All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 788 times.

Post: Understanding DSCR Loans — Worth It for Investors?

Post: Understanding DSCR Loans — Worth It for Investors?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Brandon Lee,

One of our clients purchased twelve properties in the last two months using DSCR loans. This same client has bought more than 20 properties from us and plans to purchase six more in November, again using DSCR loans because of the number of mortgages they have. Like every other loan option, DSCR loans have advantages and disadvantages.

Advantages:

- Easier to qualify: Lenders focus on the property’s rental income instead of the borrower’s personal income.

- No property limits: DSCR lenders don't restrict the number of properties you can finance.

- Ideal for international buyers: Most international clients don't qualify for conventional loans, so DSCR loans are often their only financing option.

Disadvantages (compared to conventional loans):

- Higher interest rates: DSCR loans typically cost more than standard mortgages.

- Larger down payment: They usually require more money upfront.

- Cash flow requirements: If a property’s rental income doesn’t meet the lender’s debt service ratio, the property may not qualify.

- Not for primary residences: These loans are designed for investment properties only.

In short, DSCR loans provide flexibility but come with higher costs, larger down payments, and stricter rental income requirements than conventional loans.

Are DSCR loans for short term or long term? The DSCR loans our clients typically obtain have a 30-year term. However, if/when interest rates fall, they will likely refinance to lower rates.

In summary, DSCR loans offer both advantages and disadvantages. Due to their higher costs, conventional loans remain the preferred choice for most of our non-international clients.

Post: Should I invest in San Diego, CA?

Post: Should I invest in San Diego, CA?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Rose Cole,

Where you should invest depends upon your goal. If your goal is to own a property in California, anywhere in California will work. If your goal is financial independence, that's a different issue. The saying, “live where you like but invest where you can make money,” is one every investor should take to heart. Long-term financial independence requires a rental income stream that meets the following requirements:

- Rents increase faster than inflation. Every time you shop, you pay more. Inflation is continually increasing prices. Only if your rent increases faster than inflation will you have the additional dollars needed to continue paying inflated prices. If you buy anywhere where rents do not outpace inflation, you can not achieve financial independence no matter how many properties you buy.

- Your rental income must last throughout your lifetime. For that to happen, your tenants need to remain employed at similar wages for decades. However, most U.S. companies only stay in business for about 10 to 18 years. So, if you plan to hold a property for 30 or 40 years, your tenants will likely have to find new employers multiple times. Replacement jobs will only be available if new companies come to the city and create jobs that pay comparable wages for similar skills. When companies are selecting a location to set up operations, the basic requirements include (but are not limited to):

- Low operating costs, since every business has competitors. California is known for high operating costs.

- A business-friendly government, which makes it easier to run and grow a company, California is less pro-business than many other states.

- Your income reliability depends on the tenants who live in your property. To have a steady, dependable income, you need what I call a reliable tenant. A reliable tenant stays for many years and always pays rent on time. These tenants are the exception, not the norm. You can improve your chances of always having reliable tenants by buying properties that appeal to tenant segments made up of stable, dependable people. The other key factor is your property manager. You’ll want someone with the skill to consistently identify and select reliable tenants—a talent that’s rare among property managers.

I will add another requirement for successful investing. No rent control of any kind. California has state-level rental controls (AB 1482). Individual cities may have additional restrictions. Rent control may prevent you from selecting the best tenant, limit your ability to evict non-performing tenants, and not allow you to increase rents fast enough to keep pace with inflation.

I live in Las Vegas, and I will compare the environment for investors here versus California.

- Rent control: None

- Time to evict: 20 to 40 days

- No state income taxes.

- Pro business and pro landlord environment.

- Low operating costs (low property taxes and insurance)

We have completed over 90 1031 exchanges, most of which were from California. There is a reason so many investors have decided to exit California.

Another consideration, whether you buy in your own neighborhood or another state, it's essential to work with a local investment team. Books, podcasts, websites, and seminars provide general concepts, but real investing happens in specific cities, with specific properties, with unique rules, regulations, and market dynamics. You'll also need reliable local service providers you can trust. The only source for all of this is an experienced local investment team. Also, working with an investment team costs no more than working with any other realtor, but you get the benefit of years of experience and all the resources you're going to need.

In summary, do not limit yourself to California. Invest where you can make money.

