Market Trends & Data

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated over 1 year ago on . Most recent reply

- Real Estate Agent

- Nashville, TN

- 131

- Votes |

- 257

- Posts

Should you Rent or Buy?....How about Both! (Yes it's possible)

Hello all my BP Compatriots!

Welcome to my weekly a real estate investment article, coming at you live from Nashville, TN, where I do a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Main Story: Is it Better to Rent or Buy? We Calculate the Answer!

- - The Bottom Line

- - More Positive Economic News. The US added 353k jobs (seasonally adjusted). Unemployment unchanged at 3.7%. Wage growth continued higher, hourly earnings were up 0.6% in January, which is a 6.8% annual rate. That is a big number, and is higher than pre-COVID numbers. This, after last weeks’ 2023 GDP print. (BLS).

- - Office Building Conversion. A record number of office buildings will be converted into apartments in 2024 (NYPost).

- - US Consumer Credit Card Debt Hits Record. (YahooFinance)

Today’s Interest Rate: 6.96%

(☝️ .21% from this time last week, 30-yr mortgage)Not much happening with interest rates this week, they remain range-bound near 7%. High. This begs the question, with rates so high….

…Is it “Better” to Buy or Rent your Home?

Let’s get into it…

This is obviously an aged-old question. Whether it’s 1954 or 2024, it’s never been particularly easy to save-up a pile of money to buy a home. We all have to rent at some point, or stay longer in mom and dad’s home, as is common in many Asian and… Long Island cultures. Or, option 4, go full barbarian. (Keep reading).

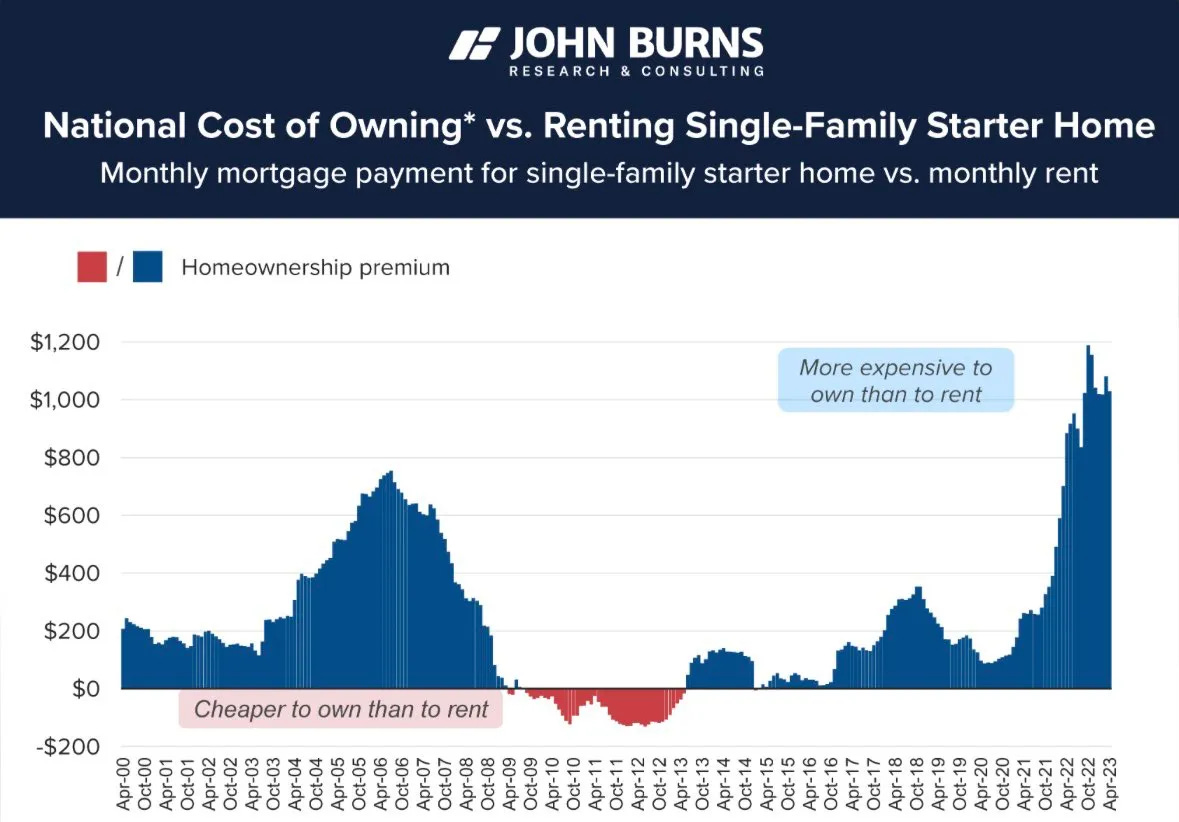

How “expensive” is it to rent vs buy? According to John Burns research, interest rates have made it just too “expensive,” in general, to own vs rent.

