All Forum Posts by: Andreas Mueller

Andreas Mueller has started 66 posts and replied 241 times.

Post: The Pressure Campaign to Cut Rates Continues on Powell

Post: The Pressure Campaign to Cut Rates Continues on Powell

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Interesting take why do they "need" to be?

Post: The Pressure Campaign to Cut Rates Continues on Powell

Post: The Pressure Campaign to Cut Rates Continues on Powell

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to the Skeptical Investor, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today, we’re talkin’ random market thoughts. I got a few things knockin’ around the ol’ noggin. Today’s issue will be a little shorter than normal. PLUS….A big announcement and gift! You’ll have to read to find out. Let’s get into it.

-----

Today’s Interest Rate: 6.83%

(☝️.02% from this time last week, 30-yr mortgage)-------

The Weekly 3 in News:- --Amazon CEO: No inflation so far: “We have so far not seen prices appreciably go up (CNBC).”

- --Wages for hourly workers are up 2% in 2025. One key reason, perhaps, why the consumer is holding up so well despite the confidence ups and downs (Treasury).

- --Weekly Trade Watch:

- Forthcoming trade deals with Indonesia and Vietnam were just announced. U.S. exports to Indonesia would face no tariffs, while Indonesian goods would be charged a tariff of 19% in the United States. On the Vietnam front, the agreement is expected to include a 20% tariff on their goods with no such tax on US exports. Mexican President Claudia Sheinbaum is discussing trade collaboration with Canadian Prime Minister Mark Carney, focusing on countering U.S. tariffs set for August 1. South Korea also signaled progress toward a possible U.S. trade deal by August.

----------

The Economy: State of Play and This Week’s Numbers

Both Consumer and Producer (wholesale) inflation numbers came in slightly higher and below expectations, respectively.

This week’s Consumer Price Index (CPI) showed inflation at 2.7% YoY, slightly above the expected 2.6%. Producer Price Index (PPI) came in at 2.3%, below the expected 2.5%, YoY. MoM was flat, also below the expected .2% increase. Core PPI (excluding volatile food and energy) was flat MoM and 2.6% YoY, both also lower than expected.

Fun fact, PPI came in lower than all 50 economists in Bloomberg’s survey predicted.

What’s the difference in CPI and PPI? PPI measures the average change in prices received by domestic producers for their goods and services over time. It’s focused on the wholesale level, aka raw materials, intermediate goods, and products before they hit retail. CPI tracks the average price changes for a basket of goods and services bought by consumers, like groceries, rent, or gas, retail goods... So, PPI looks at prices from the producer’s side, early in the supply chain, while CPI reflects what consumers actually pay at the retail level. PPI can signal future consumer price shifts since producer costs often trickle down, but it’s slightly narrower, missing things like housing/shelter, which CPI covers. This is important to know because shelter cost was the primary factor for the monthly increase in CPI. Up 3.8% YoY.

Importantly, shelter costs have a massively outsized weighting, making up ~40%+ of CPI. This hefty weighting means shelter has quite an influence on inflation numbers. Moreover, it may sometimes overstate inflation numbers due to lags in how rent data is collected (leases are typically 12 months), which can trail real-time market trends by many months. Of note, shelter costs are likely not affected by trade/tariff policy.

Other notable sector increases over the last year include medical care (+2.8%), motor vehicle insurance (+6.1%), household furnishings and operations (+3.3%), and recreation (+2.1%).

So, what do these numbers mean to us?Inflation is still not showing signs of reigniting, signaling a higher likelihood of lower interest rates in the near future. What’s the chance the Fed lowers rates in September? 40%.

Just kidding, nobody knows.

Side Note: Whenever I see a TV/Newsletter/Podcast pundit making a bold prediction by assessing the odds at 40% - I always think of this Wall Street Journal 2018 piece.

40% is 100% correct, all the time.

Tariffs Aren’t Derailing the Party Train

So far, while tariffs are important to the President’s agenda, they may not necessarily derail the economy. We have not seen a meaningful increase in prices, consumer confidence or job numbers.

Let’s remember that the economy has remained strong despite all the craziness in the world. Hell, the stock market had a waterfall decline in April because of the tariff announcement, and everyone thought the market wouldn't recover because the Fed wasn't going to unleash liquidity, but it was a V-shaped rebound. Once investors recovered from the shock of a worldwide reorganization of tariff/trade policy, things started to make sense.