Post: New and stuck in analysis, looking for advice for how to start

Post: New and stuck in analysis, looking for advice for how to start

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Benjamin Dolly,

From your post, I gathered two main questions:

- Limited capital

- How to get started — I won’t focus on this one, since I don’t believe it’s the biggest challenge right now.

Limited Capital

Operating with limited funds can be risky. In my opinion, you need to have three different “buckets” of funds:

- Emergency funds: Cash reserves you can access immediately if something unexpected happens. I keep six months of expenses in reserve.

- Real estate investment funds: Money set aside specifically for property purchases and improvements. Real estate is not liquid, so you can’t access these funds quickly.

- Liquid assets: Stocks or similar investments that can be converted to cash quickly if needed.

You mentioned being able to afford a 20% down payment, but that’s only part of the total cost. Here’s an example based on a $400,000 property in Las Vegas, which you can scale to other price points:

- Down payment: 20% × $400,000 = $80,000

- Closing costs: 3% × $400,000 = $12,000 (including points buy downs)

- Renovation costs: $20,000 (typical for the types of properties we target)

- Total cash needed: $112,000

So in this case, you’d need about $112,000 in total, not just the $80,000 for the down payment.

If the property doesn’t rent immediately, you’ll need to cover mortgage payments and expenses until it does. Also, will a 20% down payment still produce positive cash flow—if not, you’ll have to fund the difference until rent increases. And don’t forget about unexpected repairs, such as replacing a water heater or other major systems.

When my business partner and I started, we set one clear rule: “No one gets hurt on our watch.” We’ve turned down clients who wanted to buy high-risk properties or who didn’t have enough financial cushion to invest safely. Unless I’ve misunderstood your situation, I wouldn’t recommend investing until you have accumulated sufficient funds.

Post: Does long term rentals still work to build wealth?

Post: Does long term rentals still work to build wealth?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Charles Bishop,

Long-term rentals is the easiest and safest path to financial independence, provided you buy in a good investment city and your property is occupied by reliable tenants. The requirements.

- Investment city - The city matters most. Choose a city where rents and prices have consistently outpaced inflation. Every time you shop it costs more and more to buy the same goods and services. The only way you will have the income you will need to pay future inflated prices is if your rents increase faster than inflation. And, if prices of existing homes rise faster than inflation, you can acquire additional properties with minimal additional cash from savings using cash-out refinancing.

- Income reliability - Tenants pay rent, not properties. You need your property occupied by tenants who stay for many years and pay on time, which I call reliable tenants. Through property manager interviews, you can identify the segment(s) with a high concentration of reliable people. Then, buy properties similar to what and where they are currently renting.

Does this city and tenant segment driven process work? Below are our 17+ year results.

- We have delivered over 580 investment properties to over 170 clients worldwide. Less than 10 clients were local. All the rest lived in other states or countries. Also, we've never met 60% of our clients and a significant percentage have never been to Las Vegas.

- Our clients, on average, buy three or more properties because their properties continue to perform.

- Our average tenant stays over five years. This is due to the demographic we target which is families with young children.

- We've had seven evictions in the last 17+ years (over 1,000 tenants). This is due to the demographic we target, the skill of the property manager we work with, and the pro-landlord environment in Las Vegas.

- 2008 crash - Zero decline in rent and zero vacancies. The demographic we targeted have direct revenue producing, mission critical, or government jobs. They didn't lose their jobs so there was no decrease in rent or vacancies.

- Since 2015, the average annual appreciation and rent growth rates were 9% and 7%, respectively.

- Less than 2% vacancy rate

Where did I come up with this method? National retail chains. National retail chains have used these methods for almost 100 years and they are very good at what they do. I learned how companies like Whole Foods, Trader Joe's, Costco, Barnes & Noble, McDonald's and others select store locations and how to attract their target demographic based on offerings. I just did what they did.

Remote Investing

The odds that you live in a city that meets the requirements for financial independence are small. You need to invest where you can achieve long term financial independence. And, even if you were investing in your hometown, you need to work with an experienced investment team.

Everything you learn from books, podcast, seminars, websites, is general information. You're going to buy a specific property, in a specific location, subject to specific local conditions, and you will need local resources. An experienced local investment team has everything you need. And, you cannot duplicate the years of experience and resources a team of experts already possesses. And the best part is working with an investment team costs no more than working with any other realtor. Additionally, you get a master class on real world investing.

