All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 788 times.

Post: Scaling Rentals with DSCR Loans — Who’s Using Them?

Post: Scaling Rentals with DSCR Loans — Who’s Using Them?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Kelly Schroeder,

Some of our clients use DSCR loans once they've reached the limit of ten conventional mortgages. There are portfolio loans but they come with issues that I will not discuss here.

For example, one client inherited three 4-plexes in Las Vegas. Because of tenant challenges (non-payment, property damage, evictions, etc.), they are replacing them with single-family homes for better cash flow and income reliability. The client is using DSCR loans to acquire six or seven replacement properties per multifamily relinquished.

The other client segment that uses DSCR loans is international clients, as well as others who can't qualify for conventional financing.

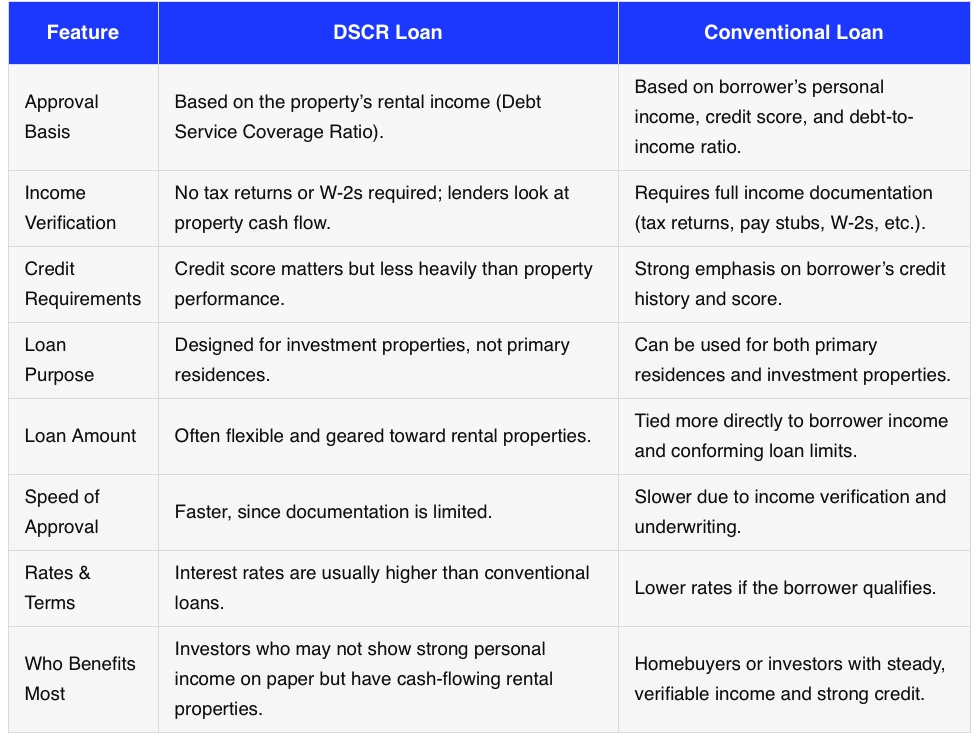

While we've facilitated a number of DSCR loans, I'm not a lender and only have limited knowledge. Below is my understanding of how DSCR loans compare with conventional loans.

I hope this helps.

Post: Starting out in LA / Vegas

Post: Starting out in LA / Vegas

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Jacob Coakley,

Whether Las Vegas is a good investment city depends on your goals. If your only focus is immediate cash flow, cities like Memphis or Cleveland with declining populations and inexpensive houses are likely your best option. But low prices reflect weak long term demand due to the decrease in population. So, you will see limited rent and price growth. In markets where rents and values don’t outpace inflation, lifelong financial independence is not achievable—the purchasing power of your rental income (and equity) continues to decline.

If your goal is lifelong financial independence, Las Vegas stands as one of the best markets in the country. The reason is straightforward: supply and demand.

Supply

- Land supply is fixed. Las Vegas has little undeveloped land left, and the metro consumes 4,000–5,000 acres annually. A recent report by Applied Analysis found the valley could run out of land in as little as seven years. That scarcity pushes land prices in desirable areas above $1 million per acre and drives new home prices starting at $550,000. See the 2022 aerial view below. There is no area for expansion.

- Affordable inventory is limited. For more than 17 years, we've focused on families earning $60,000–$85,000 (today's dollars) a year. This income range can only rent single-family homes priced between $350,000 and $475,000 today. The starting cost of desirable new single-family homes is $550,000 largely due to the high cost of land, resulting in an almost fixed supply of homes in the $350,000–$475,000 range.