Fun fact, today stocks are actually cheaper than they were on the eve of COVID in 2020, by 1.5x. And we have had six Black Swans in that time!:

- -We had COVID.

- -We had the supply chain shock.

- -We had the inflation shock.

- -The Fed's fastest hikes in history.

- -We had tariff armageddon.

- -And then we had the US bombing Iran nuclear facility.

US companies produced earnings growth the entire time. The economy is looking, dare I say, indestructible (Tom Lee).

So, the good economic times are still a movin’. I know it may not feel that way to everyone. There is plenty of political angst, uncertainty, frustration, and even fear in the air. And we real estate folks are agonizing over interest rates (me included!). But our little ol’ economy is chuggin along. Thomas the Tank Engine would be impressed. (Tangent: Did you know that show lasted until 2021? 1984-2021! Holy hell, what a run y’all).

The Campaign to Cut Continues

The President is getting ever more frustrated that the Fed has not cut interest rates. A reminder, the Fed cut rates last on December 18th, 2024, and has paused since.

The pressure on Powell to cut rates continues to escalate:

- -Powell’s stubborn stance on rates is starting to upset other Fed board members, with some now publicly saying they would support a rate cut.

- -The President wants the next Fed Chair to “be someone who will cut rates” and is expected to name Powell’s successor before the Fall, according to Treasury Secretary Bessent.

- -And, the President is now calling for the first 3% interest rate cut in US history.

Who will be the next Fed Chair?

Former Fed Governor Kevin Warsh is considered a top contender. He has

But then yesterday, when asked if the next Fed chair is going to be independent, Warsh said, "In a word, yes. I’ve strongly believed for 20 years, and history tells us, that the independent operations in the conduct of monetary policy is essential."

Guess he’s off the short list now. :)

Although he then backed off those comments, saying, “We need regime change in the conduct of policy,” and the Fed should have “[a policy alliance with the Treasury Department].” He also called their models outdated and a relic of the past.

I must admit I agree on the latter.

Ok, he’s back on the list.

My Skeptical Take:

The signal of a change in the Fed Chair is a form of forward guidance for markets. How far out will they look for guidance? When will Powell be considered a “Lame Duck?”

Prediction: The moment the President names a new Fed Chair, there will be a few days of volatility, and then rates will continue their stair-step downward. I do think we get a small .25% rate cut in September, but Powell seems increasingly stubborn, as he attempts to avoid looking political (to his credit this is a difficult position). Again, Powell’s effort to remain apolitical is beginning to appear political, as I have written about previously.

But time will tell. I’m gathering capital, selling some stocks and getting ready to fund my next real estate deal. Property prices are softening, and it's starting to look like a damn great time to.....

......

There's more, just shoot me a message and I'll send you the rest. After all, isn't that what BP is all about. Let's get to know eachtoher! DM me now!

....

Thank you. Thank you. Thank you…all you awesome Skeptical Investor readers out there.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor

Post: July 2025 Rental Market Deep‑Dive - Price changes, Days on Market, etc.

Post: July 2025 Rental Market Deep‑Dive - Price changes, Days on Market, etc.

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

You got it, but its not just a little off, its a whole other universe!

anyway, much luck my friend.

Quote from @Matt Thelen:

Quote from @Andreas Mueller:

Just a spot check, your data source may be off.

Example: Nashville is not even close to 48 DOM. It's 29.

This is real time direct from the MLS.

I would reach out to your source, hope this is helpful.

Thanks for the data point @Andreas Mueller! MLS will be different from the data source I used, Zillow, for at least a few reasons so I would expect them to differ.

*Zillow has much more data of course

*MLS listings are probably a little different from the rest of the market. I assume MLS listings might skew nicer and more expensive but let me know if you think that's off

*I filter by homes, but the MLS would have townhomes and condos too.

Here's the direct Zillow link for homes in Nashville. Zillow has 46 DOM and 1,250 active house listings right now. How many houses does the local MLS have listed right now out of curiosity? I'll guess it's 10%-20% of the 1,250 but I could be wrong! https://www.zillow.com/rental-manager/market-trends/nashvill...