Summary

Long-term rentals are the easiest and safest method for achieving long-term financial independence. Millions have already done it and you can too. However, not just any rental in any city will do. You have to pick the city based on long-term performance and the tenant segment based on income reliability. Then purchase properties similar to what they're renting today.

Post: Advice on building equity or cash flow

Post: Advice on building equity or cash flow

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Jessica Yuan,

You need both. Cash flow pays bills, and appreciation grows wealth.

If your goal is long-term financial independence, then you need a rental income that increases faster than inflation and will last throughout your lifetime. Also, you'll likely need more than one property to replace your current income so you need to acquire multiple properties with the least additional capital.

Rents follow property prices, with a 2 to 5 year lag. When prices are high, fewer people can't afford to purchase so they are forced to rent. The increased demand for rental properties increase rents. When prices are low, more people can afford to purchase and fewer people rent leading to static or declining rents.

The city requirement for rising prices and rents can be summarized as follows:

-

Significant and sustained population growth. Population growth is the demand side of the supply and demand equation.

-

Low crime. People move to a city for a job. They don't just randomly move. Companies hesitate to set up new operation in cities known for high crime.

-

Low operating costs. Every dollar you lose to overhead is a dollar less for you to live on. Some states, like Texas and Florida, have very high operating costs. Nevada has relatively low operating cost. Here’s a comparison of average homeowners insurance costs and property tax rates in 2025 for Florida, Nevada, and Texas:

State Avg. Homeowners Insurance (Annual) Avg. Property Tax Rate Typical Annual Property Taxes Florida $2,625 [per year]nerdwallet 0.80% ~$2,338 makefloridayourhome Nevada $1,305 [per year]nerdwallet+1 0.50% ~$1,335 (on $267K median) worldpopulationreview+1 Texas $4,585 [per year]nerdwallet 1.60–2.50% ~$5,200–$7,500+ (on $325K) hometaxsolutions

Key points:

- Florida and Texas rates can be much higher in coastal or urban areas, and local tax rates vary. Nevada also offers some of the lowest property taxes nationwide.

Sources:

- Homeowners insurance: National/state averages for $300K dwelling coverage with typical deductible.nerdwallet+1

- Property tax: State/local government averages and example calculations.makefloridayourhome+3

- https://www.nerdwallet.com/article/insurance/average-homeowners-insurance-cost

- https://www.makefloridayourhome.com/florida/blog/property-tax-in-florida

- https://www.nerdwallet.com/insurance/homeowners/nevada-home-insurance

- https://worldpopulationreview.com/states/nevada/property-tax

- https://smartasset.com/taxes/nevada-property-tax-calculator

- https://www.hometaxsolutions.com/2025/06/how-property-taxes-are-determined/

- https://www.nerdwallet.com/insurance/homeowners/florida-home-insurance

- https://www.bankrate.com/insurance/homeowners-insurance/states/

- https://www.axios.com/2025/08/26/home-insurance-premiums-cost-map

- https://matic.com/cost-of-homeowners-insurance-guide/

- https://www.moneygeek.com/insurance/homeowners/average-home-insurance-cost-calculator-texas/

- https://www.greatflorida.com/blog/2025/how-much-is-home-insurance-in-florida/

- https://www.kiplinger.com/taxes/floridians-vote-to-increase-property-tax-break

- https://www.moneygeek.com/insurance/homeowners/average-cost-home-insurance-nevada/

- https://states.aarp.org/texas/texas-homeowners-insurance-rates-rise

- https://www.texastribune.org/2025/06/04/texas-legislature-property-tax-cuts-2025/

- https://www.marketwatch.com/insurance-services/homeowners-insurance/average-home-insurance-cost/

- https://www.rocketmortgage.com/learn/property-taxes-by-state

- https://www.insurance.com/home-and-renters-insurance/home-insurance-basics/average-homeowners-insurance-rates-by-state

- https://belonghome.com/blog/property-taxes-by-state-2025

I hope this helps.

Post: Buying a property with tenants that don’t pay

Post: Buying a property with tenants that don’t pay

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Johnathan Cummings,

It really comes down to the cost and the time it takes to evict someone. Ideally, you’d want them to agree to a cash-for-keys arrangement, but that may not interest them. Right now they’re living rent-free, so there’s little motivation for them to move somewhere else and start paying rent, even if you hand them cash.

