Updated 6 months ago on .

- Real Estate Agent

- Nashville, TN

- 167

- Votes |

- 335

- Posts

US Housing Data is, Flawed?

Welcome to the Skeptical Investor weekly article, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

This week, we’re talkin’ economic data for real estate investors, and I point out some seriously flawed census housing data. Amidst a wild week of geopolitical news, I filter out the noise from the headlines. And, could the Fed cut rates, yet mortgage rates don’t go down?

Let’s get into it.

--------

Today’s Interest Rate: 6.59%

(☝️.02% from this time last week, 30-yr mortgage)-----------

The Weekly 3 in News:- Lumber prices dropped in August, with futures down 8%. While annual prices are still up 11% YoY, it’s from a low base. Lumber inflation remains muted, especially when compared to 2021 and again in 2022. Timbrrrrrrrrrr :) (Lumber Futures).

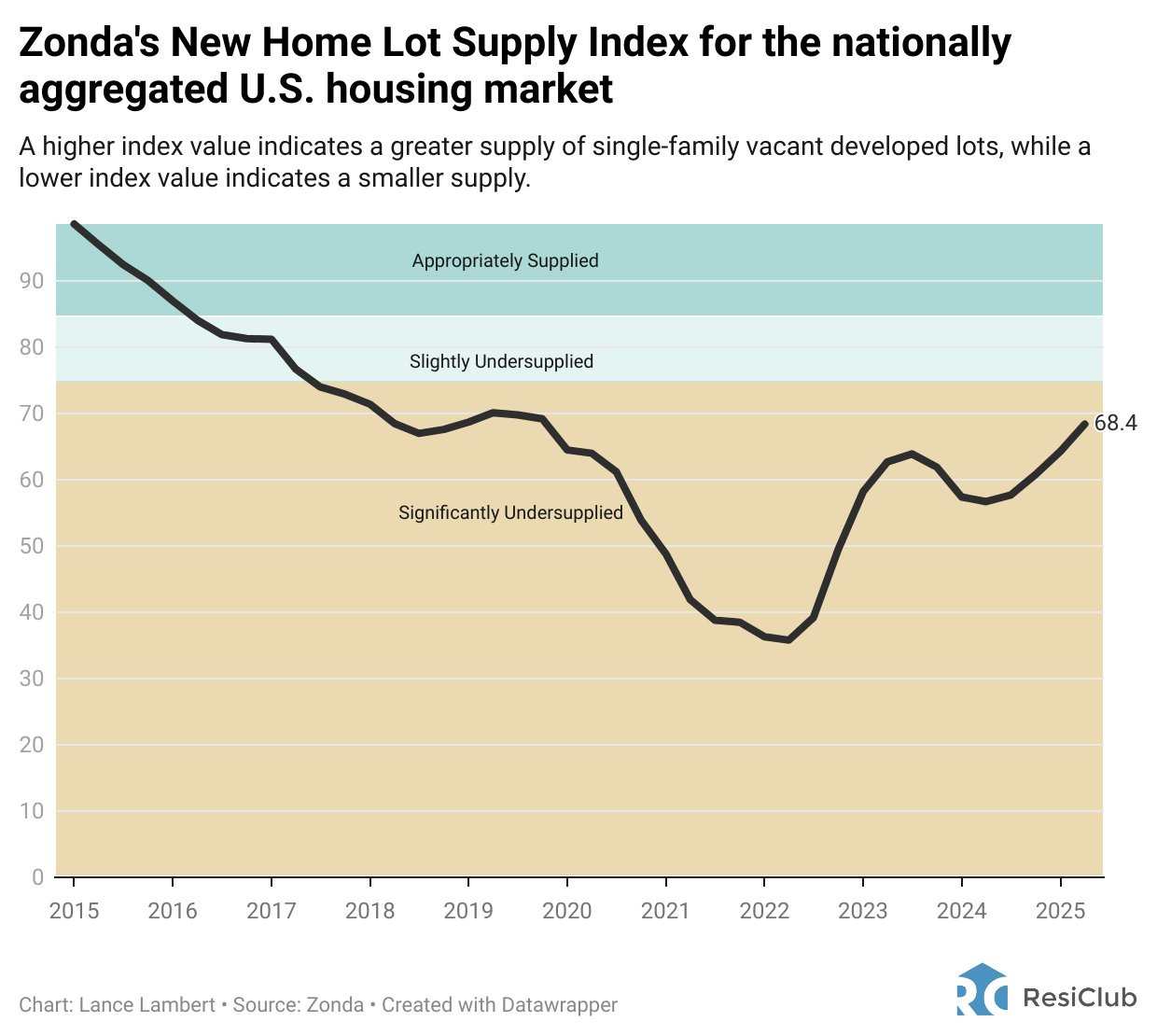

- Supply of available lots for homebuilders is up in most markets, just in time IF rates drop in the coming months. We are now right at 2019 levels, which was below historic averages. (ResiClub/Zonda).

