All Forum Posts by: Andreas Mueller

Andreas Mueller has started 66 posts and replied 241 times.

Post: Interest Rate Cut in Oct: Trick or Treat? (+ BPCON25!)

Post: Interest Rate Cut in Oct: Trick or Treat? (+ BPCON25!)

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Welcome to my weekly Skeptical Investor article, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

-----------

This week, we’re talkin’ gov “shut down”, is the Fed cutting rates in October still?, and I’m at the Bigger Pockets 2025 Conference in Las Vegas!

Let’s get into it.

----------

Today’s Interest Rate: 6.34%

(FLAT from this time last week, 30-yr mortgage) -------- The Weekly 3 in News:- - Is the labor market really weakening, or is it merely “rebalancing” as a result of low immigration? Dallas Fed analysis says it may not be as bad as the pundits are saying (DCB).

- - The Atlanta Fed’s GDPNow says the U.S. is growing at +3.8%. But Moody’s Analytics finds 23 states may be in recession. What gives? (Simon Ree)

- - Data centers are growing geometrically, and so is electricity demand. What will happen to electricity prices, landlords/renters? (ZeroHeddge)

Apologies for the late post y’all!

I’ve been at a real estate investor conference this week hosted by BiggerPockets.com, a fantastic online resource and community for real estate investors (And if you are unfamiliar with this community, I highly recommend you check it out. I’m one of their featured real estate agents, and have been a part of this community for the better part of a decade).

So this week’s article will be a little more concise, if I can help it, as I frantically attack my keyboard before I sprint over to meet a few conference attendees who want to talk real estate (one of my favorite things, obviously).

Nevertheless, I wanted to give a few thoughts before I head over.

Quick Take: State of the Economy

In short. The labor market continues to soften, inflation is on trend down but may be volatile in the short term, the US economy is still expected to grow like gangbusters at 3.8%, and the Fed has a great cut decision to make just before Halloween (Oct. 29th).

Spoooooooky.

Oh, and we have no government data on either of the above since Congress is totally cockeyed and can’t pass a budget.

Cool. Cool.

Companies Lower Hiring Plans

Without BLS jobs data (which has been ultra-suspect for years, frankly), we (and the Fed itself) are operating a bit in the dark. Companies last month announced plans to add 117,313 jobs, down 71% from a year earlier and the weakest September reading since 2011.

Now this is what companies tell the surveyor, but still a very strong signal.

And job postings on the Indeed job platform are down. Now close to 2019 levels.

Again, not terrible, but a signal.

Folks may be keeping their jobs, unemployment is still at 4.3%. But the pace of hiring is really taking a breather.

Trick or Treat From the Fed?The Fed is likely to cut rates in October. Bond market has priced in a near 100% chance.

However…I now have (some) doubts.

They could very much use the excuse that, because of the Shut Down, they do not have enough data to determine if the labor market is weak enough to warrant a cut, in the face of levitating inflation (which they also don’t have fidelity on). The US economy is still at full employment (aka anything below 5%).

Quick aside: the government isn’t “Shut down.” That is a salacious term that is used for some odd reason. Because Congress couldn’t agree on its annual spending bills by the start of the Fiscal Year on Oct. 1, we are essentially now running in government Safe Mode. Essential functions of the government still function, many folks still are required to go to work, and those who are furloughed (ie, sent home and told not to come to work) are effectively taking a vacation; they will receive full backpay once Congress gets its act together to pass the government funding bill.

If I were handicapping it, based on the rhetoric from both sides, I think they take another 2-4 weeks to figure this out.

But I digress….

The Bigger Pockets 2025 Conference: Las Vegas

BPCon25 this year has been fantastic. I've been both enthralled by superb presenters/speakers and met numerous good folks from across the country (and a few from overseas) who are all looking to better themselves as investors/operators.

And I've been a little surprised by how genuinely enthusiastic folks are in, not only what I'm doing, but also in my home market of Nashville. The second I mention Nashville, the topic always turns to their intrigue about it as an investment market and how they have heard great things from colleagues who invest here (and also the, shall we say, enhanced time they had here once last at night on Broadway).

Candidly, I’ve felt a little like the hot girl at the club (for once :).

But really, it’s been the learning from others that has been such a value add. I've met so many beginning, growing, record-breaking real estate investors this week, across a variety of strategies and asset classes. I’ve shared (and debated) about views on the economy, the role of government in real estate, investment strategies, asset classes, how to best underwrite deals… It's frankly just damn enjoyable to turn around in a room and be able to talk and share with a new person in the industry.

Everyone here is trying to step their game up, and give a hand up to the next person.

If you haven’t been and are even the slightest interested in real estate as an investment class, I highly recommend.

And.

They don’t throw a bad party. (Drai’s)

Post-cocktail dance floor.

Oh, and I caught the UFC fight over the weekend!

Here is a picture I snapped of Alex Pereira getting the belt back after KO’ing Magomed Ankalaev in the first round. Holy hell this was epic!

I completely lost my voice before the conference even started.

Worth it.

My Skeptical Take:

The market is softening, but there are mixed signals. As we saw last week, personal consumption is still robust enough and unemployment, low enough, and income growth is high enough (still higher than inflation) that the US economy is chugging along nicely.

So far.

Or, perhaps we’re in a good enough economy? Artificial intelligence is driving, corporate profits, strong employment, and a robust American consumer.

We should celebrate that.

But also, there are pockets of deep despair. I would not want to be a college graduate now in anything not math or science related, especially if I were looking for a white collar, middle-manager type career.

Counterpoint: blue-collar workers are having their day. Working in the trades, working with your hands, is something that AI cannot disrupt. (At least for many years to come). If you sweat for a living chances, are you're doing pretty damn well.

