All Forum Posts by: Andreas Mueller

Andreas Mueller has started 66 posts and replied 241 times.

Post: Nashville Lifestyle Investor

Post: Nashville Lifestyle Investor

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

what specifically do you want help with? There’s 1000 things to talk about when we’re talking development.

happy to chat again if you would like to talk off-line. Hard to get into it writing back and forth

Quote from @Randy Davis:

Quote from @Andreas Mueller:

Dont know what you need here but looks like a fun/lucrative endeavor.

Is there a question you may have?

And STRs are still fantastic here in Nashville on the high end. You just can't be average. Its a professional business, you need to come correct. But those that do kill it. We had 16.8 million (yes million) on a population of 700k in 2024.

Happy to chat anytime, DM me. I always love talking real estate.

Thanks Andreas - I'm excited about it too. And Vastland is the one building it. You're probably familiar with them. They generally do top notch work.

I was really just mainly looking to see if anybody had pointers on this type of investment that I hadn't already considered. Also, since this is a bit unique to Nashville, wondering if anyone had thoughts about that type of a venture in the Nashville market.

I don't think it's going to make a killing in the short term, but once the brand is established I think it could be quite lucrative. The key for me is to be able to cash flow in the short term, and then to get out before property becomes dated, HOA fees skyrocket, etc.

Post: Nashville Lifestyle Investor

Post: Nashville Lifestyle Investor

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Dont know what you need here but looks like a fun/lucrative endeavor.

Is there a question you may have?

And STRs are still fantastic here in Nashville on the high end. You just can't be average. Its a professional business, you need to come correct. But those that do kill it. We had 16.8 million (yes million) on a population of 700k in 2024.

Happy to chat anytime, DM me. I always love talking real estate.

Post: Sometimes taking a risk, is the safest thing to do

Post: Sometimes taking a risk, is the safest thing to do

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to my Skeptical Investor Article, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.98%

(👇.01% from this time last week, 30-yr mortgage) The Weekly 3 in News:- - Zillow turns bear, projects that U.S. home prices will fall -1.7% between March - 2025 and March 2026. Last month, Zillow said home prices would rise this year. Uncertainty is pervasive and self-fulfilling (Zillow).

- - Stocks turning Bear, down close to 20% from the January highs (AP).

- - Surprising demand resilience for housing: Despite high rates, housing demand is up, with existing-home sales 4.2% higher MoM, driven by increased inventory and steady buyer interest. April 24th is the next existing home reading, and will be telling (NAR).

Today, we’re talkin’ total market update, sans trade/tariffs (I think we are all a little tired of that subject). Pessimistic news and tumbling stock market got you down? Stop hitting refresh on your Robin Hood account for a moment and tune in. You can’t do anything about it anyway.

As the old Hank Williams song goes: “The interest is up and the stock market’s down and you only get mugged if you go downtown…” and when you panic about the economy and do something stupid you will regret.

Instead, fellow Skeptic, you can protect yourself.

Let’s get into it.

The Pulse of Our Shared Prosperity

The economy, in a capitalist society, is a fragile dance of opportunity, aspiration and execution. And when someone or something rudely cuts in, that delicate balance is disrupted.

This may or may not be the case today.

Unfortunately, we often identify economic problems - including the dreaded R-word - in hindsight. Data is lagging, and it takes time to collect and analyze. Many economic indicators are untrustworthy, often showing conflicting or mixed signals that are difficult to filter. Plus, for some reason, human psychology resists acknowledging downturns until they’re unmistakable.

In an era of fractured certainties, let me offer this with precision: I do not think we are in a recession, nor do I think we are headed for one…

…Yet. (I’ll let you know, if I can resist my biology).

We are far more likely, even if uncertainty persists, passing through a fleeting moment of adversity, fraught with: gross political turbulence, pessimistic sentiment and - perhaps - slower economic growth. But growth nonetheless.

What does exist is heightened risk, because the state of affairs could completely change tomorrow, to the up- or downside. The unique attribute about this political environment is: execution happens rapidly, no matter how you judge it. It’s an interesting time to be alive on this cosmic molten stone, that’s for sure.

Are we headed for or entering a recession? I’m quite skeptical. Up until now, the worry has been the opposite of recession, an overheating economy and inflation.

And it bears mentioning, recessions happen all the time (again, not saying we are headed toward one). It is not the end of the world and is healthy for a thriving long-term economy, much like small fires are beneficial for a thriving forest.

Markets run in cycles. And the thing about both bull and bear markets is, they are self-fulfilling flywheels. Negativity can rapidly set in, even if it’s not warranted. Remember, 2/3 of GDP is consumer spending. If the consumer starts to get too pessimistic, that eventually starts to really matter. After all, one household’s spending is another household’s income.

We have been in quite the bull market for quite a while. Now we have a correction in the stock market. Will this proliferate to the economy?

Here is the stock market with stock markets, recessions are marked.

And home prices, again with recessions marked.

Recessions and economic slowdowns happen. And the world keeps spinning, especially here in the US. Just keep everything in perspective.

Ok, let’s look at some numbers.

Positive Economic IndicatorsComing off the all-time highs in January, the stock market is close to hitting a true Bear Market (-20%) today, after last bottoming April 7-8. (the tech-heavy Nasdaq has entered a Bear Market).

Was this the bottom of the market correction? Could be. Or maybe we retest those lows but IMO we have seen the worst reaction from markets, barring a new surprise of course.

Labor Markets Holding up WellUnemployment doesn’t look bad at all, labor is still scarce, and job quitting has normalized to historic levels. Last week, jobless claims came in at 215,000, a decrease of 9,000 from the previous week. The 4-week moving average was 220,750, a decrease of 2,500 from the previous week's average.

Job openings remained robust and largely unchanged at 7.6 million from the previous month, with some increased separations seen in government employees. Job openings are still above pre-pandemic levels.

Perhaps the rate of hiring could slow from here, but again, so far so good on the labor front.

Consumers are spending at a higher clip than last year. Retail sales were up again last month.

Inflation is still trending down, both core and headline.

Total industrial production is still holding up, positive YoY.

Wage growth is still at historic levels, and is more than 1% higher than inflation. This is very positive, in my view. The trend looks down, but I view this as normalizing, not concerning. We are way above pre-COVID levels.

Lots of positive data out there as you can see.

Negative and Mixed Economic IndicatorsConsumer confidence in March was down again, for the fourth consecutive month the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead (Conference Board). “Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects.” Now, confidence surveys are historically not great indicators, but this is definitely at yellow alert levels. When consumers stop spending, that pessimism can be a self-fulfilling prophecy of recession. More than 60% of our economy is attributed to consumer spending.

