Updated over 1 year ago on . Most recent reply

- Real Estate Agent

- Nashville, TN

- 153

- Votes |

- 302

- Posts

A Skeptical Dude's Market Insights - No Job, No Problem Loans Making a Comeback??

Welcome to A Skeptical Real Estate Dude my weekly post on market insights coming at you live from Nashville, TN. Every week I write a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

- - The Weekly 3 - News and Data to Keep you Informed

- - Mortgage Market is in Severe Recession: Mortgage Brokers are Quitting

- - No Job, No Problem Loans Making a Comeback??

- - Chocolate is the New Gold

- - The Bottom Line

- - Fed’s Goolsbee: Rate Cuts Will be Warranted. Inflation progress need not be as good as it has been. Policy is tight. "If we stay this restrictive for too long, we will start having to worry about the employment side of the Fed’s mandate." (WSJ).

- - China's current population of 1.4 billion people is projected to fall to 525 million by the end of 2100. A 63% decline (@charliebilello).

- - Bitcoin Crosses $1 Trillion Market Cap (@KobeissiLetter).

Today’s Interest Rate: 7.13%

(☝️ .17% from this time last week, 30-yr mortgage) Mortgage Rate UpdateMortgage rates are climbing higher again this week to 7.13%, doubling last week’s increase - up ~1/2% in just 2 weeks. We are back to Nov 29th levels folks. It appears the bond market continues to call BS, remaining dubious that inflation will come down rapidly (or potential labor market weakening).

And those traders may be right, at least for now.

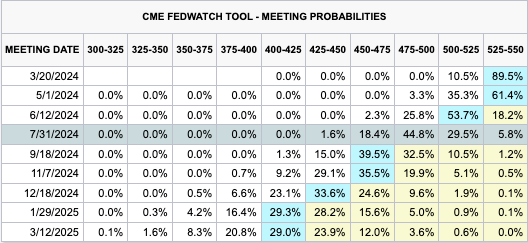

Fed Fund futures are now pricing in ~4 rate cuts in 2024, down from 6+, which it has fluctuated around the past few months.

IMO, we are still most likely to see roughly 3 rate cuts, totaling 100 bps (1%) this year, given current available labor and inflation data. Inflation is still lingering around, like that creepy guy who's just a “little too old to be in da club.”

