Updated 3 months ago on . Most recent reply

Don't hold out for lower rates. Now is the time.

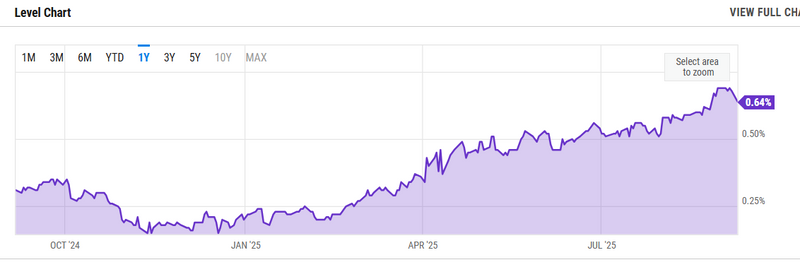

If you need to refinance a rental property or exit a bridge loan. I would suggest pulling the trigger now. The 10 year treasury yield has had a steep drop off, now hovering around 4%. Interest rates for most scenarios are pricing well into the 6's. We saw the same thing happen last year right before the FED cut in September. We came across many Investors who were holding out anticipating the yields to drop further when in reality the treasury yields marched higher through the winter into spring of 2025. It was a case of "buy the rumor, sell the news" One or two bad inflation reports or strong job reports and the rates will start moving in the wrong direction. Take advantage of the rates while you can.

- Matthew Crivelli

- [email protected]

- 413-348-8346

Most Popular Reply

We have no idea how the 10 year will react.

The 30 vs 10 is as wide as it's been that would tell me it might dip a lot more than we figure. Perhaps are pricing in the cuts against future inflation, or longer rates for higher. All depends how you interpret it.

Either ways, always buy based off the rate you get. Quit timing this, don't let lenders like the one's above FOMO you in.