Durable goods orders are positive YoY and in total dollar amount, but could be trending down after pulling through so much during COVID.

Housing starts eked out an ever so slightly positive number, but this is likely attributable to high interest rates.

Luxury brands like LVMH have begun 2025 on a poor note, with sales falling 2% in the first three months. Could be nothing, as the company says. Could be a trend/signal.

Business investment remains positive, but could be in a downtrend. Capital expenditure may remain strong in certain sectors (e.g., tech) while others contract, creating uneven signals.

Purchase Manager’s Index (PMI) was 49% in March, 1.3% lower compared to February (PMI above 42.3% generally indicates economic expansion. PMI is a composite index that measures the performance of the manufacturing and service sectors of an economy). Of note: the New Orders Index contracted for the second month in a row following a three-month period of expansion. A PMI near 50 can also indicate a mixed sentiment in the market, rather than clear expansion or contraction.

Where does all this put us, real estate investors?

The indicators overlaying the political environment make me slightly worried re: interest rates. Fed Chair Powell may be reluctant to cut rates, as folks are arguing he perhaps should, so as not to appear political. I fear that avoiding the perception of acting politically in the face of the President calling him names for not cutting rates, ironically, makes the decision not to cut in May, June or even July, a political decision.

Last week (April 16th), Powell signaled patience amidst uncertainty, saying, “For the time being, we are well-positioned to wait for greater clarity before considering any adjustments to our policy stance.”

I still think the Fed will not in May, and markets agree, and renewed political pressure on the Fed by the President could backfire, resulting in fewer cuts in 2025 (2 or fewer).

As of now, markets are pricing in a razor-thin 50.9% chance of 4 rate cuts in 2025. Tough call. I think we get 3 x .25% cuts, given the above data.

My Skeptical Take:

More these days, I’m hearing fellow investors and prospective homebuyers utter the phrase “that’s too risky… I don’t want to take a risk.”

But, sometimes taking a risk is the safest thing to do...

Cont....

Want to read the rest? Send me a DM! After all, conversing with your fellow BP compatriot is the point of being in the BP community!

-Andreas

Post: This Too Shall Pass....Ignore the stock market, it's not the economy

Post: This Too Shall Pass....Ignore the stock market, it's not the economy

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to the Skeptical Investor post on Bigger Pockets, A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

-----------

What a wild ride!

Today, we’re talkin’ stock market chaos, trade, tariffs, lower prices and what real estate investors should be doing to come out ahead. I go deep here, you don’t want to skip this week’s newsletter!

Let’s get into it.

--------

Today’s Interest Rate: 6.75%

(flat % from this time last week, 30-yr mortgage)--------

The Weekly 3 in News:- - Markets now predicting 4 interest rate cuts in 2025 ().

- - Nashville News - Nashville unemployment is 3.1%, 1.3% lower than the national average. Nashville is cookin’! (BLS).

- - Housing Input prices are plummeting. First interest rates, now lumber.

Investor Pep Talk

I’m not happy with what is happening in the market. If you own stocks, this is not fun.

I do. It doesn’t feel great.

But let’s be honest. Most folks in the market are wealthy, relative to others.

Sorry, it’s true.

An anecdote: in the summer of 2024 “[a record number of Americans both vacationed in Europe and were forced to get meals at food banks] (Bessant).”

Remember, the top 10% of Americans own 88% of stocks, the next 40% owns just 12% of the stock market. The bottom 50% does not own much if any stocks, or any other asset for that matter. They have debt: car loans, student loans, credit card loans.

Fellow investors, these are your tenants.

So while the stock market is down, so are interest rates, which is more impactful for most Americans who are unfortunate debtors.

It’s also particularly impactful for real estate investors.

For the wealthy, it’s not actually about money. It’s the mood. The wealth effect for them is quite pronounced. They will pull back aggressively with their spending/buying/ investing.

When the stock market plummets it makes them feel poor.

So for you fellow investors, real estate owners, and landlords I say to you:

This too shall pass.

(It might be like passing a kidney stone, but it will pass).

You only lose money when you sell. Remind yourself of this.

I’m not changing my investment thesis. Real estate is the survivor asset, when times get tough, it gets better.

And guess what else is way down? Prices.

Eggs, gas/energy, bacon, milk….all down.

This is great for your tenants.

Ok, had to get that out of my head. Now buckle up, I have a TON of great information for you today.

Let’s Get Some Perspective

We (the news, people online, nervous investors…) are talking mainly about the stock market reaction over the last 7 days.

Again, remember stockholders, you only lose money when you panic and sell.

The truth is, this is not a historic moment.

There have been 6 bear markets (down 20%) in my lifetime. This is likely the 7th.

A-Political Politics

I try not to get political here, and I’m not starting now.

But because the market reaction is fomenting so many of my readers and investors, I’m going to draw on my time on Capitol Hill to address what is happening with tariffs, trade, negotiations, and how all this affects the housing market, ie us real estate investors. Importantly, I am going to pass judgment. I’m sticking to the facts I see from the data while providing predictions on the results.

My first thought is: nobody, including should be surprised that the President (POTUS) followed through with implementing tariffs on imported goods, even if they were more robust than a bunch of pencil pushers on Wall Street were expecting.

He talked about it constantly. Hell, here he is decades ago talking about it on Oprah:

What is Happening Anyway???

A brief summary of the week: “[POTUS announced sweeping new import tariffs, including a baseline 10% duty on virtually all imports with higher rates for certain countries. In response, China immediately implemented 34% tariffs on all U.S. goods while tightening export controls on critical minerals, the EU announced counter-tariffs up to 25% on select U.S. products, and Canada imposed 25% tariffs on select U.S. products. In addition to China, the EU, and Canada, numerous other countries, including U.S. trading partners across Asia and Latin America, have signaled readiness to impose retaliatory tariffs or trade restrictions. These measures triggered a severe market response, with the S&P 500 declining 10.5% over two days, erasing around $5 trillion of market value (chamath).]”

Why is this Happening?

First and foremost, I still view tariffs not as an end state, but as a means. A high ceiling has been set. This is where negotiations start.

And, dare I say, this POTUS very much enjoys a good negotiation.

What the Administration is doing is turning their world upside down, rewriting the financially-stimulated global economy. Case in point: We spent $10 trillion to try to avoid a recession during COVID, only to cause extreme inflation and indebtedness to the tune of $36 trillion that we must now refinance. As a result, we now spend $1.1 trillion / year just on the national debt’s interest payments. Again, not passing judgment, that is what happened.