According to Redfin, demand for large rental apartments and houses is climbing, one in five millennials who responded to a 2023 housing survey believe they’ll never own a home. Nearly half said it’s because homes are too expensive or they can’t afford to the down payment. But others just prefer renting: 12% said they aren’t interested in homeownership and 7% said they don’t want to put in the effort to maintain their own home. As a result, Redfin expects prices of large rental units to climb next year as supply fails to meet demand, but smaller rentals may drift slightly lower because there are more of them and a backlog waiting to hit the market.

So what should we do? Rent or buy? Well the answer is….it depends. It depends on your goals, are we speaking strictly financially? Do you like owning something? Or just running around the (secluded) yard naked?

Let’s dive in.

In my humble opinion, I say it’s virtually always a better financial decision to own instead of rent. This is because of all the additional ways we are growing our wealth when we own real estate assets, much like owning other assets like a small business. In fact that’s how I look at home ownership/owning real estate in general.

Let’s do some quick math. Don’t worry, I’ll keep it light. This is rough math so don’t get cute and tweet at me all the little things we don’t account for. This will be very close approximation, with some assumptions, like insurance and property tax costs. For those I’ll be using average costs to fill in the blanks and borrowing from costs in my home city of Nashville, TN. We also assume this is your primary residence, not an investment property (much more on that below).

Renting Your HomeAccording to the above research, the average premium for home ownership, given the high interest rates, is about $1000, meaning, ostensibly, that the cost to own the home is $1000 more / mo than it would be to rent it. This number seems extremely high to me, but we will use it as an average to remain conservative. This means the rent for the same average home of $417,700 would be $1636.

Saving the 20% $83,400 downpayment, let’s say you invest that instead in the stock market and make 7% avg. returns. At the end of the year you have made $5838 on that money. Your total housing costs were $19,632. Net, this is $13,794.

After 10 years - The Net Wealth Effect of RentingBut, what about after 10 years? The 10yr net wealth effect of renting a home and saving your money is: $-73,841.15. In other words, you will have made $80,660.42 in gains from your investment of the original down payment + the original capital from your down payment, and paid $237,910.57 in rents, for a net total wealth effect of $-73,841.15, from renting. All other things equal.

- Savings invested Total Value - $164,060.42

- Rent Paid - $237,901.57 (yuck!)

**Assumes rents increase 4.2% on average each year (Rents inflated 6.2% last year but we will use the historical average).

Owning Your HomeThe average home value in the US is $417,700 (Fed). A mortgage on that home would be roughly $2636 (including taxes and insurance). This means your annual housing costs would be $31,632 /yr.

Now, owning a home means you own an asset, so this asset will naturally appreciate. The historical average natural home price appreciation is 5.4%. (CoreLogic, since 1992).And each month you actually pay yourself; a portion of the mortgage payment goes toward paying down the loan you took out to buy the property. And this amount increases over time as a % of the mortgage.

After 10 years - The Net Wealth Effect of Owning

After 10 years - The Net Wealth Effect of Owning

But, what about after 10 years? The 10yr net wealth effect of owning your home is: +$103,687.09. In other words, after 10 years I have $103,687.09 in positive wealth, all other things in my life being equal.

- Equity (wealth) I own in home - $420,007.09

- Home’s value after 10 years from Natural Appreciation ($706,757.76) - original loan amount ($334,160) + Principle Pay-Down ($47,409.33)

- Mortgage costs paid - $316,320.

So without doing really anything in either scenario - no crazy financial engineering or value boosting home remodeling etc… - what is the best financial decision? In 2 words:

Owning > RentingLooks like home ownership wins, and it ain’t close. The real force at play here is that while you start with a lower rent amount vs mortgage, both rent costs and home values are inflating, yet the basis for the home inflating is much much greater, so it compounds at a much faster / larger clip. Add to that the principle you are banking away each month and the tortoise becomes the rabbit pretty rapidly. (er or vice versa? anyway….)

What’s more, we didn’t even talk mortgage interest rates coming down! These calculations assume interest rates remain at 7%. What if you refinance in year 2 to 6% or 5% in year 3? etc… For brevity, I’m not going to calculate all scenarios but it would obviously much improve the home owning scenario. Mortgage interest rates coming down would be a big deal.

But Wait, There’s More….We have forced appreciation, that is forcibly appreciating the value of the home through a renovation / property improvements. What if, in addition to the above, you decided to spend $30k on a modest renovation of 2 bathrooms in your home? And let’s assume, IMO conservatively, that you will realize a 50% return on that investment in the value of the home. So the home is now worth $45k more in value? Well, congratulations you gained an additional $15k in equity / wealth. Forcing appreciation to a home you own is unique to home ownership, can’t do that as a renter. Pretty cool!

