All Forum Categories

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

All Forum Posts by: Andreas Mueller

Andreas Mueller has started 56 posts and replied 191 times.

Post: A Skeptical Dude's Market Insights - No Job, No Problem Loans Making a Comeback??

Post: A Skeptical Dude's Market Insights - No Job, No Problem Loans Making a Comeback??

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Hi Chris! I do but BP blocks it so I just copy paste it here. It’s on substack.

Linking to outside blogs for some reason, violates their forum policy, which is crazy because we can link other peoples articles to not our own. Interested with other folks here on the forums think about this BP rule??

Quote from @Chris Seveney:

Quote from @Andreas Mueller:

Welcome to A Skeptical Real Estate Dude my weekly post on market insights coming at you live from Nashville, TN. Every week I write a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Mortgage Market is in Severe Recession: Mortgage Brokers are Quitting

- - No Job, No Problem Loans Making a Comeback??

- - Chocolate is the New Gold

- - The Bottom Line

- - Fed’s Goolsbee: Rate Cuts Will be Warranted. Inflation progress need not be as good as it has been. Policy is tight. "If we stay this restrictive for too long, we will start having to worry about the employment side of the Fed’s mandate." (WSJ).

- - China's current population of 1.4 billion people is projected to fall to 525 million by the end of 2100. A 63% decline (@charliebilello).

- - Bitcoin Crosses $1 Trillion Market Cap (@KobeissiLetter).

Today’s Interest Rate: 7.13%

(☝️ .17% from this time last week, 30-yr mortgage) Mortgage Rate UpdateMortgage rates are climbing higher again this week to 7.13%, doubling last week’s increase - up ~1/2% in just 2 weeks. We are back to Nov 29th levels folks. It appears the bond market continues to call BS, remaining dubious that inflation will come down rapidly (or potential labor market weakening).

And those traders may be right, at least for now.

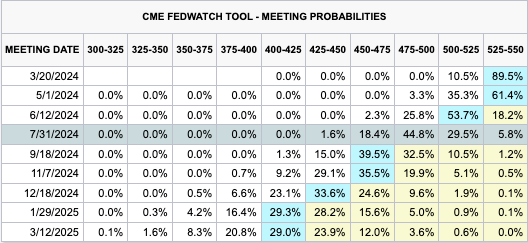

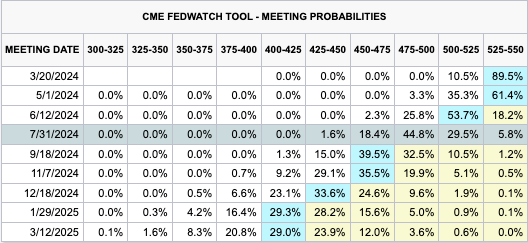

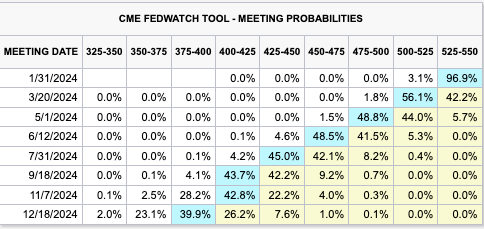

Fed Fund futures are now pricing in ~4 rate cuts in 2024, down from 6+, which it has fluctuated around the past few months.

IMO, we are still most likely to see roughly 3 rate cuts, totaling 100 bps (1%) this year, given current available labor and inflation data. Inflation is still lingering around, like that creepy guy who's just a “little too old to be in da club.”

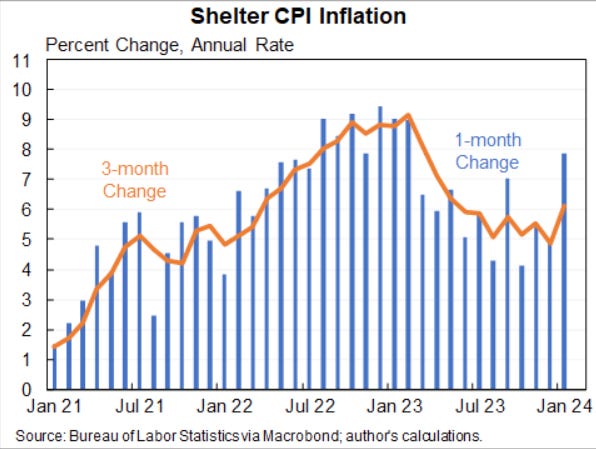

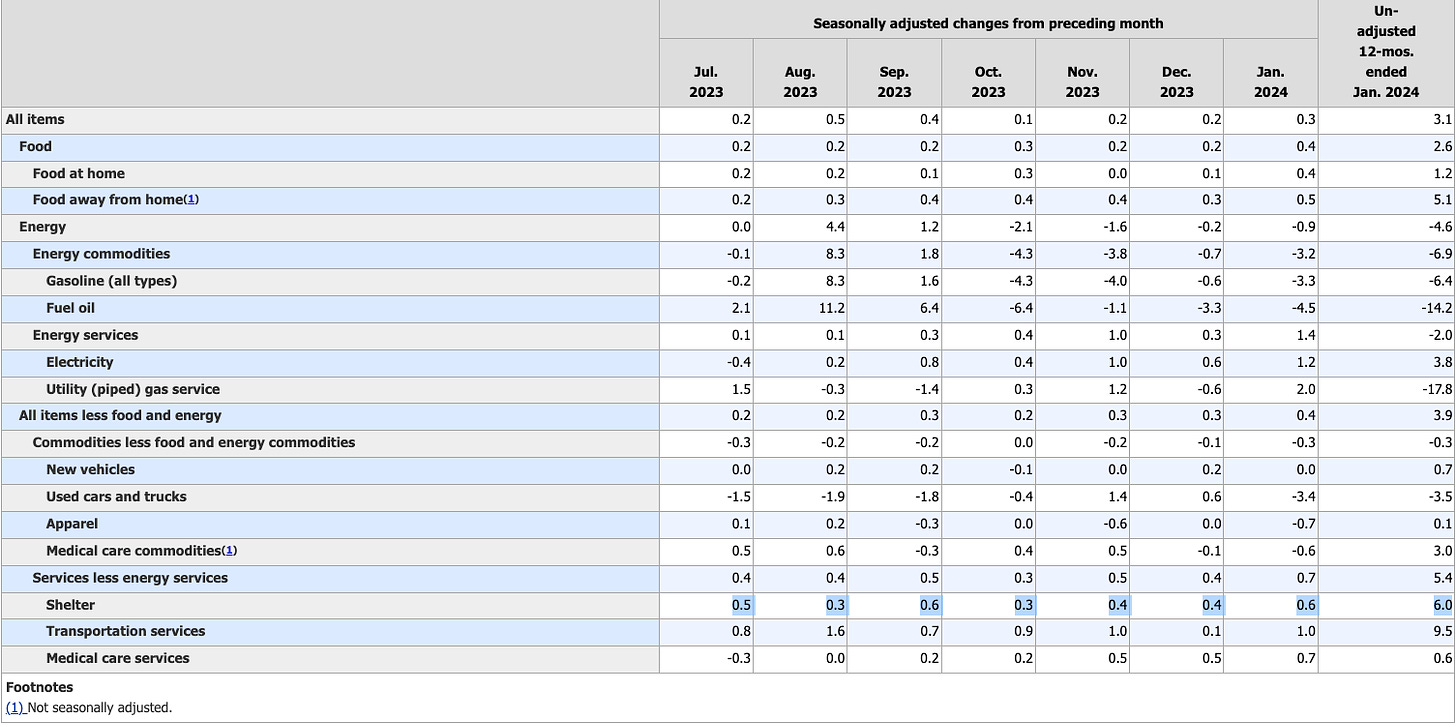

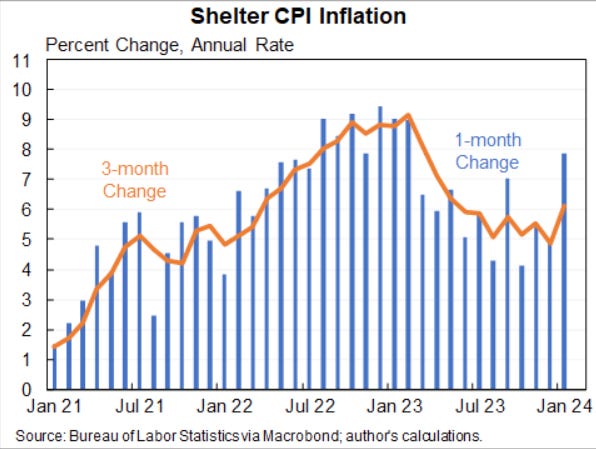

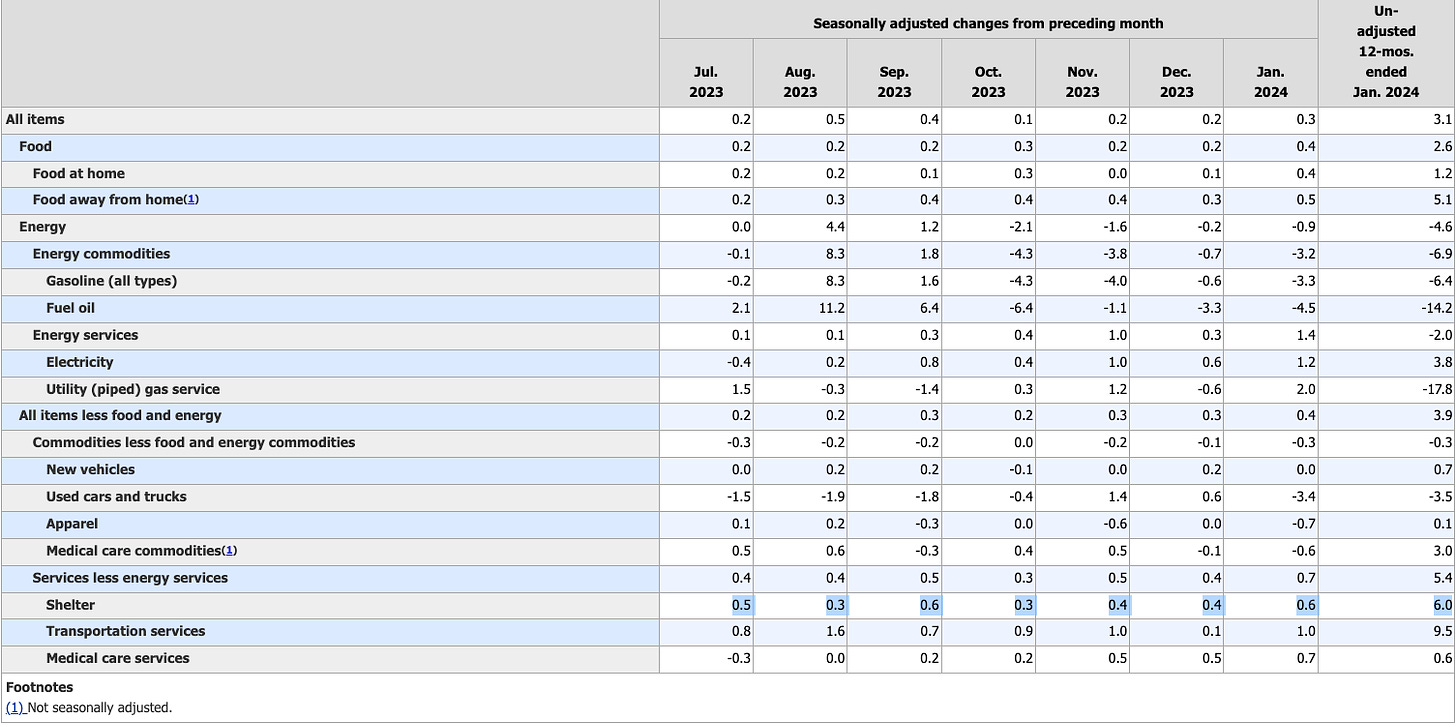

Inflation Rearing its Ugly HeadInflation numbers this week showed core CPI in January was hotter than expected, 0.4%, which is a 4.8% annual rate. Of note, housing costs [shelter] accounted for over two thirds of the monthly increase. Looks like rents are not weakening like many pundits have been warning. And it is important to note, shelter costs have been up every month, not down. Lower inflation (disinflation) just means at times shelter costs were rising less-fast. Not decreasing (deflation). And this is a lagging number, meaning they are likely higher today than we think. IMO.

