All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 788 times.

Post: In Connecticut but trying to branch out

Post: In Connecticut but trying to branch out

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Ricardo Diaz,

Rather than providing a list of cities I consider good for investments, I'll share the criteria I would use to evaluate and select an investment city.

Before I continue, it's important to understand what your goals are.

- Immediate cash flow: Consider cities that have seen big population declines. For example, Cleveland—since 1970, it’s lost over half its population, dropping from 750,903 to 372,624 by 2020. In cities that are losing population, property prices are low because demand is low, so it’s easier to get positive cash flow right away. Memphis is another option; it’s lost about 6% population in the past decade. But remember, low prices mean little or no appreciation for a long time. Cities like these are good for initial cash flow, but they’re unlikely to support long-term financial independence.

- Long-term financial independence: Financial independence is not a one time event or a fixed number of dollars. It requires a rental income that increases faster than inflation. This is necessary because every time you go to the store it costs more to buy the same basket of goods. And, unless your rental income is increasing faster than the inflation rate, you won't have the dollars to continue buying the same basket of goods and your only option will be to return to work or drastically decrease your standard of living. What are the characteristics of cities that will enable lifelong financial independence?

- Significant and sustained population growth. Focus instead on cities with metropolitan populations over 1 million that show significant, sustained population growth. This Wikipedia page has the data you need. Smaller cities are typically more vulnerable to economic downturns and market shifts.

- Rents increase faster than inflation. Rents follow prices so where there has been significant appreciation, rents will follow and increase rapidly. See: Zillow Research. Specifically, I used the "ZHVI Single-Family Homes Time Series ($)" dataset.

- Pro landlord regulations. Use a Google search phrase like the following: “Is [city] landlord friendly?”, “Landlord tenant laws in [city]”, “Eviction laws in [city]”

- Low crime. Avoid cities with high crime rates. Use resources like CBS’s list of the 50 Most Dangerous Cities in America to identify cities to avoid.

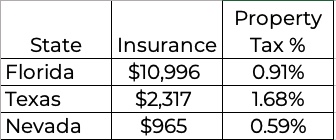

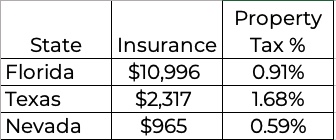

- Low operating costs. What matters most is your net income, not your gross income. Every dollar spent on property taxes and insurance reduces your living income. Operating costs vary tremendously by state. Below is a comparison between three states with no income taxes: Nevada, Texas, and Florida.

- State average property tax source.

- Average insurance source.

- Florida's average insurance cost source

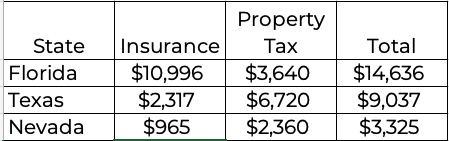

To put this in perspective, below is the estimated annual operating costs for a $400,000 property in each state.

Compared to a property in Nevada, properties in other states require additional cash flow to compensate for their higher operating costs.

- Florida: +$11,311 ($14,636 - $3,325)

- Texas: +$5,712 ($9,037 - $3,325)

The takeaway is that operating costs can have a huge impact on net income.

Ricardo, feel free to reach out if you have additional questions.