The X-Factor to Owning a HomeLastly, the intangible, which is up to your personal preference and lifestyle. Many of us, just love owning the home. We can do (pretty much) what we want and don’t have anyone telling us what to do. Want to get a dog? You get that pound pup. Want to compost in the backyard and add some raised garden beds? Time to get dirty. There is an emotional aspect to consider.

Do you like working on your home? We have seen that you can add tremendous value through a renovation. And if you do it yourself, at a discount to having to hire a contractor, well that’s even more $ added to your overall wealth. That’s equity in your pocket.

On the other hand, renting can be a much less stressful option and many folks just like that lifestyle. Have the landlord handle those pesky maintenance issues, roofing repairs, deluge of water coming from the washing machine on the 3rd floor that just exploded through to the kitchen below (yes, this just happened to me in my home. Ah the humanity!) If this lifestyle appeals to you, by all means rent (or find a spouse that is handy :)

Option 4…Do Both! Yes, you can!

Yes it is very possible to do both, and financially, it’s the best option by far.

Here it is…

Rent where you live, and rent-out what you buy. Why? Well, tax incentives for one, which you don’t get when living in your primary residence. Real estate mogul Grant Cardone agrees. If you can stomach his brash and boisterous attitude, he preaches in his books that owning your primary residence is a “trap” and that money is better put to use in buying investment properties and renting where you physically live. And if renting in your area is “cheaper” than owning, more reason to pay rent and have your tenants pay your mortgage. Plus, there are 5 total ways you make money real estate investing that likely make it financially a better choice of where to put your money and are all only available to you if you are renting-out the home. We have already reviewed most of these but there is a new kid on the block, tax depreciation:

- Cash flow + rent increases over time

- Natural appreciation

- Principle pay down of mortgage + increases over time

- Forced appreciation through a renovation

- Tax benefits to renting-out a home:

- tax depreciation (you get to deduct 3.6% every year of the value of the home structure, for 27.5 years!)

- Bonus depreciation

- Cost segregation

- And a few more too….

Bottom Line

People need homes. This issue is not going away. It’s no longer acute, housing supply has now become a chronic issue. Regardless of your perspective on renting vs buying your primary residence, IMO more individuals should become real estate investors. It is a great personal finance decision, and an even better investment decision. Getting involved in real estate investing is also good for humanity. We have a severely limited housing supply and we need every investor we can get to pitch in. After all, the government doesn’t build homes, investors do. IMO we should think about real estate investing as a service to your fellow human, frankly (not to get too sappy / patriotic on you).

But don’t take my word for it. Think about what makes sense for you and yours. Let me tell you a story about the wild decision my dad made.

My dad was the ultimate homeowner. In 1976 he bought a piece of land in Kensington, CA for $70k. He built the home himself over the course of 4 years, relying only on a few subcontractors to lay the large pillar foundation into the property’s steep grade. But he didn’t rent an apartment while he built it. No, No… He was a little bit of a barbarian. He slept in a tent in the backyard for 2 years until the home was livable. And when he was done - around the time I was born, after he had built this beautiful redwood and cedar home - we lived in the lower level and he rented-out the main home upstairs! No mortgage, and the rents paid far more than the mortgage and insurance cost.

Do I recommend you do this? Probably not. But maybe you can live through a little renovation on your home, even use some elbow grease to lay down some tile yourself?

I think there is a little barbarian in all of us. Tap it.

And as always…Stay skeptical.

** A Few Assumptions to Note:

- Calculations assumes home values increase on average 5.4%, since 1992. Natural appreciation obviously varies by location, my home city of Nashville rose at 9%. But we used the average to remain conservative.

- Yes, true, I did not take into consideration property taxes and insurance costs inflation. These are hyper local so it’s tough to do in this space, and, importantly, it is likely a small portion of your overall housing payment, relative to the cost of rent or mortgage so even if they appreciate faster than rents appreciate the basis is lower and they won’t catch up to make a meaningful difference in our decision. Anecdotally my property tax and insurance would not have. If you feel strongly, tack on a an extra % to mortgage costs.

- Importantly, there are tax advantages to owning a home. You are able to deduct your property tax and the interest you pay on your mortgage from taxes you owe, this should be counted as income from the asset. This can get complicated and there are limits so consult a CPA. This is not financial advice. I won’t count them for our example but I wanted you to be aware that they exist.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me directly right here on BP!

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

- Andreas Mueller

Most Popular Reply

- Rental Property Investor

- East Wenatchee, WA

- 16,123

- Votes |

- 10,257

- Posts

Your dad sounds like a character for sure. I lived in a trailer park on purpose for 5 years, but no way would I live in a tent for 2.

Doing both (own and rent out) I agree is the way to go. Gurus that tout renting vs buying like Remit, Cardone etc never seem to contemplate this hybrid.

If we are in a place to settle down, owning a plex or 'luxury' househack can be the foundation to long-term freedom.

Interesting write up @Andreas Mueller 👍