All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 786 times.

Post: September Las Vegas Rental Market Update

Post: September Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

It's September, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

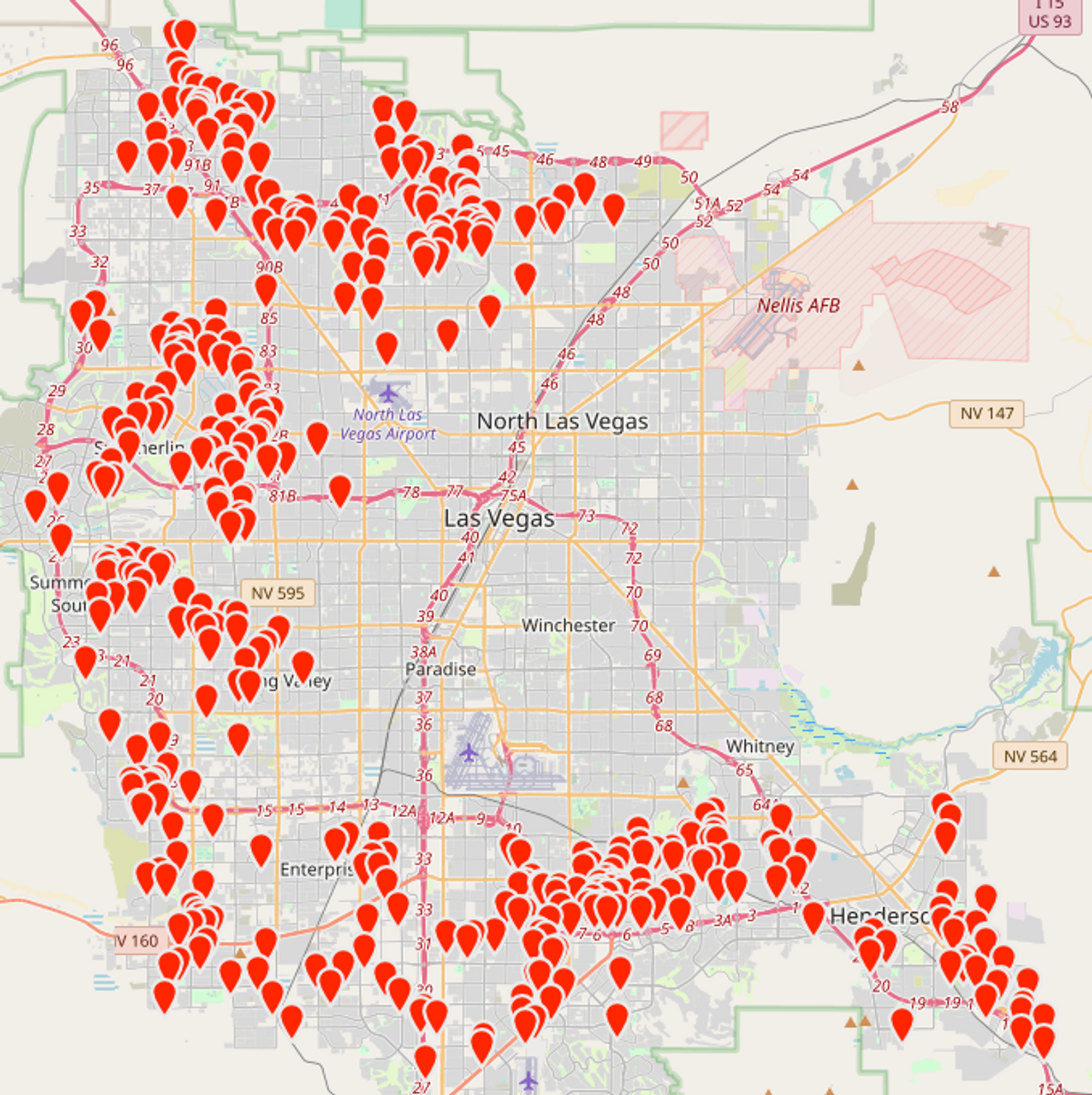

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

- Location: See the map below

Overall Market Inventory

The chart below, from the MLS, includes ALL property types and price ranges. The overall inventory has stabilized.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