Demand

- Demand continues to climb. Las Vegas adds 40,000–50,000 new residents each year mostly due to job growth. At the most recent major job fair, there were over 20,000 open positions with average annual wages of $65,000. Las Vegas is a blue-collar city, not a high tech city.

- Future jobs. According to Clark County, projects currently planned or underway in Southern Nevada total an estimated $31.1 billion, signaling a strong pipeline of future job growth.

With a fixed supply of homes in the $350,000–$475,000 range and demand driven by significant population growth, rents and property values continue to rise. In the segment we target, since 2015, rents have increased an average of 7% per year, and prices have increased an average of 9% per year.

Summary

If your only goal is immediate cash flow, I wouldn’t recommend Las Vegas. However, if your goal is lifelong financial independence, quality Las Vegas properties will provide the income necessary to achieve it.

Post: How many people do actually really live 100% off rental cash flow?

Post: How many people do actually really live 100% off rental cash flow?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Marcus Auerbach,

We have several clients who live 100% off their rental income. The problem is not real estate; the problem is where you purchased the real estate. If you buy in a city where rents do not increase faster than inflation, no matter how many properties you own, you can never live off your rental income sustainably.

Here is the problem.

Suppose you buy properties in a city where rents increase 2%/Yr, the initial rent is $1,000/Mo, and inflation averages 4%/Yr. Below is the buying power (in current value dollars) after 5, 10, and 15 years.

- After 5 years: $1,000 × (1 + 2%)^5 / (1 + 4%)^5 ≈ $907. Even though rent increased to $1,104, it didn’t keep up with inflation. $1,104 in 5 years has the same buying power as $907 today.

- After year 10: $823

- After year 15: $747

Unless you invest in a city where rents grow faster than inflation, your buying power, which is what you live on, will continue to shrink, making it impossible to live sustainably on rental income alone. We’ve closed more than ninety 1031 exchanges for clients moving out of markets where rents and property values didn’t keep up with inflation.

Post: Comparing IRR of real estate vs. other investment types

Post: Comparing IRR of real estate vs. other investment types

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Becca F.,

A client and I recently did an IRR comparison between real estate and stocks to help him decide his next investment move. Below are our calculations, shortened to make the post a reasonable length.

IRR Comparison

I've prepared the following comparison to illustrate how stocks and real estate investments are likely to perform over a five-year period. I limited the timeframe to five years because extending beyond that almost certainly involves some type of market correction (crash?), which greatly favors real estate. I will compare the IRR of investing $100,000 in stocks versus $100,000 in a rental property over this five-year period.

Assumptions

- Stocks: 8% annual price growth, no dividends, 15% capital gains tax at sale, no transaction costs, no market corrections.

- Real Estate: $400,000 property, 25% down ($100,000), 30-year fixed mortgage at 7%, $2,000 monthly rent (growing 6% per year), 8% annual appreciation, $2,200 yearly property tax, $1,000 yearly insurance, 5% disposal cost, 25% depreciation recapture on improvements.

Stock Results

After five years, $100,000 grows to about $146,933. The capital gains tax would be $7,040, which leaves leaves $139,893. That's an IRR of roughly 6.9%.

Real Estate Results

Five years of 8% appreciation raises the property value to $587,731. After selling costs, depreciation recapture, and paying off the mortgage, net proceeds are about $261,481. In this scenario, annual cash flow starts negative due to mortgage payments but improves each year as rents rise. Total cash flows produce an IRR of 20.7%.

Even with a $10,000 maintenance or vacancy hit in year two, the IRR only drops to 19.1%.

If you want to see the detailed calculations, go here.

Why Real Estate Wins

Real estate benefits from:

- Leverage – Using a mortgage magnifies returns.

- Income Growth – Rents increase over time if you invest in a city with significant and sustained population growth.

- Tax Advantages – Depreciation shields income during ownership.

Stocks rely solely on price appreciation, with limited cash flow and fewer tax benefits. Even at today’s interest rates, quality rental properties in strong markets outperform stocks. If rates fall, the gap widens.

The numbers here use conservative estimates for the types of properties we target. In practice, actual returns can be higher, but the advantage of well-selected real estate over a comparable stock investment is clear.

Debate aside, I genuinely believe that a good portfolio should include both real estate and stocks to balance.

Post: Getting started as an investor with some questions

Post: Getting started as an investor with some questions

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Giovanni Rodriguez,

If your goal is financial independence, real estate investing is straightforward if you follow three key steps:

- Location: The market you invest in determines long-term income potential. Only invest in cities where rents grow faster than inflation. Otherwise, no matter how many properties you buy, you won’t achieve sustainable financial independence.

