All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 787 times.

Post: When It Comes to Lending—Do You Value Speed or Lower Rates More

Post: When It Comes to Lending—Do You Value Speed or Lower Rates More

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Michael Santeusanio,

You’re right, the two key factors are time and interest rates.

Time

There are two important timeframes with loans:

- How long it takes to get pre-approval

- How long it takes to close once the property is under contract

Pre-Approval

We require clients to be pre-approved before we begin working with them. Depending on the lender and the client’s financial situation, this can take anywhere from a few days to a month. For example, if a client has multiple income streams and is also a 1099 worker, some lenders struggle to process it, while others may take two weeks. Because we work with several lenders, we know which ones to recommend based on the client’s circumstances, so timing has not been an issue for us.

Closing

Most of our clients use conventional or DSCR loans. Both typically close in under 30 days, and we see very little difference in closing times between lenders.

Interest Rates

Interest rates vary more than closing times, but lenders often complicate things, making comparisons difficult. Our approach is simple. Only two numbers matter:

- The total cost to acquire the property, including appraisal, loan origination fees, underwriting fees, discount points, down payment, and other expenses.

- The monthly debt service you’ll pay.

Everything else, including APR, is noise. These two numbers are all you need to compare loans effectively.

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @George Villegas,

My first property was a C-class fourplex in Houston, Texas. On paper, it looked like a cash cow—similar to the fourplexes in Las Vegas in the price range you mentioned. But, I quickly learned that the reality didn’t match the projections.

The tenant base was low-income hourly workers paid weekly. They did not depend on credit, and when applying for another rental property, the property manager simply didn't care about how many evictions they had. Almost all the tenants in this segment have multiple evictions in the past. So there's no way to really scream out the bad actors.

I dealt with frequent evictions, people skipping out on leases, vandalism, and constant repairs due to the age and condition of the property. What looked profitable on paper ended up costing me about $1000 a month in losses.

Instead of focusing on the property type, I have been focusing on the tenant segment—the people who actually pay the rent. Over the past 17+ years, we’ve delivered more than 570 investment properties to over 180 clients worldwide (so we have accumulated a lot of data). Here are the results from our tenant segment focus.

- Vacancy rate under 2%

- Average tenant stay of more than five years

- Only seven evictions in 17+ years with more than 1,000 tenants

Choosing the right tenant segment and buying what they are willing and able to rent makes all the difference.

There’s another factor to consider. Multifamily properties are almost always owned by investors. In more than 17 years of doing hundreds of deals in Las Vegas, I have never seen a multifamily property offered for sale that wasn’t losing money—usually due to deferred maintenance or tenant issues. We’ve had clients buy multifamily in the past, and none of those deals turned out well.

Also, if you're using an FHA loan, you'll be living in one of the units. I strongly suggest visiting areas like East Desert Inn Road in the evening and asking yourself if that's where you want to live. My guess is the answer will be no.

Summary

Follow the money, not the dogma.

Post: Reliable Data Collection

Post: Reliable Data Collection

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Craig Cann,

When I launched my real estate investing services business in 2005, I searched everywhere for reliable data. With my engineering background, I’m comfortable with analysis and research, but I quickly realized the available information just didn’t fit my needs. The main challenge was figuring out what our target tenants actually wanted and could afford to rent.

At first, I tried using traditional analysis methods to predict which properties would attract our ideal tenants. The problem was that the data was too broad and generic. What I needed was information specific to our tenant segment, but it simply wasn’t out there. So, I started gathering it myself.

Now, we have 12 to 14 years of detailed, historical behavioral data on our target tenants. We built this database by systematically collecting and saving information every day as we reviewed potential properties.

This process has given us valuable insights into what our target demographic—families with elementary school children earning $60,000 to $85,000 a year—looks for in a rental home.

Here are a few things we’ve learned from our data (for the Las Vegas market):

- Families in this segment prefer single-family homes.

- They won’t rent homes on lots smaller than 3,000 square feet.

- Driveways need to be at least as long as a standard car plus about a meter to the sidewalk. Anything shorter means the property takes longer to rent and earns less.

- The ideal property size is 1,200 to 1,800 square feet, with one or two stories.