Eviction timelines vary a lot depending on the state and even the county. For example, here in Las Vegas, if a tenant doesn’t pay rent but hires an attorney and drags the process out in court, it usually takes somewhere between 17 and 35 days before they’re out. On the other end of the spectrum, I had a client in another state who went through an eviction that lasted 18 months.

You also have to factor in potential damage. If someone is essentially squatting and you force them out, the risk of them trashing the property is very real. Back in 2008 and 2009, during the foreclosure wave, I saw cases where people poured concrete down drains, stripped copper wiring from the walls, left water running to flood properties, and caused extreme mold damage. The cleanup costs were huge. Because of that, I always plan for the worst, even while hoping for the best.

My recommendation is to first get a clear understanding of how long it will realistically take to remove this person if they fight the eviction process every step of the way. If the cost and timeline are manageable, I would still try to negotiate a cash-for-keys agreement to get them out without damage. Keep in mind, if they have poor or no credit, there’s very little leverage beyond the eviction process itself.

Even though you might feel like you’re getting a bargain—the seller probably factored in the hassle of removing the tenant. So, no matter how attractive the price or financing looks, if you can’t get the tenant out, the property turns into a money pit. So it’s crucial to plan carefully before moving forward.

Post: im just getting into real estate. need advice

Post: im just getting into real estate. need advice

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Some additional thoughts that I wanted to include.

Real estate investing is the common man’s path to financial independence. And, if you follow proven processes by companies like the ones below, your odds of success are high.

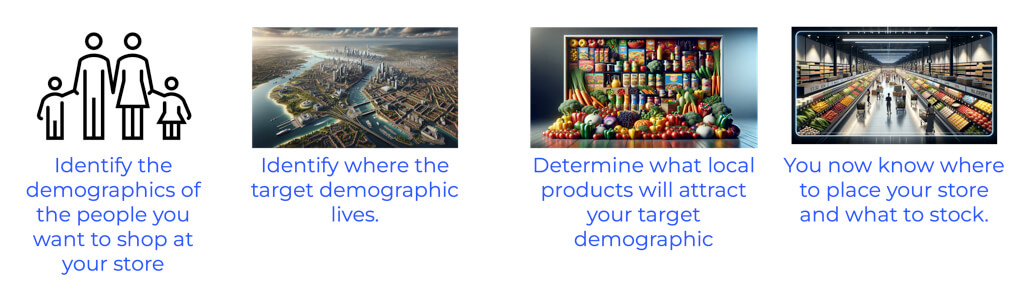

National retail chains follow a straightforward process when selecting store locations and localizing their inventory (click to enlarge):

The same process works in real estate.

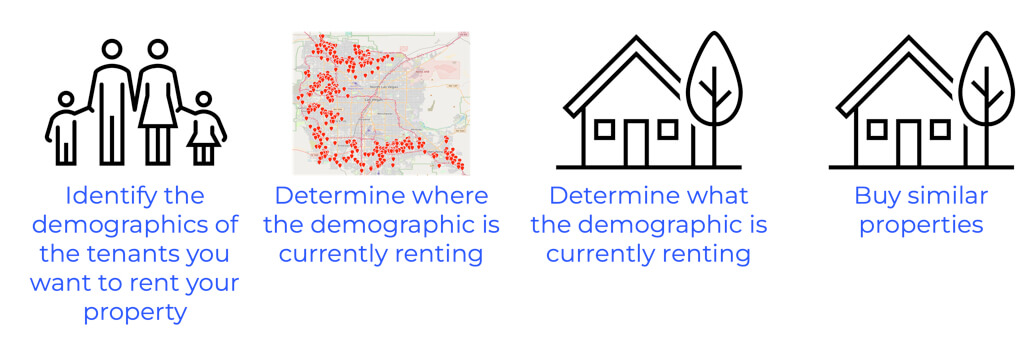

No property ever paid rent; the tenant pays the rent. So the process is:

- Identify a tenant segment that stays many years, pays the rent on schedule, and does not cause damage to the property.

- Determine what and where they rent today

- Buy similar properties

Do not listen to others’ opinions because every city is different; what works in Cleveland will not necessarily work in Houston. And, always remember, real estate investing is about making money, not conforming to property type dogma.