Post: Serious About Real Estate | Looking to Connect with BRRRR Investors & Mentors

Post: Serious About Real Estate | Looking to Connect with BRRRR Investors & Mentors

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

A simple BRRRR is really not possible today, you can get close if you do a major renovation then wait until rates come down to the 5s. (whenever that may be).

But if your strategy is long term, refinancing will still very much be possible.

Just not on repeat, today.

Post: July 2025 Rental Market Deep‑Dive - Price changes, Days on Market, etc.

Post: July 2025 Rental Market Deep‑Dive - Price changes, Days on Market, etc.

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Just a spot check, your data source may be off.

Example: Nashville is not even close to 48 DOM. It's 29.

This is real time direct from the MLS.

I would reach out to your source, hope this is helpful.

Post: Real estate retired me from a 6-figure job. Come learn how to retire yourself too!

Post: Real estate retired me from a 6-figure job. Come learn how to retire yourself too!

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

We are local to Nashville/Franklin. If I can be potentialy helpful, happy to me. DM me.

Post: Looking for a new handyman/tenant changeover person, and also lock question.

Post: Looking for a new handyman/tenant changeover person, and also lock question.

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Sam, We do full service property management in Nashville BUT also happy to help you find handy men, electricians, cleaners, ideas for folks to just go check on real estate etc... if you want to hire each out individually. Drop me a message.

Post: Will Tariffs be Inflationary?

Post: Will Tariffs be Inflationary?

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Hi luka, thanks for the comment and reading my friend.

Lumber is definitely a large(er) worry re: tariffs and cost of construction than say conrete, which is almost wholely domestic, but so far there is zero effect, according to the June Homebuilders survey.

The MUCH larger effect? Rate Buydowns from absorbing larger interest rates. Rates gotta come down. We are in year 3 of housing activity recession.

Time will tell of course...

Here is what the homebuilders are saying:

Post: Will Tariffs be Inflationary?

Post: Will Tariffs be Inflationary?

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Thanks for the comment Andrew! We will see :)

Post: Will Tariffs be Inflationary?

Post: Will Tariffs be Inflationary?

- Real Estate Agent

- Nashville, TN

- Posts 304

- Votes 154

Welcome to the Skeptical Investor weekly article, right here on BP! A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another. |

Today, we’re talkin’ will these tariffs actually be inflationary? I had a surprising revelation.

And we do a housing market update, review the positive jobs surprise, and I pontificate on all things housing and the direction of interest rates.

Let’s get into it.

