Updated 5 months ago on . Most recent reply

May Las Vegas Rental Market Update

It's May, and it's time for another Las Vegas rental market update. For a more comprehensive look at the Las Vegas investment market, please DM me for a link to our blog. There, you'll find detailed information on investing, both in general and specifically in Las Vegas.

Before I continue, note that unless otherwise stated, the charts only include properties that match the following profile.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garages, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

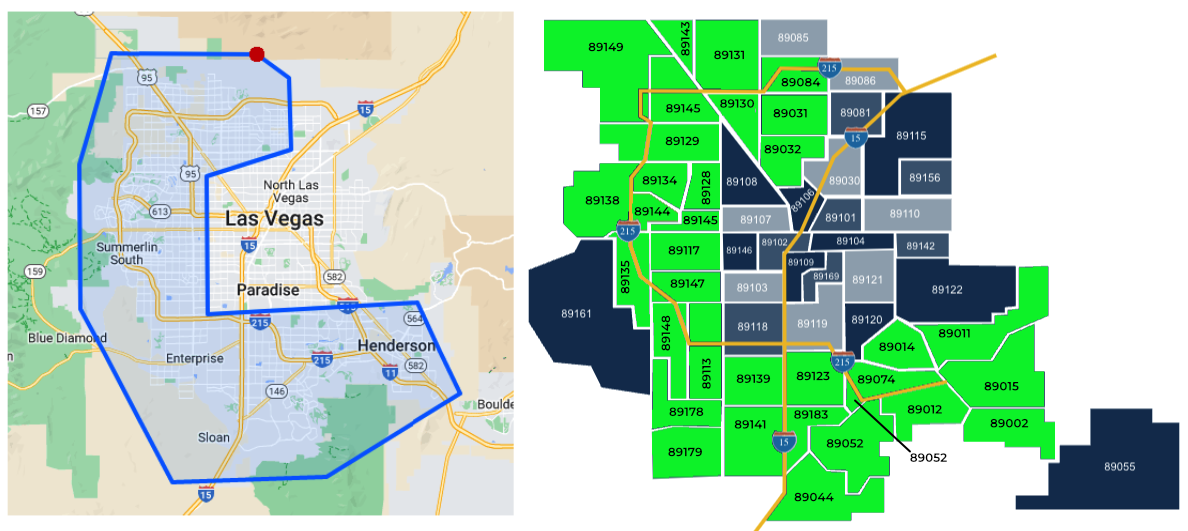

- Location: All zip codes marked in green below have one or more of our clients’ investment properties.

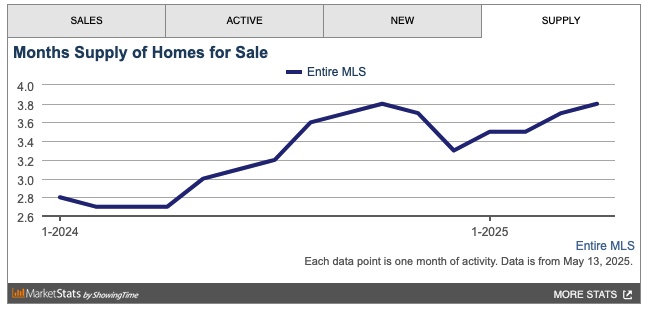

Overall market inventory:

The chart below, from the MLS, includes ALL property types and price ranges.

Rental Market Trends

The charts below are only relevant to the property profile that we target.

Rentals - Median $/SF by Month

Rents increased MoM, in line with our expectations. YoY is flat.

Rentals - Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

Rentals - Median Time to Rent

The median time to rent continued to decrease rapidly in April, now just above 20 days. This is in line with our expectations for this time of year.

Rentals - Months of Supply

Only about 0.9 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

Sales - Months of Supply

There is about 1.9 months of supply for our target property profile. A six-month supply is considered a balanced market. This limited inventory will likely continue to drive up prices.

Sales - Median $/SF by Month

The $/SF had a marginal drop MoM (from $262 to $261), likely due to the tariff effects. YoY is up 6.1%.

Why invest in Las Vegas?

The goal is to achieve and maintain financial freedom. Financial freedom means more than just matching your current income—it's about sustaining your lifestyle permanently. To accomplish this, you need income growth that exceeds inflation. Without this growth, you won't be able to keep up with the rising costs of goods and services.

What causes rents (and prices) to increase?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

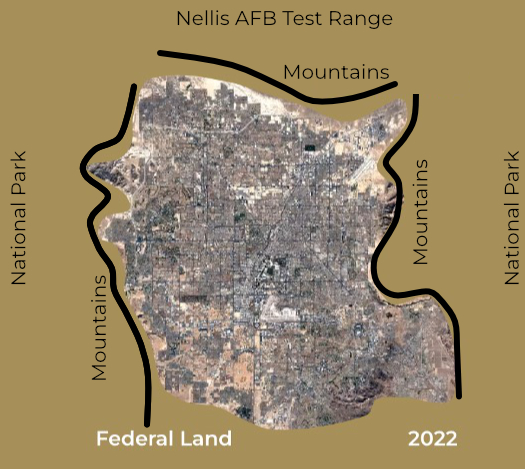

Las Vegas is unique because it is a tiny island of privately owned land in an ocean of federal land. See the 2022 aerial view below.

Very little undeveloped private land is left in the Las Vegas Valley, and desirable areas cost more than $1 million per acre. Consequently, new homes in these locations start at $550,000. Homes that appeal to our target tenant segment range from $350,000 to $475,000, so the supply of housing we target remains almost the same regardless of how many new homes are built.

Demand

Population growth drives housing demand and price and rent increases. Las Vegas's average annual population increases by 40,000 to 50,000 per year. What attracts people to Las Vegas? Jobs. Ongoing construction projects valued between $26 billion and $30 billion fuel employment opportunities. The most recent job fair featured over 20,000 open positions.

In Conclusion

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Thanks for reading my post. Reach out if you have questions or would like to discuss investing in Las Vegas.

- Eric Fernwood

- [email protected]

- 702-358-8884