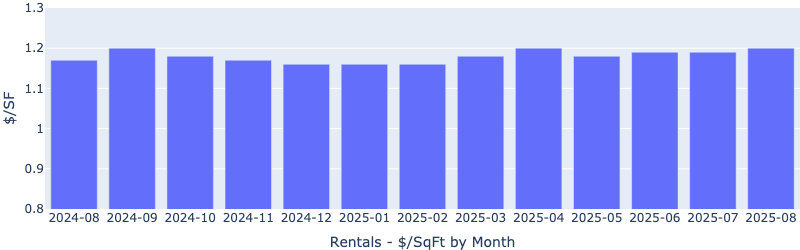

Rentals - Median $/SF by Month

Rents increased slightly in August. YoY is up 3%. Despite global and domestic tensions, rents remained stable.

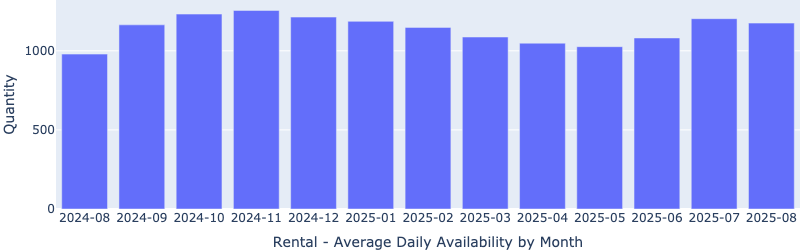

Rentals - Availability by Month

The number of homes for rent decreased slightly MoM in August, bucking the usual seasonal trend.

Rentals - Median Time to Rent

Time to rent increased marginally MoM (from 23 days to 24 days), but remained healthy.

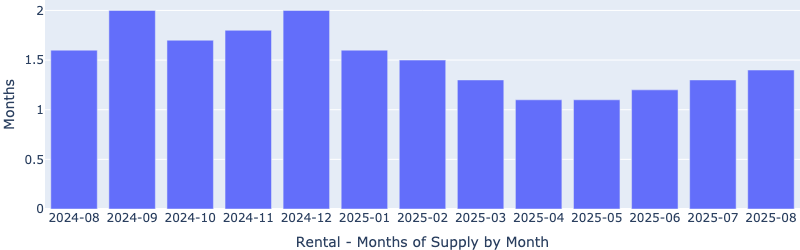

Rentals - Months of Supply

There are only 1.4 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

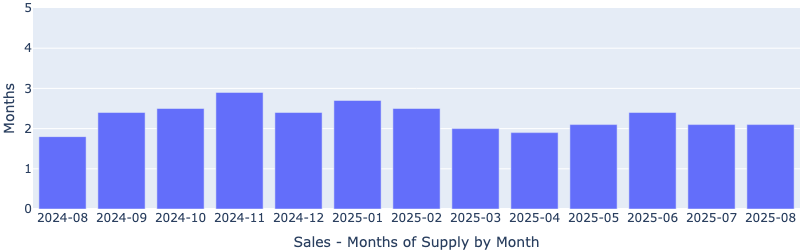

Sales - Months of Supply

Inventory remains at two months, indicating our segment is still a seller's market.

Sales - Median $/SF by Month

The price per square foot unexpectedly fell in August. While we typically see a slight slowdown when school begins mid-month, this drop was larger than normal. Since the time to sell actually decreased (see chart below) and the inventory (months of supply) remained stable, my guess is that all the negative news and global uncertainty pushed some sellers to cut prices.

I also looked into distressed single-family home sales, and there’s no sign of trouble. The numbers are very low:

- Short sales: 38, about 0.0084% of all single-family homes

- Bank owned (REO): 37, about 0.0082%

- Foreclosures started: 33, about 0.0073%

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand. Las Vegas's average annual population growth is between 2% and 3%. What draws people to Las Vegas? Jobs. Depending on the report, there is between $26B and $30B under construction, and the last job fair had over 20,000 open jobs.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.