So, getting back to real estate, will the Fed cut rates this month and deliver a treat for Halloween? Yes I believe they will however, I am now 75% sure only, down from 90% sure just last week. The labor market has not broken yet, and inflation will continue to be volatile in the short term. At the last Fed meeting in September, the minutes indicated there may have been more support for no cut than for a half-point cut.

So, in the face of low data availability, this raises doubts for a Fed that says they are data data-dependent.

But…. a thought amongst all this hoopla.

America is a great place to be.

And in the words of Peter Lynch, the famed investor, I’ll leave you with this.

“America creates China duplicates and Europe legislates.”

I wouldn’t want to be anywhere else.

Ok, time to walk the pooch. Good night y’all….

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

Post: This is a Rasputin Economy

Post: This is a Rasputin Economy

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Welcome to the Skeptical Investor Newsletter, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

-----

First: A public service announcement....

Will you be in Las Vegas next week at the Bigger Pockets Conference? I will! And if you'd like to grab some time in the hallway, coffee shop, roulette table give me a shout! First 10 people that message me I will make sure to make time for. Let's talk real estate!

Ok, now back to our regularly scheduled programming....

-----

This week, we’re talkin’ a smokin’ hot US GDP number, steady consumer data, government shutdown, and I do a deep dive into the Bureau of Economic Analysis and how they arrive at the GDP number we all follow. Spoiler, data collection methodology.

Let’s get into it.

----------------

Today’s Interest Rate: 6.38%

(☝️.03% from this time last week, 30-yr mortgage)--------------

The Weekly 3 in News:- -Refinances are boomlet’ing. Folks who purchased property recently in the 7-8% range are taking advantage of lower mortgage rates, now double last year’s refi number (ResiClub).

- -High Credit Scores Dominating New Mortgages. The majority of FICO credit scores are above 740. The average homeowner is the most financially stable they have been in decades. This is why foreclosures are at historic lows (HousingWire).

- -Mom-and-pop landlords have always dominated the single-family rental market, NOT Wall Street. 89.6% of single-family rentals are owned by landlords who hold between 1 and 5 properties. Don’t let salacious headlines fool you (ResiClub).

--------------------------

U.S. Economy is Going Gangbusters: 3.8%

The second quarter of this year was just revised up to 3.8%, which is the best second quarter since Q2 2021, and the best overall quarter since Q3 2023.

Boom!

Finally, a revision in the economic data that is not totally horrible!

This is a very positive number, up .5% from expectations.

Reacting live, CNBC’s Rick Santelli was a bit surprised, saying, “I’m a bit shocked to be honest.”

What Changed?Much of this revision was due to an unexpected acceleration in consumer spending. Economists were caught offside, trying to predict the effects of tariff policy, and thought we would see a slowdown of the consumer in the face of higher prices. This expectation has yet to materialize.

The major contributors? There was actually broad participation from much of industry.

In this report, personal consumption data from the consumer gave us insight into the health of the economy, and, shocker, folks be spendin’!

An important fact: consumer spending is ~2/3 of the US GDP. In other words, the consumer is the economy.

Personal consumption (PCE) spending was up 0.3% gain for the month, putting the annual PCE inflation at 2.7%, and up 2.9% (up .2%), excluding volatile food and energy prices.

And while all these inflation numbers were in line with consensus forecasts, were slightly higher than expected.

Good! Although the trend is toward softer income growth, with stagnant inflation.

What are consumers spending on? All kinds of fun stuff.

The Donkeys and Elephants are fighting again in DC and may not come to an agreement to fund the government for the next fiscal year (which starts October 1st).

Ignoring the stupidity of this, it is apropos to our discussion.

Why?

During a government shutdown (the government doesn’t actually shut down it just runs in “safe mode” funds for critical “essential” services continue) the BLS and BEA will be two of the agencies that will suspend operations. This includes halting the release of scheduled economic data reports. This means reports like the monthly jobs, inflation and GDP numbers would be delayed until funding is restored.

This is the king of lowered expectations Ala the 1999 MADtv sketch (classic!).

Cool. Cool…

And GDP Estimates are Now Higher for 2025.

Estimates for US Q3 GDP by the Atlanta Fed are up too, GDP is now expected to be 3.9%, up from 3.3% in their last estimate.

Gangbusters!

The culprit? You guessed it, as we just outlined, the US consumer is still spending normally, and is remaining much healthier than expected amidst a weakening labor market (which is mainly young folks, with less $ to burn) and tariff/trade policy not affecting prices as was expected. The Atlanta Fed now sees real personal consumption expenditures to be up next quarter, from 2.7% to a healthy 3.4%.

Good!

But this is just an estimate; we will see what comes to fruition.

In fact, the Q2 GDP number above? That was the third estimate by the BEA.

Wait what?

Yep, estimate #3. And while that was the final monthly revision, there will be several more revisions. Why? We live in a world of surveys, estimates, and assumptions by government, and less hard/actual data from industry.

How the Bureau of Economic Analysis Actually WorksNow, I've been picking on the Bureau of Labor Statistics over at the Department of Labor, these last few months. So I thought, time to turn my ire to the Department of Commerce and its Bureau of Economic Analysis.

Let’s go a little deeper into what they are actually doing over there to get these GDP numbers.

The BEA is responsible for calculating and releasing estimates of GDP, a measure of the total value of goods and services produced in the U.S. economy. These estimates are not fixed; instead, they evolve over time as more data becomes available from various sources, such as surveys, tax records, and administrative data. This iterative process is an effort to improve to estimate’s approximation of what is actually happening in the economy, but also means the “final” number can change multiple times.

It often does.

The BEA releases 3 quarterly estimates for each quarter’s GDP: the advance estimate (typically about a month after the quarter ends), the second estimate (two months after), and the third estimate (roughly three months after).

After that, GDP figures are subject to further revisions through annual updates (usually in July of the following year) and comprehensive revisions (every five years or so), which incorporate more complete source data. Oddly, these aren’t counted as additional “estimates,” though, so the core number is 3.