- Tenant segment: Properties don’t pay rent, tenants do. Success depends on consistently renting to reliable tenants: people who stay for years, pay on time, and take care of the property.

- Property selection: Once you’ve identified a reliable tenant segment, look at what and where they currently rent. Then buy similar properties. Do not follow the opinions of others. Let the tenant segment you want to occupy your property make all the property selection decisions.

This three step approach removes guesswork, reduces risks, and keeps you focused on financial outcomes, not outside opinions. If you want to know more about how to obtain the data needed, let me know.

You mentioned having limited capital. The reality is that investing requires both cash and credit. And the down payment isn’t your only cost. For example, on a $400,000 property:

- Down payment: $100,000 (25%)

- Closing costs: $6,000 - $12,000 (depending on points buy down)

- Renovation: $15,000 (typical)

- Total: $121,000 - $127,000

You can find cities where properties sell for much less in places like Cleveland or Memphis. But those markets have declining populations and weak housing demand. Since rents follow property values, rent growth is slow. While low prices may seem attractive, they won’t help you achieve or sustain financial independence.

I know this may not be the answer you were hoping for, but I know of no shortcuts. Real estate investing is a business, and like any business, it requires capital and credit. Building both may mean taking on extra work or cutting expenses so you can save more while improving your credit. If your goal is financial independence, this is the only way.

Post: AI-bubble? What will happen to real estate when it bursts?

Post: AI-bubble? What will happen to real estate when it bursts?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

The impact largely depends on the tenant segment that occupies your properties. If your tenants work in AI-related roles, you could see some effect on occupancy. For tenants in other fields, the impact is likely minimal (at least for the near future).

What we are seeing, however, is a broader shift. As AI replaces certain software development and rule-based, routine desk jobs, the greater risk may come from ripple effects across related industries rather than from AI companies themselves.

We have not experienced significant impact on our client’s properties. For example, during the 2008 financial crisis, our clients saw no decrease in rent and no vacancies. By contrast, properties targeting low-wage tenants were hit hard, with many multifamily abandoned and eventually foreclosed. That’s why it’s essential to understand the demographic your property attracts, the right tenants make all the difference.

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Joseph Snyder,

Thanks for the kind words.

“How do you usually calculate if rents…”

We compare the rent growth rate vs the inflation rate over a given period. We calculate the Compound Annual Growth Rate (CAGR = (Ending Median Rent / Beginning Median Rent) ^ (1/years) - 1) between 2015 and today, for properties that conform to our target property profile. On inflation, we usually use the inflation data from the Bureau of Labor Statistics.

Comparing the CAGR for rent and inflation is how we determine whether rents outpace inflation.

“Renovation enhancements…”