Post: im just getting into real estate. need advice

Post: im just getting into real estate. need advice

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hello @Aaron Phifer,

Over the past 17+ years, I’ve helped clients purchase more than 580 Las Vegas rental properties. My experience taught me that success isn’t about picking a property type, it’s about having the right tenants in your property.

Our tenant-focused strategy has produced strong results:

- Average tenant stay of more than five years

- Zero rent declines or vacancies during the 2008 crash

- Since 2015, average annual appreciation of 9% and rent growth of 7%

- Vacancy rates under 2%

- Only seven evictions out of more than 1,000 tenants over 17 years

Our target segment is families with elementary school children earning between $60,000 and $85,000 a year. Our typical rents range between $1800 to $2300/Mo.

In contrast, Las Vegas multifamily properties mostly attract low-paid hourly workers. Typical rent range for multifamily units is between $600 to $900/Mo. A popular belief is that with multifamily, even if one unit is vacant, you still have income from the remaining units. What this also means is that with a multifamily you have much greater odds of always having one unit or more units vacant. So, you will likely lose money every month by not having all units rented. Another reality is that you will have a higher cost because you have multiple refrigerators, plumbing systems, HVACs, etc. Plus, my experience is that multifamily tenants do not take care of the properties, and there's a lot of damage.

One client bought four 4-plexes (I had refused to sell him multifamily properties due to the highly probable losses) filled with Section 8 tenants. The Housing Authority paid 80% of the rent, but he almost never received the tenants’ share. Worse, the repair costs were crushing. Some months, repairs and eviction costs exceeded his mortgage payment.

Another client rented a nice single-family home to a Section 8 tenant for a small bump in rent. After one year, he did not renew the lease, and it cost him over $15,000 to restore the home to rentable condition.

I’ve also learned this lesson firsthand. My first investment, a C-class multifamily in Houston, looked like a cash cow on paper but turned into a money pit of evictions, vacancies, and repairs. Later, I purchased two 4-plexes in a suburb of Atlanta that attracted young professionals and performed well.

If you’re considering living in one of the units yourself, I strongly suggest visiting the complex at night or on the weekend. Most Las Vegas multifamily properties are located in high-crime, distressed neighborhoods, and it’s important to know that when you are making that decision. Drive out to East Desert Inn road and you will find many multifamily properties.

Conclusion

The property is just a container. Tenants pay the rent, so long-term success depends on attracting and keeping the right ones. Before you buy any property, understand the behavioral characteristics of the tenant segment it will attract. I do not recommend multifamily in Las Vegas due to all the issues associated with these properties and the tenant segment they attract.

Post: Don't buy real estate in Detroit...

Post: Don't buy real estate in Detroit...

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hello @Jonathan Weinberger,

The bigger issue with investing in any city where rents don’t outpace inflation is that you can’t achieve lasting financial independence. To maintain lifelong financial independence, rental income must increase faster than inflation. This does not happen in cities without significant and sustained population growth.

Take Detroit as an example. Its population growth from 2020 to 2024 was only +0.19% (and those were the Covid migration boom years). Rents fell in Detroit last year by 2.7%. U.S. inflation averaged about 4.55% per year over the past five years.

Looking at the impact of inflation on current buying power. Suppose rents increase at 2%/Yr over the next 30 years, inflation averages 4%/Yr, and your current total rental income is $10,000/Mo, here’s what happens to that income in today’s dollars:

- In 10: years $8,235 (a 17.65% decrease in buying power)

- In 20. years: $6,782 (a 32.18% decrease)

- In 30 years: $5,585 (a 44.15% decrease)

So even though your rent increases to $12,190 ($10,000 x (1 + 2%)^10) after 10 years, inflation erodes its value to the equivalent of $8,235 today. This is why, no matter how many properties you own in cities where rent growth lags behind inflation, you can’t achieve long-term financial independence.