Beyond the Quarterly Estimates: Ongoing RevisionsAfter the third estimate, GDP data undergoes further updates through 2 main types of revisions, which can alter the numbers multiple times over many years.

- Annual Revisions: These occur once a year, typically in July (about 15-16 months after an initial estimate). They revise estimates for the previous three calendar years by incorporating more complete annual source data, such as detailed business surveys (yes, more surveys…), tax returns, and census data that weren’t available earlier. These revisions can be substantial, changing growth rates by 0.5% or more for a quarter.

- Comprehensive (aka Benchmark) Revisions: These are less frequent, happening roughly every 5 years (e.g., the last major one was in 2018, with another in 2023). They involve broader changes, such as updating the base year for price indexes, incorporating new economic census data, revising methodologies (ie, their guess), or even reclassifying industries to align with international standards like the North American Industry Classification System (NAICS). These can affect GDP estimates going back decades and are designed to improve long-term accuracy and comparability.

Annnnnnd, in some (more rare) cases, there might also be “special” or out-of-cycle revisions if significant new data emerges or, the methodology changes, which happens.

When has the BEA Changed Methodology?Fairly frequently, actually. I did not know this.

The BEA periodically conducts “Comprehensive Revisions” to the National Income and Product Accounts (NIPAs), which include GDP calculations. These revisions, typically every 5 years, incorporate new source data, definitional changes, methodological improvements, and presentational updates to enhance accuracy, consistency, and international comparability.

The BEA has performed 12 major overhauls of its methodology since WW2, including in 1958, 1965, 1976, 1985, 1991, 1996, 1999, 2003, 2009, 2013, 2018, and most recently in 2023, where we “introduced new PCE price indexes excluding food, energy, and housing (and services excluding energy and housing.”

Why So Many Revisions?

The BEA’s estimates use incomplete data in an effort to inform policymakers, businesses, and the public quickly, but as more information trickles in, or is lagging or is from a survey that was underrepresented (from sources like the Census Bureau or IRS), revisions refine the picture. It's important to realize that the estimates are rarely correct, not the other way around.

On average:

- -Revisions from advance to second estimate: About ±0.5 percentage points.

- -From second to third: Smaller, around ±0.3 points.

- -Annual revisions: Can be larger, up to ±1.0 point or more for some components.

Wow.

My Concern.Frankly, I have to call balls and strikes here, including when it’s positive.

This Q2 GDP reading is great news. But it’s not a final number.

Ever since the insane 2024-2025 BLS labor and employment data revisions (you can read my rants on that here), I remain highly skeptical of these bureau estimates.

And will be until further notice.

Instead, I view all of this through an investment kaleidoscope. They are helpful in showing trends and momentum of the economy / US consumer. The problem is this data is often lagging at best, and plain wrong at worst, especially given the high use of surveys and assumptions rather than actual/measurable data.

This data is signal, not fact. We should treat it that way.

For example, remember the other week when I said it seemed like there was an odd anomaly in Texas’ unemployment numbers, which spiked the overall US unemployment number?

Well, it turns out it was fraud.

Crazy town.

----------------

My Skeptical Take:

So far we are living in a Rasputin economy. You can’t keep us down, hell, the bean counters over at BEA can’t even keep up.

And the economic data Bureaus often get it wrong, sometimes for more than a year until the actual numbers are recorded by the IRS. But it's likely not their fault. The archaic way of collecting data is making them fight with one arm tied behind their back. Frankly, surveys are a stupid collection method in 2025. We need a new way.

The BEA has refined its methodology many times over the years. So when I hear concerns about changes by this Administration over at these Bureaus, I don’t bristle. In fact, perhaps it’s an appropriate time for a government data OS update?

For example, in 1985 IBM helped the BEA develop “hedonic regression techniques (with assistance from IBM) to account for rapid improvements in speed, capacity, and quality.”

It’s 2025. Why aren’t we collecting this data directly from private sector operators? Why are we using so many surveys? Why do we need to insert so many assumptions and guesses when we don’t have the data? The government doesn’t have this data in the first place; businesses do. We need a major data-source and presentation overhaul.

The Secretaries of Labor and Commerce shouldn’t just be asking “Is this really the best we can do?” They should be asking a First Principles question:

“If we were to create this data collection today from scratch, how would we do it?

Get on it lady and gent.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

Post: So the Fed Cut Rates. But Mortgages are..Higher?

Post: So the Fed Cut Rates. But Mortgages are..Higher?

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Welcome to the Skeptical Investor weekly BP article! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

-----

This week, we’re talkin’ Federal Reserve Rate cuts! Wait… why are mortgage rates up?

Let’s get into it.

------

Today’s Interest Rate: 6.35%

(☝️.1% from this time last week, 30-yr mortgage)------

The Weekly 3 in News:- - In 2025, Florida is projected to have the highest annual cost of home insurance at $15,460, followed by Louisiana at $13,397 and Oklahoma at $8,369 (Insurify).

- - Chair Powell is soon to be a lame duck. US Treasury's Bessent says they are interviewing 11 Fed chair candidates (ET).

- - Want to talk inflation? Look first at colleges. College tuition is up 695% over the last 40 years ().

Yes, the Fed cut rates by .25%, as expected, but…

- -The market was pricing in a little more dovishness, and

- -Remember, the Fed does not control mortgage interest rates.

Keep reading…

If you listen to the news, you would believe that when the Fed cuts interest rates, it would directly translate to a decline in mortgage rates.

No.

And this avoids important nuance.

Mortgages are predominantly influenced by the market demand for 10-year Treasury bonds, not the Federal Reserve's adjustments to its short-term Fed-Funds rate.