Today’s Interest Rate: 6.81%

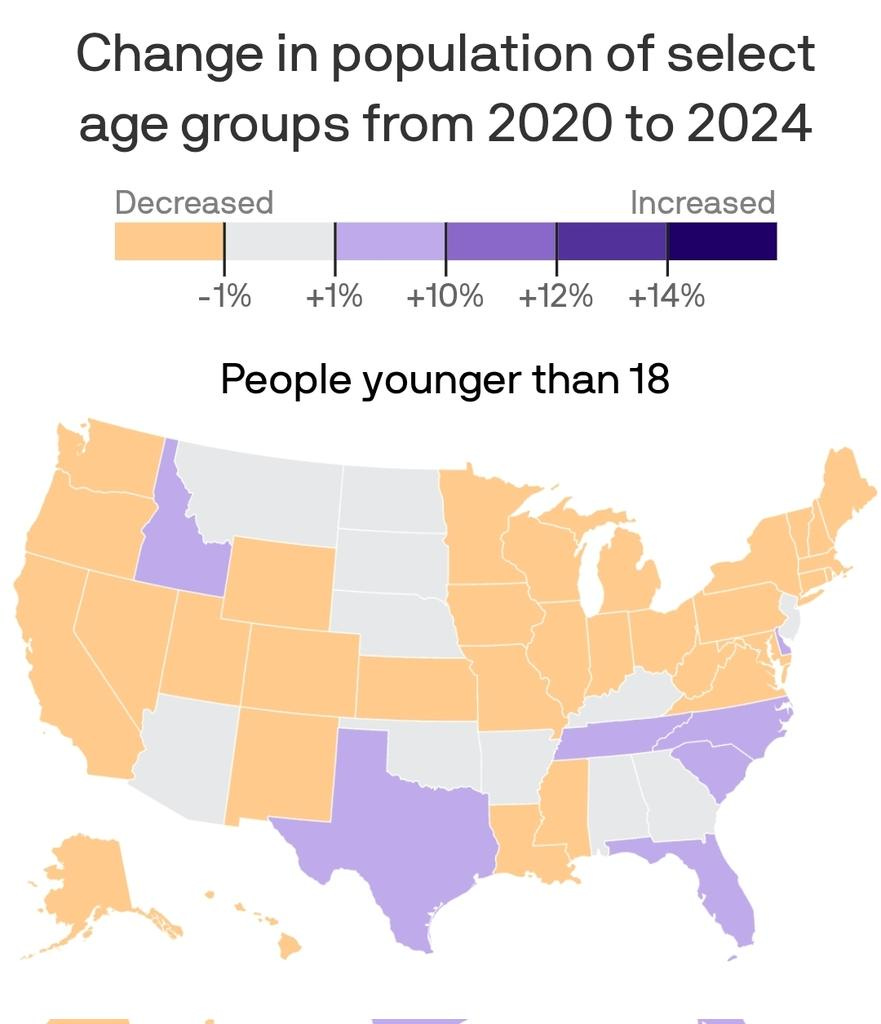

(☝️.14% from this time last week, 30-yr mortgage) The Weekly 3 in News:- -Only a few US States are seeing starkly higher numbers of young people. Let’s Go Tennessee! That’s baby-makin’ music down here (Parsons).

- -Perspective: “Consumers have been cautious since the start of the year. After-inflation consumer spending has gone sideways. That’s because of the well-to-do, those in the top 20% of the income distribution who account for ≈50% of spending. They had powered spending coming out of the pandemic, but not recently (Economist Mark Zandi).”

- -Nashville home market shows resilience. We had 3,185 home closings in June, a 5% YoY increase. (Greater Nashville REALTORS).

As the olde country song Country Boy Can Survive goes…

"The interest is up and the stock market's down….”

But, things are a changin’ Mr. Williams Jr.…

Interest rates are coming down. Are you paying attention?

In just the last 30 days, rates are down .15%, and last week they had been down another .14% to 6.67%, before interests pivoted from the war in Iran and Israel back to potential tariffs.

As I said a few weeks ago, with inflation now close to 2% and a labor market that is showing signs of waning, the bond market is starting to do the Fed’s job for them, albeit slowly, amidst all that is happening in the world. The 10-yr treasury bond has crept down to 4.421%, which mortgage rates track. And was down even more.

I expect it to continue its one step back, two steps forward routine, edging slowly down, for the rest of 2025.

Will these Tariffs be Inflationary?To date, the Fed’s argument to the public has been that they can’t lower rates because of uncertain tariff policy, which could be inflationary.

Hey, I can’t blame someone too much for being skeptical. But so far, that has not been the case.

And I must admit, I have a confession to make. After much rigor, back and forth, consternation, and effort to resist all things political, I have changed my mind.

I am now skeptical that these tariffs will become inflationary.

I know, I know. I can’t wait to see the hyperbolic, politicking hater messages I’m going to get this week. But I do think this is the most intellectually honest way to look at the current tariff discussion (of course, this can change, especially with this President). But for now, I am fairly confident.

Why?

Since announced on April 2nd, many reasons. But I will start here: tariffs have brought in $300 billion, up from ~$80 billion a year ago (annualized, Treasury).

And since then, the inflation rate has decreased to 2.3% (the Fed’s preferred measure PCE, BLS).

For me, the discussion on tariffs comes down to these three features of tariffs.

- Tariffs are like taxes. They are fixed rates. Taxes are not inflationary.

- Tariffs are a one-time action, and thus transitory (yes, the dreaded T-word).

- Tariffs do not compound, which is the hallmark of prices that are inflating.

I believe this to be a more accurate way of framing the current tariff risk and its potential effect on my portfolio. Why is this important? It means bond buying will continue, lowering interest rates, regardless of the Fed’s actions. Not the opposite. This is not political. I use this to forecast my investments accordingly.

So, where does that put us?

Interest rates are starting to do the itsy bitsy spider, labor market is playing freeze tag, and I am on my third cup of coffee.