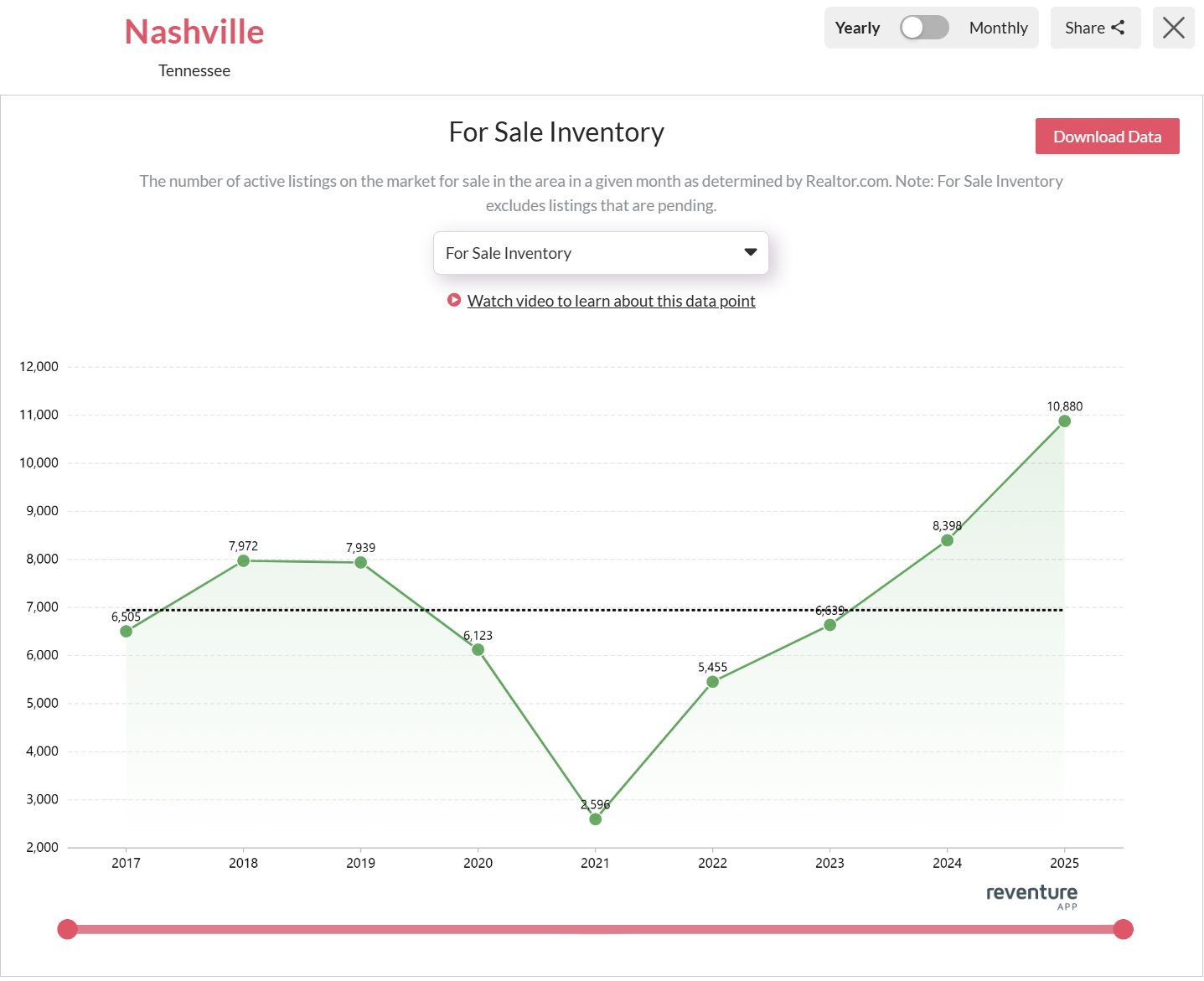

- Noise Level 9 - Nashville inventory is now higher than pre-COVID levels, true, but savvy investors are skeptical. Much of the new inventory is cheap new builds coming on the market, not investible or value-add properties (and frankly, the builders are screwing up, we are swimming in ugly/mediocre new construction that I would never buy, and I find myself often steering my clients away. Step it up developers!). The inventory of available existing homes is still near an all-time low. This is the exact kind of headline that can severely mislead the uninformed investor (Reventure). 👇

News or Noise?

This week, we get a slew of important economic-related data mixed in with a larger witches’ brew of geopolitical developments.

But don’t let all that slosh around your noggin and cloud your judgment. Keep your head steady and ignore the noise. Headline news could overshadow the important economic data released this week.

Here is a short list of all the happenings to watch out for:

- - The President meets with both European leaders and President Zelensky of Ukraine. This, on the back of a face-to-face sit-down with President Putin, distracting fireworks will be abundant. IF some sort of peace deal is reached, equity markets may rip. I have no idea what the bond market will do, likely slightly bullish for rate drops as some uncertainty is moved off the board. However, for us as investors, this is a distraction. Focus on the numbers and the forthcoming data below. Any deal is likely weeks away at the earliest.