Remember, the Fed does not control mortgage rates. It controls the overnight spending rate between banks. Thus, the Fed has tremendous control over short-term debt (aka the short end of the Yield Curve) and no direct control over long-term debt (aka the long end of the Yield Curve).

The Fed signals to the bond market, and its millions of participants who are all trying to predict the future and decide/guess what price and a given % rate is appropriate for today’s economic risk (put simply). Then all those millions buy/sell the bond at that price and %, which makes the market.

And it is the 10yr Treasury Bond and 30yr mortgage that are competing assets investors buy in our public marketplace, expecting a given return for their expected risk. If investors expect higher risk to the economy, they buy 10-yr Treasuries; if the future seems less risky, they buy 30-yr mortgages (in general). Thus, a reduction in the Federal Funds Rate does not directly or immediately impact 30-year mortgage rates (slightly oversimplified).

But, they do rhyme.

Also, last Fall, when the Fed cut .50% do you remember what happened?

Yup, mortgage rates popped up.

Well, I do declare!… Hey media, don’t act so shocked. You can cool it with the doomer headlines and rhetoric.

Fun fact, the 10yr Treasury yield rises (and 30-yr mortgages follow, remember) on the day the Fed trimmed rates in about a third of the prior 50+ central bank rate cuts since 1990 (Mishkin). Fed Funds is also a target, not a directive. Even the Fed Funds rate is in constant flux. The new range is 4%-4.25%.

Think of the Fed as a captain on a ship; they can control the boat (Fed Funds Rate) but not the Ocean (the Market).

So, Why Are Rates Higher Today vs Last Week?The market was largely expecting a .25% cut, and thus mortgage rates had already ticked down in anticipation in previous weeks. When the Fed affirmed the market’s assumption, trading of the 10yr Treasury continued on as normal, and in this case, investors sold the 10yr. No reason to buy more, it’s like nothing happened at the Fed b/c that was priced in. Additionally, Powell’s comments during his press conference, which can be more important than the rate decision itself, were not as dovish, ie, there was low certainty in his words that there would be future rate cuts. The latter is important to know.

Fed Is Not DovishIn fact, when answering questions, Powell literally said this was more of a “risk management cut” to hedge against a potential weakening labor market. So the Fed, it seems, has still not gotten religion on labor market weakness, so they begrudgingly cut rates. The market, on the other hand, does believe the labor market is in danger and thus was expecting at least a .25% rate cut ( if not a .5% rate cut) and would have reacted extremely negatively/ volatile if they had not.

In other words, if I may be so crass, the Fed didn’t really want to do it but they needed to do something so the market wouldn’t crash, and because they’re getting so much **** from everyone. The labor market is not solid, so they couldn't use that line anymore with a straight face, but they don't see it as highly problematic either. Even with essentially zero job growth and unemployment slowly ticking up, now 4.3%. It’s interesting.

But, I give them a small shred of credit; this is really the first time the Fed is acknowledging some labor market worries.

The Fed is Still Worried about Tariffs, but Now Admits May not be InflationaryTo be clear, the Fed still fears “inflation in some categories of goods.” But…

Chair Powell now says, “A reasonable base case is that the effects on inflation will be relatively short-lived—a one-time shift in the price.”

They finally admitted it. Not only may tariffs not be inflationary, but that is most likely. However, he did also hedge later in his speech, saying “it is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed. Our obligation is to ensure that a one-time increase in the price level does not become an ongoing inflation problem. Their overall effects on economic activity and inflation remain to be seen.”

In fact, Powell said that what’s happening in the labor market may have more to do with immigration rather than tariffs:

“But I would say if you're looking at why employment is doing what it's doing that's much more about the change in immigration. So the supply of workers has, obviously, come way down. There's very little growth, if any, in the supply of workers and at the same time demand for workers has also come down quite sharply and to the point where we see what I've called a curious balance (Powell).”

Fair points. And thank you for the admission that inflation may be sticky, but meaningful reinflation worries should be behind us.

So, looking forward, it is the labor market we should be paying attention to for potential future rate cuts.

But they are not yet willing to admit the labor market is flashing serious red alerts.

Hence, why we only got a .25% cut.

But the market wanted more. Either a .5% cut or a more dovish tone in his comments, signaling future cuts. Neither happened, so mortgage rates have gone up a bit since.

That’s why.

Future Rate Cuts in Question.Importantly, a rate cut in October is NOT certain; in fact, today several Federal Reserve Governors said publicly that it is not.

Case in point: Atlanta Fed President Raphael Bostic said inflation makes him hesitant to support an October cut: "I today would not be moving or in favor of it, but we’ll see what happens (WSJ)."

Counterpoint: The President will name a new Fed Chair in May, who will very likely be dovish. And he also recently appointed one Governor, Stephen Miran, who was confirmed just in time to vote last week on the Fed rate cut. The Fed reports individual governors’ votes for rate cuts anonymously via its Dot plot.

Gee, I wonder who this was…(voted for a .5% cut).

AND one voted for a rate hike! (likely Cook, who may be fired soon).

Expect this soon: Treasury Secretary Bessent said today they have interviewed 10 candidates to replace Fed Chair Powell. Mortgage rates could fall faster than expected if they name a replacement before May, and who could act as a . This could move markets and relegate Powell to lame duck status.

Stay tuned.

We are still in a Restrictive Fed Policy Environment.Remember, we are still in a restrictive environment. At this meeting, the Fed “…judged it appropriate at this meeting to take another step toward a more neutral policy stance (Chair Powell)… and continue[d] reducing the size of our balance sheet” (ie, quantitative tightening, not easing). The only outstanding question is, how long will it take to get to neutral? This is what the market will continue to react to.

So, for now, this is as good as it gets for mortgage rates. The 6.2-6.5% range. And, depending on the above, they will continue to tick down. Frustratingly slow. However, the spread (the difference between the interest rate on the 10yr Treasury and the 30yr mortgage) will also continue to compress to normal levels, bringing down rates even without the Fed. A normal spread is about 1.6% today's spread is 2.2%.