It’s a great time to be liquid, raise some cash, gather your money…

…and make some damn money.

Get it? Got it? Good.

And now for something completely different…

Housing Market Update: Healthy-er

Fortunately, real estate transaction activity is picking up, albeit from a low base. Market activity is up in 2025, painting a more positive picture for the summer market.

Housing inventory on the market is creeping up, still not back to pre-2019, but it’s the best number we’ve seen in 5 years, just passing 2020 housing inventory levels.

In almost 50% of the 50 largest metro areas, there are now more homes for sale than there were before the pandemic (realtor.com).

Good!

Again, inventory is up in many markets, but still down / flat in most. And notice that the markets seeing increased inventory are highly desirable areas to live. Remember, real estate is always about Location. Location. Location. These areas will still be fantastic markets to invest in. Real estate is a market. And like all markets, they cycle.

Hell, Amy Schumer just slashed $1.25M off the price of her Brooklyn townhouse. (although she is still netting $500k since buying in 2022, so don’t shed any tears). It’s time to pick up a deal, son!

I do love her rustic kitchen; this is my vibe.

But I’m not a fan of the prisoner shower. Better get some soap on a rope, gents.

In short, this is progress towards a healthy, normal market. We need inventory to normalize, and we aren’t normal yet. A 2-2.5 million market inventory is the historical norm, so if we can approach 2 million, the market will feel normal rather than tight. Affordability would begin to relax as well, as choice suppresses home price appreciation (likely not price decline, but price disinflation, of course, this is market-specific). Inventory still has a ways to go for more than half of major cities, but at least it is out of its meek, gothic phase.

Anecdote: My Skeptical Investor community is not seeing inventory come through to investors as deal flow. I’m just not seeing a plethora of value-add properties available. Especially in growing C+ to B + class neighborhoods. Neither single-family nor small/medium-sized multifamily properties. There is still plentiful demand, circling too little supply. When rates drop to the 6s and 5s, investors are going to descend like Attila and his Huns on the existing home residential real estate market inventory. I am front-funning that demand in my business, and am actively looking for my next deal (Have a deal? Send it to me, I pay handsome referral fees).

On housing, we should be skeptical of the activity numbers for May, up .8%. We are in the second busiest season (summer), but as of yet, there are not enough strong demand indicators. The result? Real estate inventory is likely to continue higher, hopefully providing more/better choices for investors.

Counterpoint: we still have a record number of homeowners (71.3%) with awesomely-low interest-rate mortgages who won’t sell/move until they can buy again with a lower rate.

Would you sell if you had a 4.5% interest rate? Hell no. Only if you had to.

The mixture of homes on the market will continue to skew to newer homes, rather than existing homes (aka fewer value-add homes for investors to gobble up).

All this being said, we should be skeptical of the doomers in the press and online “experts” saying home prices will fall. Don’t believe the hype. And don’t just take my word for it. The Chief Economist for RedFin, Daryl Fairweather, thinks so.

Speaking of Prices

Prices should continue to rise (but not always, keep reading). Yes, price data may be volatile because 1) suppressed activity from tight Fed Policy (ie, continued high rates) and 2) in certain geographic areas with local dynamics at play (a big one is new apartment supply falling off a cliff right now).

How have the last 30 years gone (ResiClub)? Up 300%.

Of course, home prices could go down. But so what? We have had one price crash in my 42-year lifetime, and that was the Great Financial Crisis. And even if you bought into that weakness, you are pretty happy today. Moreover, 2009’s economic factors are not present today. All markets cycle. Fear and loss aversion are powerful human emotions. Successful investors can separate the signal from the noise.

Case in point, back in the 2006-2012 timeframe, inventory skyrocketed, depressing home prices. Today, we are at 4.6 months of inventory. Which, as you can see, is a historically normal level (Mohtashami).

Keep calm and carry on.

The Labor Market Still StrongThe Fed won’t cut in July unless the labor market weakens. And, the latest jobs numbers were pretty good.

In June, the US economy added 147k jobs, the previous month was revised up +16,000 jobs, and the unemployment rate actually ticked down to 4.1% (BLS). This, after unemployment had slowly risen for the last year and a half, albeit from a low base. I am keeping a skeptical eye on it. So far, the trend is still a slowly weakening labor market. This is likely just some volatility in the data. But a positive economic outlook nonetheless.