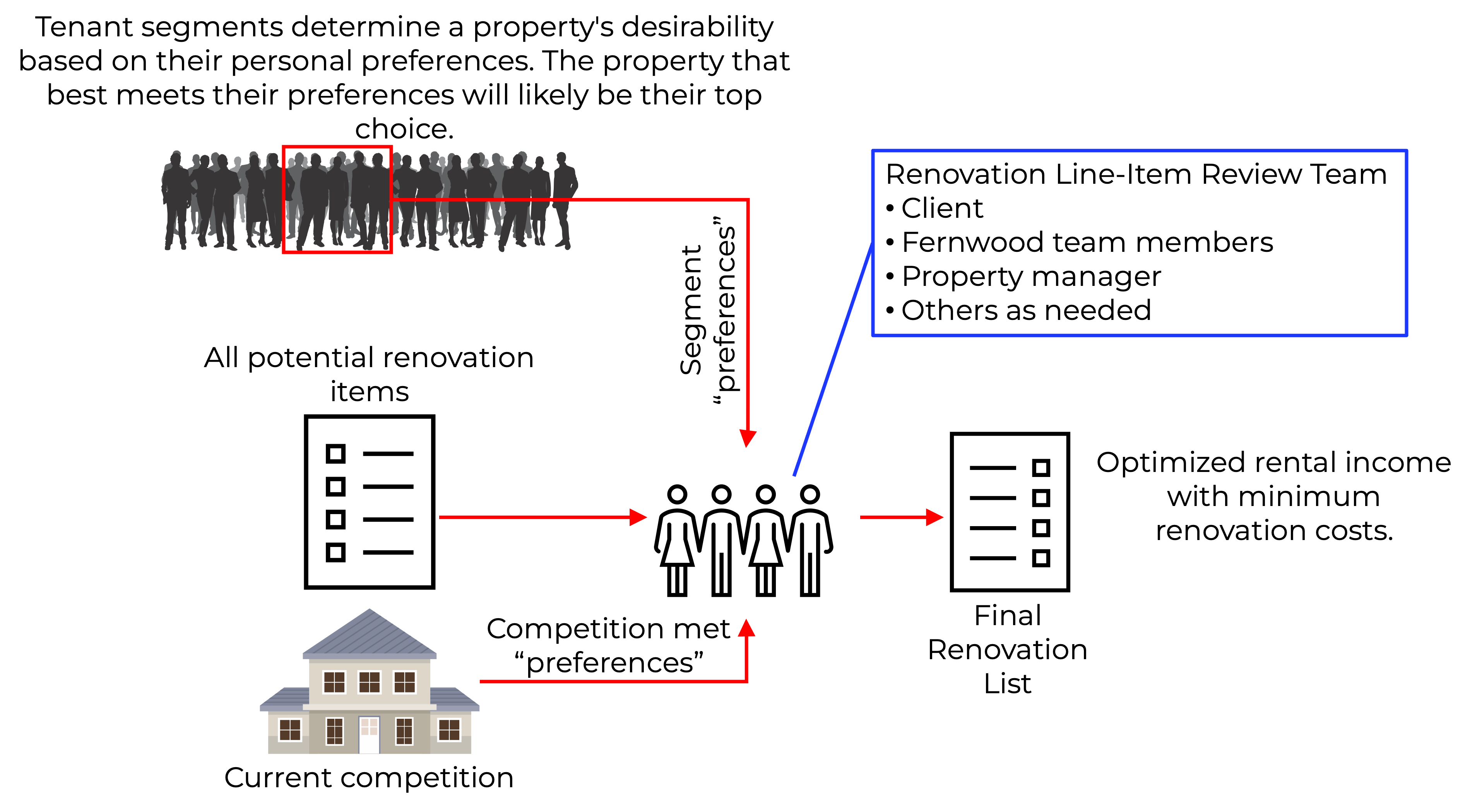

Determining what enhancements will significantly increase rent is more difficult than it seems. We do this in a two step process. First, we come up with a list of all renovation items that would make the house as attractive as possible to our target Tenant segment. We don't care about the cost at this point; we just want to get a consolidated list.

Next, we have a meeting with a team of people where we review each renovation line item and decide whether the ROI is sufficient. See the diagram below.

We start with a detailed list of potential renovations based on the preferences of our target tenant segment. Then we compare the property to competing available properties. Competition isn’t limited to the neighborhood—someone moving to Las Vegas for work may look on either side of town, so a comparable property could be across the city.

We also consider rent sensitivity. The more you spend on renovations, the higher the rent must be, which shrinks the pool of qualified tenants. Depending on market conditions, it can be smarter to limit upgrades to keep costs down and attract a broader tenant base.

As to using this on social media with a shoutout, please do. Thank you.

Joseph, if I wasn't clear or if you have other questions, please let me know.

Post: How Much Cash and Time Are Required to Invest with Us?

Post: How Much Cash and Time Are Required to Invest with Us?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

During new client meetings, the two questions I hear most frequently are, “How much will it cost?” and “How much of my time will be required?” These are important, fundamental questions any investor should consider. In this post, I will provide a detailed rundown on the cash and time required to acquire a good Las Vegas investment property with us.

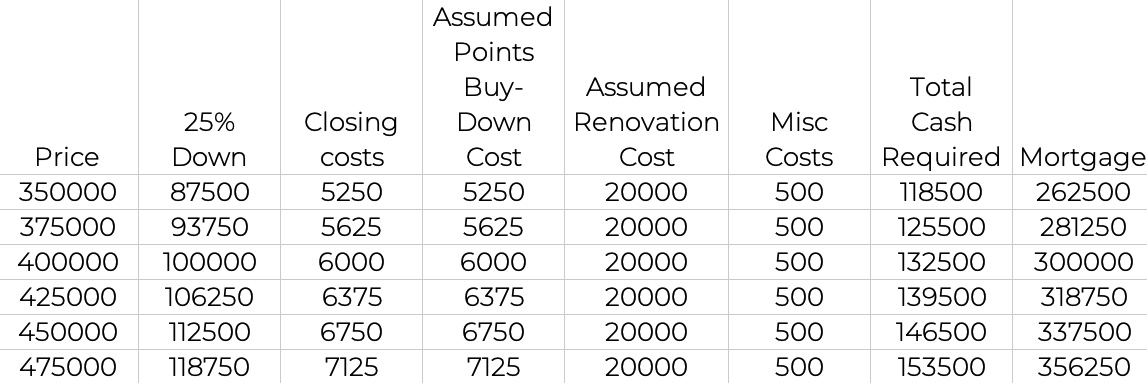

How Much Do You Need to Invest in a Good Las Vegas Investment PropertyMany people only consider the down payment when they’re estimating the cost. There are many additional costs, and below is a reasonable estimate of how much cash you will need to close and bring to (rental) market a $400,000 rental property. Note that some items are property-specific, for example, renovation cost.