Post: July Las Vegas Rental Market Update

Post: July Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

It's July, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

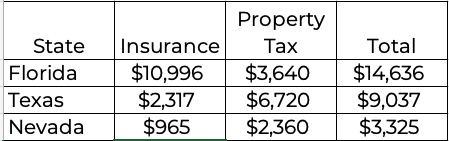

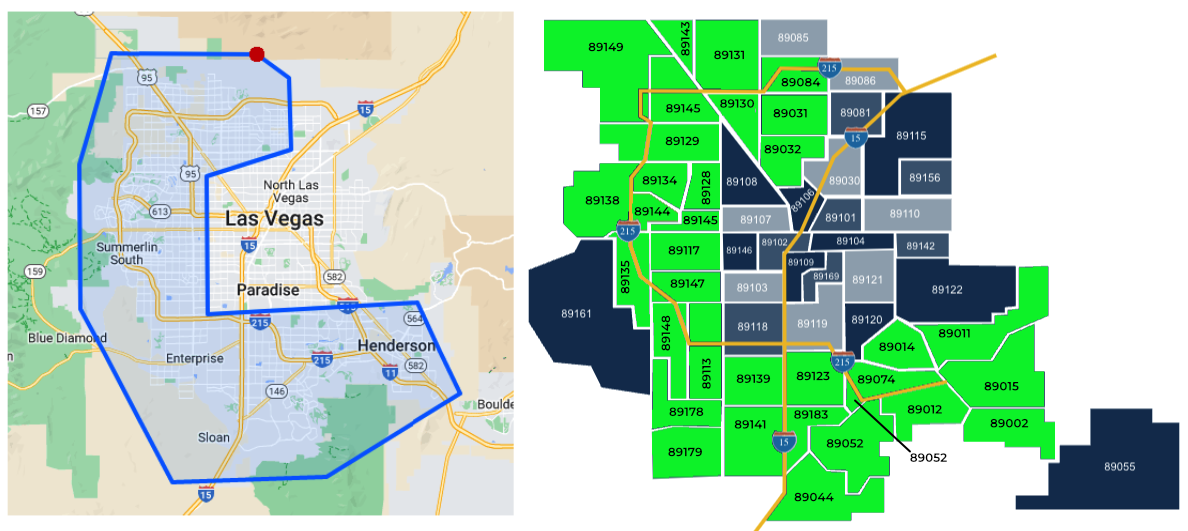

- Location: All zip codes marked in green below have one or more of our client’s investment properties.

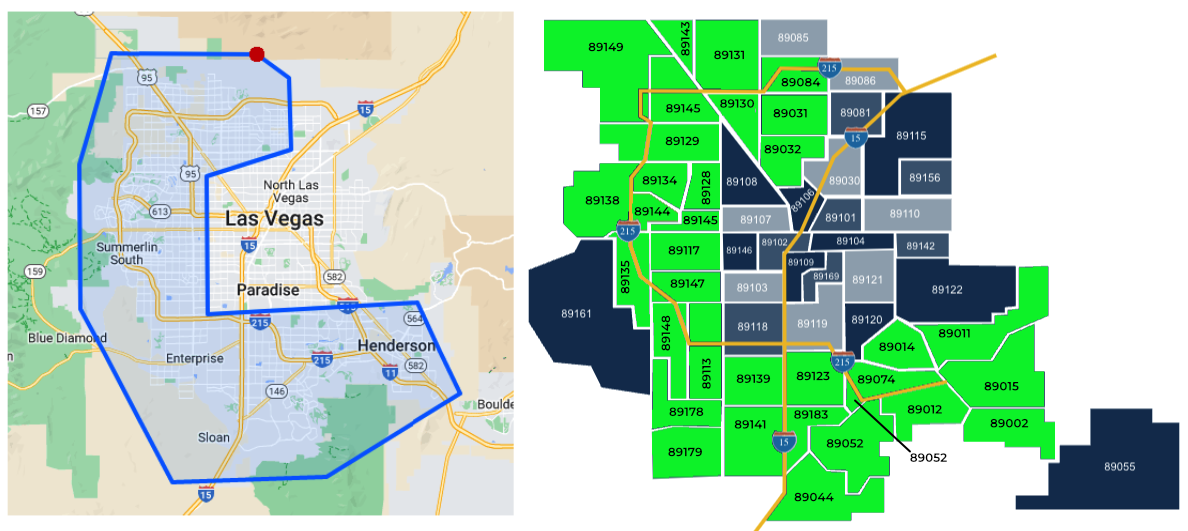

Overall market inventory:

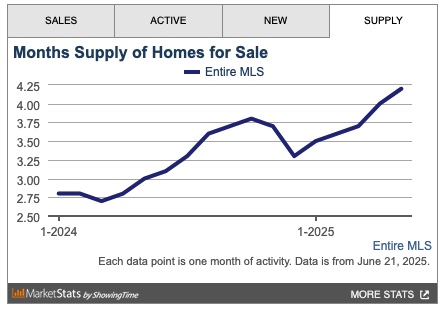

The chart below, from the MLS, includes ALL property types and price ranges. The unseasonal increase in inventory corresponds with the impacts of tariffs and geopolitical tensions.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