We have some room to go.

But again, without the labor market breaking (it may be already, and we don’t know it), the Fed and the 10yr will not signal enough worry to bring down mortgage rates any quicker. It will likely still be 12-18+ months before we get to neutral. And IMO it will be closer to 12.

The labor market will keep cooling as long as long as policy is restrictive. So I woudl urge the Fed to get over its inflation PTSD, and cut rates! The Fed needs to move toward neutral policy and protect the labor market, which has been the best labor market since the late 1990s!

Remember, we still have low historical job separations…

…and low unemployment…

For now….

And now, this….

Tangent Alert! And then I saw this article from the ….

We are NOT in a “loose” (aka accommodative) monetary policy. The Fed is continuing to reduce its balance sheet (aka quantitative tightening) and is keeping rates higher than the RR neutral rate.

Where the hell did you go to economics class?

But I digress….

My Skeptical Take:

I feel like I’ve become some version of a Federal Reserve whisperer, and I really wish that wasn’t the case. I don’t want to think and talk about the Federal Reserve constantly. Much like I bet most people want to see and think about politics all day.

Let’s just get back to neutral policy (let alone loose or accommodated policy) and stop strangling the labor market over unwarranted fears about a one-time tax (aka tariffs) that’s likely not inflationary, which you finally just admitted.

What the **** are we doing here? Let’s let the economy cook!

But even amidst all this hoopla, I still do think we get to 5.xx% rates in the Spring. As long as no crazy politics enters (like Fed Gov Lisa Cook saying we should have a rate hike, what the actual F, Ms Cook??).

My message to the Fed Governors: A year ago, you cut .50% when the unemployment rate was lower, payrolls were in the triple digits, and inflation was higher.

So, why not cut .5% now?

Fed Powell admitted in his speech that the labor market is “somewhat softer…and, the downside risks to employment appear to have risen. In our SEP, the median projection for the unemployment rate is 4.5 percent at the end of this year and edges down thereafter.”

Why not signal future cuts in 2025?

Fun fact they are cutting more, in one new area…Fed jobs.

In the question-and-answer session after his speech, Chair Powell said they would begin a 10% headcount at the Fed, and maybe do more reductions in the future. Bravo. This has been a point of criticism at the Fed. There are 24,000+ employees in total at the Fed/Central Banks (Fed annual report), which begs the question…

…how many economists does it really take to screw in a lightbulb?

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

Post: Any subject-to pros near Nashville?

Post: Any subject-to pros near Nashville?

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Careful of the Gurus.

Post: Brad Smotherman Mentorship Programs

Post: Brad Smotherman Mentorship Programs

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Careful of the Gurus, especially when you are starting out.

Post: Fix And Flip Market

Post: Fix And Flip Market

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Deals are everywhere. I would offer investors should be "deal dependent," not tied to a particular neighborhood/area within the Nashville metro.

Had 3 clients pick up fantastic fix/flip deals in East Nashville, Wedgewood and Glenncliff just this past 2 weeks.

Deals are out there, an investor sometimes has to make the deal.

Post: US Labor Market is... Laboring

Post: US Labor Market is... Laboring

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

It will stair-step, I've talked about this in previous articles. In general every .25% reduction in rates = will result in a 200k properties purchased. In general.

Thanks for the good word Benjamin.

Post: US Labor Market is... Laboring

Post: US Labor Market is... Laboring

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Welcome to the weekly Skeptical Investor BP article! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

-------

This week, we’re talkin’ more shenanigans with our government employment data, a spotlight on construction workers, and the coiled spring that is the housing market.

Let’s get into it.