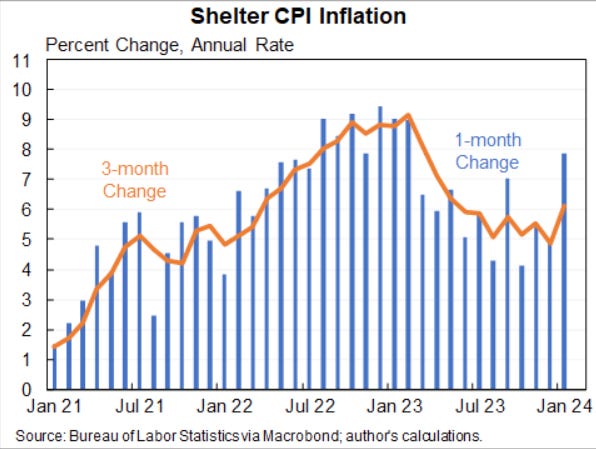

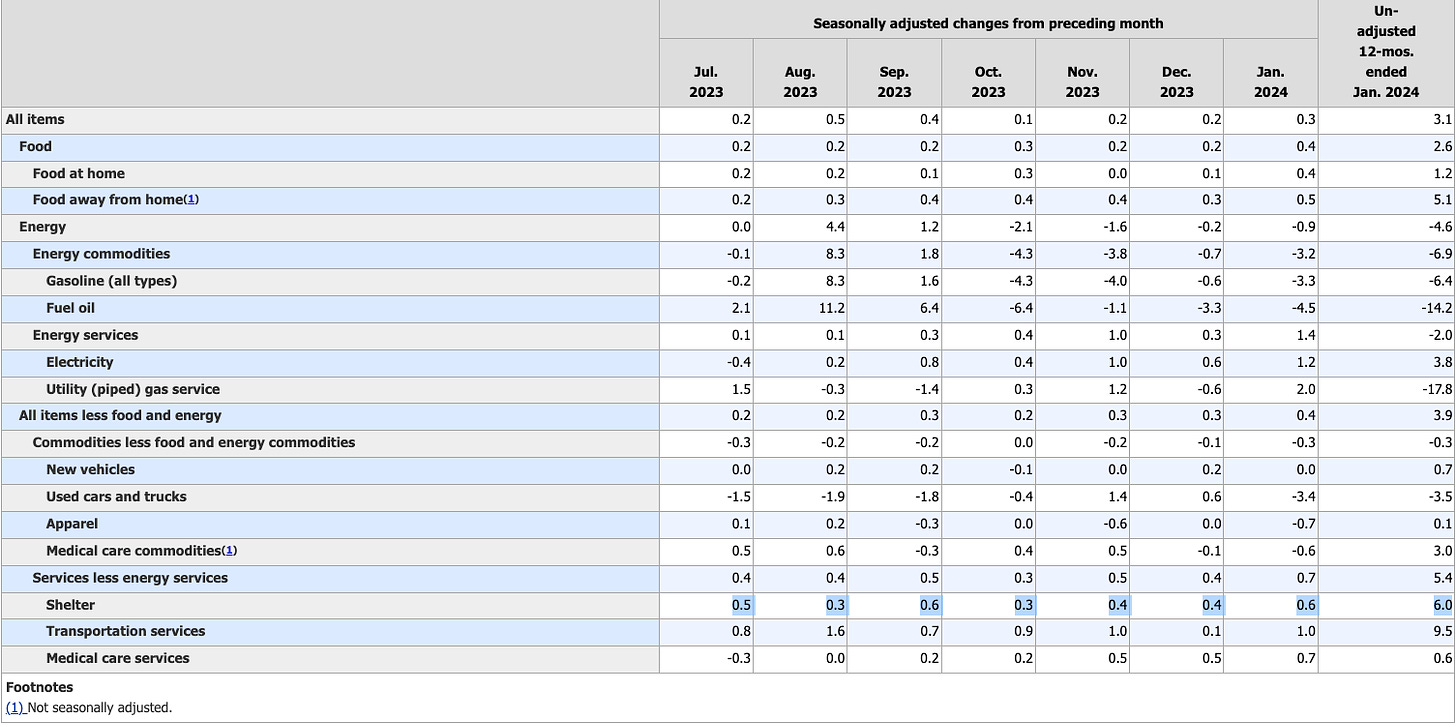

Inflation Rearing its Ugly HeadInflation numbers this week showed core CPI in January was hotter than expected, 0.4%, which is a 4.8% annual rate. Of note, housing costs [shelter] accounted for over two thirds of the monthly increase. Looks like rents are not weakening like many pundits have been warning. And it is important to note, shelter costs have been up every month, not down. Lower inflation (disinflation) just means at times shelter costs were rising less-fast. Not decreasing (deflation). And this is a lagging number, meaning they are likely higher today than we think. IMO.