Now let’s compare this to Las Vegas. Since 2015, the single-family home segment rents have increased on average by 7%/Yr. Starting with the same $10,000 monthly income, here’s what that looks like in today’s dollars:

- Year 10: $13,289 (a 33% increase in buying power)

- Year 20: $17,660 (a 77% increase)

- Year 30: $23,470 (a 135% increase)

When rent growth consistently outpaces inflation, your buying power rises over time, allowing you to improve your standard of living.

Summary

The city where you invest determines long term income, not properties.

Post: Don't hold out for lower rates. Now is the time.

Post: Don't hold out for lower rates. Now is the time.

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Pre-Covid, the spread between the 30-year fixed rate mortgage and the 10-year has been in a tight band of 1.5% to 2%. The spread went into wild swings post-COVID when (Fed and mortgage) rates were artificially suppressed and then raised sharply. It is gradually coming down.

![[Source: Board of Governors of the Federal Reserve System (US) via FRED®]](https://www.lasvegasrealestateinvestmentgroup.com/nwassets/images/20250266.jpg)

[Source: Board of Governors of the Federal Reserve System (US) via FRED®]

Assuming the spread returns to its pre-COVID range, and the 10-year in the low 4’s, my guess is that the 30-year mortgage rates will likely remain above 6%, though somewhat lower than today’s, for the rest of 2025.

I have another consideration for investors who are waiting on rates to go down. If you’re buying in a city where rents and property values are rising quickly, holding off usually costs far more than any benefit from a small drop in interest rates. Even if rates fall by half a point, the higher purchase price you’ll face later can wipe out any savings.

Real estate investing is always about the long-term view. The key is not short-term rate fluctuations but whether the market you choose can consistently deliver rent and price growth above inflation. If it does, you’re building wealth and moving closer to financial independence. Waiting on the sidelines only delays those gains.

Successful investing isn't about timing the market—it's about time in the right market.

Post: Out of market traveling vs local market super low cash on cash return

Post: Out of market traveling vs local market super low cash on cash return

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hello @Craig Cann,

It is tempting to chase properties with strong initial cash flow. But if your goal is financial independence, you need properties where rents increase faster than inflation.

A $7,000 Example

Suppose your properties generate $7,000/mo in a city where rents rise by 2% per year. After 10 years with this growth rate, your rent will increase to $8,533. However, if inflation averages 5% per year during this same period, that $8,533 will only have the purchasing power of $5,239 in today's dollars.

If you invest in markets where rents do not outpace inflation, you will eventually face two choices: continually cut your living expenses or return to work.

Rents Follow Prices

Property prices are determined by the imbalance between supply and demand.

In markets where supply exceeds demand, prices are low, enabling more people to buy rather than rent, limiting rental demand. Depending on the location, there is a 2 to 5-year lag between property prices and rent trends. So, current rent reflects property values from two to five years ago, when homes were worth more. That’s why properties with low prices usually produce higher initial cash flow. But weak demand limits appreciation and future rent growth.

In markets where demand exceeds supply, prices rise rapidly, fewer people can afford to buy, so more are forced to rent. This increased demand for rentals pushes rents higher. Because rents reflect values from two to five years ago, when homes were cheaper, initial cash flow is lower. However, strong demand drives much superior long-term appreciation and rent growth.

Summary

The conditions that create low prices and higher initial cash flow won't produce rents that rise faster than inflation. You have to either select properties with strong initial cash flow or choose properties that enable financial independence because rents will increase faster than inflation. You can not have both at the same time.

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Quote from @George Villegas:

Quote from @Eric Fernwood:

Quote from @George Villegas:

Quote from @Michael Smythe:

@George Villegas here's some info to build on the great warning from @Eric Fernwood

The Real Estate Crash of 2008-2010 caused real estate prices to crash across the country - but didn't affect rent amounts. This caused a historically unique opportunity for investors - they could buy Class A properties and immediately cashflow when renting them out.

This couldn't last forever, and it didn't, as excited new investors drove up prices.