The good news: We are still at “full employment” (normally defined as sub-5% unemployment). Parsing out construction employment, we still see a healthy market up YoY.

Falling construction employment usually precedes recessions.

Anecdote: State and local government added +73,000 job gains, which led all job categories, accounting for half of all job gains. Wow. Why?

In other words, so far, no cause for concern. Unless you are trying to buy a house at 7% interest! Well, it’s mom’s basement for another 6 months for you Jimmy.

**Tangent**

You know what I find myself thinking more about? The next decade. And not just real estate. This world is about to be wildly different. Just wrap your noggin around this:

- Iran's leader - Khamenei is 86 years old.

- Russia's leader - Putin is 72

- China's leader - Xi Jinping is 72

- Israel’s leader - Netanyahu is 75

- India's leader - Modi is 74

There will be seismic political shifts in geopolitics, upending a generation of rulers, and allowing a new generation of thinkers. I am hopeful the next generation in these tough countries will be more caring.

What will the world look like in 10-15 short years?

But I digress…

The Campaign to Cut Continues

The President is expected to name Federal Reserve Chair Jerome Powell’s successor within the next few weeks. He is getting ever more frustrated that the Fed has not cut interest rates. The Fed cut rates last on December 18th, 2024, and has paused since.

What the hell Powell? Jimmy is still in the basement, and his girlfriend Jane is pissed!

My Thoughts: I do think we get a teeny .25% rate cut in September, but Powell is seeming increasingly stubborn to me. In testimony before Congress last week, he was not the least bit dovish. I do not think Powell is acting politically. Quite the opposite. He is hyper-aware that his actions may be seen as political, that is, helping or hurting the President’s political agenda. But ironically, the result may be the same. Powell’s effort to remain apolitical is beginning to appear political, as I have written about previously.

But there is a difference today than even just a few weeks ago. Powell’s stubborn stance on rates is starting to upset other Fed board members, with some now publicly saying they would support a rate cut.

The President wants the next Fed Chair to “be someone who will cut rates.”

So, then again, maybe Bowman just wants his job :).

My Skeptical Take:

Our long-term thesis: Real estate remains a growing necessity.

Mo people = mo housing units.

Of course, we should always be skeptical that any trend will continue unbroken. But, in those times, it’s not a bearish signal.

It’s bullish.

Why? We don’t invest for the trade, we invest in our long-term thesis of owning real estate as a long-term asset.

So if prices do decrease, that trend break will, in my humble opinion, be relatively short-lived to our investment timeline and present a full-on “smash the giant green button” buying opportunity.

Remember 2008-2010?

We had a no-kidding real estate crash then. And the market didn't bottom until 2011. How do you think you would have handled it if you bought a property in 2008 or 2009, thinking it was a great investment, only to see prices go down further? Would you have had the stomach to hold tight? After all, you were buying when the market was fearful, like all the great investors, like Warren Buffett, say to do. But then, the market continued down for another 3+ years!

Would you have panic-sold?

The right decision, with the benefit of hindsight of course, would have been to hold. And I don’t know anyone upset that they bought in 2009. Or 2006, for that matter. In fact, I did this. For my first investment property, in 2009 I bought a 3-bed/2-bath townhome in Washington DC in, shall we say, an interesting C-class area, during a recession, when prices were falling and the only thing in abundance was uncertainty. And what we didn’t know at the time, it would turn out to be the greatest economic downturn since the Great Depression.

And guess what? My investment was a home run. I fixed it up and sold it for a handsome $300k profit. And the rest is history.

You can never perfectly time the market, but you can stay vigilant for when the market brings you opportunity.

To be sure, my default posture is skeptical. I am prepared as if things don’t go great, like we have a recession for instance. I do not think this will happen, but I am prepared.

Remember, you have agency over your own actions. And ONLY your own actions.

Create your own luck, manage risk, and have a solid balance sheet. Don’t take insane risks. Don’t overleverage. Don’t get cute. Don’t try to be a genius, just try to not be stupid. Be patient. If you do, you will be successful. Like Mr. Munger.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

-The Skeptical Investor