- Purchase price: $400,000

- Down payment (25%): $100,000. I used 25% down because this is the most common amount our clients put down.

- Closing cost (financed, not a cash purchase): 1.5% x $400,000 = $6,000. This includes the cost of obtaining a loan, title and escrow fees, home inspection, etc.

- Typical interest rate buy-down cost: 1.5% x $400,000 = $6,000

- Typical renovation cost: $20,000

- Miscellaneous additional costs: $500

Total estimated cash required: $132,500 with a 25% down payment. This investment will also require a $300,000 mortgage. Below is a table showing how much cash and mortgage for different price points.

Notes:

- Property price: Obviously, higher-priced properties will cost more to acquire. However, the narrow property segment we target (to maximize chances of high performance) costs between $320,000 and $475,000 today.

- Our Fees: As outlined in our terms and conditions, we charge 2.5% of the gross sales price. What’s important to understand is that the seller, not you, almost always pays this fee. Out of 560+ properties, our clients have contributed to our fee only six to eight times or, about 1.4% of cases. If a seller refuses to pay our fees, we recommend finding another property.

- Renovation: I used $20,000 as an estimate, but actual costs depend on the property and market. We don’t use a standard upgrade list—just what’s needed to make the property competitive. We start with a full list of possible upgrades in the Property Report, then, during due diligence, narrow it down to only what’s needed to meet the rental goals.

- Buy Down Cost: I estimated the interest rate buy-down at 1.5% of the purchase price for simplicity, though the actual cost depends on your loan amount, down payment, and credit score, and is usually based on the loan amount, not the sales price. I used the sales price to be conservative. The buy-down lasts for the life of the loan, but I expect you’ll refinance to a lower rate if the interest rates drop significantly at some point.

- Down Payment: With the current high interest rates, you may need to put down more than 25% to have a neutral cash flow the first year. How much you need to actually put down depends on the cost to buy down the interest rate and the current interest rate at the time you buy. So there’s no simple answer. I just assumed 25% and 1.5% of the purchase price to buy down the interest rate.

- Miscellaneous Costs: I included a $500 buffer to cover unexpected minor expenses that may arise.