To identify a tenant segment that stays many years and pays rent on schedule, ask multiple property managers this question: "If you wanted to buy rental properties where tenants stay long-term and pay reliably, what and where would you buy?" When starting my business, I first used research to identify tenant segments with the right behaviors. I then verified my findings by asking about 15 property managers a similar question. Remarkably, 13 of the 15 property managers identified the same properties.

Has our tenant segment focused method worked? Here are 17+ years results:

- We have delivered over 580 investment properties to over 170 clients worldwide.

- On average, our clients buy three or more properties because of consistent results.

- Our average tenant stays over five years.

- We've had seven evictions in the last 17+ years (over 1,000 tenants).

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID eviction moratorium - almost no impact

- Since 2015, the average annual appreciation and rent growth rates were 9% and 7%, respectively.

- Less than 2% vacancy

Summary

Tenants pay the rent, not the property. What you need to be successful is to always have your property occupied by people who stay for many years and pay the rent on schedule. And, do not make any assumptions or guesses. Follow the method used by national retail store chains.

Post: Evaluating established rental properties

Post: Evaluating established rental properties

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Kevin Mertus,

Stocks, bonds, and CDs play a different role than real estate.

Stocks

Stocks are for capital accumulation. Once you have accumulated enough capital you draw down a monthly amount. How much you need to accumulate depends on how much you need each month and how long you expect to live after retirement. For example, if you need $10,000 a month for 30 years, that’s about $3.6 million assuming no inflation and no market crashes. If there is a 5 percent average inflation with no market crashes, then you need to accumulate about $8 million before you retire. Hitting either number is tough for most people.

Advantages

- Near-instant liquidity

- Easy to start with small amounts

- Values are simple to track

Disadvantages

- You must consistently beat inflation and ride out crashes for your drawdown period, which even the best money managers are unable to do.

- Allocate time to monitor the markets and react

- Limited tax advantages, little or no leverage

- Monthly withdrawals reduce principal and make diversification more difficult.

Rentals

With rentals, my goal is to own enough properties so net rent replaces my paycheck. In the right market, I can add doors with modest new capital after the first purchase through cash-out refinancing. Rents in strong cities tend to outpace inflation while major costs stay fixed with long-term, fixed-rate loans. Tax tools like depreciation and 1031 exchanges improve after-tax results. The right tenant segment keeps income steady, and with an experienced local team, my time commitment stays low.

Advantages (when I invest in the right city)

- Inflation-adjusted rent growth can exceed inflation, lifting my standard of living over time

- I need a fraction of the capital required by pure accumulation strategies

- Income can last for life and continue for heirs

- Performance is driven by supply and demand, not daily sentiment

Disadvantages

- Real estate is not liquid

- Market and tenant selection are critical, though the process is straightforward

- Entry costs are higher, often about $140,000 cash plus a mortgage in Las Vegas

Bottom line: stocks are for building a pile, real estate is for building an income stream. They are not the same.

Should you sell?