The aim of these actions is “less financialization, less Wall Street and more “Main Street,” boost manufacturing in America and reduce global integration, with a focus on China and its subsidized economy and, yes, slave labor.

It’s a big gamble.

And we will eventually have to figure out how we trade and interact with the global economy. America First maybe, but it can’t be America Only.

The Administration has implemented a Dual Mandate.

Their North Star is: reduce interest rates so that:

- 1 - The non-wealthy / “main-street” / “tenant-class” must pay less for consumer goods & energy (Bessant) and get out from under their tremendous debt load, and

- 2 - The country’s $36 trillion debt can be refinanced at lower rates without bankrupting the country.

And I do have to say the method to this madness has been a bit, shall we say, brash. The execution is reckless. Perhaps that is the intent? Will they be right? I don’t know. But so far…

It’s working…

Oil prices:

10-Yr Treasury:

30-yr Mortgage:

Prices are cratering and the 10-yr treasury / 30-yr mortgage is cooking.

The Negotiation to Critical Mass Begins

The negotiations and concessions have begun. The next few weeks will be frantic, with negotiation lines being drawn and redrawn very quickly. In a month or two, we could be looking at an entirely different geopolitical trade order.

Already we are seeing reports from Argentina, Taiwan, Japan, Israel, Vietnam and… just a moment ago, the European Union said it wants to negotiate a zero-for-zero tariff trade deal.

It’s been just a few days…

If this persists, and individual countries (and large corporations) make deals with the US , at some point, we will reach a critical mass. Once perhaps 3, 5, maybe 10 larger-er countries make deals, the political calculus for negotiations will 180, from “screw this impose our own retaliatory tariffs/we don’t have to play this game”

to…

“Oh ****, countries are making new agreements, we need to cut a deal NOW.”

And this just in…

Over the weekend, more than 50 countries reached out to negotiate.

I this true or political posturing?

No idea.

But one fact does remain: you do NOT want to be last to negotiate. It’s a bit of a prisoner’s dilemma.

Once the market (stock/bond) sees Critical Mass on the horizon (I need a better phrase for what is about to happen) the stock market is going to go into launch mode. If you own stocks, you won’t want to miss that.

What am I doing with my stock portfolio? Nothing. Patience, not panic.

This is actually normal. This has happened many times before, it’s just a new kind of surprise.

What am I doing with my real estate portfolio? I’m rasing funds and refinancing (soon) to go bigger than ever before (keep reading).

The economy is fine and real estate investors will win

Last week we saw that breakfast is getting cheaper: eggs, milk, orange juice and bacon.

Inflation is trending down. So far.

Again, energy prices are cratering. I have to look at an energy chart again:

Holy hell!

Tariffs haven’t even taken effect yetImportantly, tariffs don’t actually take effect until April 10th. So far it’s mostly the stock market that is having a tantrum.

Are we headed to a recession? Let’s look at some future/signal data.

Construction is gaining steam: “Today, residential building construction hit a new cycle high. Residential building construction is usually in contraction well before most traditional recessions start (Lambert).”

So far, we do not have a recession signal from the housing market. In fact…

We also have positive, forward-looking housing dataEven amidst all this trade-war posturing. Here are some fast facts from housing analysis Logan Mohtashami:

- -Purchase applications for homes are positive

- -Weekly pending contracts are positive

- -Total pending contracts are positive

- -New listings data positive

And because of the wild appreciation in home prices, homeowners are in a much better financial position than ever before, adding robustness to the economy.

The average loan-to-value for all outstanding mortgages is only 46.9%, and only 0.3% of borrowers are underwater on their homes. True, the total number of borrowers in delinquency is creeping higher, but still very very low (Simonsen).

The Bond market is not freaking out.

Another positive indicator, the bond market, the big brother of the stock market (1.5x the size), is remaining relatively calm. The all-important 10-yr Treasury is continuing to tick down, passing 4% yield for a moment last Friday but there is no crash to safety. It’s actually acting quite sensible.

Free trade might be ideal, but we don’t live in an ideal world.

Our national debt, and the interest we are paying on it, is an existential risk lurking below the surface of the economy. In a perfect world, we should not be for any tariffs, but we are in a fiscally unsustainable economy. Getting our debt under control is imperative. If tariffs make interest rates crash, and even cause a recession the long-term outcome will be better for the US.

Yes, that is a big IF.

Short term, this will suck for stocks and we must be particularly mindful of job losses, recession or not. So far, the labor market is remaining strong, but then again, tariffs haven’t even hit yet. We are still in the stock market tantrum phase.

On Friday, we got positive labor and unemployment numbers:

Here is famed investor Stanley Druckenmiller to explain what I’m talking about:

Mortgage Relief is In Sight

Home affordability has become wildly difficult in just the last few years.

BUT..

Home prices may be permanent, but your monthly mortgage is not.

Why?

Most of your new mortgage is interest, not principle, and thus as interest rates tick down the monthly cost of home ownership will depreciate. And it will be meaningful.

Interest rates are close to 7%. As rates tick down to say 5.5% (where I think we will land) that could mean a ~25% reduction in interest payments. And if the trade war continues 5% is very much within reach.

So while home prices are stuck where they are, and will continue to appreciate over time, 2025 will likely bring mortgage relief.

And let’s be honest, most folks care about/ budget for their monthly costs more than prices.

A Quick Example - Mortgages are 👇!January - If you bought a $400,000 home here in Nashville, my home market, at a then 7.26% 30-yr mortgage and 20% down you would have a $2535 mortgage payment.

This week, at 6.75%, that same home would be $2425. (4% less)

If rates keep falling to 5%, as they very well could with this wild trade war, you would have a $2067. mortgage payment.

That’s a 22.6% reduction.

And you probably could negotiate the price down (I am), taking advantage of stock owners’ panic and pull back from making large investments.

---------

My Skeptical Take:

In my opinion, tariffs....

Want the rest of this article? Send me a DM. After all, isn't investor discussion what BP is all about?

Dont be a stranger. :)

Herzliche Grüße,

-The Skeptical Investor

Post: STR analysis for Nashville, TN

Post: STR analysis for Nashville, TN

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Average STRs yes are "overpopulated," (ie for a given place you are getting lesss rent than get 3+ years ago).

But the stand-out STRs are soaking up all the business. My clients buying STRs who make them stand out/amazing/unique rentals in Nashville are absolutely killing it.

