Why you don't invest "All Cash" in commercial real estate

It’s not common, but sometimes you’ll meet a real estate investor that owns a commercial asset “all cash” — meaning they have no loan leveraging their equity. It’s uncommon for a few reasons, not the least of which is the fact that commercial buildings are usually high-ticket price items, and buying one outright without using a loan is not easy to accomplish. That’s not the primary driver though, as institutions that have billions in assets under management typically still prefer a levered investment.

Why is that?

Rule of Thumb: Cap Rate vs Interest Rate

Many investors use a quick “rule of thumb” that if the interest rate on a loan is higher than the cap rate on the asset, you’re losing money. While these generalities exist for a reason and are useful as a quick opinion, the reality is more complicated. Cap Rate is most useful as a measure of future returns when a property is fully stabilized — meaning the Net Operating Income is unlikely to dramatically change over the course of the investment life.

Understanding your future investment returns without a solid pro forma model is nearly impossible. Today we’re looking deeper into a couple of common investment scenarios to test whether you’ll make a better IRR (Internal Rate of Return) by buying a property all-cash, or levering up at 50%.

Stabilized Office

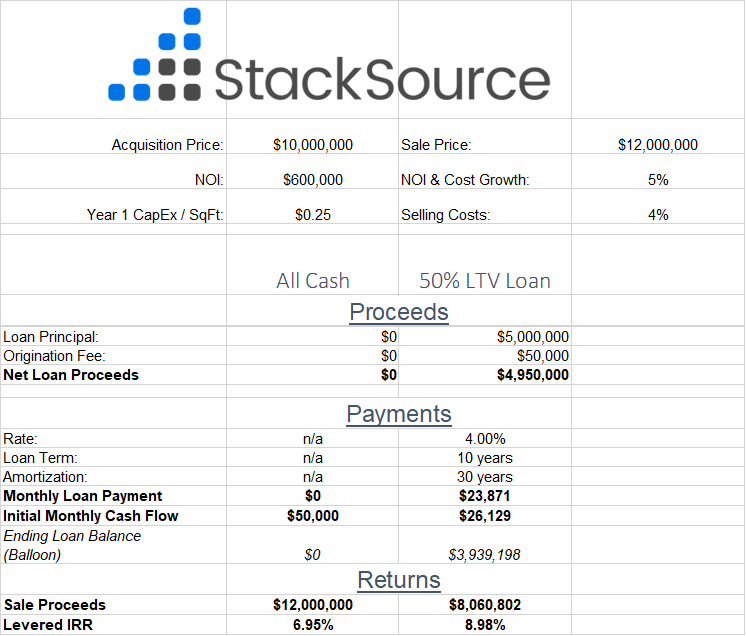

The first example investment is a stabilized office building being acquired at a 6% cap rate for $10,000,000. Assuming it’s a safe, conservative investment and you expect to sell in 10 years for $12,000,000, should you buy cash or lever at 50%?

You’re looking at turning your 7% return into a 9% return for this investment with the given loan terms, which are reasonable ones in today’s market. Leverage wins here.

Value-add Multifamily

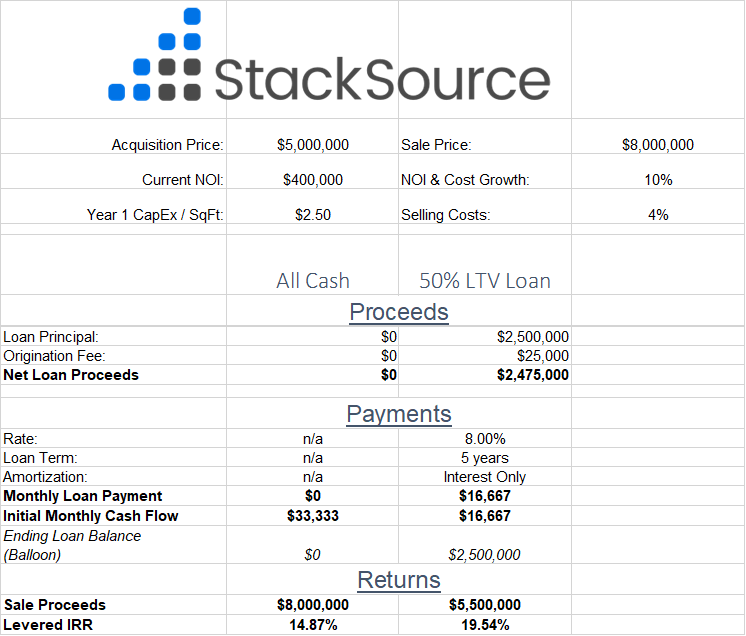

So that seems all well and good for stabilized assets, but what about heavy value-add? Should you pony up all cash if you can for a five year substantial value play? We looked at the investment return on a five-year rehab and sell scenario.

Even if you get “stuck” in an 8% loan for the full five years and can’t refinance down to bank rates, you’re looking at boosting your IRR by nearly 5% for this value-add. Leverage wins again.

Results will vary, but principle holds

The financing package available for a particular transaction will vary, but typically a legitimate investor won’t have any trouble finding a loan for at least 50% of the property’s value, and it’s usually makes sense to lever up to some degree. Whether the ideal leverage point for your deal is 50%, 70%, or higher will depend on the scenario. The good news is that you can always source multiple loan quotes, analyze your investment returns for each package, and then make an informed decision.

Comments