- There are about 140 floor plans that don’t rent well.

- There are many more behavioral characteristics we've learned over the years.

Today, every property we consider must match roughly 40 behavioral characteristics. It’s taken a long time to gather this data, but it’s essential for choosing properties that perform well. Below is a summary of our 17+ year results:

- Average tenant stay of over five years.

- We delivered over 570 properties to 170+ clients worldwide, so we have a lot of data.

- We've had seven evictions in 17 years with a tenant population exceeding 1000.

- We have a less than 2% vacancy rate.

Data is essential but it's not easy to get the specific data you need.

Post: How Are You Stress-Testing Your Deals in Today’s Market?

Post: How Are You Stress-Testing Your Deals in Today’s Market?

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Daniel Sehy,

We haven’t had to adjust our analytics because we’ve always taken a conservative approach. Rent is the most critical factor when evaluating a property, so we estimate it four times: software analysis, manual review, onsite inspection with property manager input, and a final check before listing. Combined with a full accounting of recurring costs, this process has kept our projections accurate across more than 570 properties.

Another key factor is consistency. For over 17 years, we’ve focused on the same tenant demographic. With vacancy rates below 2%, we’ve built reliable projections based on years of historical data specific to this group.

In short, accuracy is everything. One bad assumption can turn what looks like a solid investment into a money drain.

Post: Failed Flip: Stuck in a Fixer Upper for 7 years

Post: Failed Flip: Stuck in a Fixer Upper for 7 years

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Alison Meehan,

You're doing great juggling careers, kids, and home renovations - that's impressive! The good news is that the hardest work is done. Small details like doors, trim, or fence sections are not critical when selling or renting. What really counts are the main systems working well - roof, heating/cooling, plumbing, electrical, kitchens, and bathrooms.

You need to decide: keep the house as a rental or sell it for the cash. Your 2.5% mortgage rate means renting it out could bring in good monthly income. On the other hand, selling would give you access to over $200,000, which could reduce your stress and give you more time for your family and jobs.

Here are a few things to weigh:

- If the house continues to drain your time and energy, selling could be the best “investment” for your peace of mind.

- If you keep it, don’t aim for perfection. Get it rent-ready, since tenants rarely notice the small flaws that owners do.

- Because you qualify for a VA loan, moving into a simpler home while keeping your first property as a rental could give you both income and a fresh start.

In the end, it comes down to your priorities. If long-term wealth through rentals is the goal, holding onto the property may make sense. If reducing stress and freeing up time for careers and kids matters more, selling could be the smarter choice.

Post: Fed Funds Rate vs Long-Term Mortgage Rates

Post: Fed Funds Rate vs Long-Term Mortgage Rates

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Great breakdown. Thank you for the post. I agree that watching the 10-Year Treasury gives a much clearer picture of where mortgage rates are heading than focusing on Fed announcements. In addition, the 30-year fixed-rate MBS price (such as the 30-year UMBS 5.5) should be closely monitored, as it is in lock-step with the mortgage rates, just in opposite directions.

I also agree on your point about documentation—those underwriting requirements aren’t just red tape, they’re what keep the secondary market working and make 30-year fixed loans possible.