You can't be average and expect above-average cash flow just because it's an STR.

Real estate is professionalized. This isn't 2014 anymore.

Post: The Market Lives in the Future

Post: The Market Lives in the Future

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Quote from @Tenzapa Wakombe:

I love this post! I work within the Middle Tennessee market that includes Nashville so this is definitely an insightful post for investors wanting to park their money into real estate in Tennessee!

Thanks Tenzapa.

Post: How to Pick Your Real Estate Market?

Post: How to Pick Your Real Estate Market?

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Thanks Taylor.

Post: How to Pick Your Real Estate Market?

Post: How to Pick Your Real Estate Market?

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to my Skeptical Blog right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today?

Growth vs Cash Flow. Let's fight it out!

Today’s Read Time: 10 minutes

The Weekly 3 in News:

- - Housing Will ‘Unfreeze’ in Weeks and 2% Inflation Will Return. "The housing market is stuck now, but I would expect that the housing market, sometime in the next few weeks, is going to unfreeze…it is Trump’s economy in 6-12 months -Treasury Secretary Scott Bessent (Bloomberg)."

- - Active housing inventory for sale is rising on a year-over-year basis in all 50 states. Time for investors to dive in. (Resiclub).

- - Housing Hotspots for 2025, according to the National Association of Realtors. Hint: they missed a few, but a good list ().

Today’s Interest Rate: 6.74%

(👇.13% from this time last week, 30-yr mortgage)Today, we’re talkin’ how to pick your market to invest in. Tampa or Seattle? Austin or Nashville? Charleston or Denver? Growth market vs cash flow? It’s all about the market metrics.

First a quick look at the rent growth vs supply scare.

Let’s get into it.

In General…Growth is Good

Choosing the right city is critical because it directly impacts the success and profitability of your investment. Cities vary widely in terms of economic growth, population trends, job markets, and housing demand—all of which influence property values and rental income potential. A well-chosen city to invest in can offer strong appreciation, consistent cash flow, and lower risk, while a poorly chosen one might leave you with stagnant properties or high vacancies.

Now many folks just think about cash flow and rent growth when selecting a market. This is no doubt important. But, it’s not everything and the data can be misleading.

Before we get into our main topic: growth markets vs cash flow markets (its a fun one:) I want to address the current hullabaloo of rent growth/losses as it relates to supply, which has been much “doomered” in the news.

Folks I talk to often focus too much on rent growth as a key metric, but beware… it's nuanced.

Now don’t get me wrong. Renovating a slumlord’s scary 4-plex into something habitable ain’t cheap (I’ve done it many times). An investor needs to generate a return for spending the money and taking the risk to turn that place into a something a tenant would love to live in. So over time they need to be able to raise the rents to keep up with the market and cover their insurance, property tax, repair, maintenance, vacancy, landscaping etc…costs (all of which have been inflating markedly).

And yes, certain markets are growing rents faster than others, but watch out!

If you only look at rent growth and cash flow, you are likely missing the forrest for the trees.

Why?

Supply. If housing supply is growing in a city it will suppress (or even depress) rent growth. But housing supply growth is a good sign. It is a key signal of a city’s population and economic growth.

For example: Austin is a solid city to invest in. But recently it experienced significant housing supply surge, particularly apartment unit growth, causing rents to come back to earth. This is great for housing affordability, and a strong sign of a healthy market. We can’t have housing prices double and rents up in kind.

But if you looked only at the YoY rent metrics it would send you into a panic! Rents are down? AHHHHH.

First off, in general, nationwide, rent growth hit 8% YoY 2 years ago. That was not sustainable and had to come down. Some markets built more than others so they went down faster (Austin).

And rent growth is still elevated at ~4%, 33% higher than the historical average (although wage growth is still higher than rent growth, barely).

This is… dare I say…. transitory. And something very important is about to happen to housing supply.

The supply of available housing units will soon fall off a cliff.

Why?

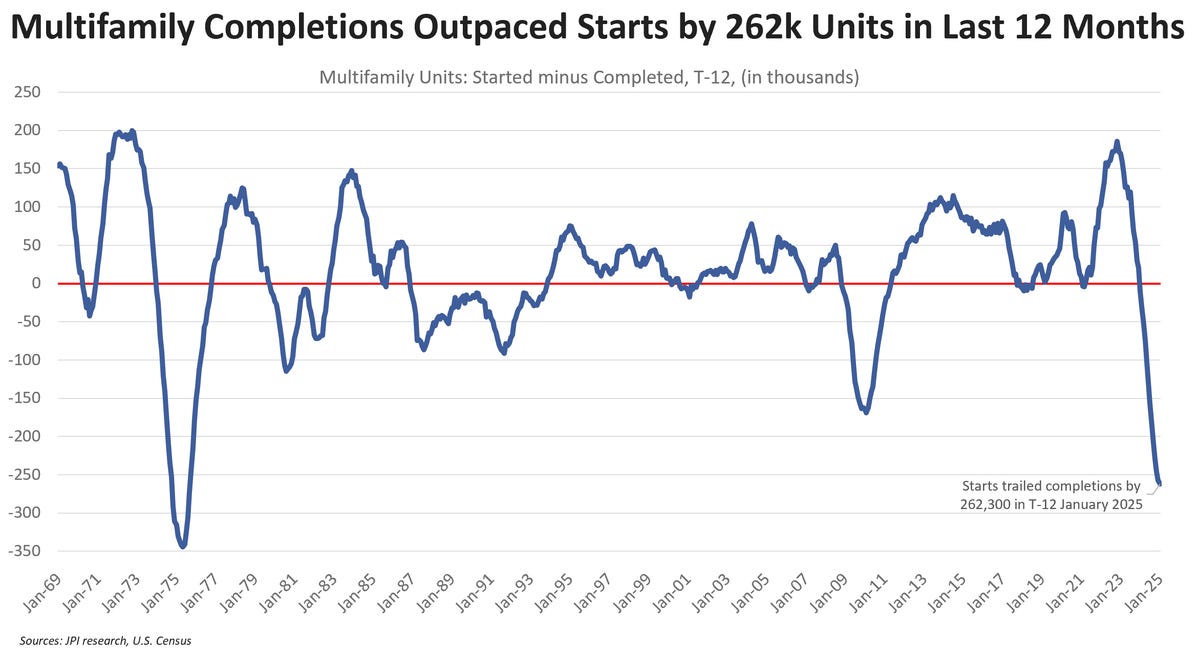

Apartment completions are at a record high today, but apartment starts are at a record low.

Why?