And

Mortgage Market is in Severe Recession

Mortgage Market is in Severe Recession

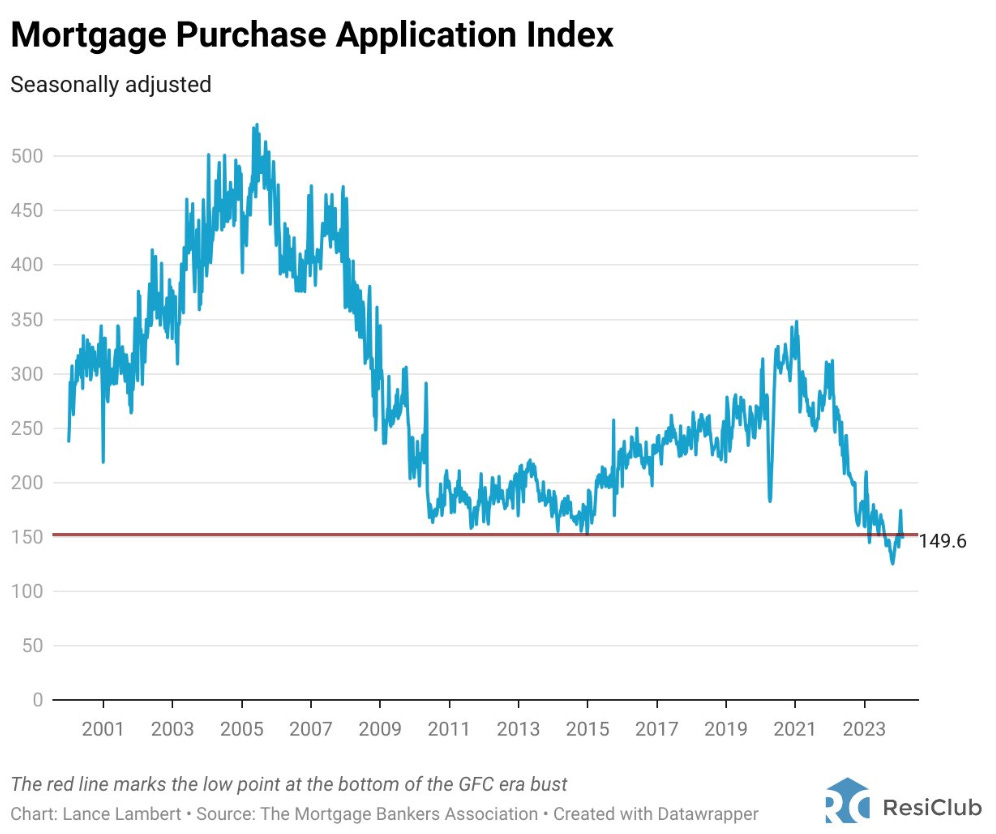

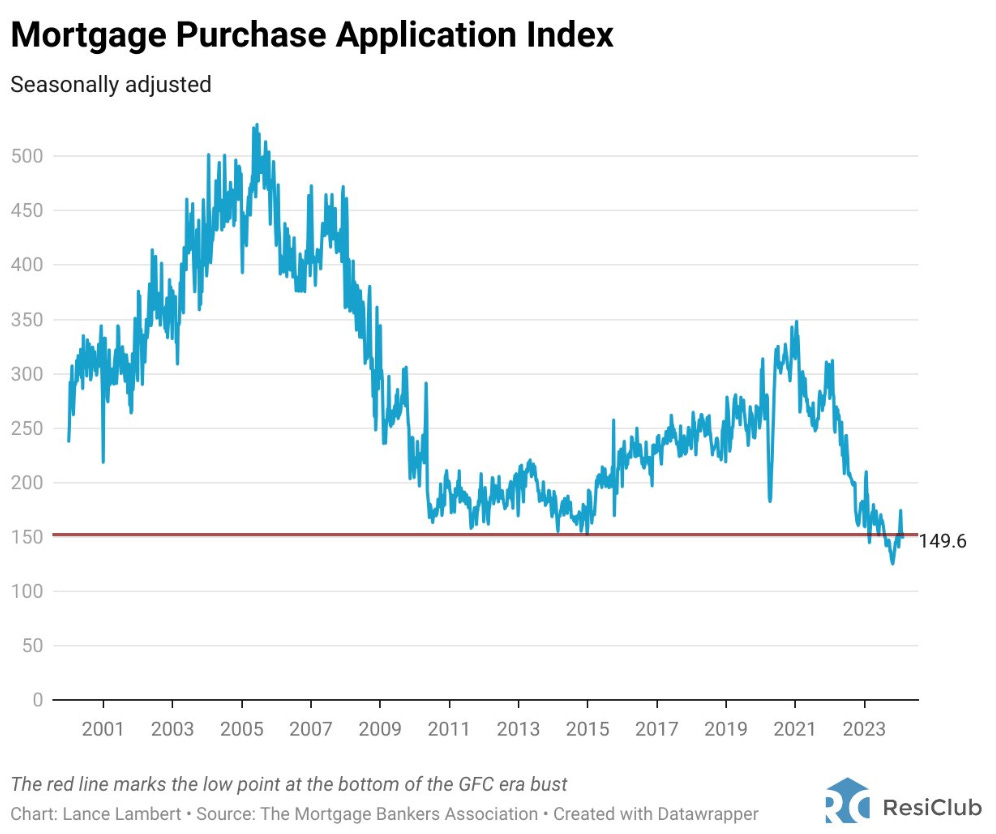

This may be one of the steepest and longest downturns in the history of the mortgage market. Mortgage applications are negative YoY, and remain near the lows during the Financial Crisis.

Mortgage demand is down 14% over the last year and 40% from pre-pandemic levels (Reventure). Supply of available homes to buy remains low, as 90% of homeowners have mortgage rates below 5%. Additionally, low rates for homeowners mean refinances are virtually zero (only those desperate to get out of hard money, construction or bridge funding).

What is this doing to the Mortgage Industry?It’s tough to be a mortgage officer. Layoffs and mergers by necessity are happening almost every day. Since the beginning of the year we have seen mergers and layoffs at:….

- City National Bank to cut 56 jobs in Los Angeles (2/14/24)

- Guild Mortgage acquires Academy Mortgage (2/13/24)

- Proprietary Capital acquires American Financial Resources, LLC (2/12/24)

- 1st Priority Mortgage to acquire Hudson United Mortgage (2/6/24)

- Fairway Independent Mortgage Corp. to shutter wholesale lending division (2/2/24)

- Newrez layoffs (2/2/24)

- New American Funding (NAF) to acquire Draper and Kramer Mortgage Corp. (DKMC) (2/1/24)

- Crescent Mortgage Co. to shut down, lay off 65 employees (1/31/24)

- Heritage Bank to exit retail mortgage lending (1/25/24)

- UMortgage acquires Community Mortgage Brokers (CMB) (1/22/24)

- Country Club Mortgage to let go of 105 employees in Central California (1/17/24)

- Wells Fargo mortgage layoffs (ongoing)

- Truist Financial to close bank branches, cut mortgage jobs (1/8/24)

- Kinecta Federal Credit Union layoffs in El Segundo, CA (1/3/24)

Case in point, Treasury Secretary Janet Yellen recently testified in front of Congress and expressed explicit concern over non-bank mortgage lenders. These mortgage loan originators, originated a whopping 70% of mortgages in 2023! (I had no idea it was that high).

They are reliant on short term financing not deposits (like a bank) or access to financing from the Federal Reserve, so “in stressful times their credit lines can be pulled.” “There is concern that in stressful market conditions we could see the failure of [these lenders]…this has become very significant in the mortgage market.”

And if rates, drop fast this actually could spell disaster for these mortgage companies. Anyone in a high rate mortgage (I have a few admittedly, b/c I got a fantastic deal on the property) is going to refinance immediately and repay the loan. Are these mortgage companies ready/aware of prepayment risk for loans they at making today? This could happen faster than income from new loan originations.

Mortgage Officers are Choosing Not to Renew their Licenses at a Wild Pace.

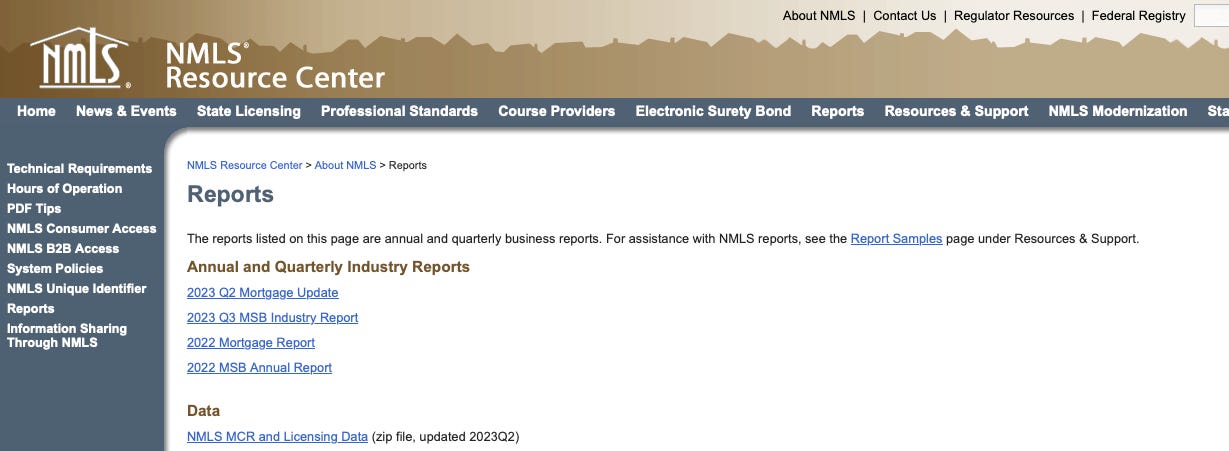

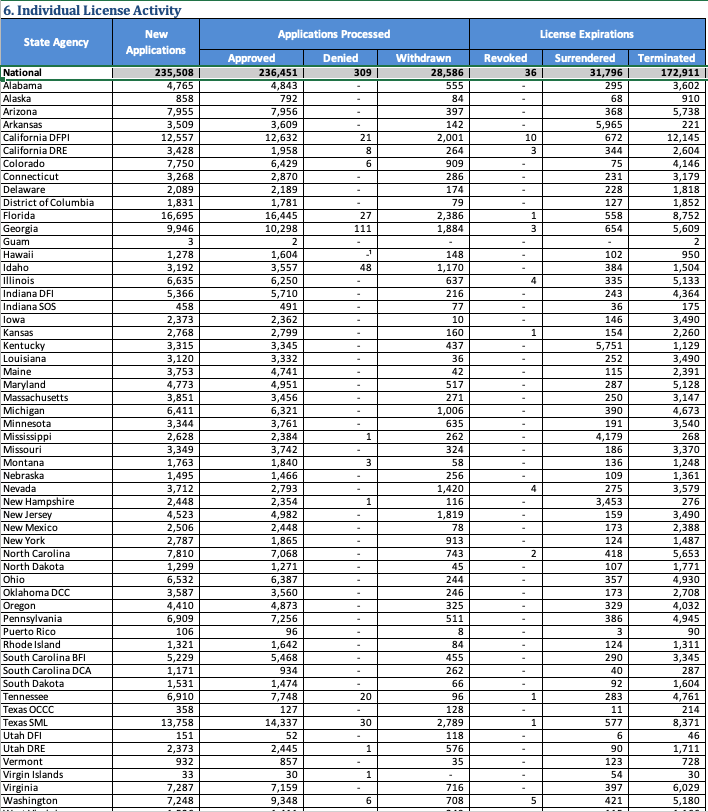

According to data by the NMLS, the Nationwide Mortgage Licensing System, the number of registered mortgage officers dropped 24.5% YoY in Q2 2023. In other words, One Quarter of mortgage officers decided to call it quits from the mortgage industry and not renew their license (for some reason the NMLS is only up to Q2 2023 data collection, odd…IMO full year 2023 was probably a blood bath. We will see.)

And in 2022, more mortgage licenses expired or were withdrawn than were approved (again, the 2023 annual report is not yet out, see below).

WOW.

And in some states the data is even wilder. Check out the linked chart below.

Check out California and DC…

Quick Story: Are mortgage lenders making risky loans again?