And

Mortgage Market is in Severe Recession

Mortgage Market is in Severe Recession

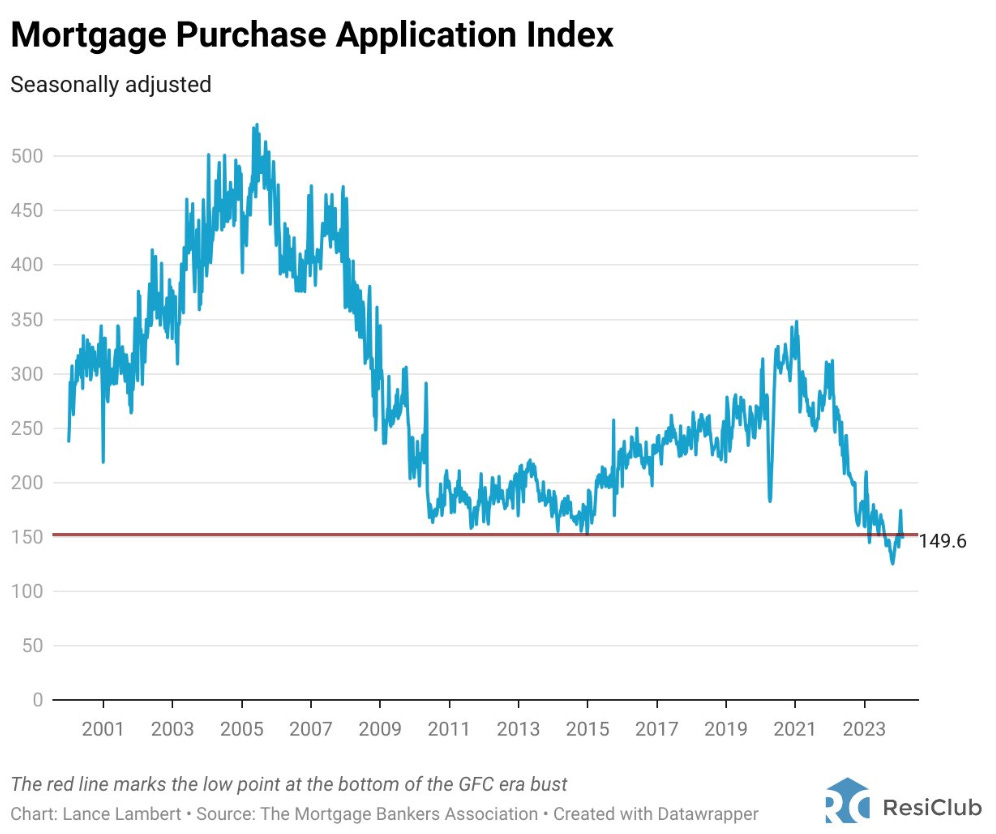

This may be one of the steepest and longest downturns in the history of the mortgage market. Mortgage applications are negative YoY, and remain near the lows during the Financial Crisis.

Mortgage demand is down 14% over the last year and 40% from pre-pandemic levels (Reventure). Supply of available homes to buy remains low, as 90% of homeowners have mortgage rates below 5%. Additionally, low rates for homeowners mean refinances are virtually zero (only those desperate to get out of hard money, construction or bridge funding).

What is this doing to the Mortgage Industry?It’s tough to be a mortgage officer. Layoffs and mergers by necessity are happening almost every day. Since the beginning of the year we have seen mergers and layoffs at:….

- City National Bank to cut 56 jobs in Los Angeles (2/14/24)

- Guild Mortgage acquires Academy Mortgage (2/13/24)

- Proprietary Capital acquires American Financial Resources, LLC (2/12/24)

- 1st Priority Mortgage to acquire Hudson United Mortgage (2/6/24)

- Fairway Independent Mortgage Corp. to shutter wholesale lending division (2/2/24)

- Newrez layoffs (2/2/24)

- New American Funding (NAF) to acquire Draper and Kramer Mortgage Corp. (DKMC) (2/1/24)

- Crescent Mortgage Co. to shut down, lay off 65 employees (1/31/24)

- Heritage Bank to exit retail mortgage lending (1/25/24)

- UMortgage acquires Community Mortgage Brokers (CMB) (1/22/24)

- Country Club Mortgage to let go of 105 employees in Central California (1/17/24)

- Wells Fargo mortgage layoffs (ongoing)

- Truist Financial to close bank branches, cut mortgage jobs (1/8/24)

- Kinecta Federal Credit Union layoffs in El Segundo, CA (1/3/24)

Case in point, Treasury Secretary Janet Yellen recently testified in front of Congress and expressed explicit concern over non-bank mortgage lenders. These mortgage loan originators, originated a whopping 70% of mortgages in 2023! (I had no idea it was that high).

They are reliant on short term financing not deposits (like a bank) or access to financing from the Federal Reserve, so “in stressful times their credit lines can be pulled.” “There is concern that in stressful market conditions we could see the failure of [these lenders]…this has become very significant in the mortgage market.”

And if rates, drop fast this actually could spell disaster for these mortgage companies. Anyone in a high rate mortgage (I have a few admittedly, b/c I got a fantastic deal on the property) is going to refinance immediately and repay the loan. Are these mortgage companies ready/aware of prepayment risk for loans they at making today? This could happen faster than income from new loan originations.

Mortgage Officers are Choosing Not to Renew their Licenses at a Wild Pace.