--------

Today’s Interest Rate: 6.28%

(👇.22% from this time last week, 30-yr mortgage)---------

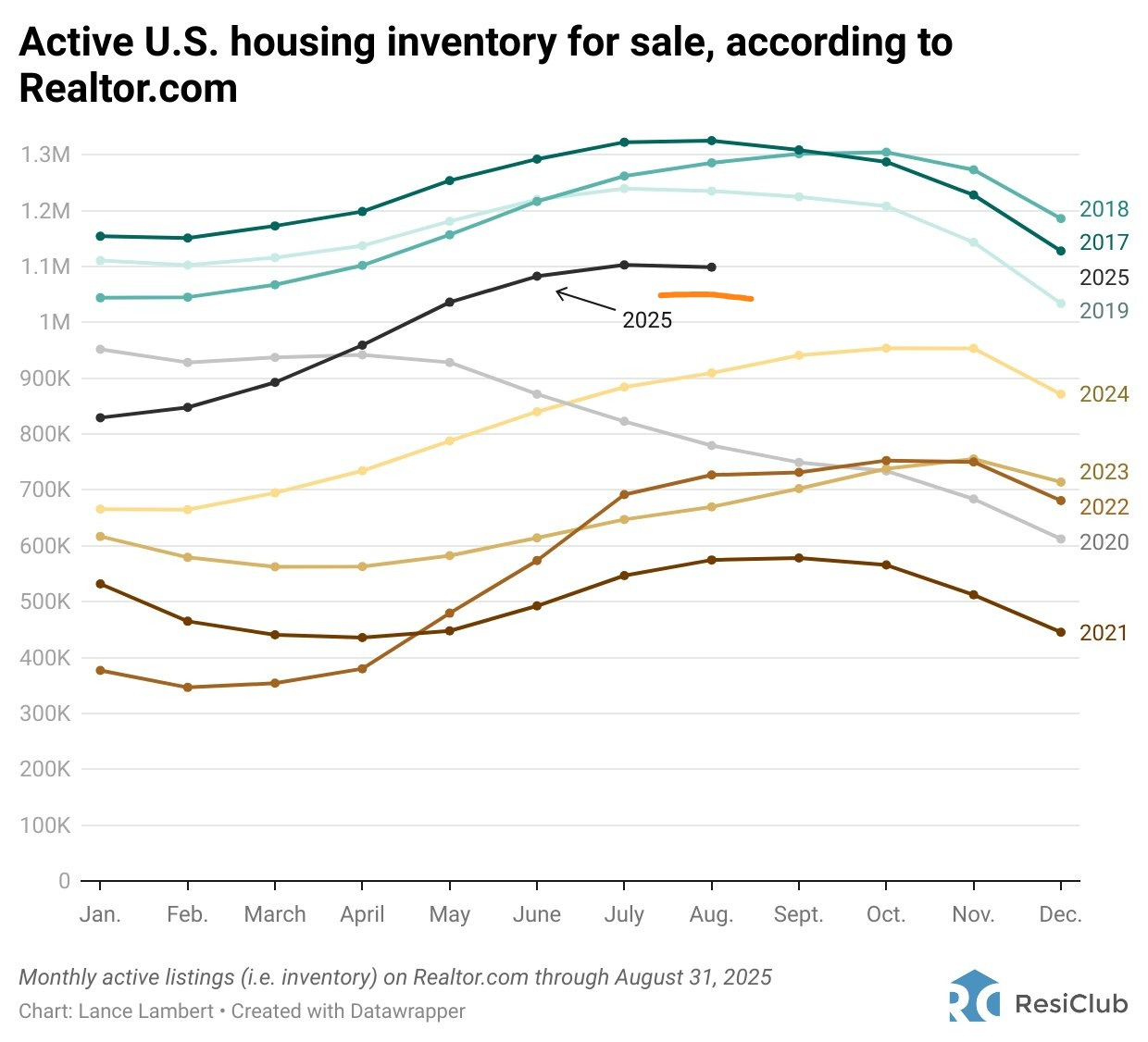

The Weekly 3 in News:- - Housing Inventory has started to decline. “While national active inventory is still up YoY, the pace of growth has slowed in recent months… some sellers have thrown in the towel (Lambert).”

- - Tennessee News - Google announces Tennessee as site for small modular nuclear reactor. 50 megawatts could be coming by 2030 (Reuters).

- - Nashville News - What cities are growing and which are not so far in 2025? Take a look. Nashville is an all-weather economy, growing steadily (Eisen).

-------

Labor Market Starting to Stumble

Hot off the presses this AM: the economy added -911,000 fewer jobs than initially reported during the 12-month period ending March 2025. The largest negative revision in 20+ years.

Yes, this is how the job data is collected, reported, and revised.

Yes. We are just finding this out now.

Yes, this is an insanely archaic process in 2025.

How inaccurate are we at reporting jobs data?For historical sake, here is a chart showing just the revisions in the job numbers. The over at the BLS. Just look at how wrong they are, it often drastically overestimate jobs numbers, only to revise them down later.

This is the 3rd catastrophically large revision dating back to the Fall of last year. We have now erased ~2 million phantom jobs we thought had been created.

This is crazy.

Why the Revisions?

Each month, the BLS estimates job additions based on employer surveys. However, these initial figures are later refined using “better data” (known as the Quarterly Census of Employment and Wages (QCEW), which provides a clearer picture of employment trends. The preliminary estimate, released in August or September, offers a preview of revisions for the prior 12 months ending in March. A final revision follows in February, incorporating this data and adjustments to the BLS’s “birth-death model,” which accounts for the creation and closure of businesses.

This is why I have disdain for surveys; they do not produce accurate data.

Unemployment Rate Unaffected

Importantly, these job revisions will not impact the unemployment rate, which is derived from a separate household survey…

Cool… more surveys. What could go wrong there?…

Why This is Important

Accurate data is extremely significant for businesses so they can make informed decisions on hiring, allocating capital, investing, research and development, etc. The same applies to how the government and the Federal Reserve react. Federal Reserve Chair Jerome Powell has reminded us time and time again that they are “data dependent.”

Well. What if the data is wrong? (And being late leads to the same outcome).

For example, we now know that there was virtually no job creation last year. So, the Fed would have very likely started cutting in February if it had accurate data.

This latest report gives credence to the White House firing the head of the BLS, illustrating their data collection methods as flawed. In fact, the White House is now preparing a report laying out alleged shortcomings of the Bureau of Labor Statistics’ jobs data, five weeks after President Trump fired the chief of the agency (WSJ). This is politically concerning and certain to stir more short-term uncertainty in the market, but it is also likely necessary. We can’t keep doing this.

+ Job Cuts Worse in AugustNumbers for job cuts were also recently released for August and they too add to the narrative of a weakening labor market.

U.S. businesses announced 85,979 job cuts in August, up 39% from July and up 13% YoY, according to executive coaching firm Challenger, Gray & Christmas. August’s total was the highest for the month since 2020 (115,762 job cuts). Before 2020, it was the highest August total since ‘08.

Year to date, companies have announced 892,362 job cuts, the highest YTD since 2020 (1,963,458). Importantly, YTD 2025 cuts are up 66%, vs the 536,421 job cuts announced through the first eight months of 2024.

Job Openings vs UnemploymentLastly, we just crossed a significant line: the number of job openings per unemployed person just dipped below 1, for the first time since April 2021.

In other words, total unemployment may still be low, but the clear trend is to the downside.

Sector in Spotlight: Construction Workers

Construction workers are both important for us real estate investors to track, and are a bellwether data point. Cuts in construction jobs usually frontruns a recession.

Case in point: Construction workers are not feeling secure in their job today. Recent JOLTS data shows they are quitting at below 1%.