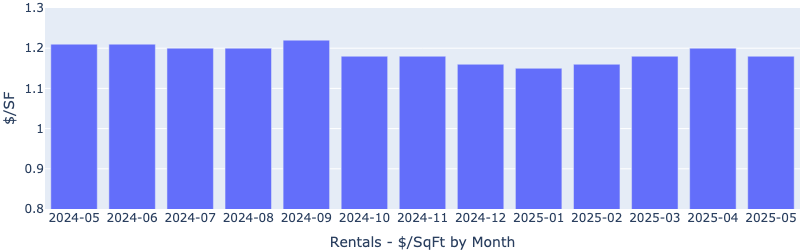

Rentals - Median $/SF by Month

Rents increased slightly MoM. Despite global tensions, rents remained reasonably stable.

Rentals - Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

Rentals - Median Time to Rent

Despite all the volatility, time to rent decreased MoM (from 22 days to 20 days), more aligned with the expected seasonal trend.

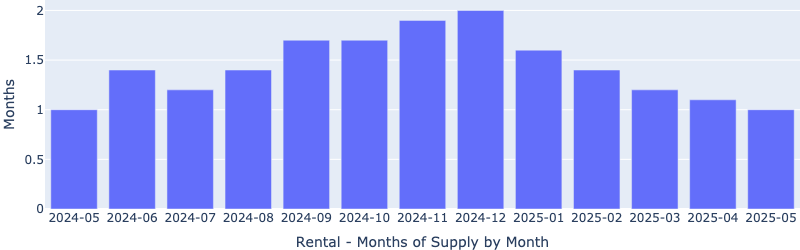

Rentals - Months of Supply

There is only 1.1 months' supply for our target rental property profile. This low inventory will continue to pressure up rents.

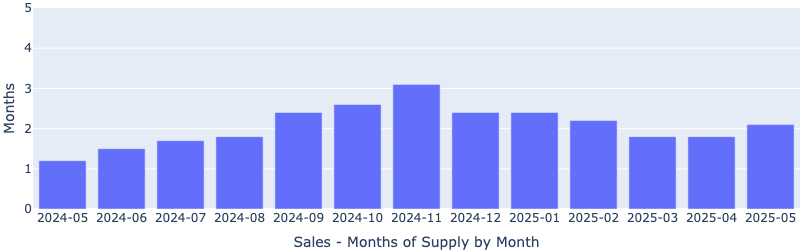

Sales - Months of Supply

Inventory remained unchanged MoM, at about 1.8 months. Six months is considered a balanced market where the number of buyers and sellers is roughly equal and prices remain stable. This is still a seller's market, despite the soundbites or clickbait you might hear or see in the media.

Sales - Median $/SF by Month

As expected with all the volatility, the $/SF had a marginal decline MoM. This has enabled us to secure better deals.

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand and price and rent increases. Las Vegas's average annual population increases by 40,000 to 50,000 per year. What attracts people to Las Vegas? Jobs. Ongoing construction projects valued between $26 billion and $30 billion fuel both short-term and long-term employment opportunities. The most recent job fair featured over 20,000 open positions.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.

Post: Which U.S. Market Offers Maximum Capital Appreciation Over Next Decade?

Post: Which U.S. Market Offers Maximum Capital Appreciation Over Next Decade?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Sushil Gupta,

Excellent question.

While no one can accurately predict the future, I can describe the characteristics of cities that are likely to perform well over the long term and experience rapid and sustained appreciation.

Prices reflect the balance (or imbalance) between the number of sellers (supply) and buyers (demand). When the number of sellers exceeds that of buyers, prices decline until the number of buyers and sellers reaches equilibrium. When buyers outnumber sellers, prices rise until supply and demand become relatively balanced.

Demand is largely driven by population change. In cities with declining populations, demand is low, resulting in more sellers than buyers, causing prices to decline or stagnate. When there is significant and sustained population growth, prices rise because demand is high. So the first city criterion is significant and sustained population growth.

Why do people move to a city? In most cases, people move to a city for jobs. However, most jobs are relatively short-lived. Companies in the US only last on average 10 to 18 years. If new companies don't move into the city and create replacement jobs, the only remaining jobs will be lower-paying service sector jobs. When this happens, area incomes fall. City services are funded by sales and property taxes. As city incomes fall, city revenues fall. With declining revenues, the city has no option but to cut back on services. This results in increasing crime and declining schools. When this occurs, people with sufficient income will relocate to cities with better economic conditions, causing a further decline in city revenues. This creates a financial death spiral from which few cities have ever recovered.

Long-term appreciation depends on new companies creating jobs that replace existing ones with comparable wages and skill requirements. When selecting locations for new operations, companies have numerous options. What characteristics make a city attractive to these businesses?

- Pro-business environment: Companies are in the business of making money, not fighting local legislation. This is why so many companies are leaving California. It's simply too expensive and time consuming to battle government regulations while competing with other companies in pro-business environments.

- Low crime: Companies are unlikely to choose any high crime city. Do not consider any city on this list by CBS News.

- Minimum population size: Companies setting up operations seek cities with significant infrastructure. This includes airports, interstate freeways, and a large population from which to hire employees. These assets are typically only found in cities with a metro population exceeding 1 million people.

- Low operating costs: Companies tend to avoid cities with high operating costs. Between various locations, you could have a 20% difference in operating costs. A good barometer for operating costs is insurance and property tax rates.

- Low risk of natural disaster: Natural disasters can devastate your property and the city, leading to job losses and the closure of shops and businesses. This forces people to immediately relocate. While insurance might cover the reconstruction of your property, the community's recovery could take years or, in some cases, never occur. Meanwhile, your expenses, like debt service, taxes, insurance, and maintenance, continue.

Bonus: limited room for expansion. In other words, expensive land. A great example is Las Vegas. It is surrounded by federal and conservation lands and has very limited land left available. When supply is limited and demand (population) continues to grow, the odds are very good that appreciation will be strong.

Sushil, if you select a city that meets the above requirements, you'll have a high probability of rapid, sustained appreciation.

Post: New Orleans Ranked “Worst” Market – Why That Might Be a Buy Signal

Post: New Orleans Ranked “Worst” Market – Why That Might Be a Buy Signal

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Low-cost properties aren't necessarily good investments if your goal is financial independence. If you're seeking initial cash flow, declining cities with cheap properties may provide higher initial cash flow, but they won't provide lifelong financial independence.

The rental income requirements for lifelong financial independence are:

- Rents must increase faster than inflation. You don't live on a fixed number of dollars. Due to inflation, prices increase every day. Unless your rents increase faster than inflation, you cannot achieve lifelong financial independence. Rents and prices are driven by demand, which is a function of population. If the population is declining, prices will decline as well. If the population is increasing, prices and rents will rise. Never buy in cities with a declining population.

- Existing homes must appreciate faster than inflation. Cash flow pays bills, appreciation builds wealth. If you have rapid, sustained appreciation, you'll be able to leverage the increased equity in your existing rental properties to acquire more properties. This only occurs with rapid population growth. If you buy in a city where the population is declining, every investment dollar must come from your savings.

- Rental income must last throughout your lifetime. Tenants can only pay rent if they are employed, and not just any job will do. They must maintain a similar wage to pay their rent consistently. The challenge is that companies typically last only 10–18 years on average. If you're holding a property for 30 years, your tenants' jobs will likely end two or three times during that period. Only if replacement jobs offer similar wages and require comparable skills will tenants be able to continue paying rent. With companies having relatively short lifespans, locations depend on attracting new businesses that create employment. Companies have many options when choosing where to establish new operations, and they're unlikely to select cities with high crime rates or declining population.

The notion that buying cheap properties will enable lifelong financial independence is false.

Post: June Las Vegas Rental Market Update

Post: June Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

It's June, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

- Location: All zip codes marked in green below have one or more of our client’s investment properties.

Overall market inventory:

The chart below, from the MLS, includes ALL property types and price ranges. The unseasonal increase in inventory corresponds with the impacts of tariffs and geopolitical tensions.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

Rentals - Median $/SF by Month

Rents had a slight decrease MoM. Despite global tensions, rents remained reasonably stable.

Rentals - Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

Rentals - Median Time to Rent

As expected with all the volatility, time to rent increased slightly MoM, but still at a healthy 22 days.

Rentals - Months of Supply

There is only one month of supply for our target rental property profile. This low inventory will continue to pressure up rents.

Sales - Months of Supply

Sales inventory increased slightly as well MoM. There are about two months of supply in our segment. Six months is considered a balanced market where the number of buyers and sellers are roughly equal. This is still a seller's market but we are seeing better deals.

Sales - Median $/SF by Month

As expected with all the volatility, the $/SF had a slight decline MoM. This has enabled us to secure better deals.

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand and price and rent increases. Las Vegas's average annual population increases by 40,000 to 50,000 per year. What attracts people to Las Vegas? Jobs. Ongoing construction projects valued between $26 billion and $30 billion fuel both short-term and long-term employment opportunities. The most recent job fair featured over 20,000 open positions.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.

Post: Population Bust, Property Value Decline?

Post: Population Bust, Property Value Decline?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Mat Garcia,

While there may be population declines at national levels, local factors have a much bigger impact on RE. For example, from 1970 to 2020, Cleveland lost 50% of its population (from 750,903 to 372,624). This dramatic decline had nothing to do with birth rates. Meanwhile, Las Vegas's population increased by 410% during the same period (from 125,787 to 641,903), also not due to birth rates. So, while national and international population trends exist, they may not apply to individual cities within a country.

For the U.S., immigration will play a significant role in population growth for the next decades.

Population changes significantly impact real estate investors. In cities with declining populations, properties are typically much cheaper, but rents and prices rarely outpace inflation. Conversely, in cities experiencing significant and sustained population growth, while initial prices are higher, both property values and rents are more likely to outpace inflation.

Post: San Diego Investor looking to invest out of state, BUT WHERE?

Post: San Diego Investor looking to invest out of state, BUT WHERE?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello Kelby Kraft,

Whether a city is a good investment location depends on your goals. If your goal is initial cash flow, Midwestern cities are some of the better places to buy properties. The challenge with most Midwestern cities is that prices and rents haven't kept pace with inflation.

We don't live on a fixed number of dollars. As inflation rises, it takes more money to purchase the same goods and services. If your rental income isn't growing faster than inflation, you won't have the additional income to pay these higher prices. In this situation, your only options would be to either continuously reduce your standard of living or return to work.

An example will show the problem. Suppose your planned hold period is 30 years, the average inflation during this period is 5% per year, rent growth is 2% per year, and your initial rent is $1,000 per month. How much will the rent be in 10 years, 20 years, 30 years?

- Rent in 10 years: $1,000 × (1 + 2%)^10 ≈ $1,219

- Rent in 20 years: $1,000 × (1 + 2%)^20 ≈ $1,486

- Rent in 30 years: $1,000 × (1 + 2%)^30 ≈ $1,811

As you can see, over 30 years the rent increases from $1,000 to $1,811. However, because inflation rose more rapidly than rent, your buying power—what you actually live on—declined, as shown below.

- Buying power in today's dollars after 10 years: $1,000 × (1 + 2%)^10 / (1 + 5%)^10 ≈ $748

- Buying power in today's dollars after 20 years: $1,000 × (1 + 2%)^20 / (1 + 5%)^20 ≈ $560

- Buying power in today's dollars after 30 years: $1,000 × (1 + 2%)^30 / (1 + 5%)^30 ≈ $419

Therefore, if your goal is initial cash flow but not financial independence, most Midwestern cities are good investment locations. However, if your goal is financial independence, cities were rented and prices do not increase faster than inflation will not enable long term financial independence.

Post: San Diego Investor looking to invest out of state, BUT WHERE?

Post: San Diego Investor looking to invest out of state, BUT WHERE?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Anthony D'Angelo,

While I can't recommend a specific city without understanding your situation and goals, you're absolutely right to prioritize choosing the right city for your real estate investments. The city where you invest determines all long-term income characteristics.

Many people choose cities with low property prices or follow recommendations for specific cities. As an engineer, I believe in clearly establishing the goal and then working backward to where you are today.

The Goal of Real Estate Investing

The goal of real estate investing is lifelong financial independence. This isn’t a one-time milestone or a fixed amount of money—it’s about creating a sustainable income stream that meets two key criteria:

- Rents Outpace Inflation: Rental income must grow faster than inflation to cover rising costs. Cities with strong, sustained population growth are more likely to meet this requirement.

- Lifelong Income Stability: Your income must last a lifetime. This requires tenants to maintain stable employment, even as companies come and go. Cities that attract new businesses, have low crime rates, a metro population over 1 million (for infrastructure and skilled labor), and low operating costs are best positioned to meet this need.

Where to Start Your Search

Evaluating every city in the U.S. isn't practical. Start your search by focusing on cities with metropolitan populations over 1 million that have had significant and sustained population growth. This Wikipedia page has the data you need. Smaller cities are typically more vulnerable to economic downturns and market shifts and do not attract major employers.

After identifying cities that meet these basic criteria, apply the following filters to narrow down your list:

- Low Crime Rates: Avoid cities with high crime rates. Use resources like CBS’s list of the 50 Most Dangerous Cities in America to identify cities to avoid.

- Low Operating Costs: High operating costs erode your profits. Key considerations include property taxes and insurance rates. Resources like ValuePenguin and LendingTree can help you compare your operating costs across cities.

- No Rent Control: Rent control can limit your ability to raise rents, screen tenants, or evict non-performing tenants. Avoid investing in cities with rent control policies.

By filtering out cities that don’t meet these criteria, you’ll create a shortlist of potential investment locations for further evaluation.

Operating Costs

Operating costs are such a huge factor for investors that I wanted to provide more detail. Below is a comparison between Nevada, Texas, and Florida.

- State average property tax source.

- Texas and Nevada average insurance source.

- Florida's average insurance cost source

To put this in perspective, below is the estimated annual operating costs for a $400,000 property.

Compared to a property in Nevada, properties in other states require additional cash flow to compensate for their higher operating costs.

- Florida: +$11,311 ($14,636 - $3,325)

- Texas: +$5,712 ($9,037 - $3,325)

The takeaway is that operating costs can have a huge impact on financial independence.

Remote Investing

Live where you like, but invest where you can achieve lifelong financial independence.

Most investors don't live in cities that meet all the requirements for financial independence. Therefore, the real question isn't whether to invest remotely—it's where and how to do it safely.

Once you've selected a city that meets the requirements, you'll need an experienced local investment team. While books, seminars, podcasts, and websites offer valuable general knowledge, ultimately, you're investing in a specific property in a specific city. This requires deep local expertise. Only an experienced investment team can provide the local market knowledge and resources you need.

Post: How To Analyze the Market??

Post: How To Analyze the Market??

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Emily Strong,

The first step should be selecting an investment city. The city where you invest determines all long-term income characteristics. I will share a straightforward process for creating a short list of cities for potential further consideration. And, you will not have to pay for any of the data. It's publicly available.

Before I do, I want to ensure we have a common understanding of the goal of real estate investing.

The Goal of Real Estate Investing

The ultimate goal of real estate investing is lifelong financial independence. This isn’t a one-time milestone or a fixed amount of money—it’s about creating a sustainable income stream that meets two key criteria:

- Rents Outpace Inflation: Rental income must grow faster than inflation to cover rising costs. Cities with strong, sustained population growth are more likely to meet this requirement.

- Lifelong Income Stability: Your income must last a lifetime. This requires tenants to maintain stable employment, even as companies come and go. Cities that attract new businesses, have low crime rates, a metro population over 1 million (for infrastructure and skilled labor), and low operating costs are best positioned to meet this need.

Where to Start Your Search

Evaluating every city in the U.S. isn't practical. Start with cities that have a metropolitan population of over 1 million and have significant and sustained population growth. This Wikipedia page has the data you need. Smaller cities are typically more vulnerable to economic downturns and market shifts. Plus, they don't tend to attract new major employers that will create the replacement jobs your tenants will need over time.

After identifying cities that meet these basic criteria, apply the following filters to narrow down your list:

- Low Crime Rates: Avoid cities with high crime rates. Use resources like CBS’s list of the 50 Most Dangerous Cities in America to identify cities to avoid.

- Low Operating Costs: High operating costs erode your profits. Key considerations include property taxes and insurance rates. Resources like ValuePenguin and LendingTree can help you compare your operating costs across cities.

- No Rent Control: Rent control can limit your ability to raise rents, screen tenants, or evict non-performing tenants. Avoid investing in cities with rent control policies.

By filtering out cities that don’t meet these criteria, you’ll create a shortlist of potential investment locations for further evaluation.

Remote Investing

Live where you like, but invest where you can achieve lifelong financial independence.

Most investors don't live in cities that meet all the requirements for financial independence. Therefore, the real question isn't whether to invest remotely—it's where and how to do it safely.

Once you've selected a city that meets the requirements, you'll need an experienced local investment team to minimize risk and maximize returns. While books, seminars, podcasts, and websites offer valuable general knowledge, ultimately, you're investing in a specific property in a specific city. This requires deep local expertise. Only an experienced local team can provide the local market knowledge and resources essential for success.

Summary

By following the steps outlined above, you can quickly narrow your focus to cities that support lifelong financial independence. However, if you invest in a city that doesn’t meet these criteria, no number of properties will compensate for the long-term challenges you’ll face.

Post: Best markets to invest in?

Post: Best markets to invest in?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,571

Hello @Eric Shim,

You’re absolutely right to prioritize choosing the right city for your real estate investments. Where you invest determines all long-term income characteristics. While I can’t recommend specific cities without understanding your current situation and long-term goals, I will share a straightforward process for creating a short list of cities for potential further consideration.

Before I do, I want to ensure we have a common understanding of the goal of real estate investing.

The Goal of Real Estate Investing

The ultimate goal of real estate investing is lifelong financial independence. This isn’t a one-time milestone or a fixed amount of money—it’s about creating a sustainable income stream that meets two key criteria:

- Rents Outpace Inflation: Rental income must grow faster than inflation to cover rising costs. Cities with strong, sustained population growth are more likely to meet this requirement.

- Lifelong Income Stability: Your income must last a lifetime. This requires tenants to maintain stable employment, even as companies come and go. Cities that attract new businesses, have low crime rates, a metro population over 1 million (for infrastructure and skilled labor), and low operating costs are best positioned to meet this need.

Where to Start Your Search

Evaluating every city in the U.S. isn't practical. Focus instead on cities with metropolitan populations over 1 million that show significant, sustained population growth. This Wikipedia page has the data you need. Smaller cities are typically more vulnerable to economic downturns and market shifts.

After identifying cities that meet these basic criteria, apply the following filters to narrow down your list:

- Low Crime Rates: Avoid cities with high crime rates. Use resources like CBS’s list of the 50 Most Dangerous Cities in America to identify cities to avoid.

- Low Operating Costs: High operating costs erode your profits. Key considerations include property taxes and insurance rates. Resources like ValuePenguin and LendingTree can help you compare your operating costs across cities.

- No Rent Control: Rent control can limit your ability to raise rents, screen tenants, or evict non-performing tenants. Avoid investing in cities with rent controls.

By filtering out cities that don’t meet these criteria, you’ll create a shortlist of potential investment locations for further evaluation.

Remote Investing

Live where you like, but invest where you can achieve lifelong financial independence.

Most investors don't live in cities that meet all the requirements for financial independence. Therefore, the real question isn't whether to invest remotely—it's where and how to do it safely.

Once you've selected a city that meets the requirements, you'll need an experienced local investment team to minimize risk and maximize returns. While books, seminars, podcasts, and websites offer valuable general knowledge, ultimately, you're investing in a specific property in a specific city. This requires deep local expertise. Only an experienced local team can provide the local market knowledge and resources essential for success.

Summary

By following the steps outlined above, you can quickly narrow your focus to cities that support lifelong financial independence. However, if you invest in a city that doesn’t meet these criteria, no number of properties will compensate for the long-term challenges you’ll face.