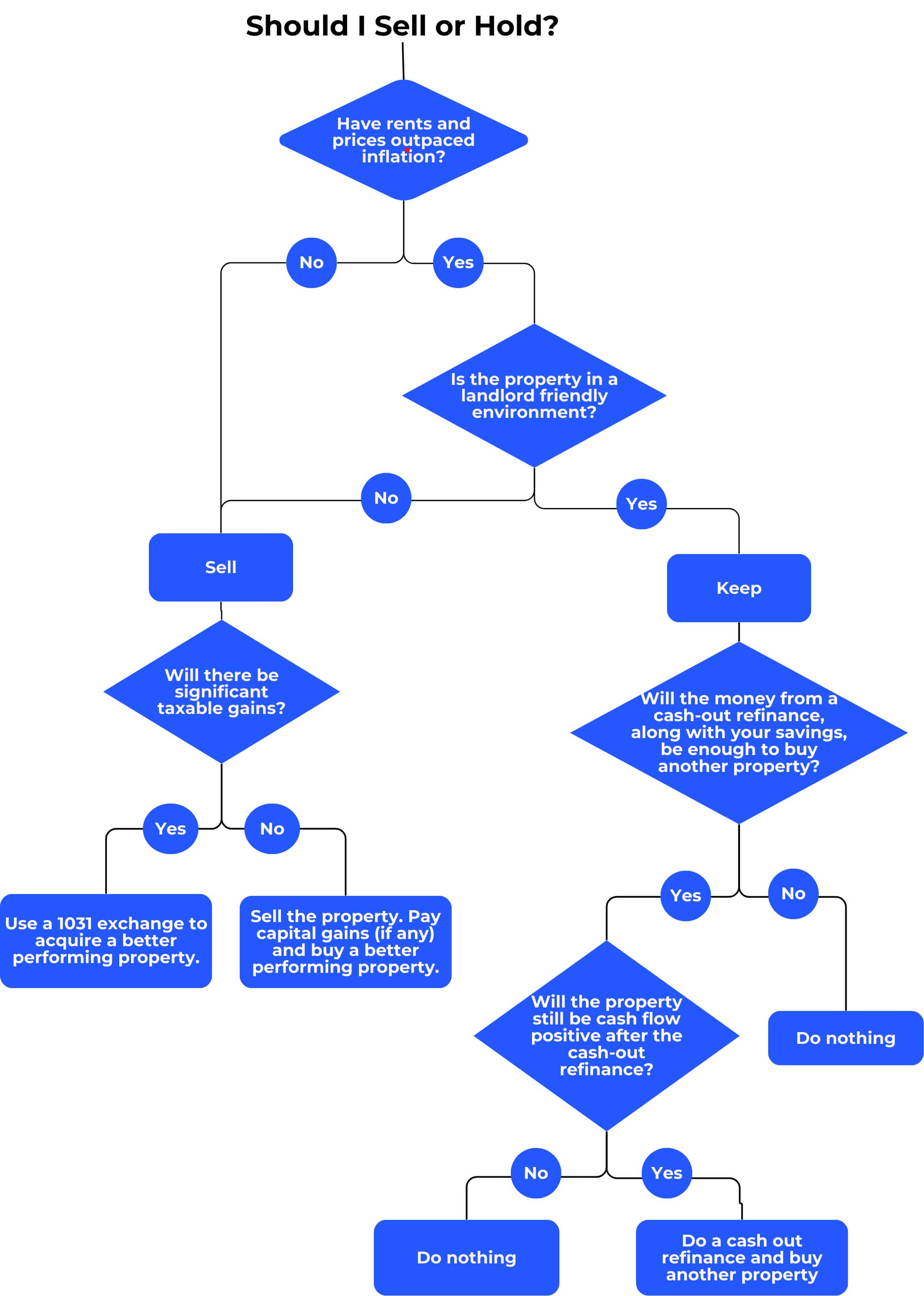

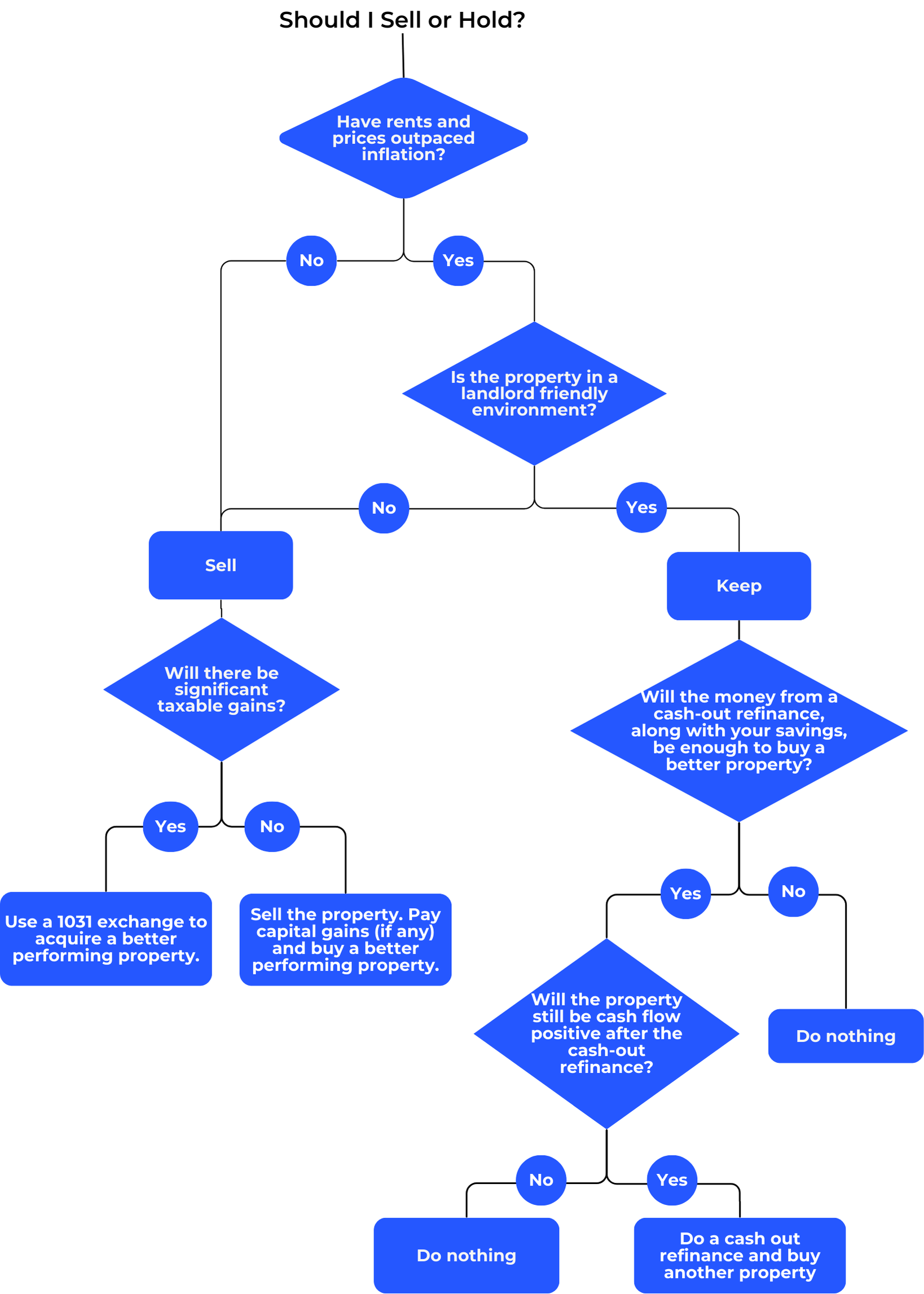

The key test is simple, have your rent and property value outpaced inflation over time?

The old adage: “Live where you like but invest where you can make money” remains true. And, if you work with a local experienced investment team, it does not matter whether you invest in your city or across the country,

I hope this helps.

Post: Accessing Equity and Scaling the Portfolio

Post: Accessing Equity and Scaling the Portfolio

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Chris Berezansky,

You asked a simple question, but there’s no simple answer. Here are a few things I’d consider:

- If you refinance your rental, your rate will likely jump to around 6.5% or higher. That would probably wipe out your cash flow, and for me, it would be tough to give up such a low interest rate.

- If you go the HELOC route, you're right that it's a floating rate loan. Some lenders do offer fixed terms for five to seven years, which could buy you enough time to refinance if and when rates come down.

- House hacking is probably the lowest risk option, though it may take time for you to build up down payment if you can't use another 0% down VA loan. This would be a trade off between time and money.

The bigger question is whether continuing to hold the property or buying more properties in the same area makes sense. That depends on your long-term goals. If financial independence is the objective, then the income from your rentals has to meet certain requirements:

- Rents and prices need to rise faster than inflation.

- Operating costs must stay low. The two biggest costs investors face are property taxes and insurance. For example, I own two homes of similar value, one in Las Vegas and one in Austin. In Las Vegas, I pay about $2,200 a year in property taxes. In Austin, the taxes are over $10,000 a year, and the rent per square foot in Vegas is actually higher than in Austin.

I created this decision tree to help investors think through whether to refinance, hold, or sell:

In my view, there’s more to consider than just interest rates. To live on rental income in the future, you need rents that consistently grow faster than inflation. If they don’t, then no matter how many properties you own, it won’t add up to sustainable financial independence.

Post: September Las Vegas Rental Market Update

Post: September Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,570

Hello @Young Yim,

There are overall trends, and then there are individual properties. Even if the general trend is strong, a specific property may not perform as well, and vice versa. Starting in August, we hit a slower time of year for rentals, which you can see in the stats we posted. Part of the challenge is that we focus on families with children, and once school starts in mid-August, demand slows down. The impact is more pronounced for larger homes such as yours (you have a beautiful property in a highly desirable location). As a result, it’s taking longer to lease, and we’re not getting the higher rents we had expected.

I will reach out to the property manager and get back to you via email.