Quick Story: Are mortgage lenders making risky loans again?

Perhaps, and they are some bizarre loans that remind me of 2008. And this is crazy…

I was having breakfast with a local mortgage lender, at a bank, but who is also a mortgage broker. FYI many mortgage officers are both a lender of a bank’s/institution’s money and also a mortgage broker where they broker mortgages for other mortgage originators. 😬😬😬

So anyway, he told me that he recently brokered a loan with no income verification (This was not a VA loan, backed by the government).

My jaw dropped. I thought this was illegal since the Financial Crisis / Dodd Frank?

But that’s not the bad part. Listen to the terms:

- - 11.5% interest rate

- - 5 points up front (pay 5% up front as a loan origination fee)

- - Have to hold 18 months in reserves for PITI.

Now the story is quite sweet. It was a local musician who just got a record deal but has been only making $30k a year and, with a hopeful advance on that deal coming, wanted to buy a home. I get it. They want a house…

Unfortunately this is a tremendously high risk loan with terms so terrible 1) I will be surprised if he doesn’t default, and 2) he is getting, well, screwed. It’s frankly worse than 2008 products and the word expensive doesn’t describe it. Hard money may have been better. 3) How many of these loans have been made and who was the lender he was brokering to?

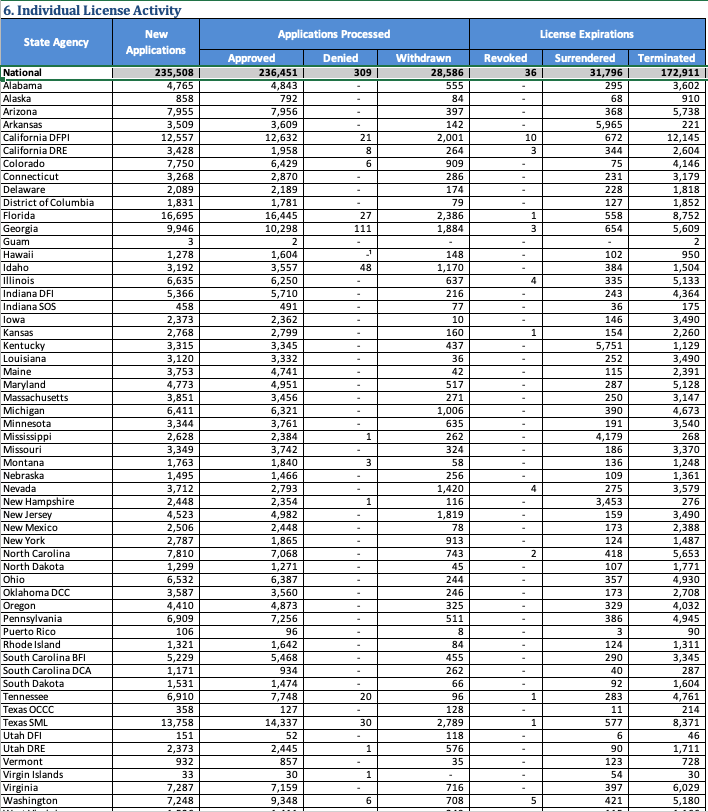

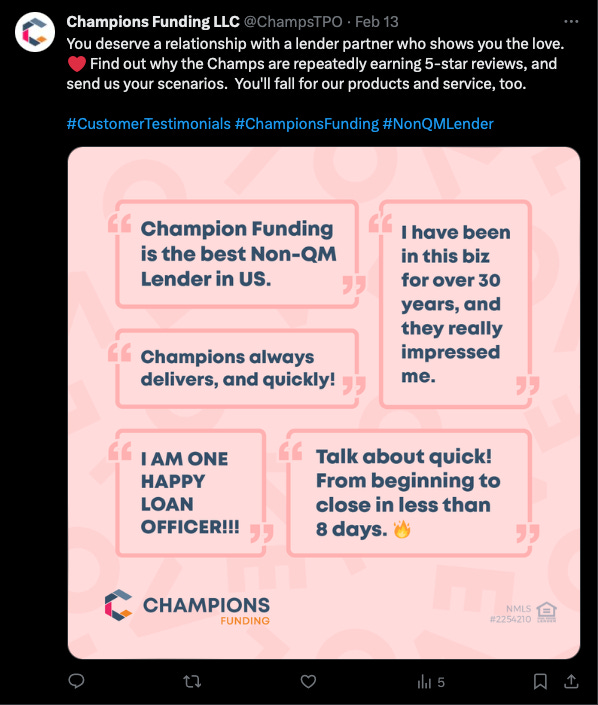

Champions Funding and I wish I knew how many loans they have made. But if they were public I would, in the words of Steve Carroll in the Big Short, “short everything that guy owns.”

They are literally advertising on Twitter that they are the “best” at lending to folks that are “Not Qualified.”

I hope he can really sing….Absolutely insane.

Home PricesYet, home prices are up 5%. Which makes sense given lower home sales volume, driven by low market supply. And remember, CPI of nearly everything is higher every single month, which permeates into materials, services etc… that are necessary for building / renovating homes.

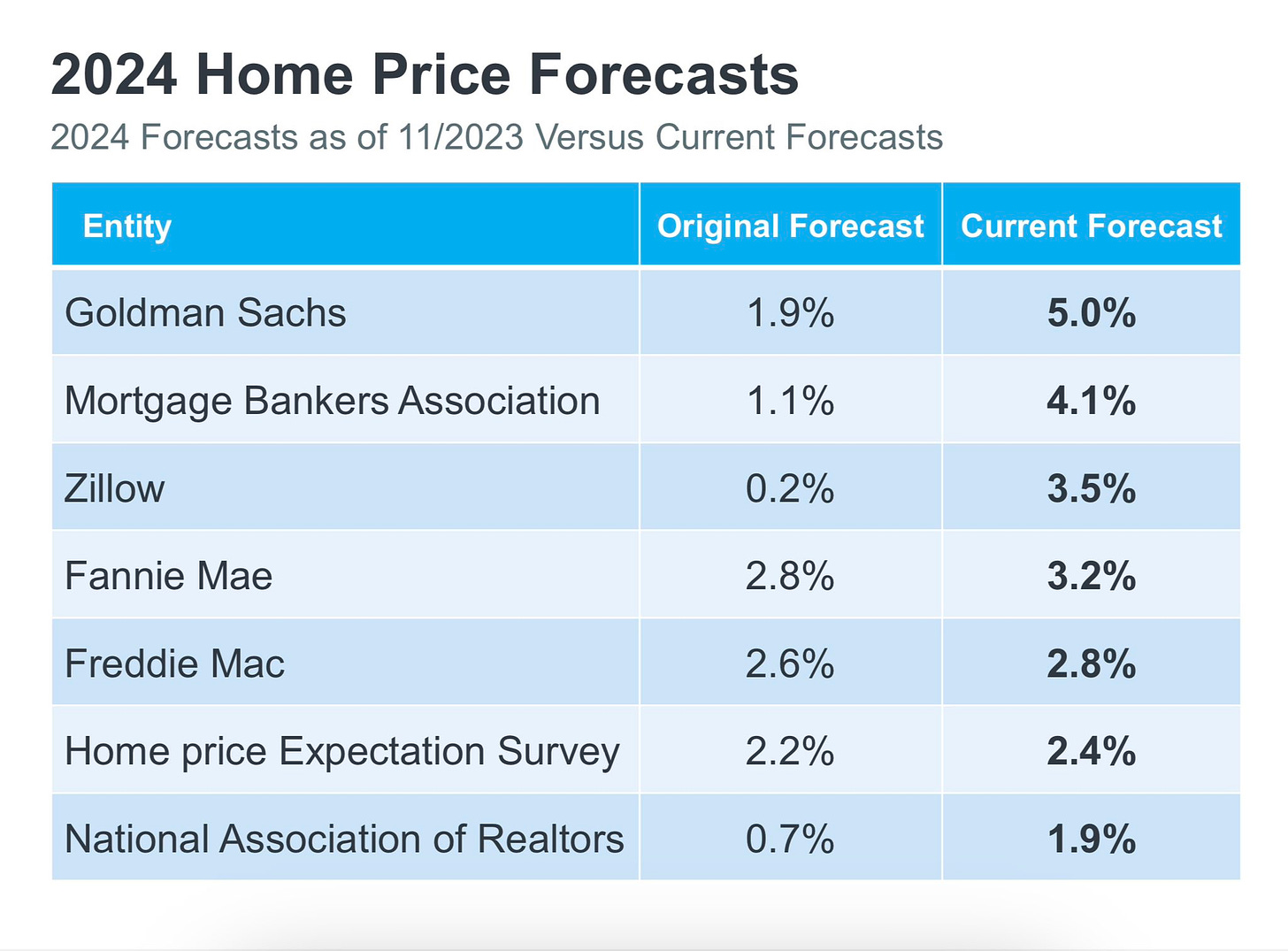

And the predictions for higher home prices keep being revised higher.

My Take? Get it while the gettin is good (bonus points for who gets the reference :).

Valentines Day Tangent!

You know what else is up, all you lover dudes and dudettes?

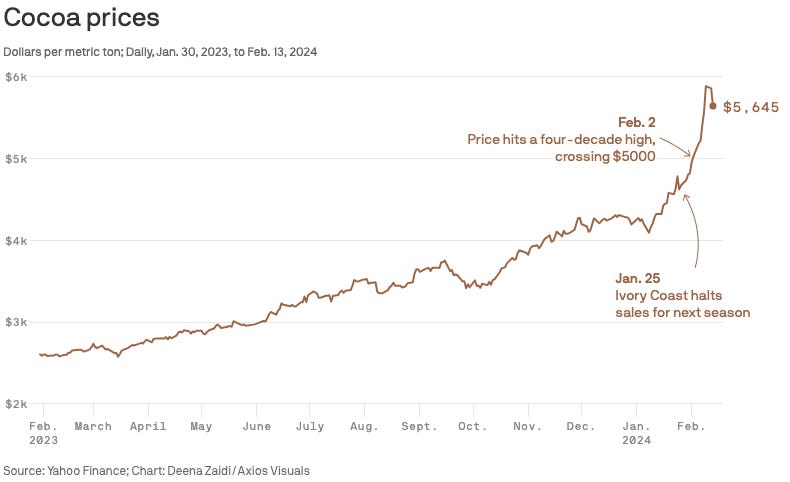

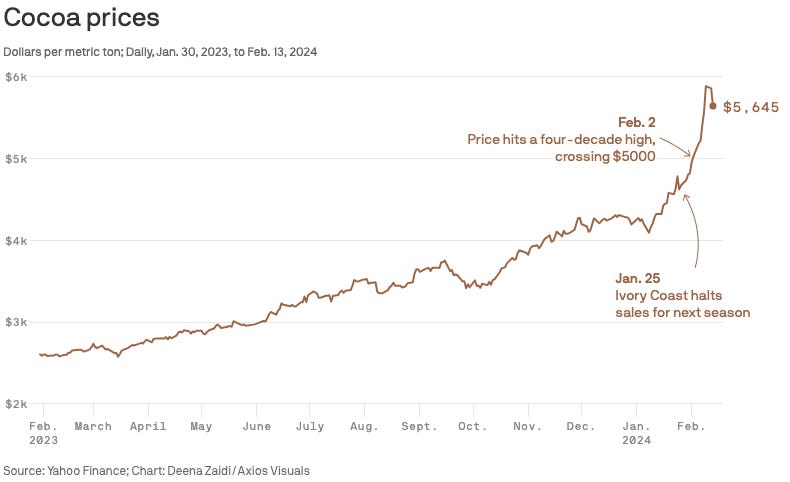

Chocolate!

Holy smores, cocoa prices have skyrocketed to a record high, mostly due to disruptive weather, and also higher freight costs. Good thing I …. hate chocolate! Gimme wine and cheese and olives all day for dessert.

Queue the hate 😁.

But I digress…..

Bottom Line

We just simply need more homes (and larger/expanded) homes to house more people. In my home market of Nashville. Median inventory was down 9% in January. Not great given the lows we are at already.

True, so far 2024 is looking like a potential turnaround year to makeup for the 2022 housing recession, as long as inflation and labor markets act right. But certain areas like mortgage lending are hurting, bad, and we are seeing areas of additional risk-taking to try to make additional $. I had no idea non-QM loans were even legal.

This leads me to why I am getting a little more cautious when it comes to the overall economy. In short, it’s because things are looking, well… good.

