All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 788 times.

Post: May Las Vegas Rental Market Update

Post: May Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

It's May, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

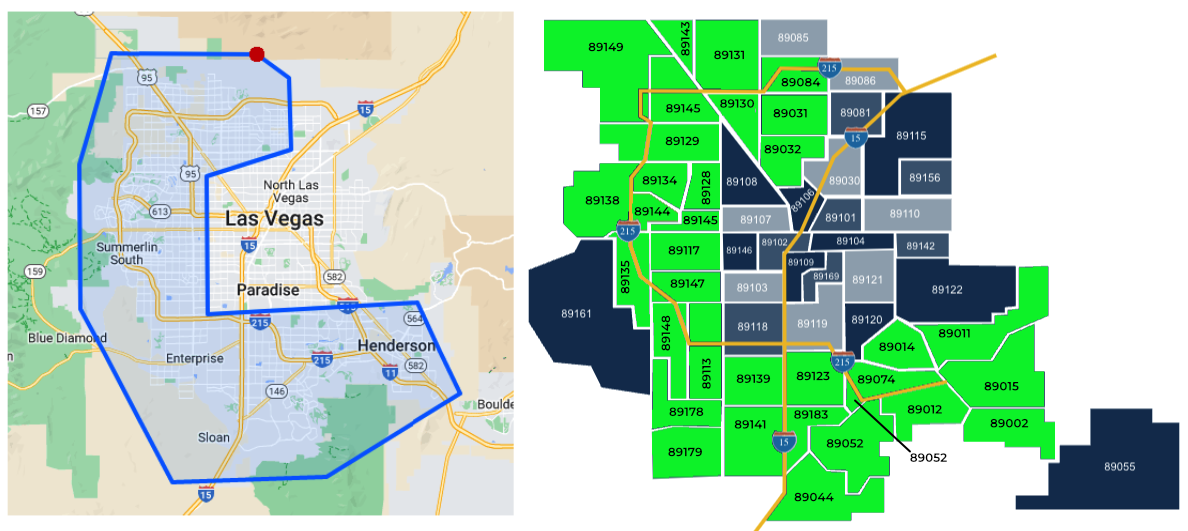

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

- Location: All zip codes marked in green below have one or more of our clients’ investment properties.

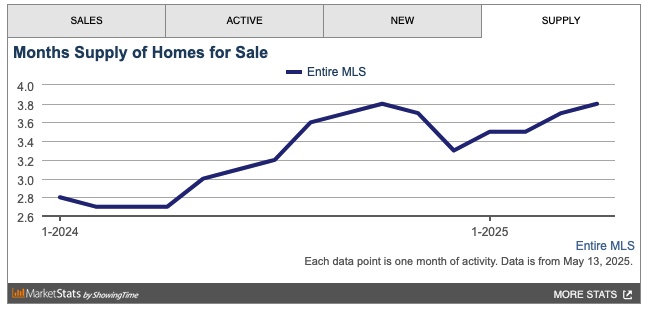

Overall market inventory:

The chart below, from the MLS, includes ALL property types and price ranges.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

Rentals - Median $/SF by Month

Rents increased MoM, in line with our expectations. YoY is flat.

Rentals - Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

Rentals - Median Time to Rent

The median time to rent continued to decrease rapidly in April, now just above 20 days. This is in line with our expectations for this time of year.

Rentals - Months of Supply

Only about 0.9 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

Sales - Months of Supply

There is about 1.9 months of supply for our target property profile. A six-month supply is considered a balanced market. This limited inventory will likely continue to drive up prices.

Sales - Median $/SF by Month

The $/SF had a marginal drop MoM (from $262 to $261), likely due to the tariff effects. YoY is up 6.1%.

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand and price and rent increases. Las Vegas's average annual population increases by 40,000 to 50,000 per year. What attracts people to Las Vegas? Jobs. Ongoing construction projects valued between $26 billion and $30 billion fuel employment opportunities. The most recent job fair featured over 20,000 open positions.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.

Post: How do you manage properties that are hours away?

Post: How do you manage properties that are hours away?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Christopher Carrese Gougeon,

Whether your property is next door or across the country, you simply cannot afford to manage it yourself.

Many landlords mistakenly believe that a property manager's only value is collecting rent. While rent collection is important, it's just one small part of their essential services. Here's what truly matters:

- Tenant Screening: The single most important service a property manager provides is selecting reliable tenants. Most issues can be avoided by not putting a problem tenant in the property. If you think you can handle it yourself, watch the movie Pacific Heights. There are many people who cruise sites like Craigslist and others looking for privately managed rental properties. These people know they can take advantage of you, and they will. However, they know they are very unlikely to pass screening by an experienced property manager and will just look for an easier target.