And perhaps for good reason. Construction labor just ticked down, ever so slightly, by 3800 jobs. Now, this is admittedly a very small number, but losses in construction jobs are a rare occurrence and again usually a leading indicator of overall economic weakness (ResiClub).

Ok, whew, that was a lot. Now, let’s look at the bright side, after that Doctor Doom labor market moment.

Silver Lining #1: Wages and the ConsumerDespite a slow uptick in unemployment to 4.3% (anything below 5% is considered “full employment”)…

…Wage growth has remained robust. Still growing at 3.7%, much faster than overall price inflation. In fact, wage growth has been higher than consumer inflation for 2+ years, even faster than shelter costs.

We have officially come full circle on interest rates, this without another rate cut from the Federal Reserve and amidst all the fun trade, tariff, international turmoil etc… We are now back to last year’s levels. A great chart (Robertson):

Today’s interest rate: 6.28%

New Coffee Table - Part Zwei.

And I know you all want to see it. Here is the finished product from last week. Live-edge coffee table.

Sandpaper and poly are magical.

My Skeptical Take:

For us real estate investors, the implications of a softening labor market are relevant.

In short, we may finally see, after 3 damn years of high interest rates, the bond market and Federal Reserve work together and stop the vigilante infighting. They both care most about labor, even over inflation and it is starting to bring them together.

Just look at the spread between the 10-yr Treasury bond and mortgage rates (which track each other), today at a 3 year low, now dancing in tandem down the water spout.

And there is MUCH room to compress spreads. Today’s spread is 2.23%. The historical average is 1.76% (since the 1970s).

This means, even IF the Fed does not cut rates, and/or the bond market does not play ball, mortgage rates could normalize down to 5.81%!

What happens when the Fed starts to cut again, as I still expect them to do in September and likely again before year’s end?

We would be in the 5% range. Perhaps by Spring (as I predicted earlier this year 🤞).

Housing Demand is Coiled like a CobraThere is plenty of pent-up demand from investors and homebuyers alike, coiling like a spring ready to be released once interest rates come down. And the longer the coiling, the bigger the jump when released.

We are now in year 3 of suppressed demand. That is quite the winding-up period.

Anecdote from the Arena - I had 2 real estate investor clients outbid this week on reasonable offers. The interesting thing, both were on properties that had been sitting on the market 90 days+. What are the odds that another higher offer would come in right when we were offering? What does this mean?

More investors are returning to the market now that rates are under 6.5%.

My advice: Start looking for your next deal.

The coil may be unwinding already.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

Post: Governor Cook, You're Fired!?

Post: Governor Cook, You're Fired!?

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Hi Drew, I only long term rent, hospitality is just not my interest. But I have many clients on the brokerage side that kill it with STRs in Nashville (we had 16.8 million tourists in 2024).

Total ROI across the 5-Ways we investors make money in real estate is ~18% annual return on my money invested (cash on cash return, natural appreciation, depreciation, forced appreciation through renovation and principle pay down)

Post: Governor Cook, You're Fired!?

Post: Governor Cook, You're Fired!?

- Real Estate Agent

- Nashville, TN

- Posts 303

- Votes 153

Welcome to the Weekly Skeptical Investor BP Article. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

----

This week, we’re talkin’ a new focus on the weakening labor market/employment #s, a changin’ “dovish” tone at the Federal Reserve, and I show a preview of my latest real estate project.

Let’s get into it.

-----

Today’s Interest Rate: 6.54%

(👇.05% from this time last week, 30-yr mortgage)------

The Weekly 3 in News:- - Warren Buffett is betting on the housing market. Taking a large equity stake in homebuilders D.R. Horton and Lennar (SEC filings).

- - Mortgage Applications are Up, again! We are at 6.5% rates, and since 2022, anytime rates drop to 6% - 6.64% range, housing data improves. We have had three weeks now with mortgage rates below 6.64% and 29 straight weeks of positive year-over-year data (HousingWire).

- - Nashville’s massive East Bank Redevelopment Plan is shaping up. The Oracle world headquarters campus and new Titans stadium will anchor the lovely riverfront greenway development (Nashonomics).

- - Breaking News Bonus - The President has fired Fed Governor Lisa Cook for cause, alleging mortgage fraud (buying 2 primary residences, to get a favorable mortgage rate). This vacant seat could secure him voting control of the Fed’s FOMC interest rate cutting board come May, 2026. But in a turn of events, Governor Cook is refusing to leave her position (I wish the rest of us could just do that). This week is going to be interesting! (White House)

The Fed Changes its Tone (again)

Last week, the Federal Reserve's annual Economic Policy Symposium took place in lovely Jackson Hole, Wyoming. The event featured many of the world’s central bankers, economists, and policymakers talk talk talking (and a few walk and talks) about global economics, focusing on inflation dynamics, labor markets, and policy frameworks. The US Administration’s trade and tariff policies were the primary boogey man in the room.

The bell of the ball was Jerome Powell, of course, and at his keynote speech, all ears were wide open to listen between the lines, and interpret the tea tasseography.

What did he say, and not say?

In short, Powell was more “dovish” than expected (a fancy way of saying/signaling future interest rate cuts and less restrictive monetary policy in his closely chosen language).

Now, if you are getting a little deja vu, you aren’t going crazy. We heard similar cadence from Powell a year ago, when the Fed started cutting rates. But then they stopped abruptly, concerned about trade and tariff policy. So far, it appears that concerns have not been warranted, and extending their restrictive policy into year 3 is likely contributing to the labor market slowdown.

A quick note on how we got hereThe ailing housing market is plagued by a lack of sellers wanting to sell their existing homes, leading to 1 million+ fewer homes sold annually than normal.

Why?