How? Well…

- Stocks are trading like the Fed already cut rates.

- Bonds are trading like inflation is still a big problem (and rate cuts aren’t going to happen anytime soon, ie economy is still running hot or traders have labor market concerns).

- Housing is trading like there are no problems.

- Gold is trading like there are no problems.

- Chocolate is trading like gold.

- Oil is trading like we are in a recession.

- My spider sense is tingling….

The Skeptics Take: So when you jump on your next real estate deal. Remain cautious. Make sure it's a great deal. Don't build into your IRR returns a refinance down to 5.5% in month 6. Make sure you can afford that higher mortgage payment for an extended time IF needed. Maybe set aside additional reserve funds in the property's checking account. Sure a faster rate drop could happen, but if it were to, that would likely mean we are in a recession, and you may have other issues then. Like finding renters or higher eviction / vacancy rates. I'm targeting mid-level rentals as investments (buildings that rent for $1500-$2000) / unit. These units rent in any economy. And I am building in a 12-18 month timeline for rate to remain high. In other words, rates will remain above my target refinance rate of 5.5% for the next year / year and a half. I'm also reinvesting in my current portfolio of properties. For example, adding a back deck, garden area and dog washing shed in a few of my properties to ensure I attract the best tenants and they appreciate living in my property (and don't leave).

When times seem good, that is precisely the time to be prudent. Tighten up costs. Run market analysis on rent renewals. Take some time to improve / harden your properties etc….to remain robust against any potential downturn. Because you can NEVER predict when it is coming. Don’t try. Just keep improving and building that moat of resilience ….

And as always…Stay skeptical.

Most Interesting Tweet(s) of the WeekSo sweet. Happy V-Day y’all.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me right here on BP!

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

I recommend you make this a blog post

Post: A Skeptical Dude's Market Insights - No Job, No Problem Loans Making a Comeback??

Post: A Skeptical Dude's Market Insights - No Job, No Problem Loans Making a Comeback??

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Welcome to A Skeptical Real Estate Dude my weekly post on market insights coming at you live from Nashville, TN. Every week I write a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Mortgage Market is in Severe Recession: Mortgage Brokers are Quitting

- - No Job, No Problem Loans Making a Comeback??

- - Chocolate is the New Gold

- - The Bottom Line

- - Fed’s Goolsbee: Rate Cuts Will be Warranted. Inflation progress need not be as good as it has been. Policy is tight. "If we stay this restrictive for too long, we will start having to worry about the employment side of the Fed’s mandate." (WSJ).

- - China's current population of 1.4 billion people is projected to fall to 525 million by the end of 2100. A 63% decline (@charliebilello).

- - Bitcoin Crosses $1 Trillion Market Cap (@KobeissiLetter).

Today’s Interest Rate: 7.13%

(☝️ .17% from this time last week, 30-yr mortgage) Mortgage Rate UpdateMortgage rates are climbing higher again this week to 7.13%, doubling last week’s increase - up ~1/2% in just 2 weeks. We are back to Nov 29th levels folks. It appears the bond market continues to call BS, remaining dubious that inflation will come down rapidly (or potential labor market weakening).

And those traders may be right, at least for now.

Fed Fund futures are now pricing in ~4 rate cuts in 2024, down from 6+, which it has fluctuated around the past few months.

IMO, we are still most likely to see roughly 3 rate cuts, totaling 100 bps (1%) this year, given current available labor and inflation data. Inflation is still lingering around, like that creepy guy who's just a “little too old to be in da club.”

Inflation Rearing its Ugly HeadInflation numbers this week showed core CPI in January was hotter than expected, 0.4%, which is a 4.8% annual rate. Of note, housing costs [shelter] accounted for over two thirds of the monthly increase. Looks like rents are not weakening like many pundits have been warning. And it is important to note, shelter costs have been up every month, not down. Lower inflation (disinflation) just means at times shelter costs were rising less-fast. Not decreasing (deflation). And this is a lagging number, meaning they are likely higher today than we think. IMO.

And

Mortgage Market is in Severe Recession

Mortgage Market is in Severe Recession

This may be one of the steepest and longest downturns in the history of the mortgage market. Mortgage applications are negative YoY, and remain near the lows during the Financial Crisis.

Mortgage demand is down 14% over the last year and 40% from pre-pandemic levels (Reventure). Supply of available homes to buy remains low, as 90% of homeowners have mortgage rates below 5%. Additionally, low rates for homeowners mean refinances are virtually zero (only those desperate to get out of hard money, construction or bridge funding).

What is this doing to the Mortgage Industry?It’s tough to be a mortgage officer. Layoffs and mergers by necessity are happening almost every day. Since the beginning of the year we have seen mergers and layoffs at:….

- City National Bank to cut 56 jobs in Los Angeles (2/14/24)

- Guild Mortgage acquires Academy Mortgage (2/13/24)

- Proprietary Capital acquires American Financial Resources, LLC (2/12/24)

- 1st Priority Mortgage to acquire Hudson United Mortgage (2/6/24)

- Fairway Independent Mortgage Corp. to shutter wholesale lending division (2/2/24)

- Newrez layoffs (2/2/24)

- New American Funding (NAF) to acquire Draper and Kramer Mortgage Corp. (DKMC) (2/1/24)

- Crescent Mortgage Co. to shut down, lay off 65 employees (1/31/24)

- Heritage Bank to exit retail mortgage lending (1/25/24)

- UMortgage acquires Community Mortgage Brokers (CMB) (1/22/24)

- Country Club Mortgage to let go of 105 employees in Central California (1/17/24)

- Wells Fargo mortgage layoffs (ongoing)

- Truist Financial to close bank branches, cut mortgage jobs (1/8/24)

- Kinecta Federal Credit Union layoffs in El Segundo, CA (1/3/24)

Case in point, Treasury Secretary Janet Yellen recently testified in front of Congress and expressed explicit concern over non-bank mortgage lenders. These mortgage loan originators, originated a whopping 70% of mortgages in 2023! (I had no idea it was that high).

They are reliant on short term financing not deposits (like a bank) or access to financing from the Federal Reserve, so “in stressful times their credit lines can be pulled.” “There is concern that in stressful market conditions we could see the failure of [these lenders]…this has become very significant in the mortgage market.”

And if rates, drop fast this actually could spell disaster for these mortgage companies. Anyone in a high rate mortgage (I have a few admittedly, b/c I got a fantastic deal on the property) is going to refinance immediately and repay the loan. Are these mortgage companies ready/aware of prepayment risk for loans they at making today? This could happen faster than income from new loan originations.

Mortgage Officers are Choosing Not to Renew their Licenses at a Wild Pace.

According to data by the NMLS, the Nationwide Mortgage Licensing System, the number of registered mortgage officers dropped 24.5% YoY in Q2 2023. In other words, One Quarter of mortgage officers decided to call it quits from the mortgage industry and not renew their license (for some reason the NMLS is only up to Q2 2023 data collection, odd…IMO full year 2023 was probably a blood bath. We will see.)

And in 2022, more mortgage licenses expired or were withdrawn than were approved (again, the 2023 annual report is not yet out, see below).

WOW.

And in some states the data is even wilder. Check out the linked chart below.

Check out California and DC…

Quick Story: Are mortgage lenders making risky loans again?

Quick Story: Are mortgage lenders making risky loans again?

Perhaps, and they are some bizarre loans that remind me of 2008. And this is crazy…

I was having breakfast with a local mortgage lender, at a bank, but who is also a mortgage broker. FYI many mortgage officers are both a lender of a bank’s/institution’s money and also a mortgage broker where they broker mortgages for other mortgage originators. 😬😬😬

So anyway, he told me that he recently brokered a loan with no income verification (This was not a VA loan, backed by the government).

My jaw dropped. I thought this was illegal since the Financial Crisis / Dodd Frank?

But that’s not the bad part. Listen to the terms:

- - 11.5% interest rate

- - 5 points up front (pay 5% up front as a loan origination fee)

- - Have to hold 18 months in reserves for PITI.

Now the story is quite sweet. It was a local musician who just got a record deal but has been only making $30k a year and, with a hopeful advance on that deal coming, wanted to buy a home. I get it. They want a house…

Unfortunately this is a tremendously high risk loan with terms so terrible 1) I will be surprised if he doesn’t default, and 2) he is getting, well, screwed. It’s frankly worse than 2008 products and the word expensive doesn’t describe it. Hard money may have been better. 3) How many of these loans have been made and who was the lender he was brokering to?

Champions Funding and I wish I knew how many loans they have made. But if they were public I would, in the words of Steve Carroll in the Big Short, “short everything that guy owns.”

They are literally advertising on Twitter that they are the “best” at lending to folks that are “Not Qualified.”

I hope he can really sing….Absolutely insane.