4 years ago we had ~0% interest rates followed buy 2+ years of wildly high interest rates.

Here is a snapshot of apartment rent growth data nationwide.

And detailed chart for apartment rent growth:

And single family home rent growth.

(source: Madera residential research via housing economist Jay Parsons)

High rent growth also trends to the smaller markets. So don’t be too swayed by those shinny objects. Smaller markets normally increase rents faster than large markets. And while these ternary markets can be wonderful investments, they are also likely higher risk, with fewer employers or a small number of large anchor employers, which if they left/closed, would crash the market. *cough* Detroit *cough*

Fun fact, Detroit just grew its population for the first time since 1957…wow.

So let’s look at some key metrics for picking your target real estate market.

Housing Market Metrics

In general, and in this humble (not really) investor’s opinion, there are two general market types. Growth markets and cash flow markets.

Well actually three: Uninvestable markets. Yuck.

I do not focus on cash flow markets, which we normally find in the midwest (but not always, no offense Indiana!). What is a cash flow market? You guessed it, cash flow/cash on cash return is higher (at least at first) than you will find in a growth market, maybe even double, say 12% vs 6%. The problem with these markets is, by our definition, the natural appreciation of the property is slower and the forced equity appreciation when we renovate/develop property has lower margins/returns, on average.

But this depends on your strategy and life needs. For example: if someone is 65, it may make more sense to buy for immediate cash flow, or even sell/exchange their growth market properties and plow that capital into cash flow markets.

Disclaimer: We are talking about averages and likelihood here these are broad categories. Of course you can get a deal anywhere that has one or the other or both. Hell you can get a deal that is all three! ☝️growth, ☝️cash flow and yet completely uninvestable (aka super ☝️risk: disaster prone, crime, next to your ex-wife… you get it).

“We should always be deal dependent,” as I like to tell clients. But in general I focus on growth markets to maximize my return across the 5 ways investors make money in real estate: natural appreciation, forced appreciation, depreciation, principle pay down and cash flow. Most of the wealth your property generates over time will not be from cash flow, especially in the beginning. It will be from the appreciation categories. And it’s not even close, in my opinion. *(I wrote a whole article on the 5 ways, if you are interested in further reading DM me and Ill shoot it over to you).

The cash flow value trap.

Growth markets actually bring higher cash flow/CoC returns, it just takes time.

Wait what?

Cash flow (and principle pay down) becomes very interesting over time as the property rent appreciation compounds. Cash flow is like a house plant. It starts out small. You have to nurture it. But over time, it grows. You raise rents. Yet, your long-term debt stays fixed (thank you America). Yes, property taxes and insurance (especially in some parts of the country, watch out) will tick up, but rent increases will cover those costs. So by investing in a growth market you don’t miss out on cash flow, it just comes later. And because you are in a growth market, you will be able to raise rents faster. So over time, even cash flow will likely be higher in the end.

So how should we measure housing markets?Ok, now all that mumbo jumbo is out of the way, let’s get into it!

Again, this will somewhat depend on your preferences, risk appetite, age, family status and investment goals…BUT, I would argue there are a several foundational items the savvy real estate investor looking in a growth market should always include:

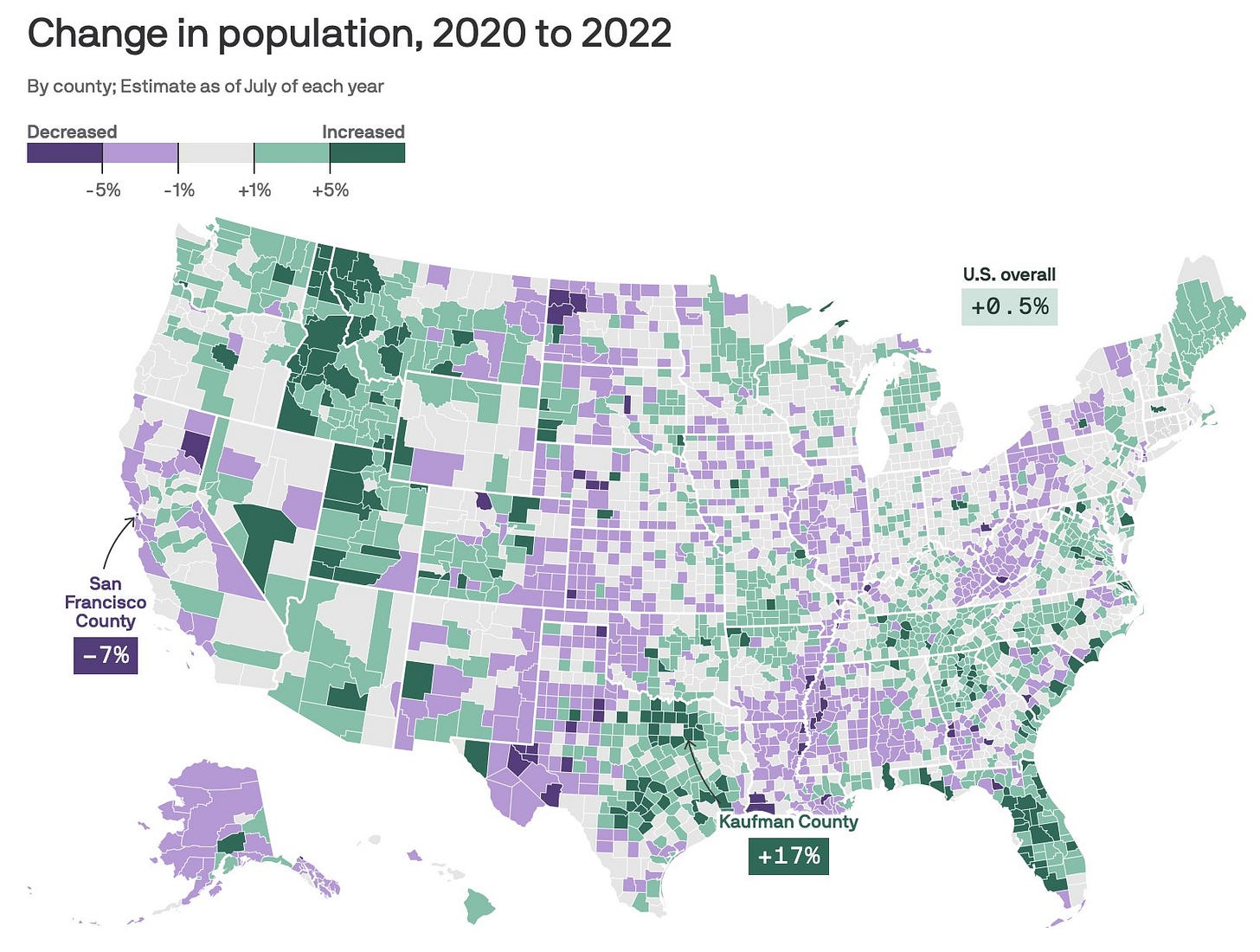

- -Population growth trending up. This, and the next metric, are the basic prerequisites for what makes a growth market and are what I focus on when I choose a market. Population growth directly impacts all the below metrics and is a primary signal for housing demand (see chart). At its center, that’s all real estate is. Buy in growth areas, were people not only want to live but are actively moving to. Investors should always track population trends and sell when you see this dip. Case in point: Two years ago I sold my last investment property in DC and redeployed to Nashville. I saw the downward trend happening. It ended up being one of the best financial moves I’ve made.