Post: How to account for Cap- Ex

Post: How to account for Cap- Ex

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Patience Echem,

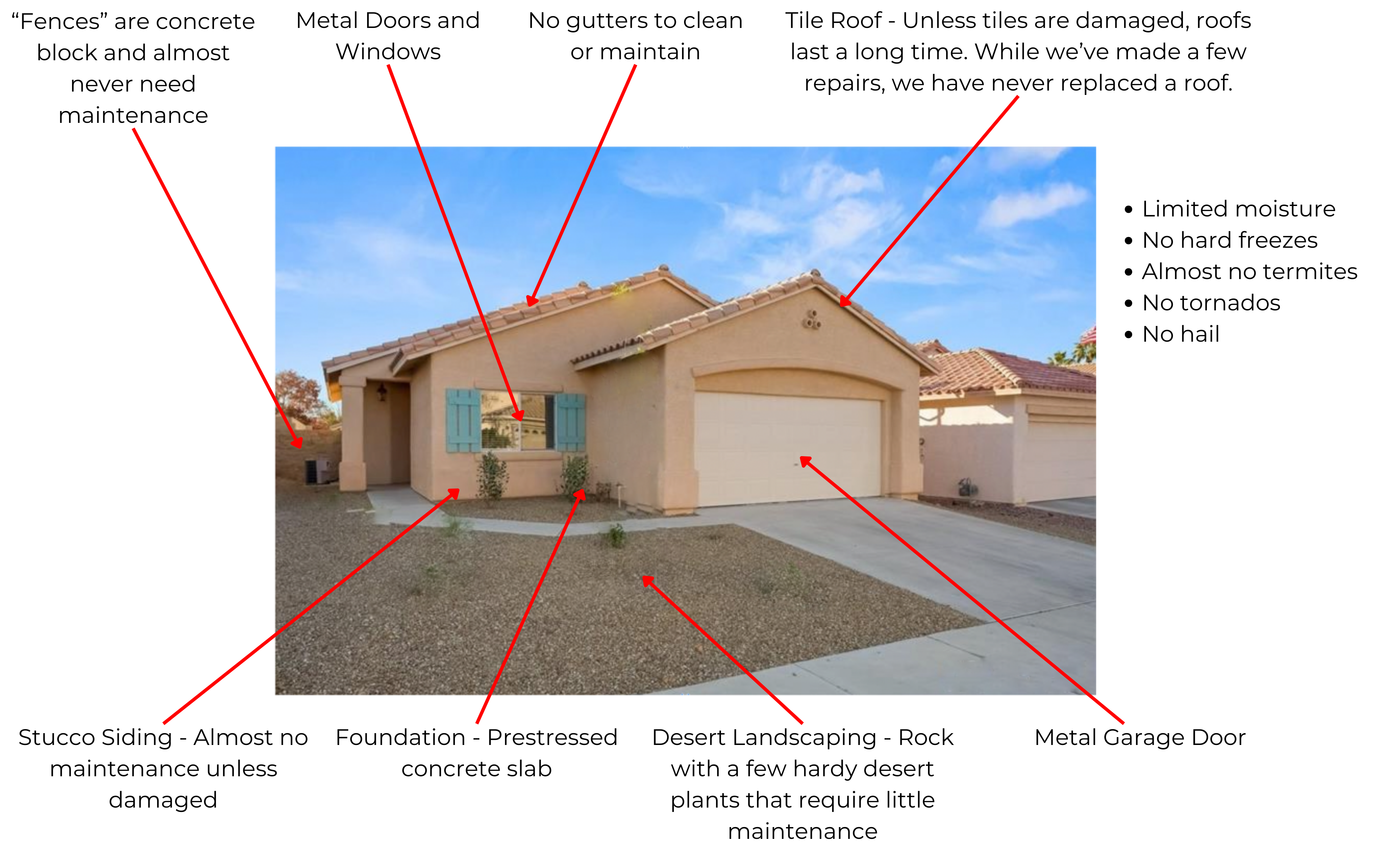

A comment on how much you should set aside for maintenance. The amount depends on the property, local climate, and the type of construction materials used. While I can’t give you an exact number for your property, I can walk you through how to estimate it. The figures I’ll use here come from averages of the 570+ rental properties we’ve delivered in Las Vegas. Because Las Vegas is in the Mojave Desert, with less than four inches of rain a year and no hard freezes, our maintenance costs are much lower than in other parts of the country. Below is typical of our rental properties (click to enlarge).

Provisioning for Major Costs

To calculate a maintenance provision, the standard approach is to base it on the remaining life of major cost components. For example, water heaters in Las Vegas typically last about 12 years on average. However, I've seen them fail as early as six years or continue working beyond 18 years. Useful life is only an educated guess. Use national averages as your guide when making estimates.

In our market, the two most significant costs are air conditioner compressors and water heaters. Tile roofs typically last decades, and in more than 17 years across 570+ properties, we’ve only had to replace the underlayment once. The rest are all minor repairs.