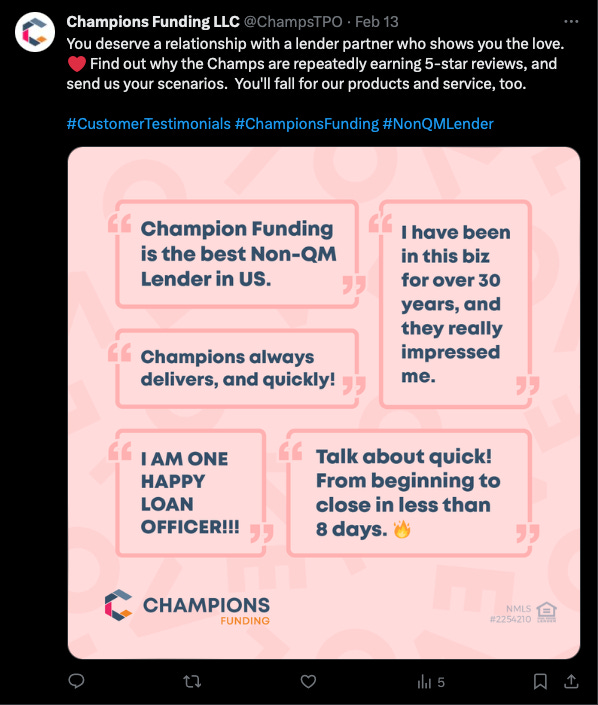

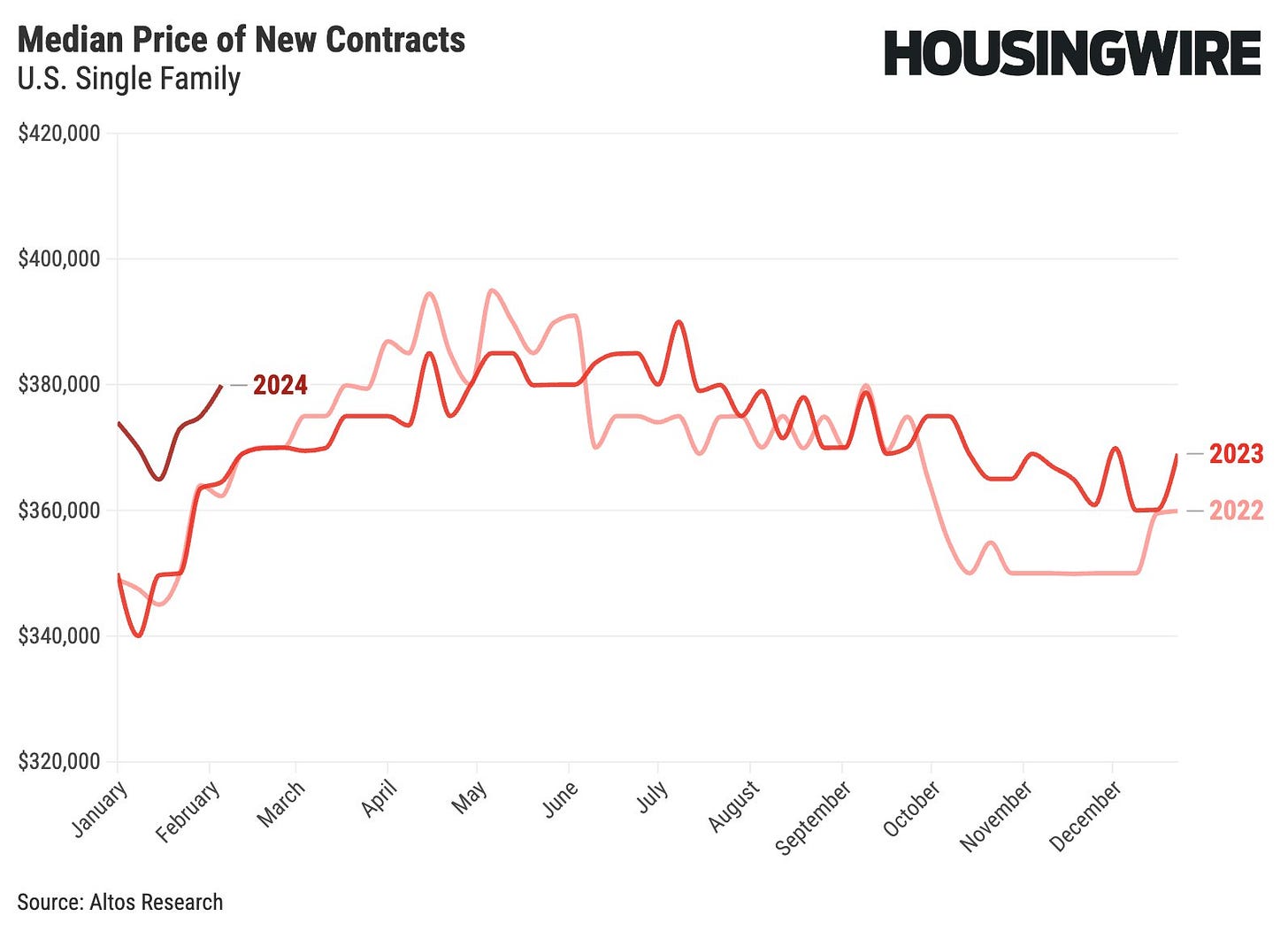

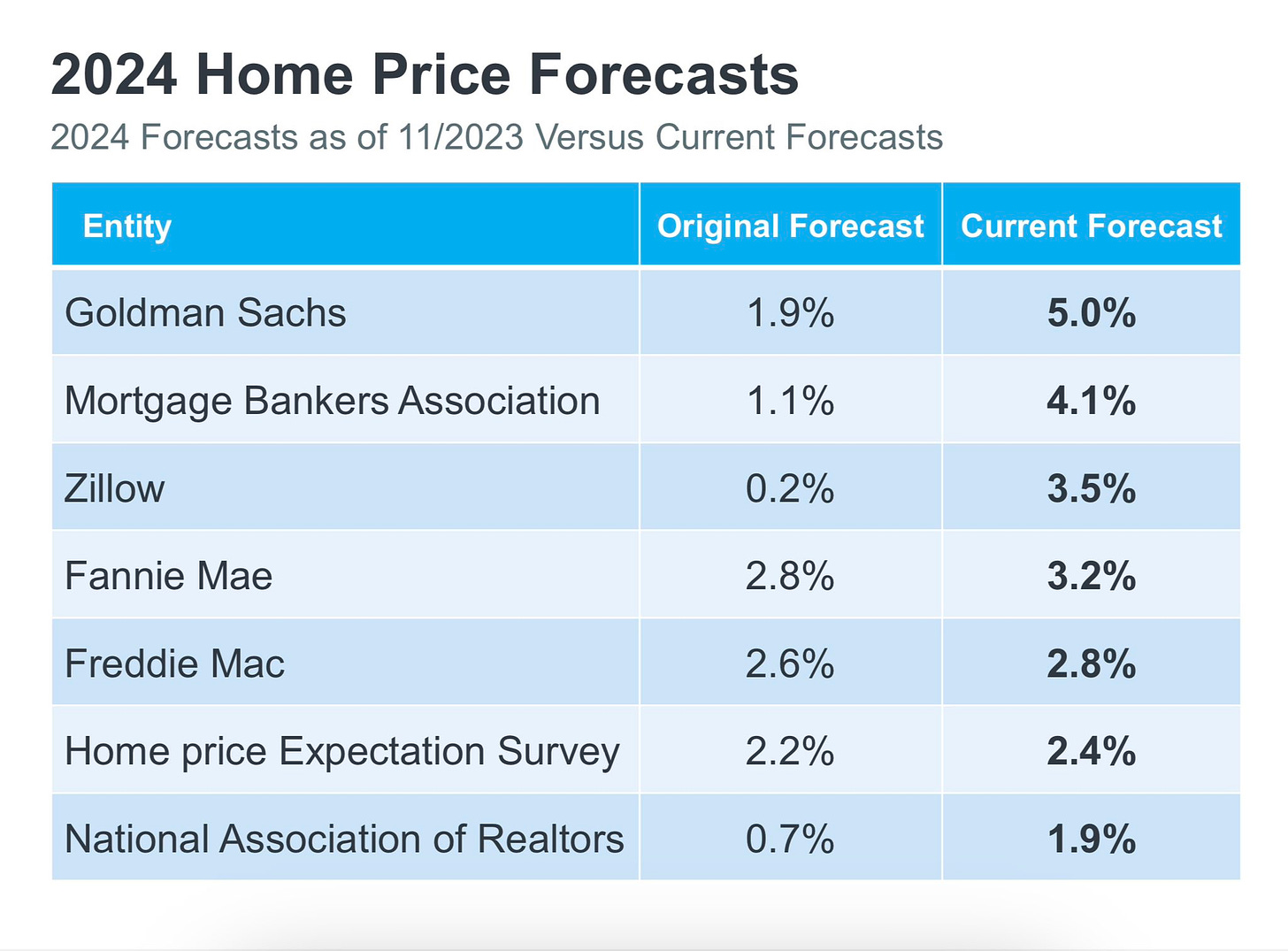

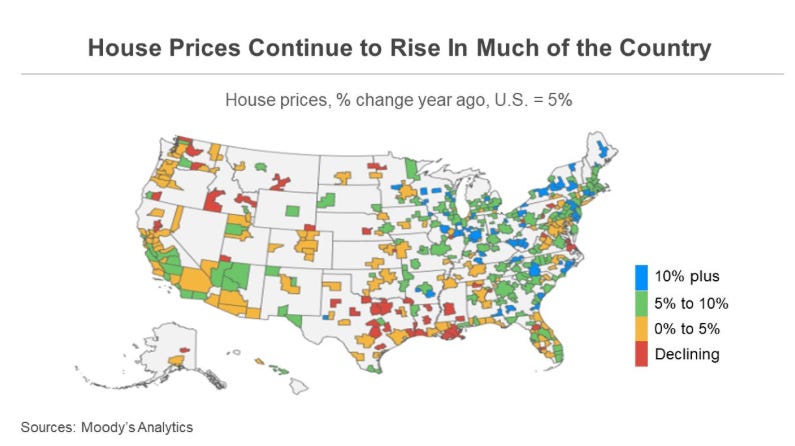

Home PricesYet, home prices are up 5%. Which makes sense given lower home sales volume, driven by low market supply. And remember, CPI of nearly everything is higher every single month, which permeates into materials, services etc… that are necessary for building / renovating homes.

And the predictions for higher home prices keep being revised higher.

My Take? Get it while the gettin is good (bonus points for who gets the reference :).

Valentines Day Tangent!

You know what else is up, all you lover dudes and dudettes?

Chocolate!

Holy smores, cocoa prices have skyrocketed to a record high, mostly due to disruptive weather, and also higher freight costs. Good thing I …. hate chocolate! Gimme wine and cheese and olives all day for dessert.

Queue the hate 😁.

But I digress…..

Bottom Line

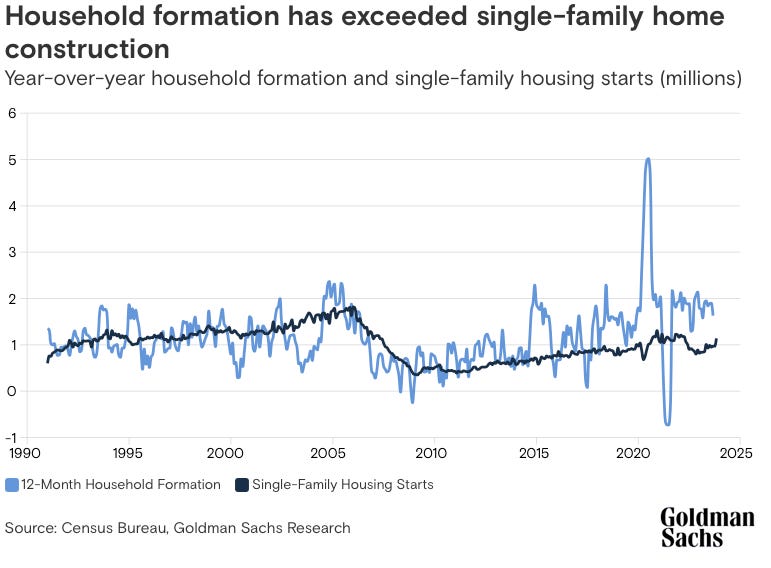

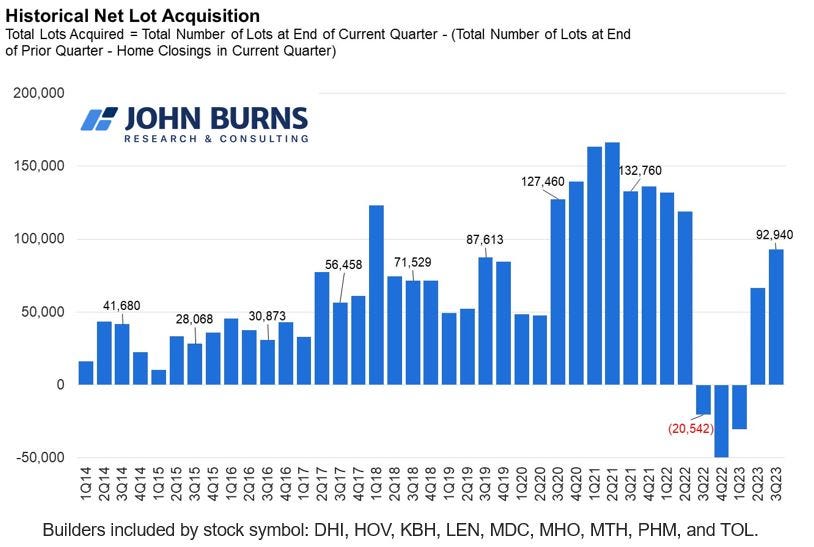

We just simply need more homes (and larger/expanded) homes to house more people. In my home market of Nashville. Median inventory was down 9% in January. Not great given the lows we are at already.

True, so far 2024 is looking like a potential turnaround year to makeup for the 2022 housing recession, as long as inflation and labor markets act right. But certain areas like mortgage lending are hurting, bad, and we are seeing areas of additional risk-taking to try to make additional $. I had no idea non-QM loans were even legal.

This leads me to why I am getting a little more cautious when it comes to the overall economy. In short, it’s because things are looking, well… good.

How? Well…

- Stocks are trading like the Fed already cut rates.

- Bonds are trading like inflation is still a big problem (and rate cuts aren’t going to happen anytime soon, ie economy is still running hot or traders have labor market concerns).

- Housing is trading like there are no problems.

- Gold is trading like there are no problems.

- Chocolate is trading like gold.

- Oil is trading like we are in a recession.

- My spider sense is tingling….

The Skeptics Take: So when you jump on your next real estate deal. Remain cautious. Make sure it's a great deal. Don't build into your IRR returns a refinance down to 5.5% in month 6. Make sure you can afford that higher mortgage payment for an extended time IF needed. Maybe set aside additional reserve funds in the property's checking account. Sure a faster rate drop could happen, but if it were to, that would likely mean we are in a recession, and you may have other issues then. Like finding renters or higher eviction / vacancy rates. I'm targeting mid-level rentals as investments (buildings that rent for $1500-$2000) / unit. These units rent in any economy. And I am building in a 12-18 month timeline for rate to remain high. In other words, rates will remain above my target refinance rate of 5.5% for the next year / year and a half. I'm also reinvesting in my current portfolio of properties. For example, adding a back deck, garden area and dog washing shed in a few of my properties to ensure I attract the best tenants and they appreciate living in my property (and don't leave).

When times seem good, that is precisely the time to be prudent. Tighten up costs. Run market analysis on rent renewals. Take some time to improve / harden your properties etc….to remain robust against any potential downturn. Because you can NEVER predict when it is coming. Don’t try. Just keep improving and building that moat of resilience ….

And as always…Stay skeptical.