- - Federal Reserve meets in Jackson Hole all week for its annual Economic Policy Symposium. This year’s theme is "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy." The event gathers a who's who of central bankers, executives and economists. There will be market-moving discussions on policy affecting the housing market. Hint: they are now focused on the labor market NOT inflation. Pay attention.

- - August S&P Manufacturing PMI data is released on Wednesday. Expected to be weaker.

- - Existing Home Sales / activity data released Thursday. Also expected to be weaker.

- - Fed Chair Powell gives annual Jackson Hole speech Friday. Additionally, speeches by other Fed Governors will be given throughout the week during the event. The stock and bond markets will be on bated breath. Expect some volatility.

- - Housing Starts and Building Permits for July will be released Tuesday AM, measuring new residential construction, and providing insight into housing supply and economic momentum. Spoiler alert, they will remain suppressed.

- - New Mortgage Applications and 30-Year Mortgage Rate data will be released by the Mortgage Bankers Association Wednesday, which tracks home loan demand and rates, reflecting borrowing costs and housing affordability. As avid readers know, I have been tracking this number like a hawk on a loose guinea pig.

- - Initial Jobless Claims get spit out on Thursday. Who knows if this is accurate, with the constant revisions and mistakes in job statistics, as I wrote about last week. I will remain extreamly skeptical of this number until the BLS can get their **** together. They are embarrassing, devoid of rigor.

- - Philadelphia Fed Manufacturing Index for August is released at 8:30 AM on Thursday. This assesses regional manufacturing activity, often a bellwether for national trends. I prefer this to the NY index. Watch out for this one, given producer price inflation last week was hot.