Buy Green

Buy Green - -Civilian labor force. I want to see this trending up and to the right. A growing number of working folks in the arena is a key filter for me when selecting a metro. If this is decreasing (seasonally adjusted/non US recession), beware! (note: labor force is different than employment. Labor force = employed + unemployed but looking). Nashville chart below.

- -Individual income. A city with a growing individual income level is a big green flag for me. It signals a cycle that can supercharge investment returns.

- -Rising incomes = people have more purchasing power. That translates to higher demand for housing, whether it’s buying homes or renting apartments, which can drive up property values and rental rates. Growing income levels signal stability and opportunity. If folks are earning more, it’s likely tied to new businesses/industries moving in/expanding and is often correlated with infrastructure improvements, better schools, and overall quality-of-life upgrades—think parks, transit, and nightlife. These make the city a magnet for more residents, keeping your property in demand long-term. A stagnant or declining income level? That’s a black flag, and I’d steer clear. You want a market where the tide’s lifting all boats, not sinking the ship.

- -Economic Growth/Stability. This one is obvious and important. A city’s overall economic health ensures resilience during downturns, protecting your investment. A diverse economy and mix of businesses reduces reliance on a single industry or employer. Look for low unemployment, economic diversity, and a history of stability during recessions.

- -Home price and forced appreciation. In general, anything above 5% long-term is healthy growth, which is higher than the US Case-Shiller average. I look for this to be a long term trend of 10+ years. You can force this by renovating or developing your property. Renovated properties also naturally appreciate faster. And in growth markets you will get a higher return for adding value to the property. I like to set a baseline of a 50% return on my construction dollar when I renovate. For example: if I spend $50k on a renovation I need the property to appreciate at a minimum of $75k. I normally shoot for 100% return as my goal, or $100k appreciation, in this example. This is very hard to do at this level in a cash flow market. And I don’t know any other investment vehicle where you can get an almost guaranteed 50% return. How? Because you can calculate the return fairly accurately. You know the comparable property values to estimate your buy price, you have an estimate for construction and you know the comparable sold properties once removed in the area (After Repair Value, ARV). The difference is your forced equity appreciation (ARV- (purchase price+construction costs) = forced equity appreciation). *** Important note! Keeping construction costs down within your necessary scope of work is THE most important skill to hone as an investor/developer. This is where **** can go sideways fast.

- -Rental Yields. Again, rental yields are important. But not the most important. Cash flow is like a house plant. It starts out small. You have to nurture it. But over time, it grows. You raise rents. Yet, your long-term debt stays fixed (thank you 30-yr mortgage, only in America). I look for 3%+ as a baseline. But beware. Large supply influxes can skew the data (see above).

- -Insurance Problems? Is insurance expensive? Is actually obtaining insurance difficult? Are insurance agencies leaving the state? Insurance troubles can make a market uninvestable. Make sure you are baking your insurance costs in your analysis and weighing the risk of environmental catastrophe. This can affect everything from rentability to profitability to refinancing to long-term appreciation.

- -Infrastructure Development. Investments in transportation, schools, and public services enhance a city’s appeal, increasing property values and attracting residents. Look for planned / ongoing projects like new highways, transit systems, city development plans are a great resource.

- -Favorable regulatory environment. Is the state/city landlord friendly? This can make or break you as an investor-operator, and is another reason some markets are uninvestable. It’s like the city/state politicians think landlords are evil. I look for places that are firm but fair, like Tennessee. Additionally, favorable zoning laws and property taxes are of course important, particularly for developers, and can make larger projects much more attractive.

- -Quality of Life. Hell, dont forget this, do folks actually want to live there? Or are they there because they have to only to move to the burbs/another state in a few years *cough* Washington DC *cough*. Good schools, healthcare, low crime, recreational opportunities etc… attract residents, supporting property values.

There are more I’m missing here. What else is important to you? Drop me a note.

My Skeptical Take:

As the great hip-hop group Wu-Tang once rapped about “Cash rules everything around me, CREAM get the money, dollar dollar bill y’all…”

True that.

But beware of the cash flow value trap.

Just like stock market investors buy blue chip and small-cap stocks, so do real estate investors, who buy in major metro markets and in smaller tertiary markets. In growth markets and in cash flow markets. On may be more volatile and one more stable. One focuses on long term growth and one on shorter term higher returns. The choice is yours really, and is based on your risk appetite and investment goals. IF you decide to go into something higher risk, perhaps consider diversifying so you don’t get caught naked when the tide goes out.

Monitor your investments everyone. Especially if you have a property manager telling you everything is roses. You may still be getting that same rental check but how is the asset doing? Are there any emerging local trends that may cause concern? How can you asset manage the property better? For example: It may make sense to build a deck or landscape the backyard to keep top-quality residents and / or increase rents. In a high mortgage interest rate environment reinvesting in your current properties may make more sense than buying another property. I’m doing this now for my portfolio and our property management clients.

Do you think there is a problem in a market you are already invested in? Is growth slowing or can you get a higher return on equity in another property? Should you redeploy?

Look at the metrics above. Run the numbers, double check that every dollar you have is still a little worker bee making you the highest return on equity, even when you’re sleeping. A great book on this is “

But sometimes, success in real estate is not a hard science. It’s a soft skill, where how you behave is more important than what you know. If your numbers look good don’t panic unless there is reason to. In 2009 I had a few properties that I had to drop rents and a few I was just under construction on. But I didn’t flinch. I didn’t sell out at the bottom. I wasn’t over-leveraged. As I know from much experience, pretty much without exception, that you can always tell an ultimately good investor from a bad one by this simple test:

Equanimity. Or as the Finnish people say, sisu!

