10 Best and Worst Markets for Year-to-Date Rental Growth

No place in the U.S. has been untouched by this year’s financial turmoil. But the impact has been uneven and inconsistent in how it has affected different communities.

To get a sense of what some of those differences look like—and why they might exist—we looked at how rent prices have reacted from January through May. We used that information to compile two lists: one with the 10 markets with the best rental growth during that period and another of the 10 poorest performing areas.

In addition, we checked available rental units for the same time periods, added some other demographic information, and then calculated the percentage change in prices.

The Results

The most striking thing about the top 10 is that 60% of these markets are in Florida, primarily in the Gold Coast area, a roughly 23-mile stretch that runs from Hollywood in Broward County south to Coconut Grove in Miami-Dade. The one outlier is Bonita Springs in Lee County on the west coast of the state.

In the same way that Florida dominated the top performers, Texas represents 40% of the most troubled markets from a rent price perspective. When we broaden the geographic area, it turns out that 60% of the list is in the Southwest, including Arizona and Nevada.

Across the two lists, there is a 49-point spread between the best YTD rent performance (+13%) and the worst (-36%). Surprisingly, the bottom 10 has a significantly higher average median income ($66,898) than the top 10 ($58,452). However, the calculation for the bottom 10 is skewed by the outliers Plano, TX ($92,121) and Irvine, CA ($100,969).

One other comparative detail: The best performing locations had an average of a 51.7% drop in available units year-to-date (YTD) versus a 60.8% decline in the most challenged areas. That’s also a surprise, since you would expect the tighter inventory to increase demand and rents.

Although we won’t focus extensively on changes in available units in this discussion, it’s worth noting that the overwhelming majority of communities in both the best and worst lists had more vacancies in January 2020 than in May 2019.

COVID-19 Seems to Have Pushed Prices Higher

The ongoing pandemic and local infection rates seem to have played an important role in local markets’ performances.

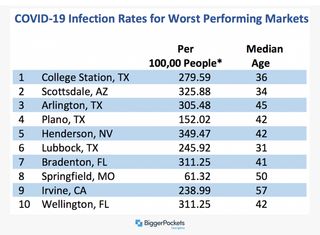

*Johns Hopkins Coronavirus Resource Center, https://coronavirus.jhu.edu/us-map

The average rate of infection for the top 10 is nearly 753/100,000 people. For the bottom 10, it’s only 258. Also, the average median age for the top 10 is 42 versus just under 36 for the bottom 10. This raises the question as to whether the higher risk due to combined increased rates of spread and a slightly older population helped drive up demand and prices when inventory was already down dramatically.

Even in states that didn’t implement strict (or early) stay-at-home orders, higher infection rates are likely to have prompted individuals to quarantine and/or social distance, delay plans for relocating, and stay in their current homes. That, too, would reduce vacancies, increase demand, and push prices higher.

There have also been numerous reports about the shift to work-from-home arrangements and the desire to live in lower density areas in light of the pandemic. That has prompted a portion of rental demand to move away from larger, more expensive cities to less congested, more affordable options.

That could be a factor in the performance of communities like Hallandale, Coconut Grove, Aventura, and Bonita Springs. In in the long-term, they offer the amenities of smaller-town living (even as rents may be more expensive for the time being), but still offer access to Miami Beach’s big-city benefits for those that want them.

St. Louis and St. Paul can also be viewed as “second-tier” cities that are much more affordable and livable than metros like San Francisco, New York City, and Los Angeles. This likely helped land St. Louis at the top of the list.

It’s unclear why Miami Beach performed as well as it did when you consider how dependent it is on tourism and travel. (Those factors are covered in the second half of this article.) It may be because it is also a substantial player in finance and international trade, culture and media, research, medicine, and biotechnology. All of these may have established sufficient momentum—and ongoing demand—to push prices up 9%.

When it comes to Honolulu, we hypothesize that a physically constrained island environment, decreased inventory, and few comparable rental options other than relocating to the U.S. mainland all contributed to increased rents.

Unique Reasons for Poor Rental Performance

It’s difficult to pinpoint the exact, direct mechanisms that drove up prices in the top 10 locations. But that’s not the case in cities where prices fell. There are a number of very specific factors that pounded the economies of these cities.

Hospitality & Entertainment

It was clear early on that hospitality, travel, and tourism were going to be slammed by the pandemic-related economic downturn.

A full 60% of the bottom 10 cities are heavily dependent on these industries:

- Scottsdale, AZ: Along with a manufacturing base that has surely been severely impacted by current economic factors, tourism is a major industry for the area.

- Arlington & Plano, TX: American Airlines is based in Fort Worth. It’s likely that many employees live in the surrounding suburbs. What’s more, Tarrant County (Arlington) is expected to lose nearly 17% in GDP. Collin and Denton Counties (Plano) are expected to lose 18%.

- Henderson, NV: Its proximity to Las Vegas positions it to see a 25.6% decline in GDP.

- Bradenton, FL (Manatee County): Close to Tampa and Sarasota, the area is predicted to be the hardest hit of 10 tourism-driven regions in the U.S. with a 28% decline in GDP.

- Irvine, CA: The city is approximately 15 miles from Anaheim, home to Disneyland and Disney California Adventure Park.

Additional Pressures on Rental Prices and Local Economies

- College Station, TX: Home to Texas A&M University, College Station was home to 69,465 enrolled students in fall 2019. The shift to distanced learning and students relocating back to their home cities certainly had a substantial impact on demand in the local rental market.

- Lubbock, TX: According to Federal Reserve Bank of Dallas, “the state’s oil and gas sector has been decimated.” Lubbock is on the edge of the Permian Basin, a massive oil and natural gas production area. It’s very likely that crashing oil prices during the pandemic have had a significant influence on driving down rental demand and prices.

- Springfield, MO: Some of Springfield’s major industries are agribusiness (including meat packing) and transportation.

The one outlier with no clear explanation for its pricing performance is Wellington, FL. It’s #10 of the bottom 10, with rents that fell 12% YTD. But it’s right outside West Palm Beach, which was #41 on the overall performance list, with a 2% increase. Perhaps name recognition has pushed West Palm to continue to be an in-demand location? We’ll need to do further research to find the full explanation.

A Common-Sense View of Poor Performance?

In economically hard-hit areas, if tenants are concerned about paying—or simply can’t pay—rent community-wide, landlords/owners have no incentive to find new tenants. (That sets aside, for the moment, the fact that most cities have had injunctions against evictions.)

With no demand and no buying power among consumers, it’s better to have existing tenants. They are likely to pay in-full eventually, or can make partial payments in the meantime. In short, when owners are faced with no demand, prices decline.

Have any other theories or insights based on this data?

We’d love to hear from you.