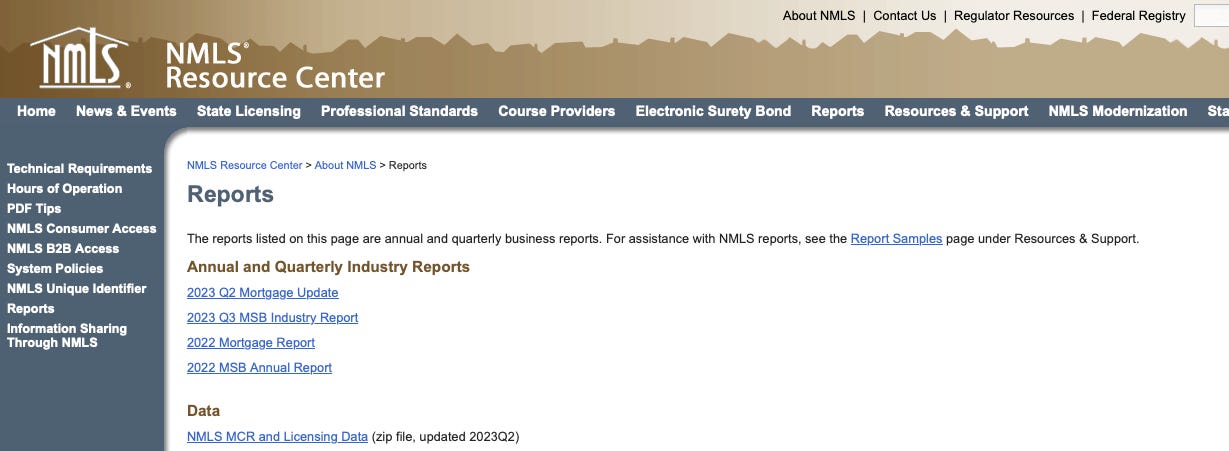

According to data by the NMLS, the Nationwide Mortgage Licensing System, the number of registered mortgage officers dropped 24.5% YoY in Q2 2023. In other words, One Quarter of mortgage officers decided to call it quits from the mortgage industry and not renew their license (for some reason the NMLS is only up to Q2 2023 data collection, odd…IMO full year 2023 was probably a blood bath. We will see.)

And in 2022, more mortgage licenses expired or were withdrawn than were approved (again, the 2023 annual report is not yet out, see below).

WOW.

And in some states the data is even wilder. Check out the linked chart below.

Check out California and DC…

Quick Story: Are mortgage lenders making risky loans again?

Quick Story: Are mortgage lenders making risky loans again?

Perhaps, and they are some bizarre loans that remind me of 2008. And this is crazy…

I was having breakfast with a local mortgage lender, at a bank, but who is also a mortgage broker. FYI many mortgage officers are both a lender of a bank’s/institution’s money and also a mortgage broker where they broker mortgages for other mortgage originators. 😬😬😬

So anyway, he told me that he recently brokered a loan with no income verification (This was not a VA loan, backed by the government).

My jaw dropped. I thought this was illegal since the Financial Crisis / Dodd Frank?

But that’s not the bad part. Listen to the terms:

- - 11.5% interest rate

- - 5 points up front (pay 5% up front as a loan origination fee)

- - Have to hold 18 months in reserves for PITI.

Now the story is quite sweet. It was a local musician who just got a record deal but has been only making $30k a year and, with a hopeful advance on that deal coming, wanted to buy a home. I get it. They want a house…

Unfortunately this is a tremendously high risk loan with terms so terrible 1) I will be surprised if he doesn’t default, and 2) he is getting, well, screwed. It’s frankly worse than 2008 products and the word expensive doesn’t describe it. Hard money may have been better. 3) How many of these loans have been made and who was the lender he was brokering to?

Champions Funding and I wish I knew how many loans they have made. But if they were public I would, in the words of Steve Carroll in the Big Short, “short everything that guy owns.”

They are literally advertising on Twitter that they are the “best” at lending to folks that are “Not Qualified.”

I hope he can really sing….Absolutely insane.