Every Tom, Dick and Harry refinanced their mortgage during the Fed’s wildly low interest rate policy during COVID. So today, 55% of homeowners have a mortgage under 4%, and 80% snagged one under 5%. But today's mortgage rate is ~6.5%. So buyers can't afford to buy, and sellers would have to sell at a price way down to move the market, which they will not do, as long as they have a job. So we are now living with the aftereffects of Fed’s loose monetary policy (which lasted farrrrr too long), the inflation it created and vastly declining homeowner mobility, which is not a good thing. The Housing market represents 18% of our total economy.

There is no free lunch.

Now, we need sustained lower interest rates for home sales to pick up.

Powell’s Language Signals Cuts

The market is a changin’. (Well, to be crystal, it’s been changing since January). Despite the Fed not cutting rates since 2024, the bond market has started the Fed’s job for them. Moving mortgage. Interest rates have been lower each week since 2025 started.

But now, a change.

Last week’s Fed speeches/talks in Jackson Hole (and the minutes for the Fed’s last Meeting were released), signaled the Fed is more likely than not to start relaxing its suffocating monetary policy. Before the Fed’s last meeting, meeting notes showed that a "majority of Fed members see inflation risks outweighing employment risks." However, this was July, just days before the "catastrophic" July jobs report (I wrote on this the other week here).

And last week, Powell’s carefully worded speech clearly signaled a priority shift from inflation to labor market concerns.

Labor > Inflation

In his speech, Powell noted that the shifting balance of risks "may warrant adjusting policy," clearly referring to the labor market.

- On inflation, Powell noted that tariffs/trade effects “are now clearly visible” and are expected to accumulate in the months ahead. But the question is, will they “materially raise the risk of an ongoing inflation problem(?)" Instead, the tariff effect could be a one-time (but not "all at once") series of price increases. I.e. Inflation may not be all that bad (as I have written about extensively ).

- On labor/employment data, Powell said the “situation [now] suggests downside risks to employment rising.” [While labor markets remain in balance], “it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers….This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher unemployment.” I.e. risks to the labor market from a slowing economy are more important.

- On potential interest rate cuts, he cautiously signaled a cut in September: “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

The Fed is now, as they say in the military, too close for missiles (inflation worry), switching to guns (labor worry).

Jobs reports will dictate rate cuts going forward. And we all know how accurate that data is…It’s going to be a volatile few months.

More on Why Labor is Now the FocusAs I wrote the other week, the last jobs report showed an average of just 35,000 jobs being created for the last three months. This was a shockingly horrible revision ownward in the data to the job growth we thought we had.

Here is a great chart, which shows the Fed’s conundrum.

The labor market is trending weaker, and inflation is trending down, but progress on the latter is stalling out.

In two weeks, we will have the final jobs week reports for the Fed to mull over before their September meeting.

Skeptical Counterpoint - Or was Powell doing a masterful job of saying nothing, giving a tentative indication of possible rate cuts while noting tremendous uncertainty?

Yes, he was doing this too, preserving the option to NOT cut if the data moves.

In other words, the Fed will probably cut rates .25% but if the data changes, they won’t.

Adding to My Portfolio

I’m putting my money where my keyboard is: just picked up this nice little duplex here in Nashville’s growing Donnelson area, just south of the famous Grand Ole Opry.

Plan is to renovate the kitchens, throw down new flooring, repair the roof (a tree fell on it), paint/scrape the popcorn ceiling, and spuce up the bathrooms. Plus I’m adding landscaping and 2 lovely decks for outdoor space on each side. May add fencing so tenants can corral their pups.

The Before Kitchen 1.

The Before Kitchen 2.

Target for completion is Halloween; hopefully the final budget for construction won’t be too spooky.

I’ll give you all some updates along the way.

My Skeptical Take:

This version of the Federal Reserve is out in 6-10 months, as a couple of governors retire, one is now under investigation for mortgage fraud, and Fed Chair Powell’s term ends (05-2026).

Fed version 2.0 will include many new faces who agree with the President’s more bullish/pro-growth, loose policy accommodation. Rightly or wrongly.

Aside # 1 - Reassessing the Fed’s Effectiveness

Interestingly, the theme for the Fed’s Jackson Hole meeting was "Reassessing the Effectiveness and Transmission of Monetary Policy in a Changing World." I listened to all the talks; I can’t say there was any “reassessing” of current monetary policy effectiveness. Zero. I fully expect them to try to stop all recessions and risk inflation and larger future recessions as a result. We should question the effectiveness of the Fed’s posture to always try to come to the rescue of the economy and if that is really a good way to run an economy. Current Treasury Secretary Scott Bessent has said they will actually be reviewing long-term federal reserve effectiveness.

Aside # 2 - Mortgae Rates Will Continue to Come Down Without the Fed

A Final Note on Mortgage Spreads - As I have written numerous times, the Bond market has been slowly edging lower and bringing interest rates with it (remember, mortgage rates follow the 10-yr Treasury bond but rhyme with the Fed’s Funds Rate). It does a masterful job of anticipating the Fed’s actions, as the efficient market (usually) does. But, an important note, the Bond market is still skeptical of inflation coming down and sees the economy as running hot. We see this in the spread between the 10-yr Treasury and the 30-yr mortgage rate. In fact, IF those spreads returned to “normal” historical levels, mortgage rates would be 0.46%-0.66% lower than today’s level (historically, mortgage spreads have ranged between 1.60% and 1.80%). So even without the Fed doing anything going forward and IF we get past inflation concerns, the Bond market will bring down mortgage rates to 5.86% - 6.06%, given today’s levels, a notable difference.

This is why I still anticipate mortgage rates to be below 6% in our near future (6 months or less).

Anecdote. In our real estate brokerage business, last week I had three buyers on three different deals get outbid. That kind of stuff hasn’t happened in two years. Slightly lower rates (6.5%) is invigorating the market.

This reminds me of the old adage, when the time comes to buy, you won’t want to.

Contemplation is good, but contemplation without action is bad.

Act accordingly, investors.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor