The Top U.S. Markets for Cash Flow in Q2 2020

Don’t you wish there was one comprehensive number to help you decide whether or not a particular property is a good investment? This singular number may not exist—but rent-to-price ratio (RtP) can certainly help because it serves as an easy proxy for cash flow. And given the current economic climate, cash flow is something all real estate investors should be seeking.

RtP compares the total annual rent for a property to its purchase price. In other words:

RtP = (Monthly Rent x 12) /Purchase Price

So, for example, if you bought a property for $100,000 and the rent is $1,000/month, the RtP would be $12,000/$100,000, or 0.12.

The RtP calculation shows you what fraction of the total purchase price you’re able to generate throughout the course of collecting rent each year. It follows, then, that the higher that fraction is, the better an investment a property is. In case you have different options to consider, RtP gives you a consistent metric to use to compare performance potential between properties.

Of course, if you are considering making an investment, you’ll want to dig into the numbers more than this simplistic calculation. RtP as we’re using it here does not factor in expenses or the particulars of any specific financing strategy. But when you’re looking to identify which markets to take a deep dive into, RtP is one of the best metrics to quickly assess cash flow potential.

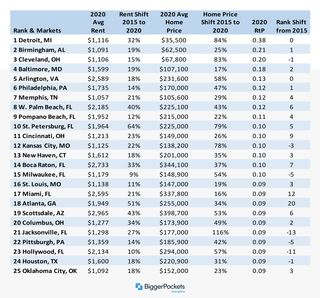

To give you a broader practical perspective into RtP, BPInsights researched the numbers nationwide and ranked the top 25 U.S. cities based on this calculation. In each market, the rankings and accompanying statistics are based on average rent and average home purchase price for each metropolitan area. This analysis also compares changes in these metrics between 2015, when the Obama administration was still focused on completely stabilizing the housing market, and 2020.

Top 25 Rent-to-Price Markets

Highlights of the Top 25

- Detroit, MI stayed in the top slot from 2015 to 2020. Even though average home prices rose 84%, this city maintained its impressive RtP ratio with a 32% increase in average rent.

- Scottsdale, AZ ranked in the bottom quarter of the list despite having the highest average rent ($2,595). Because its average home purchase price was also very high—18% higher than Miami, the next highest average home price—its RtP ratio was relatively unimpressive.

- Atlanta, GA showed the greatest positive change from 2015 to 2020 , up 20 slots to #18.

- Jacksonville, FL had the largest negative change during the five-year period we analyzed. It dropped 13 slots down to #21. This is largely due to a 116% rise in home prices, but only a 27% rise in rents.

- Twenty-two of the top 25 performers are mid-sized cities , with populations greater than 100,000 and less than 1 million. Outliers are Boca Raton (), Houston (), and Philadelphia (), all according the 2010 U.S. Census.

- Although not shown on our chart, both Orlando and Kissimmee, FL dropped out the top 25. Orlando, which fell 16 slots to #40, saw home prices increase 78%, while rents rose only 30% from 2015 to 2020. Kissimmee dropped even further, from #4 to #30, with home prices that rose 73% but rents that dropped 25%.

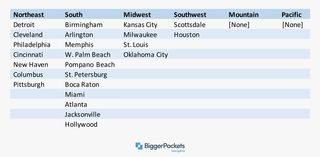

Geographic Performance Highlights*

*Presented in descending order of ranking

- Seven cities in Florida made it into the top 25 , six of them in the 75-mile stretch from West Palm Beach to Miami. When it comes to rental investments, the Gold Coast truly lived up to its name.

- In the Northeast, six out of seven top-performing cities are within a 69,000 square-mile triangle that stretches from Detroit, south to Cincinnati and east to Philadelphia.

- Perhaps unsurprisingly, there were no cities in the far Western U.S. in the top 25.

Conclusion

As you know, there are many factors that go into determining whether a particular property is a wise investment, but RtP provides a good, consistent metric that you can use to help gauge the fundamentals of any market or deal at a high level. From there, it’s up to the individual investor to learn more about the specifics of their prospective market to dial in the numbers further and get a full understanding of its prospects for cash flow.