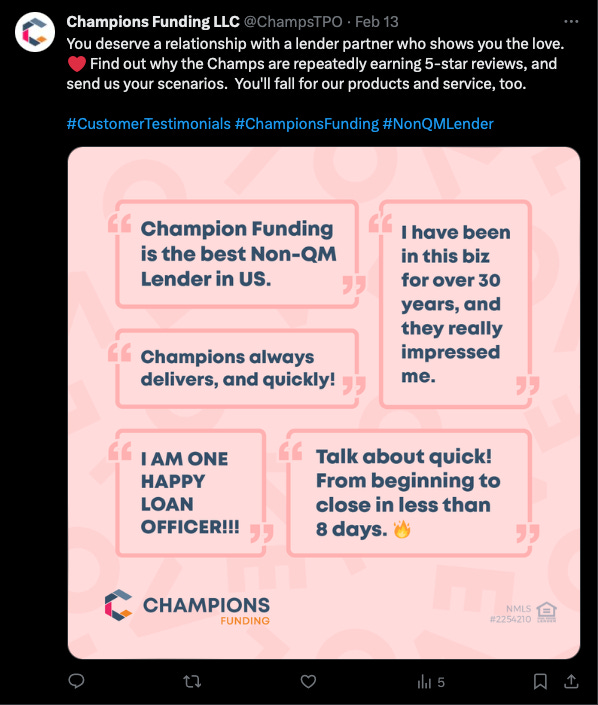

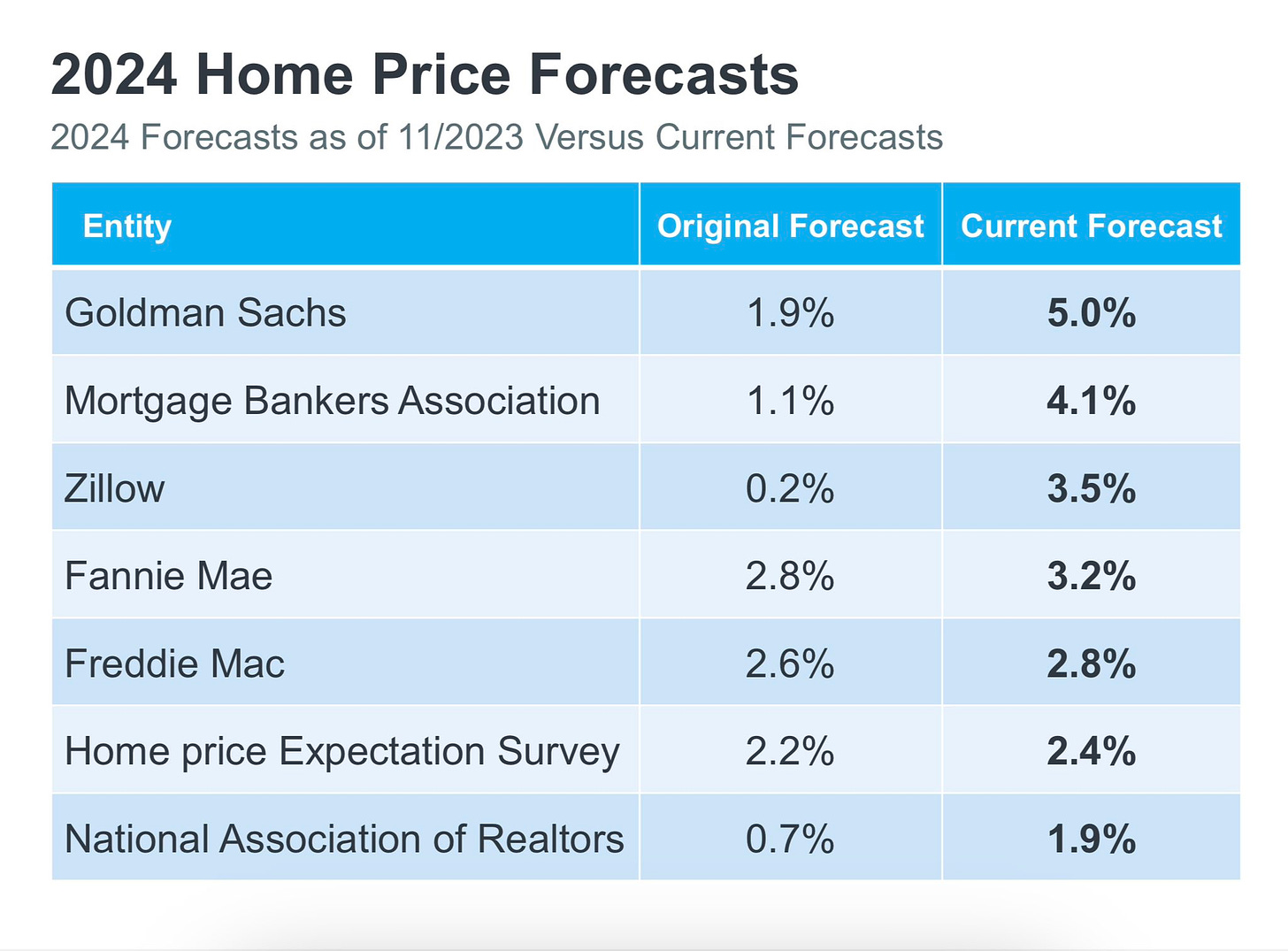

Home PricesYet, home prices are up 5%. Which makes sense given lower home sales volume, driven by low market supply. And remember, CPI of nearly everything is higher every single month, which permeates into materials, services etc… that are necessary for building / renovating homes.