- Property Marketing: Property managers have access to multiple listing services, which feed popular real estate sites such as Zillow, Redfin, Realtor.com, etc. They can give the property a much bigger market exposure than an individual landlord can.

- Compliance: Property/tenant laws are complicated and change frequently at every level, federal, state, county, and city. Only a skilled property manager keeps you compliant, often through organizations like NARPM. One mistake could land you in court.

- Cost Management: Small repairs can become costly headaches without the right vendor relationships. Property managers have buying power and trusted vendors, saving you time and money. You are just one low-dollar nuisance to most service people.

- Lease Enforcement: Many tenants will push boundaries. A strong property manager enforces leases and handles difficult situations professionally, saving you from potentially expensive litigation.

- Rent Collection: It's not just about receiving payments. Good property managers have processes in place to act immediately when rent is late, which helps educate tenants and protect your cash flow.

Even if your rental is next door, can you truly handle all these responsibilities? Even creating a compliant, enforceable lease is a challenge unless you’re deeply involved with professional organizations.

Do I manage my own properties? My team has delivered over 560 investment properties. I currently own five myself, with the farthest one just five miles from my house. Even though they're close, I simply can't afford the time and risk to save on property manager fees. One bad tenant can cost you more than years of property manager fees.

Summary:

The money you think you'll save managing your own property isn't worth the liability, hassle, and risks. You simply can't afford to do it yourself, no matter where your property is located.

Post: Am I wasting time looking for a “perfect” market?

Post: Am I wasting time looking for a “perfect” market?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Jackie Mcmorrow,

You did a great job on the criteria you specified. The city you choose to invest in IS your most important investment decision. The city defines whether you can maintain lifelong financial independence. Below are some considerations (not in any order).

Landlord-Friendly Laws

Never invest in any cities or states with rent control or restrictive rental regulations. These can make selecting performing tenants, evictions, and rent increases nearly impossible, jeopardizing your ability to maintain profitability.

Lifelong Income

Initial cash flow only predicts initial return under ideal conditions. Financial independence requires rent growth and appreciation that outpaces inflation. Growing markets with higher property prices may offer lower initial cash flow, but their rent growth typically outpaces inflation, enabling lifelong financial independence.

Jobs

An investment property is no better than the jobs your tenants have. For your income to last a lifetime, your tenants must remain employed at similar wages. Since companies have limited lifespans, only invest in cities that attract new businesses that will create the replacement jobs. Look for cities with:

- Low crime rates

- Metro populations over 1 million (for infrastructure and skilled workers)

- Low operating costs.

- Business-friendly regulations

Tenant-First Approach

No property pays rent—tenants do. To have a reliable income, you must have reliable people in your property. A reliable person stays for many years, pays rent on schedule, and takes good care of the property. These people are the exception, not the norm. Work with property managers to identify properties that attract reliable tenants. Then, buy properties similar to what they rent today. Selecting a property first and hoping for good tenants is a risky approach.

Renovation Considerations

Study comparable properties that rent quickly at full market value and make only the necessary changes. Your personal preferences don’t matter—focus solely on upgrades that increase rent or reduce vacancy time.

Summary

By focusing on these criteria, you’ll build a portfolio that supports lifelong financial independence.

Post: Realistic expectations for minimal effort?

Post: Realistic expectations for minimal effort?

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Thomas Slifka,

The best way to save time, reduce risk, and maximize your return is by working with an experienced local investment team. In other words, your best bet for hands-off investing is through a good team. Here’s how to find and qualify the right team.

Start with an Investment Realtor

Unlike residential (or “investor-friendly”) realtors, who focus on buying and selling homes, investment realtors specialize in income-generating properties. They provide the information you need, including:

- Price and rent ranges based on ROI goals

- Tenant demographics

- Area rent growth and appreciation trends

- Cash flow, ROI, and renovation cost estimates

- Local rent restrictions

Investment realtors are always part of a team because no one person can know it all. Investment realtors work closely with property managers and renovation experts, ensuring you have a team with the expertise to handle every aspect of your investment.