Eventually, Class A property values increased to the point that even increasing rents didn't allow them to cashflow upon purchase.

So, the flood of new investors switched to buying Class B properties.

COVID created a chaotic spike in both the sale & rental markets, attracting even more new real estate investors. According to CoreLogic, in December of 2023, almost 30% of home sales were to investors!

Investment also spiked in Class A Short-Term Rentals (STR) and investors started paying higher and higher prices based upon anticipated STR rental rates, that exceeded sustainability based upon Long-Term Rental rates (LTR).

Now we're seeing investors pouring money into buying Class C rentals - but, many are getting burned.

In our experience & opinion, the main determinant of property Class is not location or even property condition, those are #2 and #3. The #1 determinant is the Tenant Pool.

If you don't believe us, try putting several Class D tenants in Class A apartment buildings and watch what happens. Or try the reverse - rehab a property to Class A standards in a Class D neighborhood and try to get a Class A or B tenant to rent it.

Unfortunately, many newbie real estate investors are jumping into buying affordable Class C rentals - expecting Class A results.

In our opinion, Class C tenants have FICO scores from 560 to 620 - where their chance of default/nonpayment is 15-22%. See the chart from Fair Isaac Company (FICO) below:

|

FICO Score |

Pct of Population |

Default Probability |

|

800 or more |

13.00% |

1.00% |

|

750-799 |

27.00% |

1.00% |

|

700-749 |

18.00% |

4.40% |

|

650-699 |

15.00% |

8.90% |

|

600-649 |

12.00% |

15.80% |

|

550-599 |

8.00% |

22.50% |

|

500-549 |

5.00% |

28.40% |

|

Less than 499 |

2.00% |

41.00% |

According to this chart, investors should use corresponding vacancy + tenant-nonperformance factors of approximately 5% for Class A rentals, 10% for Class B and 20% for Class C.

To address Class C payment challenges, many industry "experts" are now selling programs to newbie investors about how Section 8 tenants are the cure. If only it was that easy. Yes, the government pays the Section 8 rent timely, but more and more tenants are having to pay a portion of their rent. Then there are the challenges with Section 8 tenants paying utilities and taking care of their rental property.

Investors should fully understand that Section 8 is not a cure-all for Class C & D tenant challenges, it's just trading one set of problems for another.

We see too many investors not doing enough research to fully understand all this and making naïve investing decisions.Thank you for the insight. I have seen alot regarding section 8 and the benefits that come from using the program. That brings me to my question... is a house hacker still able to use the section 8 program on the other units they are renting on the property while they are still living there? or is this something you can only do after you have left?

It may be possible to house hack with Section 8 tenants. Start with these resources:

- HUD Notice PIH 2021-05: Use of Shared Housing in the Housing Choice Voucher (HCV) Program

- 24 CFR § 982.615–§ 982.618: Shared Housing rules in the HCV program

Section 8, practical considerations

Section 8 is often described as guaranteed rent from the government; however, the reality is different.

- Unpaid tenant share risk. In my experience across roughly 18–20 Section 8 properties, the tenant portion of rent was paid inconsistently or not at all. A property manager who specializes in voucher units told me that nonpayment of the tenant share is the norm. Plan cash flow assuming you may only receive the housing authority portion.

- Inspections and compliance. Section 8 inspections can be brutal. In one case, the tenant wanted all new kitchen appliances. The owner was losing money anyway and was not willing to provide the appliances. The tenant then proceeded to break all the windows and damaged doors and walls. He then called Section 8 for an inspection. They required the owner to repair everything before they would resume Section 8 payment. He had no choice but to buy all new appliances.

- Income risk. Many voucher holders have very low incomes and work in low-skill roles. In downturns, they are the first laid off and the last rehired. During the 2008 financial crisis, many voucher-occupied properties in Las Vegas went into foreclosure. Do not assume stable income from Section 8 tenants when the economy is uncertain.

- Property condition and fit. I have been in many Section 8 occupied properties. With almost no exceptions, the properties were filthy and not in any way maintained by the tenant. Do you want to live with someone who behaves like this?