Most Interesting Tweet(s) of the WeekSo sweet. Happy V-Day y’all.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me right here on BP!

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

@Carlos Ptriawan , yep, I rent it I won't ever sell it. More of an emotional asset than an investment. It's in the hills, super 70s still. I'll redo it over time. All my investments are in Nashville however.

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Thanks @Carlos Ptriawan !

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

@Steve Vaughan, Love it. Im sure there were some amazing stories in the TP :)

Totally, house hack anything, especially something nice is the path. Good Luck up there in WA! If you ever visit Nashville let me know.

Post: Finding deals and my real estate journey

Post: Finding deals and my real estate journey

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Helen, just wrote a post on this very topic. May be helpful!

https://www.biggerpockets.com/forums/921/topics/1170425-shou...

-Andreas

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

And share your barbarian rehab stories!

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

Post: Should you Rent or Buy?....How about Both! (Yes it's possible)

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Hello all my BP Compatriots!

Welcome to my weekly a real estate investment article, coming at you live from Nashville, TN, where I do a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Main Story: Is it Better to Rent or Buy? We Calculate the Answer!

- - The Bottom Line

- - More Positive Economic News. The US added 353k jobs (seasonally adjusted). Unemployment unchanged at 3.7%. Wage growth continued higher, hourly earnings were up 0.6% in January, which is a 6.8% annual rate. That is a big number, and is higher than pre-COVID numbers. This, after last weeks’ 2023 GDP print. (BLS).

- - Office Building Conversion. A record number of office buildings will be converted into apartments in 2024 (NYPost).

- - US Consumer Credit Card Debt Hits Record. (YahooFinance)

Today’s Interest Rate: 6.96%

(☝️ .21% from this time last week, 30-yr mortgage)Not much happening with interest rates this week, they remain range-bound near 7%. High. This begs the question, with rates so high….

…Is it “Better” to Buy or Rent your Home?

Let’s get into it…

This is obviously an aged-old question. Whether it’s 1954 or 2024, it’s never been particularly easy to save-up a pile of money to buy a home. We all have to rent at some point, or stay longer in mom and dad’s home, as is common in many Asian and… Long Island cultures. Or, option 4, go full barbarian. (Keep reading).

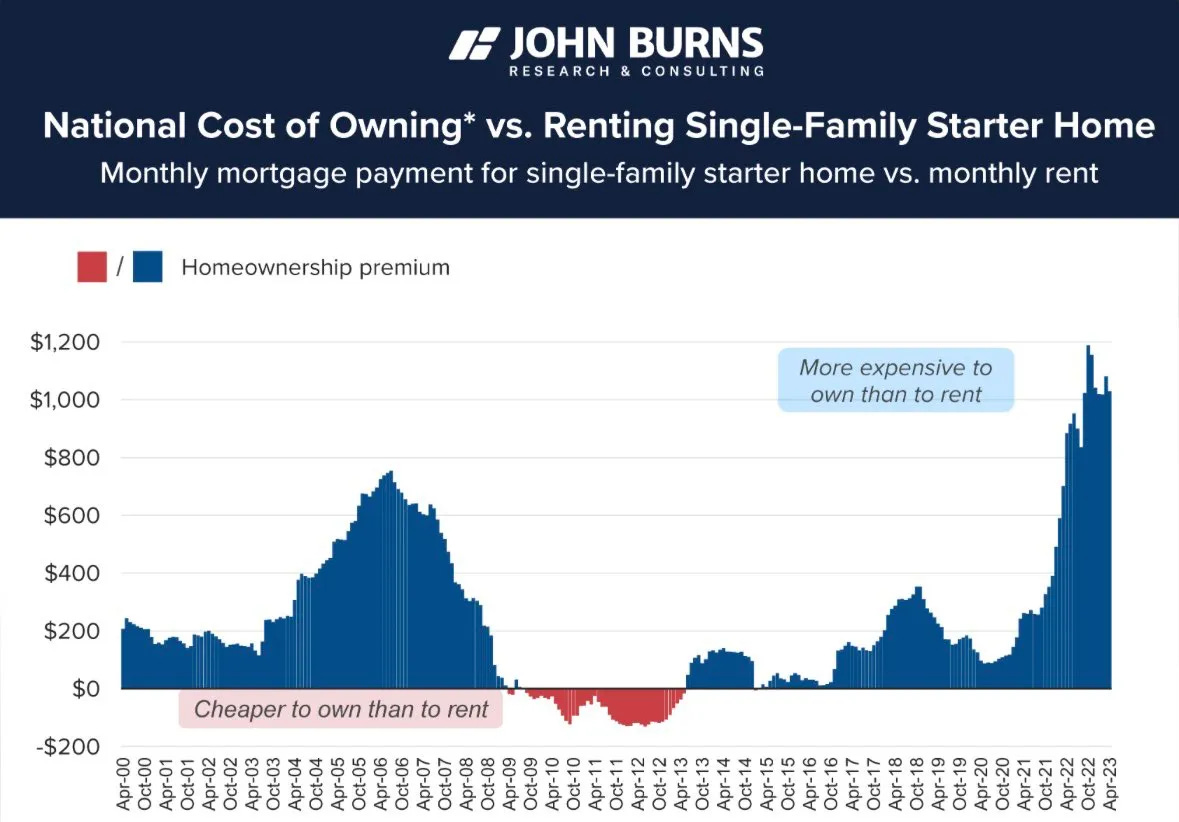

How “expensive” is it to rent vs buy? According to John Burns research, interest rates have made it just too “expensive,” in general, to own vs rent.

According to Redfin, demand for large rental apartments and houses is climbing, one in five millennials who responded to a 2023 housing survey believe they’ll never own a home. Nearly half said it’s because homes are too expensive or they can’t afford to the down payment. But others just prefer renting: 12% said they aren’t interested in homeownership and 7% said they don’t want to put in the effort to maintain their own home. As a result, Redfin expects prices of large rental units to climb next year as supply fails to meet demand, but smaller rentals may drift slightly lower because there are more of them and a backlog waiting to hit the market.

So what should we do? Rent or buy? Well the answer is….it depends. It depends on your goals, are we speaking strictly financially? Do you like owning something? Or just running around the (secluded) yard naked?

Let’s dive in.

In my humble opinion, I say it’s virtually always a better financial decision to own instead of rent. This is because of all the additional ways we are growing our wealth when we own real estate assets, much like owning other assets like a small business. In fact that’s how I look at home ownership/owning real estate in general.

Let’s do some quick math. Don’t worry, I’ll keep it light. This is rough math so don’t get cute and tweet at me all the little things we don’t account for. This will be very close approximation, with some assumptions, like insurance and property tax costs. For those I’ll be using average costs to fill in the blanks and borrowing from costs in my home city of Nashville, TN. We also assume this is your primary residence, not an investment property (much more on that below).

Renting Your HomeAccording to the above research, the average premium for home ownership, given the high interest rates, is about $1000, meaning, ostensibly, that the cost to own the home is $1000 more / mo than it would be to rent it. This number seems extremely high to me, but we will use it as an average to remain conservative. This means the rent for the same average home of $417,700 would be $1636.

Saving the 20% $83,400 downpayment, let’s say you invest that instead in the stock market and make 7% avg. returns. At the end of the year you have made $5838 on that money. Your total housing costs were $19,632. Net, this is $13,794.

After 10 years - The Net Wealth Effect of RentingBut, what about after 10 years? The 10yr net wealth effect of renting a home and saving your money is: $-73,841.15. In other words, you will have made $80,660.42 in gains from your investment of the original down payment + the original capital from your down payment, and paid $237,910.57 in rents, for a net total wealth effect of $-73,841.15, from renting. All other things equal.

- Savings invested Total Value - $164,060.42

- Rent Paid - $237,901.57 (yuck!)

**Assumes rents increase 4.2% on average each year (Rents inflated 6.2% last year but we will use the historical average).

Owning Your HomeThe average home value in the US is $417,700 (Fed). A mortgage on that home would be roughly $2636 (including taxes and insurance). This means your annual housing costs would be $31,632 /yr.

Now, owning a home means you own an asset, so this asset will naturally appreciate. The historical average natural home price appreciation is 5.4%. (CoreLogic, since 1992).And each month you actually pay yourself; a portion of the mortgage payment goes toward paying down the loan you took out to buy the property. And this amount increases over time as a % of the mortgage.

After 10 years - The Net Wealth Effect of Owning

After 10 years - The Net Wealth Effect of Owning

But, what about after 10 years? The 10yr net wealth effect of owning your home is: +$103,687.09. In other words, after 10 years I have $103,687.09 in positive wealth, all other things in my life being equal.

- Equity (wealth) I own in home - $420,007.09

- Home’s value after 10 years from Natural Appreciation ($706,757.76) - original loan amount ($334,160) + Principle Pay-Down ($47,409.33)

- Mortgage costs paid - $316,320.

So without doing really anything in either scenario - no crazy financial engineering or value boosting home remodeling etc… - what is the best financial decision? In 2 words:

Owning > RentingLooks like home ownership wins, and it ain’t close. The real force at play here is that while you start with a lower rent amount vs mortgage, both rent costs and home values are inflating, yet the basis for the home inflating is much much greater, so it compounds at a much faster / larger clip. Add to that the principle you are banking away each month and the tortoise becomes the rabbit pretty rapidly. (er or vice versa? anyway….)

What’s more, we didn’t even talk mortgage interest rates coming down! These calculations assume interest rates remain at 7%. What if you refinance in year 2 to 6% or 5% in year 3? etc… For brevity, I’m not going to calculate all scenarios but it would obviously much improve the home owning scenario. Mortgage interest rates coming down would be a big deal.

But Wait, There’s More….We have forced appreciation, that is forcibly appreciating the value of the home through a renovation / property improvements. What if, in addition to the above, you decided to spend $30k on a modest renovation of 2 bathrooms in your home? And let’s assume, IMO conservatively, that you will realize a 50% return on that investment in the value of the home. So the home is now worth $45k more in value? Well, congratulations you gained an additional $15k in equity / wealth. Forcing appreciation to a home you own is unique to home ownership, can’t do that as a renter. Pretty cool!

The X-Factor to Owning a HomeLastly, the intangible, which is up to your personal preference and lifestyle. Many of us, just love owning the home. We can do (pretty much) what we want and don’t have anyone telling us what to do. Want to get a dog? You get that pound pup. Want to compost in the backyard and add some raised garden beds? Time to get dirty. There is an emotional aspect to consider.

Do you like working on your home? We have seen that you can add tremendous value through a renovation. And if you do it yourself, at a discount to having to hire a contractor, well that’s even more $ added to your overall wealth. That’s equity in your pocket.

On the other hand, renting can be a much less stressful option and many folks just like that lifestyle. Have the landlord handle those pesky maintenance issues, roofing repairs, deluge of water coming from the washing machine on the 3rd floor that just exploded through to the kitchen below (yes, this just happened to me in my home. Ah the humanity!) If this lifestyle appeals to you, by all means rent (or find a spouse that is handy :)

Option 4…Do Both! Yes, you can!

Yes it is very possible to do both, and financially, it’s the best option by far.

Here it is…

Rent where you live, and rent-out what you buy. Why? Well, tax incentives for one, which you don’t get when living in your primary residence. Real estate mogul Grant Cardone agrees. If you can stomach his brash and boisterous attitude, he preaches in his books that owning your primary residence is a “trap” and that money is better put to use in buying investment properties and renting where you physically live. And if renting in your area is “cheaper” than owning, more reason to pay rent and have your tenants pay your mortgage. Plus, there are 5 total ways you make money real estate investing that likely make it financially a better choice of where to put your money and are all only available to you if you are renting-out the home. We have already reviewed most of these but there is a new kid on the block, tax depreciation:

- Cash flow + rent increases over time

- Natural appreciation

- Principle pay down of mortgage + increases over time

- Forced appreciation through a renovation

- Tax benefits to renting-out a home:

- tax depreciation (you get to deduct 3.6% every year of the value of the home structure, for 27.5 years!)

- Bonus depreciation

- Cost segregation

- And a few more too….

Bottom Line

People need homes. This issue is not going away. It’s no longer acute, housing supply has now become a chronic issue. Regardless of your perspective on renting vs buying your primary residence, IMO more individuals should become real estate investors. It is a great personal finance decision, and an even better investment decision. Getting involved in real estate investing is also good for humanity. We have a severely limited housing supply and we need every investor we can get to pitch in. After all, the government doesn’t build homes, investors do. IMO we should think about real estate investing as a service to your fellow human, frankly (not to get too sappy / patriotic on you).