Finding an Investment Realtor

To start, compile a list of potential candidates from sources like the following:

- Real estate investing platforms like BiggerPockets

- Local property managers and investors

- Real estate brokers, Google searches, and meetups

How to Evaluate Candidates

Once you’ve identified potential realtors, interview them using these key questions:

- Do you have an investment team? They must be part of an investment team, or they bring little to no value.

- Do you own investment properties? Unless they are investors, they will not understand what you need to be successful.

- How many investment properties have you closed in the past year? Look for at least 12.

- Who selected the properties? Reject candidates who rely on clients to select properties.

- What criteria do you use for property selection? Expect data-driven answers, not opinions.

- What tenant pool do you target? They should demonstrate knowledge of tenant behavior and demographics.

- What’s the average tenant stay? Look for specifics—e.g., “Our tenants stay over five years.”

- How do you estimate rent and time to rent? Answers should reflect recent, comparable rentals, not unreliable online estimation tools like Zillow and Rentometer.

- What’s your renovation process? They should collaborate with property managers and contractors.

After each interview, assess their honesty, expertise, and whether you feel comfortable working with them. Adjust your questions as needed, and if they check all the boxes, you’ve likely found the right partner.

By following this process, you’ll build a team that minimizes your time and risk and maximizes your returns.

Let me know if you would like any details for the above. I had to be as brief as possible to keep the post at a reasonable length.

Post: newbie trying to learn about markets

Post: newbie trying to learn about markets

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Marisa Opp,

Selecting the right investment city is crucial for achieving financial independence. Financial independence isn't a one-time event or a fixed amount—it requires an income that meets multiple characteristics, which are defined by the city where you invest. Below are two such characteristics.

- Rents outpace inflation: Your rental income must increase faster than inflation to cover rising costs. Cities with significant and sustained population growth are likely to meet this requirement.

- Lifelong income: Your income must last a lifetime, which depends on tenants maintaining employment at similar wages. Since companies have (relatively) short lifespans, tenants will need replacement jobs multiple times over your (property) hold time. Cities that attract new companies have low crime rates, a metro population over 1 million (for solid infrastructure and skilled worker pool), and low operating costs (such as low taxes and less regulation).

Evaluating every potential city is impractical, so use elimination filters:

- Population Growth: Start with cities having a metro population over 1 million and consistent and significant growth. Wikipedia

- Low Crime: Avoid cities on this list: CBS: The 50 Most Dangerous Cities in America.

- Low Operating Costs: High operating costs can turn a profitable property into a money pit. Consider property taxes and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- No Rent Control: Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

- Local Investment Team: While general knowledge from seminars and books is helpful, local expertise is crucial for specific purchases. Only an experienced local investment team can provide the resources and knowledge you'll need.

When you filter out all the cities that do not match all the above requirements, you will have a shortlist of cities for further evaluation.

Post: Paying for Market Data

Post: Paying for Market Data

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Brandon Major,

The data you need to evaluate investment cities is readily available, and there's no need to purchase anything. In this post, I will explain a process and provide the necessary information sources.

Selecting the right investment city is crucial for achieving financial independence. Financial independence isn't a one-time event or a fixed amount—it requires an income that meets multiple characteristics, which are defined by the city where you invest. Below are two such characteristics.

- Rents outpace inflation: Your rental income must increase faster than inflation to cover rising costs. Cities with significant and sustained population growth are likely to meet this requirement.

- Lifelong income: Your income must last a lifetime, which depends on tenants maintaining employment at similar wages. Since companies have (relatively) short lifespans, tenants will need replacement jobs multiple times over your (property) hold time. Cities that attract new companies have low crime rates, a metro population over 1 million (for solid infrastructure and skilled worker pool), and low operating costs (such as low taxes and less regulation).

Evaluating every potential city is impractical, so use elimination filters:

- Population Growth: Start with cities having a metro population over 1 million and consistent and significant growth. Wikipedia

- Low Crime: Avoid cities on this list: CBS: The 50 Most Dangerous Cities in America.

- Low Operating Costs: High operating costs can turn a profitable property into a money pit. Consider property taxes and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- No Rent Control: Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

- Local Investment Team: While general knowledge from seminars and books is helpful, local expertise is crucial for specific purchases. Only an experienced local investment team can provide the resources and knowledge you'll need.

When you filter out all the cities that do not match all the above requirements, you will have a shortlist of cities for further evaluation.

Post: Finding multifamily listings in New Hampshire

Post: Finding multifamily listings in New Hampshire

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Moe Collins,

The type of property you buy should align with your financial goals. If financial independence is your goal, focus on attracting reliable tenants—those who stay long-term, pay rent on time, and care for the property. However, reliable tenants are not the norm.

To find a tenant segment with a high concentration of reliable tenants, ask multiple experienced property managers: "If you were buying a property to attract responsible, long-term tenants, what and where would you buy?" Once you identify the right segment, create a property profile based on what they currently rent. For instance:

- Type: Single-family homes or select townhomes

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garages, 1,100–2,400 square feet

- Rent range: $1,900–$2,300/month

- Location: Areas they already live

Why Multifamily Properties May Not Be Ideal

While multifamily properties are often touted, they’re not always the best choice, especially for new investors. Here’s why:

- Higher vacancy rates: With multiple units, vacancies are more frequent, and without full occupancy, covering operating costs becomes challenging.

- Higher maintenance costs: A fourplex, for example, has four times the appliances, plumbing, and HVAC systems, driving up repair expenses compared to a single-family home.

- Frequent turnover: Vacant units often require costly renovations to prepare for new tenants, further impacting cash flow.

Consider Charles Lindbergh's 1927 solo flight from New York to Paris. Initially, a two-engine plane was considered for safety, but planes of that era couldn't stay aloft for long on one engine. This meant a two-engine plane doubled the risk of crashing into the Atlantic, without adding any advantages. Lindbergh opted for a single-engine plane, prioritizing simplicity and reliability.

The same principle applies to real estate investing: focus on your goal and choose tenants who meet your needs. Let these tenants guide your property choices rather than following others' opinions.

Post: Looking for out of state investing

Post: Looking for out of state investing

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Chaim Mal,

With today's high interest rates, finding properties that cash flow in their first year is difficult in most cities—except perhaps in cities with significant population decline. In these cities, you can buy properties at very low prices that may provide immediate cash flow. However, properties in such cities typically won't appreciate meaningfully in value or see meaningful rent increases over time, so they will not enable financial independence.

Real estate investing is a solution to a long-term problem: financial independence. Financial independence isn't just about a specific dollar amount, it's about an income that will sustain your current lifestyle for the rest of your life. This requires investing in a location where rents outpace inflation. Rents, like prices, are driven by long term demand.

Cash flow and ROI only predict how a property is likely to perform initially under ideal conditions. If you expect to live 30 more years, what happens in the first year matters less than what happens over the following decades. Therefore, you need to invest with a long-term perspective rather than focusing solely on day-one performance (Cash flow and ROI).

Invest in cities with the following characteristics.

- Significant and sustained population growth.

- Low overhead costs (especially property taxes and insurance).

- Pro-landlord legislative environment (rapid and low cost evictions, is one consideration).

- Rapid and sustained appreciation of existing homes.

- Low risk of natural disaster.

In summary, if your goal is financial independence, take a long-term view when choosing an investment city, as your financial success is directly linked to that city's long-term performance.

Post: Las Vegas investment

Post: Las Vegas investment

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

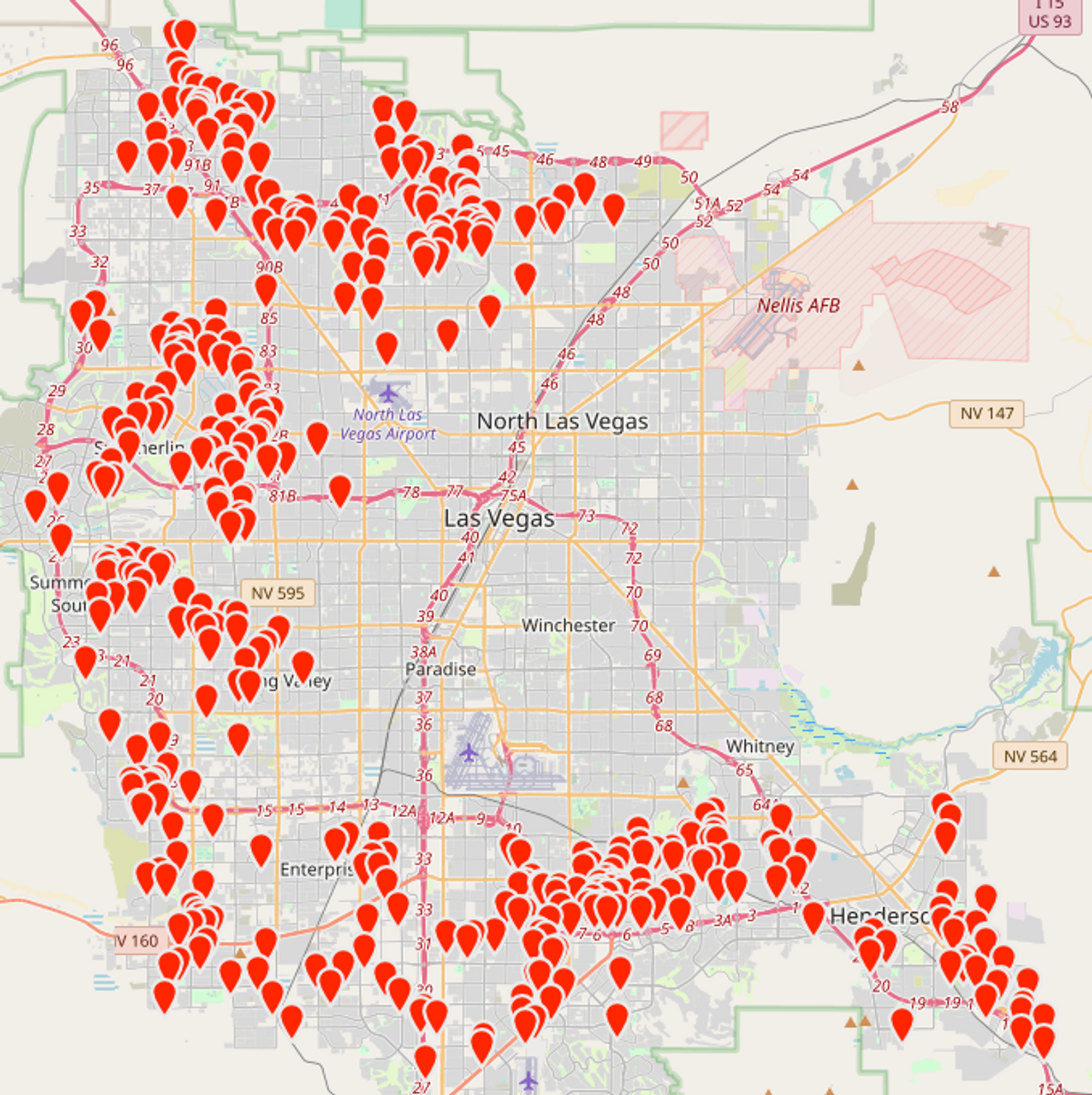

Hello @Sam Chan,

Below is a map showing where we and our clients own properties, which should give you an idea of the premier areas for investing.

DM me if you would like a drive path showing the typical areas/neighborhoods where our clients’ properties are located.

However, there is much more to the general areas. Income is critical for real estate, which means that the tenant is the crucial factor because they are the ones who pay the rent. If you buy conforming properties, you should achieve what our clients do, which is an average tenant stay of over five years. Reach out if you want more information.

Sam, I hope this gives you some idea of where to look for investment properties.

Post: I have 450k cash

Post: I have 450k cash

- Realtor

- Las Vegas, NV

- Posts 819

- Votes 1,572

Hello @Max Engel,

Most people want to invest in real estate close to where they live - that's natural. But here's the thing: to actually live off your rental income and be financially independent, you need to invest in a city with the right characteristics or you can not maintain financial independence.

Key factors for a successful investment city include:

- Population Growth: Cities with significant and sustained population growth typically have rising prices and rents. If your rents don't increase faster than inflation, the number of properties you own becomes irrelevant—you won't be able to maintain financial independence.

- Low Overhead Costs: every dollar you lose to cost like taxes and insurance is a dollar or less for you to live on. Be very aware of the overhead cost of the city where you invest.

- Job Growth: a rental property is no better than the jobs of your tenants. In the US, companies have an average lifespan between 10 and 18 years. So, during the year you will live on your rental income, your tenants will probably have to find replacement jobs on more than one occasion. So your future depends upon new companies, moving into the city and creating replacement jobs. Companies have a lot of options on where to set up new operations. The most common factors that companies based their city selection on are as follows..

- Metro Population: 1M+ population provides infrastructure and workforce.

- Low Crime Rates: Safe environments attract businesses.

- Pro-Business Climate: Favorable regulations encourage growth.

- Competitive Costs: Lower operating costs attract companies.

"Live where you love, but invest where you can achieve financial independence." Choose investment locations based on financial goals, not proximity to where you live.

Remote investing works. The critical factor is a competent full service local investment team.