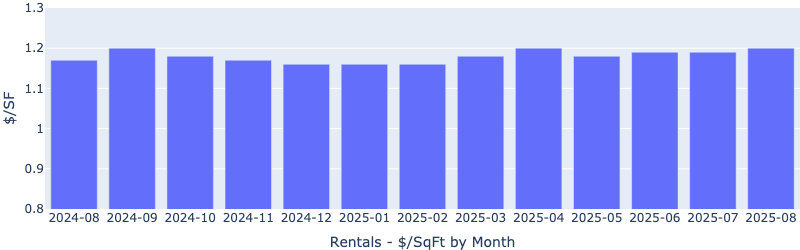

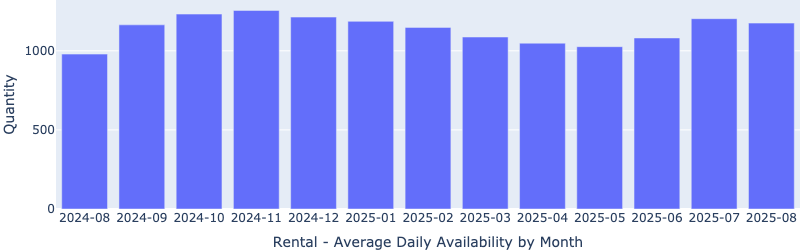

The charts below are only relevant to the property profile that we target.

Rentals - Median $/SF by Month

Rents increased slightly in August. YoY is up 3%. Despite global and domestic tensions, rents remained stable.

Rentals - Availability by Month

The number of homes for rent decreased slightly MoM in August, bucking the usual seasonal trend.

Rentals - Median Time to Rent

Time to rent increased marginally MoM (from 23 days to 24 days), but remained healthy.

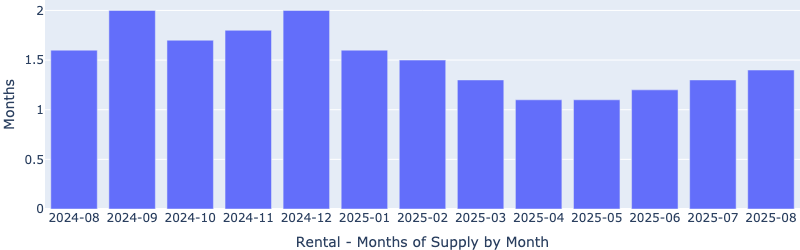

Rentals - Months of Supply

There are only 1.4 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

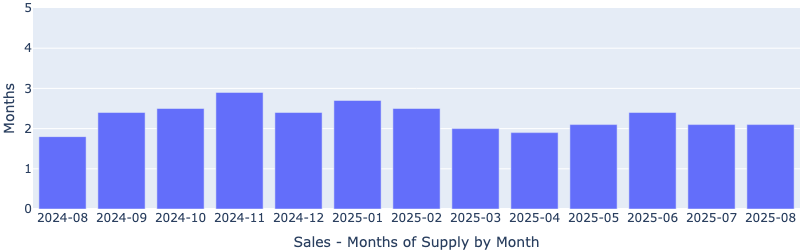

Sales - Months of Supply

Inventory remains at two months, indicating our segment is still a seller's market.

Sales - Median $/SF by Month

The price per square foot unexpectedly fell in August. While we typically see a slight slowdown when school begins mid-month, this drop was larger than normal. Since the time to sell actually decreased (see chart below) and the inventory (months of supply) remained stable, my guess is that all the negative news and global uncertainty pushed some sellers to cut prices.

I also looked into distressed single-family home sales, and there’s no sign of trouble. The numbers are very low:

- Short sales: 38, about 0.0084% of all single-family homes

- Bank owned (REO): 37, about 0.0082%

- Foreclosures started: 33, about 0.0073%

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

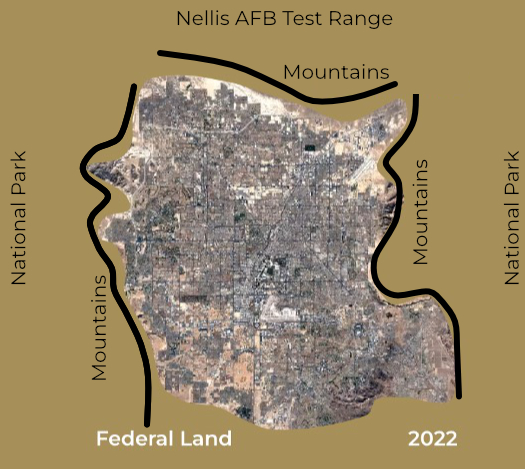

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand. Las Vegas's average annual population growth is between 2% and 3%. What draws people to Las Vegas? Jobs. Depending on the report, there is between $26B and $30B under construction, and the last job fair had over 20,000 open jobs.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.