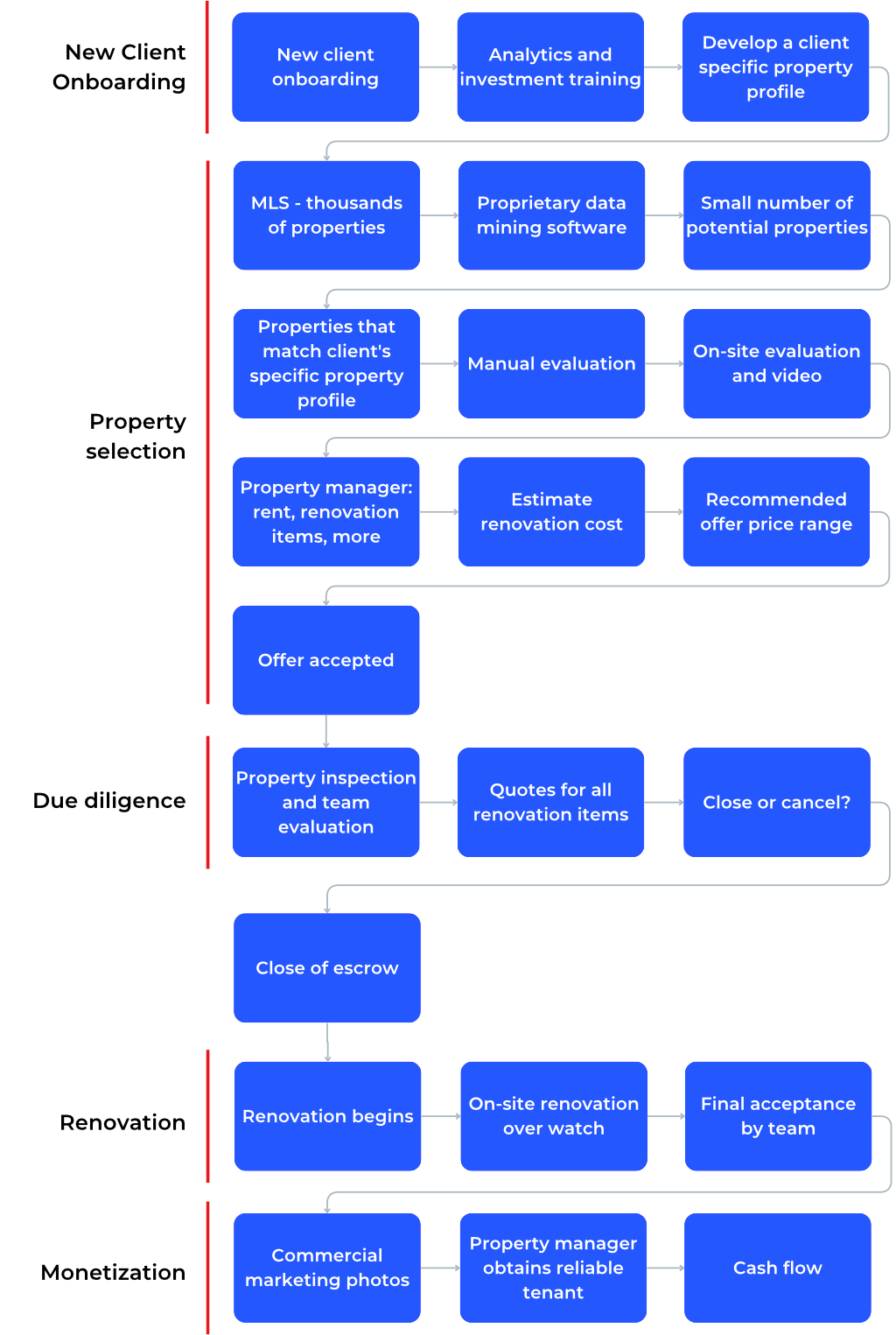

Due to our one-stop, done-for-you services, the typical amount of time that clients need to invest with us is very reasonable. I’ve asked multiple clients what the total amount of time is that they invested, including the first introductory call through getting their first rent check. The answers ranged between 8 and 12 hours total time. What does the amount of time include?

- Initial discovery call: 1 Hour. The purpose of this call is to understand your situation and goals and determine whether Las Vegas and our services are a good match for you. One-on-one with Eric Fernwood or Cleo Li.

- Processes and Fundamentals: 1 Hour. There are no secrets in real estate investing. In this session, we walk you through every step of our process. By the end, you’ll know exactly how we work and can decide if we’re the right fit for your goals. One-on-one with Eric Fernwood or Cleo Li.

- Review and Sign Terms and Conditions: 30 Minutes. Before we share property information, you’ll need to sign a buyer broker agreement. Because the standard agreement can be unclear, we add an addendum to spell out key points—like your right to cancel anytime by email or letter. If we’re not a good fit, you can walk away easily. Our terms and conditions cover several other important topics.

- Analytics and Portfolio Growth: 1 Hour. We show you how we analyze the property so that you understand the information we provide. Also, we explain how you can grow your portfolio with minimal incremental capital. One-on-one with Eric Fernwood or Cleo Li.

- Kickoff Call: in the kickoff call, you will meet with Cleo Li and the account manager. 1 Hour. The topics are typically about current market conditions and understanding your long-term goals so we can make informed property recommendations. One-on-one with Cleo Li and your assigned account manager.

- Property Report Review and Property Selection: Total: 30 minutes. On every property we evaluate that we believe matches your situation and goals, we create a detailed assessment. Initially, these could take a few minutes for you to read. Soon, you’ll be able to evaluate a property in about five minutes with the information we provide. On average, you will look at about six properties before we get one under contract.

- Review and eSign various documents: 30 minutes to an hour.

- Principal Forms of Ownership and Risk Reduction: Optional 1 hour meeting. In this meeting we will discuss what I have learned from sitting in on client attorney meetings. The goal is to be aware of the pros and cons of the various forms of ownership. Also, you will learn why we remove certain things from rental properties during renovation.

- Meet the Property Manager: 1 Hour. In this session, you’ll learn about being a landlord in Las Vegas, fees, tenant selection, maintenance, when rent is deposited, and more. This is a one-on-one meeting with the property manager.

- Final closing signing: 1 hour if financing, 15 – 30 minutes if cash.

The total time is about 7.5 to 9 hours, but most clients will spend 8 to 12 hours in total, including additional questions and meetings. This covers everything up to your first rent check. (For a more detailed description of our processes and services, click here.)

Other related questions:

- Do you need to come to Las Vegas to buy a property? No. If you’re in the U.S., the title company can send a mobile notary to you. This can also be arranged for clients in other countries (although some lenders may not allow this).