Bottom line: The question is not only whether Section 8 house hacking is permitted, it is whether the tenant profile and program requirements fit your goals, budget, and tolerance.

Understandable. And as Michael Symthe stated... you are trading one set of problems for another. But while these issues can be impossible to avoid... they can still be mitigated through a good property manager that does proper screening correct? I have also read that S8 also pays more for the unit you rent out than what a regular non S8 tenant would pay for the rental. Is that true on average?

Thank you for the links and info!

Hello George,

The issues with Section 8 tenants can only be partially mitigated by the property manager. The problem is the Section 8 tenant pool. Many live cash-based lives with no credit cards or bank accounts so evictions, judgements for property damage, mean nothing to them. Multiple property managers I’ve asked about the screening process for C-class properties told me the same thing: ALL HAVE HAD multiple evictions, evictions do not matter. The only requirement is two recent paycheck stubs and a money order for the first month’s rent.

I owned two 4-plexes outside Atlanta and the tenant segment they attracted was young professionals. I had no tenant issues and made good money with those properties.

I want you to understand the risk you are facing by telling you what two clients experienced renting to Section 8 tenants.

Client #1:

The client bought multiple single-family homes from us and made good money. He attended a seminar that promoted C-class properties with Section 8 tenants as the “secret” to wealth. He came to us wanting to buy four (class C) 4-plexes. We refused to sell them to him because our policy is simple: no one gets hurt on our watch. That decision cost us about $50,000 in commissions, but we felt it was the right call.

He didn’t believe our warnings and went to another realtor who told him multifamily with Section 8 properties were cash cows. Here’s what happened:

- Property 1: He lost so much money from tenant damage, vacancies, and only received the Housing Authority’s portion of the rent that he sold the property for a loss. For many months, repairs cost more than the mortgage.

- Properties 2, 3, and 4: Same story—severe tenant damage, vacancies, and only partial rent. They were damaged so badly that they couldn’t be rented out or sold. He decided that the most cost-effective solution was to let them go into foreclosure. (The city ended up condemning the properties and demolished the buildings.)

Client #2:

He purchased a single-family home in a good area. Always looking for a "deal", he rented it to a Section 8 tenant because he got about $100 more per month. After one year, he did not renew the Section 8 lease, and it cost him about $15,000 to restore the home to rentable condition.

Summary

From my experience, there’s only so much a property manager can do to reduce the risks. When you choose C-class properties, especially with Section 8 tenants, you’re exposing yourself to the very real chance of significant financial loss. Has everyone had the same outcome? No, I’m sure there are investors who have done well. But every client I’ve personally worked with who rented through Section 8 ended up with significant financial losses. In my view, no matter how much extra rent you might get through Section 8, the risk and potential losses far outweigh the benefits. It simply isn’t worth it.

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

Post: Working on buying my first small multifamily in Las Vegas with FHA. Let's talk!

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Quote from @George Villegas:

Quote from @Michael Smythe:

@George Villegas here's some info to build on the great warning from @Eric Fernwood

The Real Estate Crash of 2008-2010 caused real estate prices to crash across the country - but didn't affect rent amounts. This caused a historically unique opportunity for investors - they could buy Class A properties and immediately cashflow when renting them out.

This couldn't last forever, and it didn't, as excited new investors drove up prices.

Eventually, Class A property values increased to the point that even increasing rents didn't allow them to cashflow upon purchase.

So, the flood of new investors switched to buying Class B properties.

COVID created a chaotic spike in both the sale & rental markets, attracting even more new real estate investors. According to CoreLogic, in December of 2023, almost 30% of home sales were to investors!

Investment also spiked in Class A Short-Term Rentals (STR) and investors started paying higher and higher prices based upon anticipated STR rental rates, that exceeded sustainability based upon Long-Term Rental rates (LTR).

Now we're seeing investors pouring money into buying Class C rentals - but, many are getting burned.