And the predictions for higher home prices keep being revised higher.

My Take? Get it while the gettin is good (bonus points for who gets the reference :).

Valentines Day Tangent!

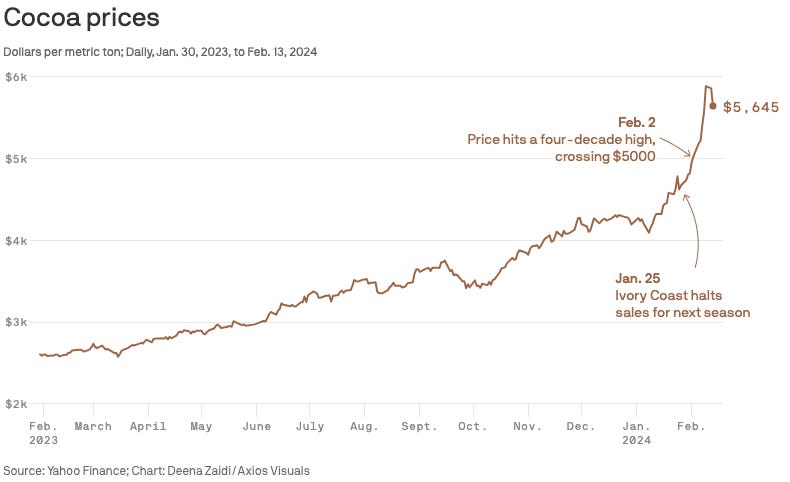

You know what else is up, all you lover dudes and dudettes?

Chocolate!

Holy smores, cocoa prices have skyrocketed to a record high, mostly due to disruptive weather, and also higher freight costs. Good thing I …. hate chocolate! Gimme wine and cheese and olives all day for dessert.

Queue the hate 😁.

But I digress…..

Bottom Line

We just simply need more homes (and larger/expanded) homes to house more people. In my home market of Nashville. Median inventory was down 9% in January. Not great given the lows we are at already.

True, so far 2024 is looking like a potential turnaround year to makeup for the 2022 housing recession, as long as inflation and labor markets act right. But certain areas like mortgage lending are hurting, bad, and we are seeing areas of additional risk-taking to try to make additional $. I had no idea non-QM loans were even legal.

This leads me to why I am getting a little more cautious when it comes to the overall economy. In short, it’s because things are looking, well… good.

How? Well…

- Stocks are trading like the Fed already cut rates.

- Bonds are trading like inflation is still a big problem (and rate cuts aren’t going to happen anytime soon, ie economy is still running hot or traders have labor market concerns).

- Housing is trading like there are no problems.

- Gold is trading like there are no problems.

- Chocolate is trading like gold.

- Oil is trading like we are in a recession.

- My spider sense is tingling….

The Skeptics Take: So when you jump on your next real estate deal. Remain cautious. Make sure it's a great deal. Don't build into your IRR returns a refinance down to 5.5% in month 6. Make sure you can afford that higher mortgage payment for an extended time IF needed. Maybe set aside additional reserve funds in the property's checking account. Sure a faster rate drop could happen, but if it were to, that would likely mean we are in a recession, and you may have other issues then. Like finding renters or higher eviction / vacancy rates. I'm targeting mid-level rentals as investments (buildings that rent for $1500-$2000) / unit. These units rent in any economy. And I am building in a 12-18 month timeline for rate to remain high. In other words, rates will remain above my target refinance rate of 5.5% for the next year / year and a half. I'm also reinvesting in my current portfolio of properties. For example, adding a back deck, garden area and dog washing shed in a few of my properties to ensure I attract the best tenants and they appreciate living in my property (and don't leave).

When times seem good, that is precisely the time to be prudent. Tighten up costs. Run market analysis on rent renewals. Take some time to improve / harden your properties etc….to remain robust against any potential downturn. Because you can NEVER predict when it is coming. Don’t try. Just keep improving and building that moat of resilience ….

And as always…Stay skeptical.

Most Interesting Tweet(s) of the WeekSo sweet. Happy V-Day y’all.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can message me right here on BP!

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

- Andreas Mueller