- What if I want to visit my property? I recommend seeing your first property in person. We’ll pick you up at the airport and take you to the property, where you’ll usually meet Selena (renovation manager), the property manager, and your account manager. We want you to know the team, since most clients buy multiple properties with us.

- How long does it take to buy additional properties? Usually much less time than the first. If it’s been a while, we’ll do a one-hour market update. Expect about two to three hours total per additional property.

- How much time will I spend each month? Most clients spend about 10 minutes a month reviewing their online portal. For any issues, contact the property manager first. If it’s not resolved quickly, contact me ([email protected]), and we’ll make sure it gets handled.

By focusing on a narrow property segment, we can provide you with a fairly accurate cash requirement. And due to our done-for-you services and heavy reliance on processes, your total time requirement to invest with us is minimal.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

I wish you success.

Post: Looking to invest out of state into multi-family 4plex. I want to do a 1031 exchange.

Post: Looking to invest out of state into multi-family 4plex. I want to do a 1031 exchange.

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Cal Hollow,

I’ll comment in two parts: building a local investment team and multifamily investing.

Local Investment Team

Instead of starting from scratch, look for an experienced, established investment team. Begin by finding an investment realtor.

Most metro areas may have thousands of residential realtors, but they mainly provide MLS listings and property access to the properties you select. Residential realtors (or "investor-friendly") provide little or no value to an investor. I've bought several investment properties through residential realtors, and it took a lot of my time and cost more than necessary.

Investment realtors work with teams that handle everything—finding, validating, inspecting, renovating, and managing properties. Only an experienced team can provide all these resources. Residential realtors can’t.

While each team has its own unique approach, below is our process—you'll find that most investment teams operate in a similar fashion.

Finding and vetting an investment realtor can be challenging. In most areas, there may be only one or two investment realtors. If you want to know how to find and qualify one, let me know.

Multifamily

Multifamily properties are popular right now, but promoters rarely mention the downsides. Multi-family is similar to when Charles Lindbergh was advised to build a two-engine plane for his solo Atlantic flight in 1927. He did the calculations and determined that if he only had one engine operating, the plane would not fly for long. So the reality was that two engines doubled the risk without adding any value.

The same is true with multi-family. For example, with a four-plex, you have four units, which means four times the chance of vacancy compared to a single-family home. With even one unit vacant, you may not be able to cover your expenses. So the actual result is you have a high probability of losing money every month with a multifamily. Also, multifamily tenants are often singles or couples without children. Our research shows tenants with children choose single-family homes and perform better.

Our 17+ year results with 570+ single-family rentals:

- Only seven evictions in over 17 years, with more than 1,000 tenants

- Average tenant stays over five years

- Vacancy rate on 570+ properties is less than 2%

Don’t just follow trends—do your own research.