But don’t take my word for it. Think about what makes sense for you and yours. Let me tell you a story about the wild decision my dad made.

My dad was the ultimate homeowner. In 1976 he bought a piece of land in Kensington, CA for $70k. He built the home himself over the course of 4 years, relying only on a few subcontractors to lay the large pillar foundation into the property’s steep grade. But he didn’t rent an apartment while he built it. No, No… He was a little bit of a barbarian. He slept in a tent in the backyard for 2 years until the home was livable. And when he was done - around the time I was born, after he had built this beautiful redwood and cedar home - we lived in the lower level and he rented-out the main home upstairs! No mortgage, and the rents paid far more than the mortgage and insurance cost.

Do I recommend you do this? Probably not. But maybe you can live through a little renovation on your home, even use some elbow grease to lay down some tile yourself?

I think there is a little barbarian in all of us. Tap it.

And as always…Stay skeptical.

** A Few Assumptions to Note:

- Calculations assumes home values increase on average 5.4%, since 1992. Natural appreciation obviously varies by location, my home city of Nashville rose at 9%. But we used the average to remain conservative.

- Yes, true, I did not take into consideration property taxes and insurance costs inflation. These are hyper local so it’s tough to do in this space, and, importantly, it is likely a small portion of your overall housing payment, relative to the cost of rent or mortgage so even if they appreciate faster than rents appreciate the basis is lower and they won’t catch up to make a meaningful difference in our decision. Anecdotally my property tax and insurance would not have. If you feel strongly, tack on a an extra % to mortgage costs.

- Importantly, there are tax advantages to owning a home. You are able to deduct your property tax and the interest you pay on your mortgage from taxes you owe, this should be counted as income from the asset. This can get complicated and there are limits so consult a CPA. This is not financial advice. I won’t count them for our example but I wanted you to be aware that they exist.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me directly right here on BP!

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

Post: Green Shoots in the Housing Market for 2024

Post: Green Shoots in the Housing Market for 2024

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

BP Compatriots! Welcome to my weekly post on all things real estate, coming at you from Nashville, TN. Every week I bring you a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - U.S. GDP - Growing Like Micro-Greens ↗️

- - Home Prices in 2024 - Up 5%+

- - Local Market Exam - Nashville, TN

- - The Bottom Line

- - Federal Reserve Keeps Rates Steady in January. Does not yet see inflation under control and may be “unlikely” for March. (@JasonFurman).

- - Egypt, Ethiopia, Iran, Saudi Arabia and the UAE have confirmed they are joining the BRICS bloc of countries, strengthening the trading alliance. Current members are: Brazil, Russia, China, India and South Africa. Argentina declined to join despite the invitation. (Reuters).

- - Mortgage purchase applications fall -11.4%. Small sample and WoW numbers, but something to watch carefully. High rates are still suppressing demand (ResiClub).

Today’s Interest Rate: 6.75%

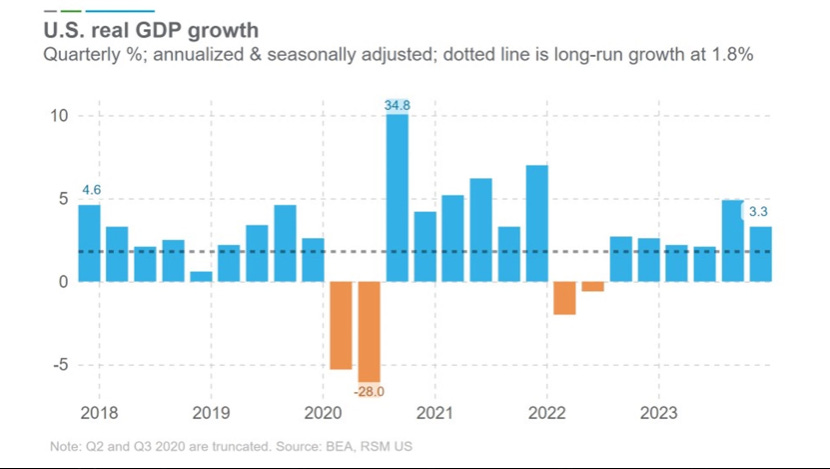

(👇 .17% from this time last week, 30-yr mortgage) U.S. Economy Grew Rapidly in 2023Much of the news coverage this week has focused on the strong U.S. GDP numbers. Rightly so, it was much greener than expected. Let’s dive in.

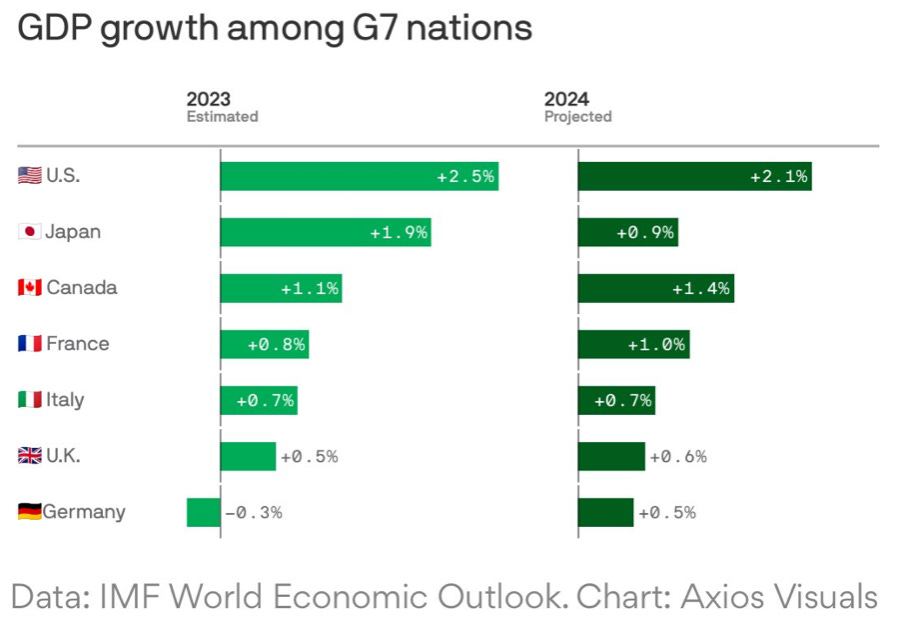

Year-on-year, the U.S. Economy expanded at 3.1% (2.5% real), significantly above “trend growth” of ~2%. And ended up 3.3% in Q4. Credit where credit is due, the predictions for recession in 2023 were wrong (or pre-mature, which is the same thing). The 400 PhD economists at the Federal Reserve predicted sluggish economic growth, and we ended up growing at 6x their prediction (WSJ). Wowza. What happened, Robert M. Adams? (see my take on risk management at the end of this article).

Perhaps the biggest takeaway is relative growth. The U.S. economy outpaced all other advanced economies last year, and it wasn’t close. You can bet the predictions are going to start rolling in. Already, economists at the IMF are predicting the US to be in pole position in 2024.

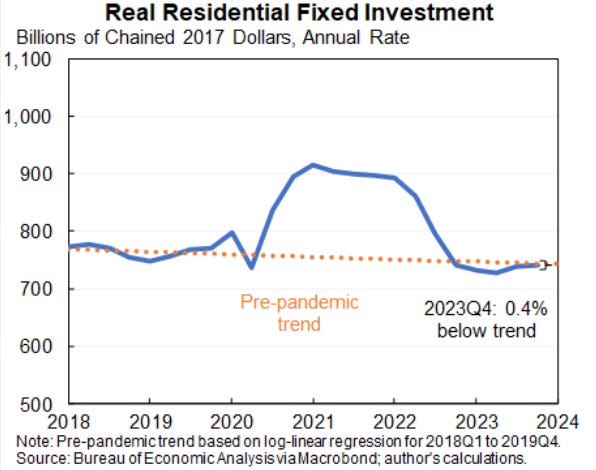

Real Estate Investment: a Weak Point in the GDP Numbers

Real Estate Investment: a Weak Point in the GDP Numbers

One data point I’d like to pull out of the strong GDP numbers is Residential Fixed Investment, i.e. purchases, remodeling of private real estate and equipment (your HVAC system), broker fees etc…owned by landlords and rented to tenants. It’s been paltry, near flat for the last year, after falling 17.4% in 2022.

High rates crushed U.S. real estate investment and led to a housing recession in 2022-Q1 2023. The GDP numbers for 2023 show the housing market is still in recovery.

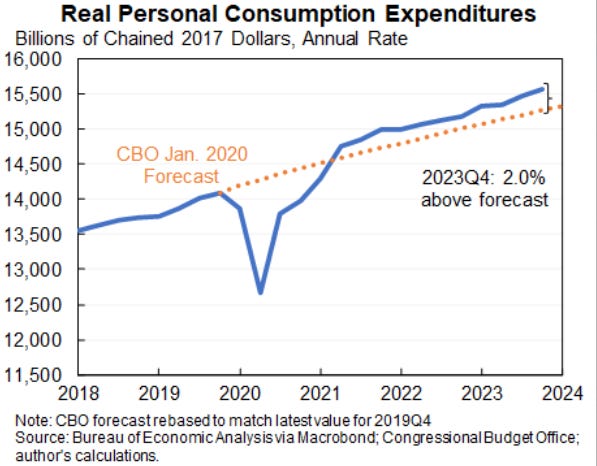

The Fed’s monetary policy has (inadvertently) hyper-targeted the real estate market. Not so much on our Amazon carts Consumers, they spendin, they spendin!

Home Prices

Home Prices

Despite restrictive monetary policy, home prices rose 5%+ last year and are continuing up and to the right. In my hometown of Nashville, we are up more than 9% YoY. This, a result of low supply, again despite high interest rates suppressing demand. Great for homeowners, not so great for homebuyers.

What’s in store for home prices in 2024? Industry analysts are getting more and more convinced it’s going to be a banner year. Both Goldman Sachs and Moodys Analytics just revised their home price forecast model up.

- - Goldman - home prices will be up 5% in 2024, 2.5x+ their previous 1.9%.

- - Moodys Analytics - home prices will be flat, “sideways” for a while, down -.4%, a large revision up from previously -4.4%. This is one of the mroe conservative calls.

- - Altos Research - home prices were up 6-7% YoY in January. And should be up 10% YoY in Q2.

- - Fannie Mae - home prices are expected to rise 3.2% in 2024.

With the supply of new homes, especially the largest cohort - existing homes -remaining low, pent up demand is likely “pent’ing up” on itself. More and more young adults are coming of age, and are ready to start a family, buy a home, and move out of their parent’s future home office. But even with the homebuilders increasing their output, it’s just not enough. For example, in FY2023 homebuilder Lennar increased its deliveries YoY by 10%, to 73,087 homes, and expects to do so again in 2024.

One potential factor is the availability of land for development. “America has a lot of land, local governments have been making it more difficult to obtain development approvals, and also make land expensive to develop.” (John Burns Research)

Thus, home prices in 2024, likely up and to the right.

U.S. Mortgage Interest Rates:With the economy ostensibly humming along, what does this portend for us in the real estate market? How about interest rates? According to oft-cited economist Mark Zandi, “[The Fed’s] got everything they need to start cutting rates…It’s just a question of precisely when.”

Goldman agrees, in its home price revision, the investment bank also now sees mortgage interest rates falling to 6.3% by the end of 2024.

However, when will we start to see rate cuts? IMO we are still looking at a June timeframe. But, regardless of when the Fed cut rates, it may be just as pertinent to think also about how fast. Even if they start in March, how many and at what % will they make said cuts in 2024? IMO, we are likely to see 3 cuts this year (.25% each). It may be until year-end 2025 when we are back to mortgage rates in the 5’s%, which could keep even more young households on the sidelines until then.

So far, the Fed, IMO, likely does not see a cause for easing monetary policy sooner and/or faster. Inflation and unemployment are remaining within the Fed’s preferred ranges. Core PCE inflation is looking decent, running at 2.1% last month and 2.9% YoY. This week’s jobs report shows a labor market in decent health: jobs openings and hiring rates are near the historical average, although trending down. Layoffs were flat in December at 1%. If there is something to watch, it could be the quits rates, which are falling and are now below 2019 levels, a potential signal of a tightening labor market.