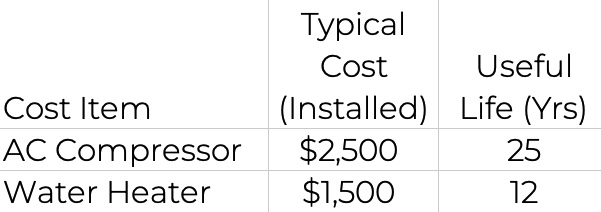

Here are typical costs (for Las Vegas) and useful lives:

Water heater age is easy to determine, since the manufacture date is stamped on the unit. Keep in mind it may have sat in a warehouse for a year or two before installation, so the date isn’t exact but the best we have in most situations. Air conditioners are harder because some parts may have been replaced, but using the manufacture date is usually a good starting point.

Calculate the remaining useful life by subtracting years in service from the useful life:

Calculate monthly provisions as follows:

- AC compressor: $2,500 ÷ 16 years ÷ 12 months ≈ $14/month

- Water heater: $1,500 ÷ 3 years ÷ 12 months ≈ $42/month

Total monthly provision: about $56

You may have more high cost items, like roof replacement.

Base Maintenance

In addition to major components, you should plan for routine repairs—things like dripping faucets, slow drains, or minor fixes.

Across the properties we manage, the five-year average for these base-level repairs is about $400 per year. It won’t be exactly $400 each year—one year could run $1,000, while another might be nothing.

In my experience, monthly cash flow is usually enough to cover these base repairs, so a separate provision often isn’t necessary.

Patience, I hope this helps you calculate a maintenance provision.

Post: Scaling Struggle: What Size should we aim for and How should we try to get there?

Post: Scaling Struggle: What Size should we aim for and How should we try to get there?

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Matthew Banks,

Replacing your income and achieving financial independence is not about hitting a fixed number of doors or dollars. It is about creating an income that allows you to maintain your standard of living for life. To do that, your rental income must:

- Outpace inflation

- Last your lifetime

- Arrive reliably each month

- Fully replace your current income

This is why the focus should be on the right markets and tenant segments, not on a door count or dollar target.

Choosing the Right Market

Rents follow property prices, and property prices are driven by supply and demand. In cities with significant and sustained population growth, demand rises faster than supply, which pushes both prices and rents higher. In cities with stagnant or declining populations, prices remain low and both appreciation and rents lag behind inflation.

Why Tenants Matter

Properties don’t pay rent, tenants do. Financial independence depends on your property being consistently occupied by reliable tenants who stay for years, pay on time, and take care of the home. These tenants are not the norm. By interviewing property managers, you can identify which tenant segments have a high percentage of reliable people. (If you’d like, I can share the questions to ask property managers to discover this.)

Once you know the segment, find out where and what they rent, then buy similar properties. That’s all there is to it. There is no pre-determined property type to chase after; only buy properties that attract reliable tenants. Does this work? We’ve applied this approach for 17 years/570+ properties, and below are the results:

- Average tenant stay of more than five years

- Only seven evictions out of more than 1,000 tenants over +17 years

- Zero rent declines and vacancies during the 2008 crash

- Average vacancy rates under 2%

In Summary

If your goal is financial independence, measure every decision against that goal. Choose cities with significant and sustained population growth and buy properties that attract tenant segments with a high concentration of reliable people.

With the right team, you don’t need to manage the details yourself. Out of our 170+ clients, fewer than 10 lived locally, yet many now live fully on their rental income. Also, I own five properties near my home and manage none of them.

Finding a skilled property manager is critical, and not always easy. In my years as a Las Vegas realtor, I’ve only found two I fully trust. If you’d like guidance on how to identify the right property manager where you target, send me a DM.

Post: Should I keep or sell my duplex?

Post: Should I keep or sell my duplex?

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Mark Vesu,

I propose a simple process for deciding whether to sell or hold a property. First, though, you need to define your goal. Is your goal short-term cash flow, or lifelong financial independence? For this post, I’ll assume your goal is lifelong financial independence.

Financial independence is not a one-time event or a fixed dollar amount. It means maintaining your standard of living throughout your lifetime. To achieve this, your rental income must:

- Increase faster than inflation

- Last for as long as you do

There are other requirements, but to keep this post short, I will skip the others.