- - The Conference Board Leading Economic Index for July comes out Thursday mid-morning. This composite is used by market participants as an indicator to help forecast future economic activity.

- Many more…..but I think you get my drift.

Speaking of Drift, I was at East Nashville’s Drift Hotel this past week, an old rundown motel that they brought back to life with a lovely renovation. Daytime margaritas poolside is quite nice, as is the lounge/speakeasy vibe bar/coffee shop inside.

Highly recommend.

But I digress…

Be Skeptical: Our Housing Data is Flawed

This week housing analyst Jay Parsons (a great follow on Twitter) dropped some real knowledge, the housing data we are getting (and the media picks up and prints) has some serious inaccuracies.

To put it nicely.

To put it not so nicely, the government data is ****ing wrong, their collection methods are lazy and often survey based with plenty of assumptions. As a result, it often varies widely when compared to higher-quality private sector data. Do we all now have to go multiple layers deep when using it to verify its accuracy? That is not sustainable; our media won’t do it. Hell, I don’t have time to check the fact checker either!

Case in point, here is a headline from Bloomberg, quoting this month’s census housing data on multifamily construction starts:

And here is Jay, who tracks this data closely and I often reference in this newsletter, absolutely eviscerates it:

“Today's Census release on multifamily housing starts makes it clear: It's time to revisit methodologies. These numbers are not believable ... way, way inflated compared to higher-quality private sector data.

Think about the potential implications of overstating housing starts...1) It might remove some urgency on local and federal policymakers to create policies to spur multifamily construction out of the doldrums.

2) It might convince the Fed that high rates are not impacting multifamily starts ... when in fact, if you ask nearly any developer, they'll tell you it's a big hurdle b/c they rely heavily on short-term debt.

The Census is telling us that multifamily starts in July soared to the SECOND-HIGHEST NUMBER FOR ANY JULY IN NEARLY FOUR DECADES. They reported a non-seasonalized monthly total of 42,000 units (or annualized starts of 470,000 units). That number surpassed even the (actual) peaks seen in 2021-22 from the era of record demand and cheap debt.

And it follows the Census reporting that June 2025 multifamily starts were the highest for any June since 1990. Also highly unlikely.

By comparison, private sector datasets like CoStar (which track individual projects, whereas the Census surveys a small percentage of permit holders to estimate starts) show multifamily starts at 12+ year lows.

Multifamily starts remain very limited. It's a tough environment to get new deals started -- even for the biggest-name developers and even for REITs with lower cost of capital. Any data that says otherwise is painting a misleading picture that risks removing some of the urgency to spur construction back up again.”

I couldn’t have said it better myself. Hear hear Jay.

A Splash of Cold Water

Last week, the bond market had completely priced in the assumption that the Fed will cut rates at its next September meeting, at 100%.

100%?! Nothing is 100%. This had me tilted over the weekend.

Now, in just the last few days, that number has decreased to 83.2%.

Better.

And the chance of a second cut in 2025 is now down to 42.7% by October but still high, 80%, by December. (3 cuts by December is low at 32.4%).

This kind of certainty makes me skeptical. And I hate to do it, because I do think it is more likely than not that the Fed cuts .25% at their next meeting, but I think we need to throw a little cold water on the assumption that the Fed will cut, not only in September but also again in December.

They could very well not.

If we get a few hot inflation signals and the labor market holds steady… why would a stubborn Fed Chair Powell - who still has a majority of the FOMC board on his side - cut then? He also could do what pundits call “a hawkish cut,” meaning, cut .25% and then in his speech provide hawkish commentary, casting doubt on future rate cuts. Interest rates would likely spike on the news.

So when investing, we shouldn’t place bets or assume. And I am not immune to this myself.

Mea culpa, last week I waited until the very last minute to lock in a rate for my next deal. I was trying to time what I thought was the upward momentum in the bond market, and eek out just a little better rate.