I love the Nashville market. Am I biased? Totally. But for good reason. It checks all the above boxes. And I’m putting my money where my mouth is.

Labor force growth? check. GDP growth? Housing price growth? Check. Check. Rent growth? Check. Tourist destination? 18 million visited last year. Check. Super fun? Check.

Do I like smaller/tertiary markets?

In general, I personally stick with the larger metros that are experiencing population, labor force and economic growth. My home market of Nashville is fantastic. It has the lowest unemployment of ANY of the top 25 major cities, strong employment growth, robust GDP, and decent rents.

However, there are some notable exceptions where I may take additional risk and I feel I have asymmetrical knowledge, like some tertiary markets around where I live and have personal experience with. But there, I go higher risk barbell approach. I look for really really small cities that are in some way easily connected or a result of the outgrowth to larger anchor metro areas. For instance, I love Madison and Ashland City, two tiny towns in the Nashville metro. Ashland City’s population is only 5500, and is 30 min from Nashville.

It’s all about aligning the city’s characteristics with your investment goals—whether you’re chasing cash flow, appreciation, or a flip. Research the above market metrics. Pick wrong, and you’re fighting an uphill battle; pick right, and the market does half the work for you.

Never lose money. That’s rule number 1.

Rule number 2?

See rule number 1.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

Andreas Mueller

Post: The Market Lives in the Future

Post: The Market Lives in the Future

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to my weekly BP Post! The Skeptical Investor, which I hope we all are :)

A frank, hopefully insightful, article from one investor to another.

Today, we’re talkin’ markets, and where they go from here. Is inflation at risk of reigniting or is the long-term downward trend still intact? Will there be a catalyst for housing activity like lower interest rates? Or will rates continue to stay high?

I found some interesting countertrends this week.

Let’s get into it.

The Weekly 3 in News:

The Weekly 3 in News:

- - 73.3% of U.S. mortgage borrowers have an interest rate under 5.0% (Lambert).

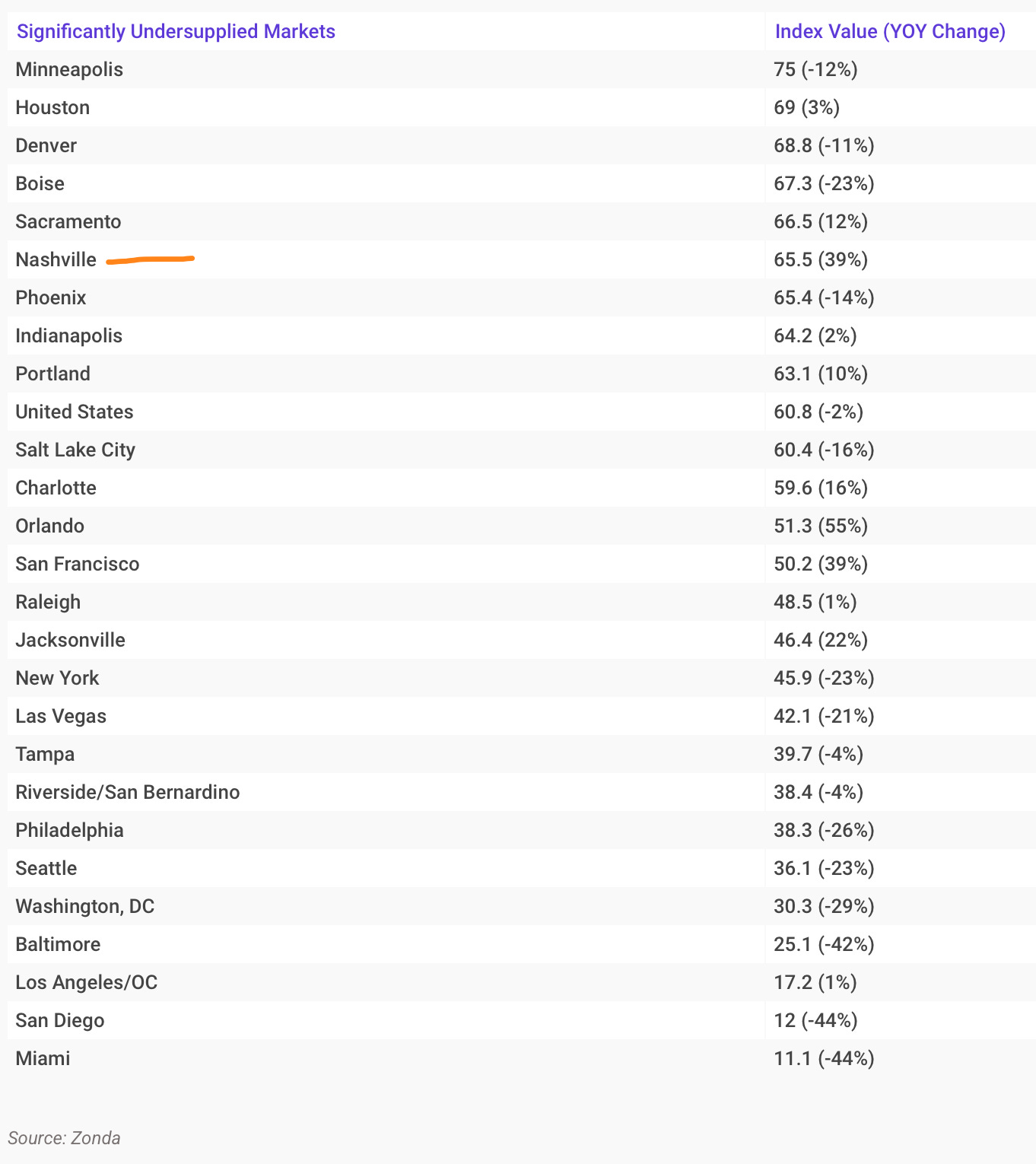

- - Most housing markets are significantly undersupplied for new lots to develop, including Nashville. We need more housing ()!

- - New apartment construction continues to plummet. Apartment development starts are trailing completions by the most since the 1970s. We are entering into a severely undersupplied housing moment as interest rates weigh on development (Parsons).

Today’s Interest Rate: 6.87%

(👇.09% from this time last week, 30-yr mortgage)Inflation has been trending higher

Inflation has come down significantly since its peak. A few years ago prices were going up 9%, and now we have settled ~ 3% price growth. But this ain’t good enough, and is still 50% higher than the Fed’s 2% target.