In our experience & opinion, the main determinant of property Class is not location or even property condition, those are #2 and #3. The #1 determinant is the Tenant Pool.

If you don't believe us, try putting several Class D tenants in Class A apartment buildings and watch what happens. Or try the reverse - rehab a property to Class A standards in a Class D neighborhood and try to get a Class A or B tenant to rent it.

Unfortunately, many newbie real estate investors are jumping into buying affordable Class C rentals - expecting Class A results.

In our opinion, Class C tenants have FICO scores from 560 to 620 - where their chance of default/nonpayment is 15-22%. See the chart from Fair Isaac Company (FICO) below:

|

FICO Score |

Pct of Population |

Default Probability |

|

800 or more |

13.00% |

1.00% |

|

750-799 |

27.00% |

1.00% |

|

700-749 |

18.00% |

4.40% |

|

650-699 |

15.00% |

8.90% |

|

600-649 |

12.00% |

15.80% |

|

550-599 |

8.00% |

22.50% |

|

500-549 |

5.00% |

28.40% |

|

Less than 499 |

2.00% |

41.00% |

According to this chart, investors should use corresponding vacancy + tenant-nonperformance factors of approximately 5% for Class A rentals, 10% for Class B and 20% for Class C.

To address Class C payment challenges, many industry "experts" are now selling programs to newbie investors about how Section 8 tenants are the cure. If only it was that easy. Yes, the government pays the Section 8 rent timely, but more and more tenants are having to pay a portion of their rent. Then there are the challenges with Section 8 tenants paying utilities and taking care of their rental property.

Investors should fully understand that Section 8 is not a cure-all for Class C & D tenant challenges, it's just trading one set of problems for another.

We see too many investors not doing enough research to fully understand all this and making naïve investing decisions.Thank you for the insight. I have seen alot regarding section 8 and the benefits that come from using the program. That brings me to my question... is a house hacker still able to use the section 8 program on the other units they are renting on the property while they are still living there? or is this something you can only do after you have left?

It may be possible to house hack with Section 8 tenants. Start with these resources:

- HUD Notice PIH 2021-05: Use of Shared Housing in the Housing Choice Voucher (HCV) Program

- 24 CFR § 982.615–§ 982.618: Shared Housing rules in the HCV program

Section 8, practical considerations

Section 8 is often described as guaranteed rent from the government; however, the reality is different.

- Unpaid tenant share risk. In my experience across roughly 18–20 Section 8 properties, the tenant portion of rent was paid inconsistently or not at all. A property manager who specializes in voucher units told me that nonpayment of the tenant share is the norm. Plan cash flow assuming you may only receive the housing authority portion.

- Inspections and compliance. Section 8 inspections can be brutal. In one case, the tenant wanted all new kitchen appliances. The owner was losing money anyway and was not willing to provide the appliances. The tenant then proceeded to break all the windows and damaged doors and walls. He then called Section 8 for an inspection. They required the owner to repair everything before they would resume Section 8 payment. He had no choice but to buy all new appliances.

- Income risk. Many voucher holders have very low incomes and work in low-skill roles. In downturns, they are the first laid off and the last rehired. During the 2008 financial crisis, many voucher-occupied properties in Las Vegas went into foreclosure. Do not assume stable income from Section 8 tenants when the economy is uncertain.

- Property condition and fit. I have been in many Section 8 occupied properties. With almost no exceptions, the properties were filthy and not in any way maintained by the tenant. Do you want to live with someone who behaves like this?

Bottom line: The question is not only whether Section 8 house hacking is permitted, it is whether the tenant profile and program requirements fit your goals, budget, and tolerance.

Post: What’s your biggest challenge managing rehabs from afar?

Post: What’s your biggest challenge managing rehabs from afar?

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hello @Maxwell Wuensch,

Remote renovations can work very well when managed properly. We’ve delivered more than 580 investment properties to clients around the world, and every one required some level of renovation. Over the years we’ve learned what works and what doesn’t. Here are a few key lessons:

- Use the right people: Handymen often deliver better results than contractors at a fraction of the cost, as long as they’re properly overseen.