Luckily, I was right. Rates decreased slightly last week. BUT that’s not the point.

I could have very well been wrong. Do not do what I did. Do not try to time the market or, more importantly, underwrite an assumption of lower rates in the near future. They could stay high for another year+. Even if that is unlikely, we just don’t know.

Counterpoint from the devil on my shoulder - I am quite self-aware; I knew I was speculating. Sometimes I like to gamble, based on the risk/reward.

A Bullish FOMC in 2026Now, all this being said, the President will have a significant moment to change the constitution of the Federal Reserve in 2026, likely bringing a more dovish (aka bullish) tone. There will be 2 open slots to fill in just the coming few months, the Chair and at least one retiring Fed Board member. Remember, Powell is the Chair of the Fed, but not its king. It is a board - The Federal Open Market Committee - which consists of 12 voting members who make decisions on monetary policy. They vote each quarter on where to set interest rates. Two governors dissented at the July meeting, voting to cut interest rates.

Below is the “Dot Plot” hilariously archaic survey that the Federal Reserve puts out showing anonymous predictions from the Federal Reserve governors for where interest rates will be in the future.

Once the FOMC board is updated, expect these dots to inch lower by 1/2-1 point, in my opinion.

Fun fact: Powell’s term as chair expires in May 2026. But his term as a Fed Governor doesn’t end until January 2028. He could technically stay longer (if he really wanted to through some cold water on future rate cuts).

A Fed Rate Cut Does Not Guarantee Lower Mortgage RatesIf the Fed cuts short-term rates a little further in September and perhaps December, but the economy and unemployment remain resilient, it is possible for mortgage rates to remain unchanged.

Yes a Fed rate cut should put downward pressure on mortgage rates—but the effect isn’t automatic or guaranteed. A lower Fed Funds Rate reduces banks' short-term borrowing costs, which normally reverberate through the broader credit system. However, if bond markets remain concerned about potential inflation or the economy/labor markets don’t materially weaken, yields may not fall materially despite the Fed cutting.

This happened last Fall, 2024, remember.

This could happen again, don’t get overconfident.

My Skeptical Take:

All eyes will now be on Jerome Powell during his speech Friday.

Will he signal dovish (cut) or hawkish (no cut) or a hawkish-dovish? (Haha, god this horse race is so ridiculous).

Will we get a rate cut? With current market data, absent another historical swing to the upside, yes the Fed should cut rates in September by .25%. But I am no longer as certain that they will follow with two more cuts at the next two meetings. I am shifting my thinking. I am now more skeptical of the labor and inflation data, and I think the Federal Reserve quietly is in the same camp, and will be more patient than the market thinks.

Yes I’m changing my prediction. Hell, I have strong opinions, but I am always learning :).

Could a rate cut not matter? Again, this could depend fully on the language Powell uses during his speech both on Friday, and after the rate cut decision in mid-September. In fact, it is possible for a rate cut in September to actually increase mortgage rates or at the very least allow them to be flat if Federal Reserve Chair Powell signals his willingness to remain patient and not restart the rate cut cycle anytime soon.

How about 2026? Powell is out in May at the latest and by then the President will have nominated, and the Senate confirmed, an additional friendly governor, meaning at least 4 of the 7 needed for a majority on the FOMC be highly likely / loud voices for additional rate cuts.

2026 is gonna be gangbusters, in my humble opinion, for real esteta.

I think we are in that part of the real estate cycle - after 3 years of high interest rates, recessionary activity/sales levels, and low inventory - that seems to be the beginning of a cyclical bull market – something we haven't seen since the last bottom in 2011. CBRE, Cushman and Wakefield, Collier, Newmark, and JLL are all raising guidance for commercial real estate in 2026. Investors have acclimated to higher rates and used the time to get their balance sheets fit and financing in order.

Sharpen your underwriting pencils. And check your data.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

- Andreas Mueller