And to his credit, Federal Reserve Chair Jerome Powell seems in no rush to cut rates with inflation above target level. During his congressional testimony last week, Powell said, “If the economy remains strong, and inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer.” And that “the Fed would not lower its policy rate until there is “greater confidence that inflation is moving sustainably down toward 2 percent.” This is a welcome, cautious approach prioritizing inflation data over premature rate reductions.

However…. it appears that inflation may instead be reversing course.

It’s been four straight months of price increases.

- October - 2.57%

- November - 2.71%

- December - 2.87%

- January - 3%

Four, a trend does make.

And oddly, Fed Chair Powell seemingly brushed this off in his testimony, saying “A couple of months doesn’t make a trend.” This is not accurate. I couldn’t believe it.

This is a big deal, and it seems nobody is talking about it. A not so fun fact, we have not had more than 2 consecutive months of inflation growth since the end of 2021.

Until now.

I’m getting PTSD from when the Fed and former Treasury Secretary Yellen insisted for months and months that inflation was not a worry, it was “transitory..”

How did that play out y’all?

So count me extremely skeptical. Inflation has a real risk to the upside here.

Where do interest rates go from here?

Now, here is where it starts to get interesting.

After having a bit of a tantrum to start the year, where the 10-yr treasury spiked to ~4.8%…

…bond vigilantes have been feeling better about inflation’s prospects these last few weeks (the breaks above are holidays).

This has translated into (slightly) lower mortgage rates.

Since peaking on Jan 13th (matching the 10-yr Treasury peak) at 7.26% the 30-yr mortgage rate has been down each week since (with some volatility last week).

Very interesting.

And, ironically, this could continue.

In an interview this past Friday, Treasury Secretary Bessent told Bloomberg that the Fed may stop selling Treasuries off their balance sheet, which the Fed has been doing while lowering interest rates. These two actions were working against each other, so if they do stop Treasures rolling off, this will make it easier (with lower supply) for the Treasury to issue/sell 10yr bonds and potentially lead to lower long-duration bond rates, and thus mortgage rates.

The Fed doesn’t control mortgage rates, but they do own mortgage bondsIt is often said, including by yours truly, that the Fed doesn’t control the long end of the yield curve. Ie, when the Fed cuts it’s short-term Fed Funds Rate that does not have a direct affect on 10-yr Treasury rates, or 30-yr mortgage rates.

True. But…

The Fed does buy mortgage bonds (mortgage-backed securities). Currently $2.2 trillion worth, in fact. This is called Quantitative Easing (QE) and it very much affects interest rates. Treasury bonds are long-term debt securities issued by the government to finance its spending. When the central bank engages in QE and buys treasury bonds, it increases the demand for these bonds. Higher demand for treasury bonds leads to an increase in their prices. Bond prices and yields are inversely related: when bond prices rise, yields fall. Therefore, QE lowers treasury bond yields. And since the 30-yr mortgage follows the 10-yr Treasury rate (put simply: they are competing investment tools) the Fed very much can affect mortgage rates.

This QE mortgage rate manipulation became a policy tool in 2009, following the Great Financial Crisis. And it will remain so, until the Fed mortgage bond portfolio drops to zero. So when the Fed buys mortgage bonds they can manipulate mortgage rates down by introducing additional demand. This contributes to a higher-than-usual premium in the spread between the 10-year Treasury and 30-yr mortgage rates i.e. higher mortgage rates.

The complication today is that since buying a hell of a lot of these bonds from 2020-2022 they have been steadily selling them back into the market or allowing them to roll off/expire.

This does put upward pressure on mortgage rates.

The Market Lives in the FutureBeyond directly lowering treasury yields, QE increases the overall money supply in the economy. This influx of money can lead to lower interest rates across various financial markets, including mortgage rates. The signaling effect of QE also plays a role. When the central bank engages in QE, it signals its commitment to keeping interest rates low for an extended period. This influences market expectations and reinforces the downward pressure on mortgage rates.

Labor market softening could further help with ratesIn his testimony, Powell also remarked that the labor market has "cooled from its formerly overheated state" but remains "solid." He continued, saying “[the Fed can] "ease policy if the labor market unexpectedly weakens or inflation falls more quickly than expected." This shows that the Fed is prepared to lower interest rates if the job market suddenly deteriorates or if inflation drops faster than anticipated.

Welcome reassurance to the market.

Additionally, Powell noted that the Fed is in the midst of a framework review, evaluating its monetary policy and communication strategies. This should wrap up by late summer 2025 and could provide a pivot point for Fed policy.

My Skeptical Take:

The 4-month inflationary trend should be extremely concerning. I am skeptical that the Fed will be able to cut rates by the conclusion of its framework review this late summer.

Last month I made a call on mortgage rates for 2025.

And I’m sticking by it.

So, if the Fed won’t do it, how could mortgage rates drop?

I still think we can get to sub-6% this year on the 30-yr mortgage. But it won’t be because of the Fed cutting rates. It will be because these 3 things happen:

- - The labor market continues to normalize (aka cool), wage inflation slows but not alarmingly, and the bond market can stop fighting the Fed. Once bond market vigilantes believe that future inflation is under control, interest rates - and thus mortgage rates - will tick down (Long-term bonds will be more valuable and investors will buy them). Mortgage rates go down with Treasuries.

- - Government spending is being slashed (hopefully). If it becomes clear that the DOGE White House effort is working, long-term Treasury bill yields will fall even faster. Hell, DOGE says they have saved $55 billion in taxpayer dollars so far, according to the Administration’s new “transparency” website. This may be “inflated” (pardon the pun) and the effort has received criticism BUT if they can achieve even a fraction of the $2 trillion they intend to cut it will be enough of a signal.

Remember, it’s been just 30 days since they started.

- - The Fed can use its balance sheet to affect mortgage rates. The Fed doesn’t need to start buying mortgage bonds again (ie quantitative easing) but it can stop selling/rolling mortgage bonds off its balance sheet. It has $2.2 trillion of these babies and continuing to release them back into the market is likely putting upward pressure on rates. And if the housing market stays in correction territory (by # of transactions) then they may even consider adding to their treasure trove of Treasuries (say that 5 times fast).

So, will we get to 5.xx% mortgage rates this year?

Yes we can.

All the market needs is confidence that inflation and federal spending are starting to tick down, with a cool, yet steady, labor market.

Remember, the market lives in the future.

I’m not assuming anything of course. And I recommend you do the same.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

Andreas Mueller

Post: Off Market Hermitage Flip in a GREAT Neighborhood!

Post: Off Market Hermitage Flip in a GREAT Neighborhood!

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

DM me for email