- Oversight is key: Without regular on-site overwatch, you will have increased costs, schedule delays, and poor-quality work. We have a dedicated team member who visits each job site every other day, records progress videos, and ensures work is being done correctly. Managing renovations remotely without your own local representative performing overwatch will inevitably lead to problems.

- Leverage matters: Working with an experienced team that manages multiple projects ensures vendors take every job seriously, large or small.

- Renovate smartly: Focus only on upgrades that match your target tenant segment and can be cost justified.

With the right team, clear documentation, and consistent oversight, remote renovations can be just as effective as local ones.

Post: Which areas are best to invest for rental properties near Bay Area California?

Post: Which areas are best to invest for rental properties near Bay Area California?

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hi @Varsha Kgan,

You’re asking the right questions. Many Bay Area investors run into the same challenge: extremely high home prices compared to rents. That imbalance makes cash flow very difficult, and California has additional hurdles:

- Rent control laws limit how much you can raise rents, even when market demand justifies it.

- Tenant-friendly regulations make it slow and expensive to remove non-paying tenants.

- High property taxes and fees further reduce returns.

- Insurance and natural disaster risks (fires, earthquakes) add uncertainty and cost.

For these reasons and more, we’ve completed over ninety 1031 exchanges, most of them out of California. Investors are moving their capital into landlord-friendly states where rents and home prices consistently rise faster than inflation.

One of the strongest examples is Las Vegas:

- No rent control — landlords can adjust rents in line with market demand.

- Pro-business and landlord-friendly laws — evictions for non-payment typically take weeks, not months.

- Strong migration and job growth — people and businesses are moving here, which pushes both rents and home prices higher.

- Consistent appreciation — since 2015, the property segment we target has appreciated at about 9% per year and rents at about 7% per year, both well above inflation.

- Lower entry cost — compared to Bay Area markets, you can often acquire two or three cash-flowing properties here for the cost of one in California.

Wherever you choose to invest, partner with an experienced local investment team. They already have the services, processes, and resources in place to find, evaluate, inspect, renovate, and manage properties. There’s no need to reinvent the wheel, and it shouldn’t cost you more than working with any other realtor.

To your other questions:

- Bedrooms: The larger the house, the smaller the pool of potential renters. For example, a five-bedroom home is likely to attract only large families with multiple children, which is a much smaller group compared to the many families with one or two children who would rent a 3-bedroom, 2-bath, 2-car garage home.

- New vs. resale: Both can work. What matters most is the tenant segment you are targeting and whether the property matches their requirements.

If your goal is long-term financial independence, invest in markets where both rents and home prices consistently rise faster than inflation. That is how wealth is built. California does not offer that environment today.

Post: When It Comes to Lending—Do You Value Speed or Lower Rates More

Post: When It Comes to Lending—Do You Value Speed or Lower Rates More

- Realtor

- Las Vegas, NV

- Posts 817

- Votes 1,565

Hello @Michael Santeusanio,

You’re right, the two key factors are time and interest rates.

Time

There are two important timeframes with loans:

- How long it takes to get pre-approval

- How long it takes to close once the property is under contract

Pre-Approval

We require clients to be pre-approved before we begin working with them. Depending on the lender and the client’s financial situation, this can take anywhere from a few days to a month. For example, if a client has multiple income streams and is also a 1099 worker, some lenders struggle to process it, while others may take two weeks. Because we work with several lenders, we know which ones to recommend based on the client’s circumstances, so timing has not been an issue for us.

Closing

Most of our clients use conventional or DSCR loans. Both typically close in under 30 days, and we see very little difference in closing times between lenders.

Interest Rates

Interest rates vary more than closing times, but lenders often complicate things, making comparisons difficult. Our approach is simple. Only two numbers matter:

- The total cost to acquire the property, including appraisal, loan origination fees, underwriting fees, discount points, down payment, and other expenses.

- The monthly debt service you’ll pay.

Everything else, including APR, is noise. These two numbers are all you need to compare loans effectively.