Post: August Las Vegas Rental Market Update

Post: August Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

It's August, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

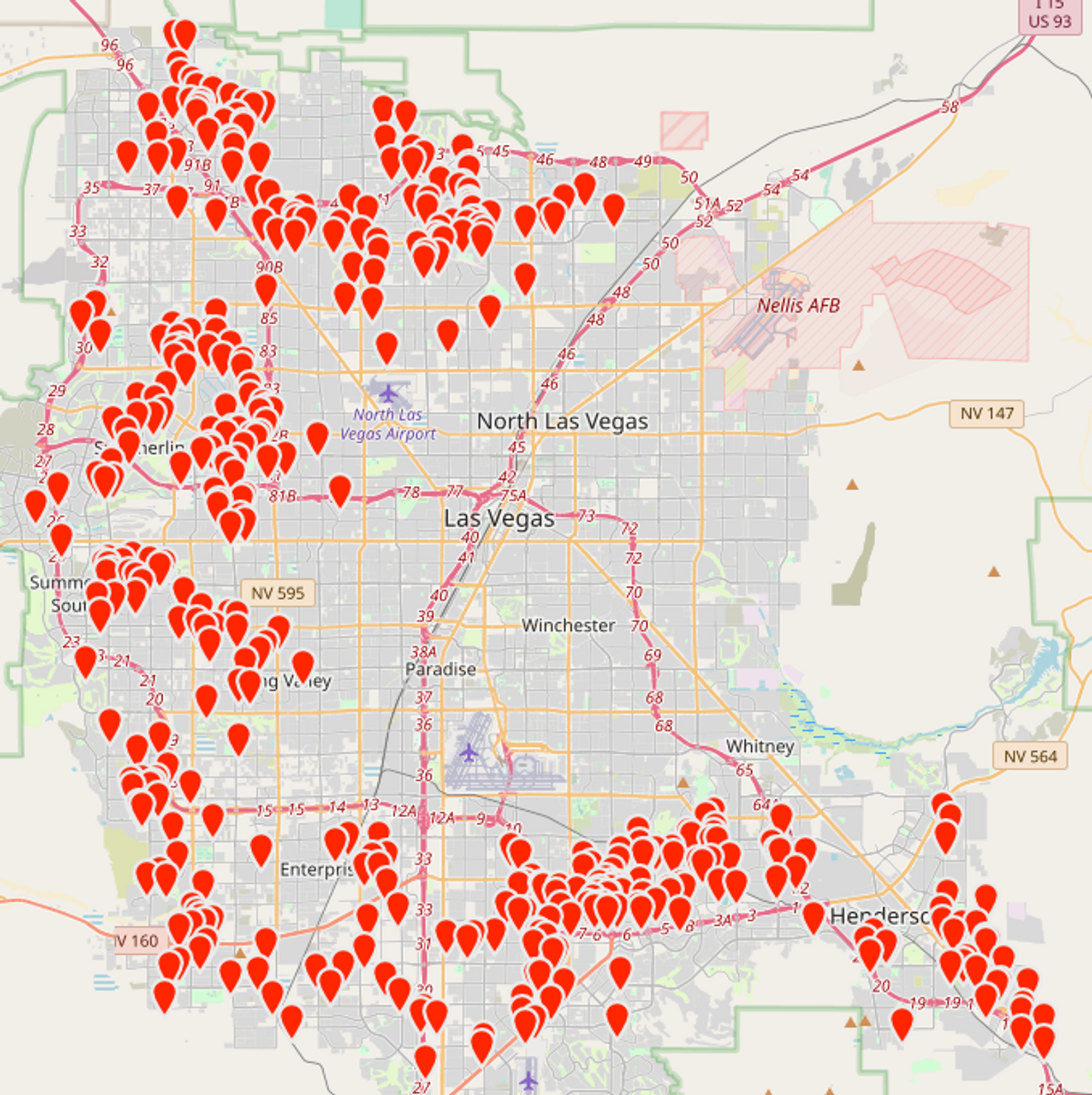

- Location: See the map below

Overall Market Inventory

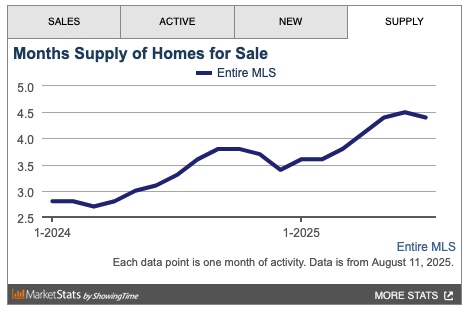

The chart below, from the MLS, includes ALL property types and price ranges. The overall inventory has stabilized and is now trending down.

“Bank-Owned Properties Rose 34% Nationwide”

I heard from some clients who had concerns about the "large number of distressed properties." Below is the actual MLS Las Vegas data for single-family homes in the Las Vegas metro area. (In 2023, there were 572,900 single family homes in the metro area.)

- Bank owned (REO): 9 for sale. (or 0.0016% of all homes)

- Short sales: 15 for sale. (or 0.0026% of all homes)

- Foreclosure started: 18 for sale. (or 0.0031% of all homes)

The article title was simply clickbait. Each location has its own unique market conditions, and national averages do not reflect the reality of any local market.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

Rentals - Median $/SF by Month

Rents remained flat in June and July. Despite global tensions, rents remained reasonably stable.

Rentals - Availability by Month

The number of homes for rent increased MoM in July, conforming to seasonal trend.

Rentals - Median Time to Rent

Time to rent increased MoM (from 20 days to 23 days), but remained healthy.

Rentals - Months of Supply

There are only 1.2 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

Sales - Months of Supply

Inventory decreased MoM to about 2.5 months. Six months is considered a balanced market where the number of buyers and sellers is roughly equal and prices remain stable. This is still a sellers market, despite the soundbites or clickbait you might hear or see in the media.

Sales - Median $/SF by Month

Despite all the volatility and alarming media headlines, the $/SF had a slight increase MoM. YoY is up 3%.

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand and price and rent increases. Las Vegas's average annual population increases by 40,000 to 50,000 per year. What attracts people to Las Vegas? Jobs. Ongoing construction projects valued between $26 billion and $30 billion fuel both short-term and long-term employment opportunities. The most recent job fair featured over 20,000 open positions.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.