But don’t tell that to the market. Fed Fund futures are now pointing to a 57.8% of a rate cut in March and 94.3% chance in June. Up 10% from last week (CME).

Nashville Market Exam

Nashville Market Exam

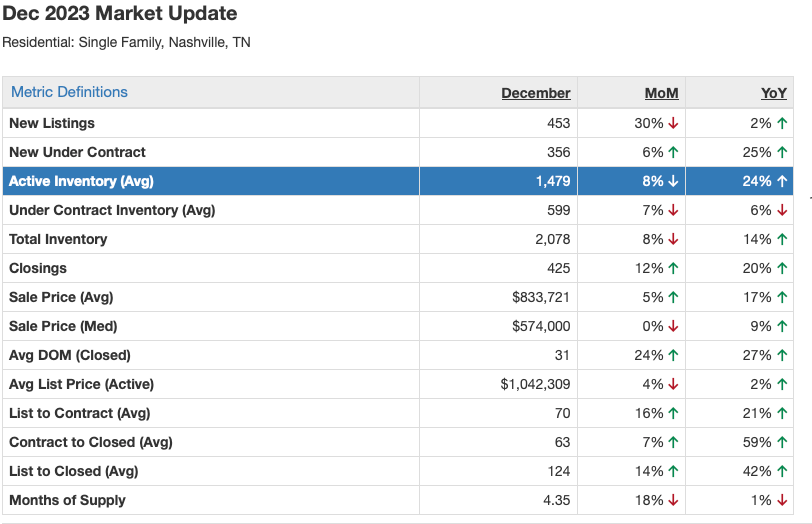

Let’s take a look at a snapshot of the housing market today, to illustrate how the market is doing, using my home market of Nashville as an example:

- - Active inventory is low but much higher than last year, up 24% YoY, indicating strong momentum into the 2024 spring season. Total inventory is up 14%.

- - Home closings are up 20% YoY

- - Sales Price (median) is up 9% YoY

- - Homes are sitting longer, average days on market is 31, up 27% YoY. And the average full listing to closed sales cycle for a home is up 42% to 124 days. Anecdotally I am seeing delayed closings due to loan shopping, tight lending standards and more price negotiating.

What’s next for 2024? MoM numbers are signaling positive results, although 1 month a trend does not make. I will keep a sharp eye out and re-exam the next 2 months, which should give a clearer picture. IMO, supply is just too low and there are too many buyers looking for homes. Anecdotally, I have more investors calling me looking for property than ever.

Bottom Line

At the end of 2022, I counted myself solidly in the bearish camp. I thought we were for sure headed for a recession as a result of monetary policy. I was on tilt. We did get a housing market recession in 2022, but that did not continue into 23’.

Of course, we all can be Eddie Bauer quarterbacks Monday after the Superbowl. Predicting where any market will go is hard. Nay, impossible. Don’t try to do it. Instead, have a plan…I absolutely had more hedges in place to manage my risk at the beginning of 2023, but kept it at that. I didn’t fire sale my property or stock market holdings. [What did I do to protect my downside? You’ll have to take some initiative. Shoot me a note, and ask :)]

And speaking of the stock market, well, it’s wild. Like tiger on the plains of Africa chasing a naked guy with a stick, wild. Which is why I prefer real estate. It’s a relatively stable and reliable market with above average growth and tax advantaged gains. The stock market on the other hand? Well…Fun fact, over the last 30 years, 50% of all returns in the stock market came in just 10 days of trading. And if you missed on the best 30 days in the market, well… your returns would be an astonishing 83% lower. Totally insane. Last year was a banner year. The S&P was up 25%. What about 2024? Who knows. In fact, just this week, JP Morgan called the current stock market similar to the DotCom Bubble. It’s been up up up for a while now, due for one of its cyclical avalanches. But again who knows… That’s why I stay aware, I stay optimistic, and of course…

I stay skeptical.

Most Interesting Tweet(s) of the WeekYou can now get ultra-fast internet almost anywhere in the world, via “space lasers.”

Property Highlight

Moving in Nashville? Check out this must see budget friendly 2 bed / 1 bath close to Vanderbilt in the rolling trees of Green Hills. A Neighborhood. Close to Whole Foods, Trader Joes, Hillsboro Pike shopping and restaurants. This would be the perfect little cottage for Nashville living. $1900/mo.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me direct, right here on BP.

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

Post: A Skeptical Dude's Market Analysis - January 24th, 2024

Post: A Skeptical Dude's Market Analysis - January 24th, 2024

- Real Estate Agent

- Nashville, TN

- Posts 240

- Votes 124

Hello BP compatriots and welcome to another edition on my real estate market analysis, coming at you from Nashville, TN. Every week I try to bring you a brief, hopefully insightful, dive into real estate and financial markets, for all you kick *** dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Interest Rates: the State of Play

- - Inflation Spotlight: How Auto Insurance Premiums Affect the Housing Market

- - A Skeptics Take: Money Supply Flashing Red Alert

- - The Bottom Line

- - 45% of Real Estate Agents who own their Firms Having Trouble Paying Rent on their Offices (Alignable).

- - US Stock Market Hits Record High. Stocks are continuing their recent advance, with the S&P 500 on track to make its fourth record high in as many days (Barrons).

- - Tens of Thousands in Layoffs already in 2024. eBay, Blackrock, Twitch, Unity, Wayfair, Unity, CitiGroup…(@GRDecter).

- - * Bonus * - Shipping through Panama Canal Plunges Back to COVID Low. $270 billion traffic jam (Bloomberg).

Today’s Interest Rate: 6.92%

(☝️ .15% from this time last week, 30-yr mortgage)Interest Rates: Will Remain Range Bound, until they Aren’t

Following the Federal Reserve’s holiday announcement that their restrictive posture in 2024 will become less restrictive, mortgage interest rates (and Treasury yields) dipped a full 1%. Since then rates have creeped up, likely from lingering inflation / wage growth concerns in the bond market.

Bear in mind, the Fed has NOT yet “pivoted.” Their policies have not yet changed from “restrictive” to “accommodating.” Nor have their policies changed to “less-restrictive.” They have merely begun to look over the horizon, and sometime in 2024 they expect to ease restrictions. They are still in a highly restrictive state. It may not be until 2025 that the Fed considers its policies accommodating.

As the market waits in anticipation for the Fed to act, trying to guess when this may be, rates will likely be volatile, yet range bound. For now, that range seems to be 6.2% - 7% (30yr mortgage). For its part, mortgage buyer Fannie Mae now expects mortgage rates to be 6.4% in Q1 2024 and 6.2% in Q2, down from 7% and 6.8% respectively when it released projections 2 months ago.

Additionally, the spread for mortgage rates above the 10-yr Treasury bond remains historically high and likely will continue to do so until the bond market feels better about inflation (more on the latter, below). Homebuyers have taken some notice. Mortgage applications, while still very low historically, have seen a 3-week positive trend upward and an 8-week trend, seasonally adjusted.

So When will the Fed Cut Rates then?Last week we talked about when the Fed may start cutting rates. At the time, the bond market was pricing in a 97.4% chance of a rate cut in March - and a mind-bogglingly high 6-8 rate cuts in 2024 (though down from 6-9 a month ago). Every meeting a rate cut, on average, and at over 50% chance. We disagreed, saying it was more likely they would start in June. Since then, the bond traders are now signaling that same sentiment.

We are down to a 43% chance of a cut in March and 82% chance in June.

Will the Fed be ‘forced’ into cutting rates? Only if the economy starts to slide, which Bank of America CEO Brian Moynihan thinks may happen, predicting 4 rate cuts this year and in 2025 to “avoid tipping the economy over.”

Counter point: Economists are touting a strong labor market, which is inflationary and will delay interest rate cuts. Wage growth is outpacing inflation across all wage tiers. It should be noted, strong (but not out of control) wage growth is good for the economy, I’m not hoping for doom and gloom. But, we Skeptics always keep an eye out.

One reason for a hesitant bond market, and thus stubbornly high mortgage to Treasury yield spreads, is inflation expectations. If inflation remains high, even though it has come down from über-high levels, bond yields and mortgage rates will remain elevated. Let’s look at one corner of the inflation front: auto insurance.

Now, we already examined home insurance inflation a few weeks back, and unfortunately, auto insurance premiums are also going wild. For partially the same reasons, like reinsurer costs due to increased disasters - and some new ones.

In short: 2023 saw auto insurance premiums jump 20+%, average premiums are now $2019/yr. The highest levels since the 1970s.

And some industry analysts are projecting premiums to increase another 12.6% in 2024. Hopefully this doesn’t affect my late-night Uber ride? 😬😬😬 (it will).

And watch out on the road folks, in 2023 5.7% of households didn’t have car insurance, up 8% YoY.

Why this Matters for Real EstateIndirectly this is a signal of overall stubborn inflation; directly, this does matter for the real estate industry. Why? Insurance markets are submarkets of the larger US economy. Higher auto insurance premiums result, assuming no foul play, from underlying costs increasing, such as from higher manufacturing costs, which mean manufacturing costs for other things like building materials are also likely to go up. Same with labor costs. Case in point: auto repair costs (parts & labor) were up almost 20% YoY, and cars are more expensive to replace in today’s market. The average new car costs $48,759. And, don’t blame ‘expensive electric vehicles’ for increased premiums (not that I care either way, but I hear this argument a lot). In 2023 the average electric car became cheaper than the average new gas car. For example: A new Tesla Y (the best selling car in the US and the world) is $3,700 below the average auto price of roughly $48,759 (Bloomberg).

Exogenous side effects can also affect both auto insurance, and….home values! For instance, higher car theft in an area/zip/city can be a factor in depressing home values. In 2023, auto were up ~34% in 2023.

Personal Anecdote: I just exited my last property investment in DC in the fall - a large renovated, yet typical, DC row-house I was renting out. I noticed home prices stagnating in my zip code, deteriorating tenant application quality and more and more anecdotal crime stories from my tenants and neighbors. My skeptical mind was flashing its Spider Senses. Was I crazy to leave a “growth market?” Then I saw this just the other week: “There were 6,829 thefts of motor vehicles last year — [a whopping] 82% increase from the previous year. In the first four days of 2024, 53 cars have already been stolen.” According to D.C. police data.

Holey moley! Everything is intertwined in our economy. Gotta keep your head on a swivel dudes and dudettes.

A Brief Skeptics Take: Money Supply Flashing RedOne historically significant indicator of potential recessions, the rate of change in the supply of money whirling around tin the economy, or M2, is officially flashing red (see M2 explanation here). In 2023 M2 declined by 2%, one of the largest annual declines on record. Rapid M2 declines have always signaled a recession is ahead (or happening).

Same is happening in the U.K. M2 plummeting.

Bottom Line

There is reason for optimism on interest rates, as long as the economy holds up, but it will likely be a gradual hike down. Slightly lower mortgage rates will slowly increase demand, accelerating when we get below 6%. Perhaps by Q1 2025. Housing supply main gain over 2023, but will remain lower than demand, propping up home prices.

On Home Prices: As we said last week, the housing market should appreciate more in 2024 than 2023, particularly in growth markets and with rates that likely peaked last year. Zillow, in just the last month, totally reversed its prediction for 2024, forecasting that home prices would appreciate +3.5%, from -.1%. Digging into these numbers, housing analyst Lance Lambert sees the only major national laggareds as the California Bay Area, and much of Lousianna.

Nevertheless, this Skeptical Dude is remaining cautious, a wider mortgage-Treasury bond spread is cyclical and unfortunately usually occurs during periods of economic market stress. I am also watching the M2 numbers like a hawk. An extremely important alert is now flashing in the US and UK, signaling an economic slowdown. Case in point, Goldman Sachs economists recently expressed concern over the labor market, saying, “[there are] three somewhat concerning developments. First, the pace of gross hiring has slowed dramatically .. Second, .. the hiring rate argues for a further drop in job openings in the first half .. Third, .. we find a higher risk of labor market deterioration today than in 2019, with the probability of a 4-5% unemployment rate within twelve months estimated at nearly 20%.” And large financial instututions are shedding employees, nearly 17,000 across Wells Fargo, Bank of America, and Citi (Reuters). Labor markets are the primary data area the Fed is watching to signal if rates need to be cut.

In other words….Stay alert and stay skeptical, all you dudes and dudettes.

Most Interesting Tweet(s) of the WeekWell, despite everything, we could be in this situation….way worse.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can message me direct right here on BP.

Again stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.