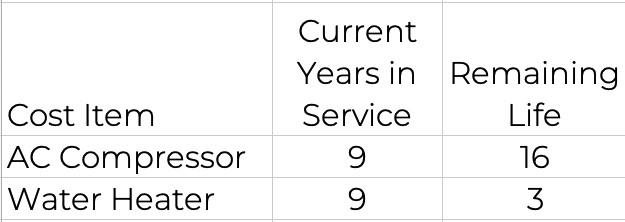

To simplify the decision-making process, I created the following decision tree. If your only goal is short-term cash flow, this tool won’t be the best fit.

In Summary

Every property should be evaluated based on how they have performed towards meeting your goals. For many, rents and prices have not outpaced inflation, and the only way to achieve financial independence is to sell the current property and buy a replacement in a location that will enable lifelong financial independence.

Live where you like but invest where you can achieve your goals.

Post: Scaling Rentals with DSCR Loans — Who’s Using Them?

Post: Scaling Rentals with DSCR Loans — Who’s Using Them?

- Realtor

- Las Vegas, NV

- Posts 818

- Votes 1,569

Hello @Kelly Schroeder,

Some of our clients use DSCR loans once they've reached the limit of ten conventional mortgages. There are portfolio loans but they come with issues that I will not discuss here.

For example, one client inherited three 4-plexes in Las Vegas. Because of tenant challenges (non-payment, property damage, evictions, etc.), they are replacing them with single-family homes for better cash flow and income reliability. The client is using DSCR loans to acquire six or seven replacement properties per multifamily relinquished.

The other client segment that uses DSCR loans is international clients, as well as others who can't qualify for conventional financing.

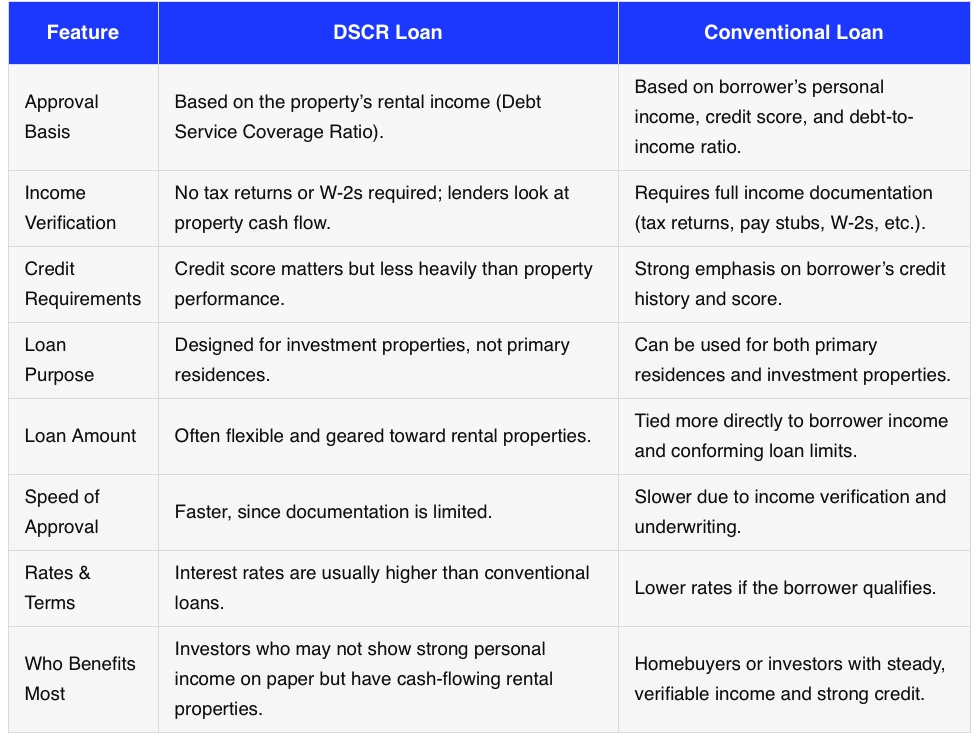

While we've facilitated a number of DSCR loans, I'm not a lender and only have limited knowledge. Below is my understanding of how DSCR loans compare with conventional loans.

I hope this helps.